Summary:

- 3M is undergoing a massive restructuring effort to address organic growth challenges and margin pressures.

- The company is facing major litigations, including a $6.01 billion settlement for defective earplugs and a $10.3 billion settlement for water contamination.

- 3M reported weak Q4 earnings and a disappointing outlook for FY24, indicating slow growth and several headwinds for the company.

jetcityimage

3M (NYSE:MMM) has been involved in several major litigations, and they are in the middle of restructuring their slow-growth portfolios. They reported their Q4 earnings on January 23 with a very weak FY24 outlook. I am initiating a ‘Sell’ recommendation with a fair value of $90 per share.

Massive Restructuring

3M has been grappling with organic growth challenges and margin pressures over the past several years. They initiated a significant restructuring effort, announced in Q1 FY23, which involves cutting approximately 6,000 positions globally, in addition to the reduction of 2,500 global manufacturing roles. Upon completion of these actions, they anticipate annual pre-tax savings of $700 million to $900 million. Notably, they have already achieved more than $400 million in savings during the current fiscal year.

I believe the restructuring is imperative for 3M, and here are the reasons for my stance. 3M has expanded into numerous regional markets in the past, and they have acknowledged this by announcing a change in the distribution model in 30 countries. They are now relying on local distributors for business development. The streamlining of their global operations is crucial as it has the potential to enhance margins and facilitate an exit from unprofitable markets.

During their Q4 FY23 earnings call, they indicated that their restructuring program aims to simplify their global supply chain and modernize their legacy IT systems. I believe that they should consider outsourcing various supply chain resources to effectively reduce manufacturing costs. Additionally, there is a need for increased investment in data analytics to optimize their global operations and manufacturing systems for enhanced efficiency.

Major Litigations

3M has faced several major litigations, and I perceive these lawsuits as indicative of poor internal control and mismanagement within the company. From my perspective, these significant litigations are detrimental to shareholders’ value and may reflect underlying issues in 3M’s management practices.

Combat Arms Earplugs litigation: Aearo Technologies sold the Dual-Ended Combat Arms – Version 2 earplugs from 2003, and 3M acquired Aearo Technologies in 2008, continuing to sell these earplugs from 2008 through 2015. Subsequently, thousands of military service members and veterans filed lawsuits against 3M, alleging hearing loss caused by defective products. On August 29, 2023, 3M agreed to a substantial settlement amount of $6.01 billion. It is noteworthy that this settlement represents approximately 10% of 3M’s current market capitalization, which is approximately $60 billion. As disclosed in a recent conference, 3M has received more than 30,000 releases from Combat Arms earplug claimants.

Forever chemicals in U.S. public drinking water systems: According to the media, 3M is expected to pay at least $10.3 billion to settle lawsuits related to the contamination of numerous U.S. public drinking water systems with potentially harmful compounds found in firefighting foam and various consumer products. As mentioned in a recent conference, the final approval hearing for this settlement is scheduled for February 2, 2024. This represents another substantial settlement amount for 3M.

Recent Result and Outlook

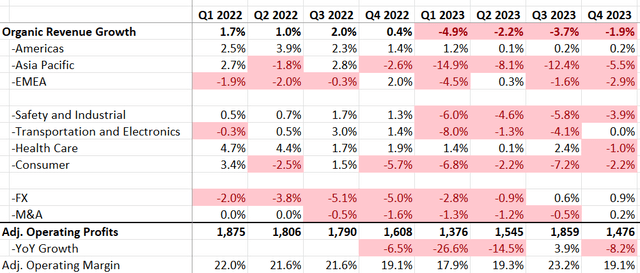

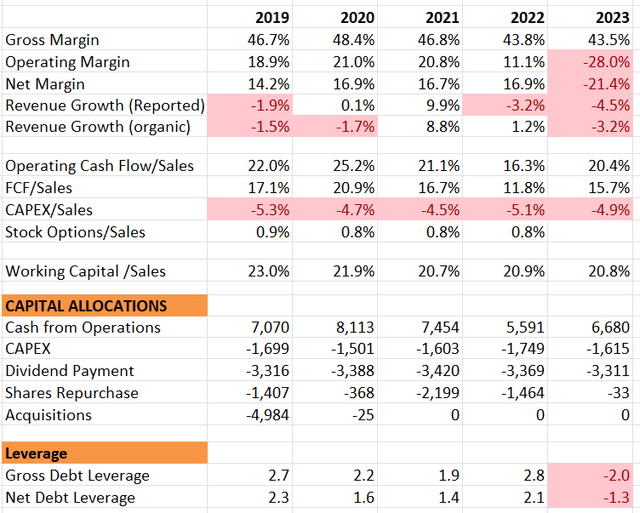

In Q4 FY23, they reported -1.9% organic revenue growth and -8.2% adjusted operating profit growth. For the full year, they ended with -3.2% organic revenue growth and -10.2% adjusted operating profit growth, indicating a very weak overall growth. On the balance sheet, they hold $16 billion in total debts and approximately $6 billion in cash and equivalents. Throughout the full year, they distributed $3.3 billion in dividends and only repurchased $33 million of their own shares.

For FY24, they are guiding 0-2% organic revenue growth and an Adjusted EPS in the range of $9.35 to $9.75. The provided outlook falls short of market expectations. 3M’s current guidance aligns with my expectations, and FY24 is anticipated to be another year of slow growth for the company, facing several headwinds.

The company’s business is closely tied to global industrial production to some extent. During the earnings call, they expect global industrial production to grow by 2% worldwide, with the U.S. remaining flat. Furthermore, 3M’s growth will be influenced by the production activities in automotive and electronics, as automotive and aerospace contribute to 20% of group revenue, and electronics represent 38% of total revenue.

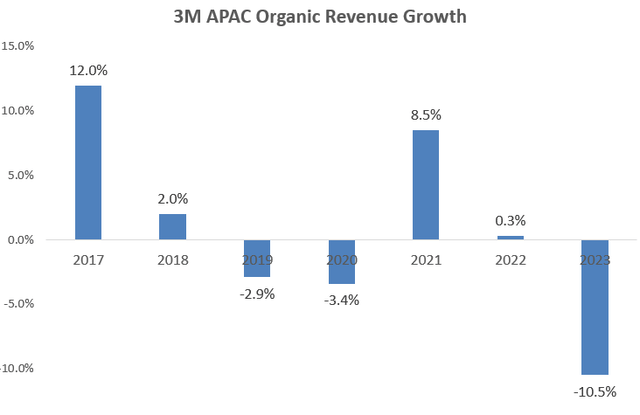

Another significant factor is their Asia Pacific business, which accounts for approximately 30% of total revenue. As depicted in the chart below, in certain years such as FY17 and FY21, Asia Pacific exhibited outstanding growth. However, in the post-pandemic period, the region’s growth has been subdued. Notably, China’s overall industrial growth has been weak. I do not anticipate a recovery in China’s industrial growth in FY24, and the region is expected to continue exerting pressure on 3M’s overall growth.

Due to sluggish growth and ongoing legal litigations, the company has been grappling with declining margins and decelerated growth, as illustrated in the table below.

Health Care Business Spin-off

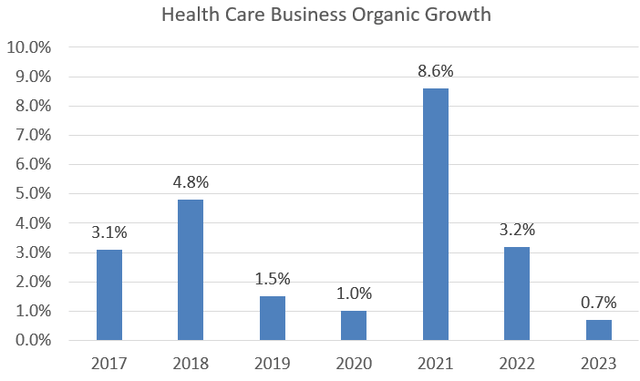

Compared to 3M’s other business lines, the healthcare business is quite healthy with steady growth, as illustrated in the chart below. As disclosed in the earnings call, the Health Care spend remains on track for the first half of 2024, and they continue to expect the business to be spun off with an estimated net leverage of 3x to 3.5x EBITDA, and with the proceeds to be distributed to 3M prior to the completion of the spin.

The spin-off could potentially unlock some of 3M’s value for their shareholders, as the market is likely to assign a much higher multiple to their healthcare business. Additionally, I believe the spin-off makes sense, as 3M’s core business is in the global industrial production area, which is quite different from the healthcare industry.

Valuations

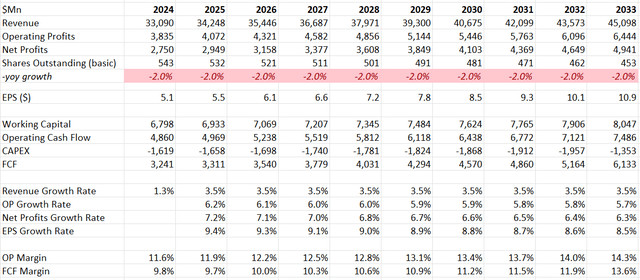

I anticipate a 1.3% revenue growth in FY24, aligning with their full-year guidance. For normalized revenue growth, I expect their organic growth rate to be around 3%, similar to the level of global industrial production growth. With some tuck-in acquisitions, an additional 50 basis points of growth for revenue is anticipated. The ongoing massive restructuring program is expected to contribute to continued margin expansion over time. I assume that the majority of margin expansion will stem from cost reductions, as operating leverage won’t be a significant driver due to the expected low topline growth discussed earlier. Additionally, gross margin expansion over time could be supported by price increases.

3M DCF – Author’s Calculations

The model employs a 10% discount rate, maintaining a consistent assumption across all my models. Based on these parameters, the fair value is estimated to be $90 per share according to my calculations.

Verdict

3M is going through a tough restructuring period with quite weak growth and profit. The stock price is more likely to be in the penalty box, and I am initiating a ‘Sell’ with a fair value of $90 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.