Summary:

- 3M’s substantial litigation costs will negatively impact free cash flow, making it a potential value trap.

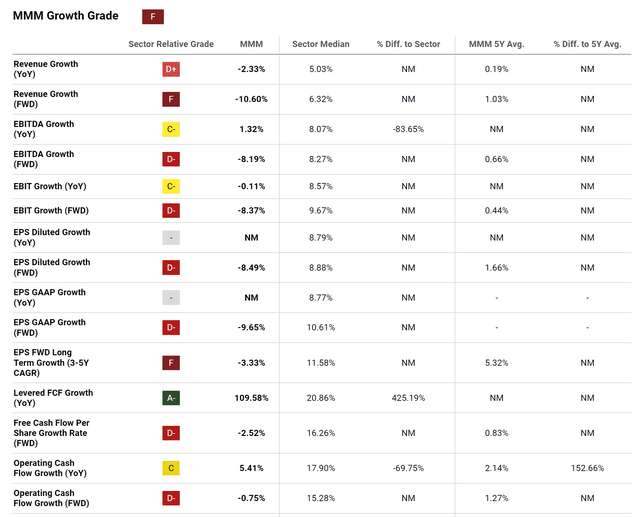

- Growth has been nonexistent in recent years and no clear catalysts for growth are visible.

- 3M may be overvalued, but is considered a hold by the author.

wellesenterprises

Investment Thesis

3M Company’s (NYSE:MMM) financial growth has deteriorated in recent years and free cash flow generation is at risk due to $18.5 billion in legal settlements damages. I don’t see any reason to believe that the company can return to sustainable growth and believe it might be a value trap. I consider the stock to be a hold, as it may not be terribly overvalued, and I cannot rule out that a turnaround won’t happen.

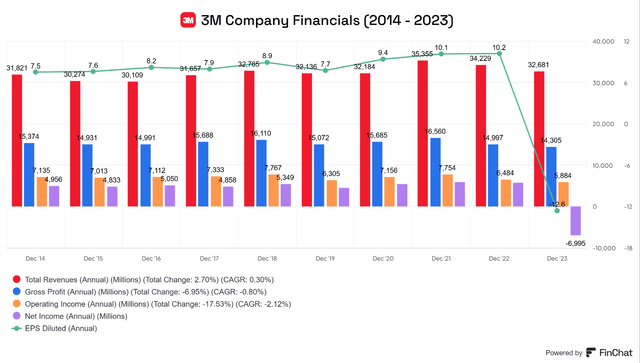

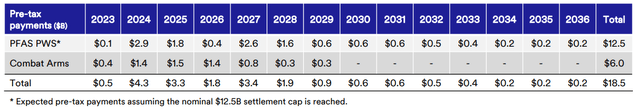

3M’s Financial Picture

3M’s financials have deteriorated since 2014, with revenue only experiencing notable growth during the pandemic, which arguably was a beneficial time for the company. Gross profit and operating income have declined, and net income actually turned negative during 2023 due to its legal woes, as the company posted a full year GAAP net loss of $12.63 per share, driven by the accrual of $20.39 per share impact of litigation costs related to its Combat Arms Earplug (CAE) and Public Water Systems (PWS) settlements, as well as $1.48 per share in other special costs.

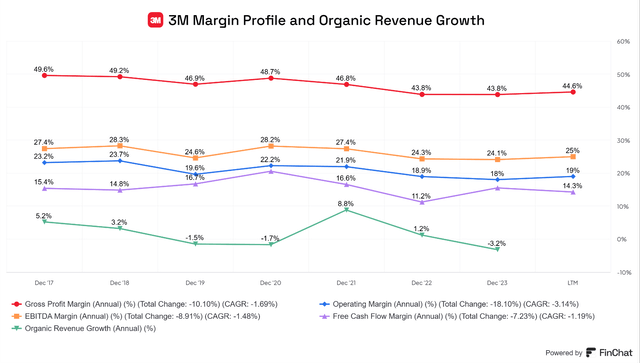

The most troubling trend is 3M’s margin profile. Gross, operating, EBITDA and free cash flow margins are all declining. The company also shows poor organic revenue growth, making me doubt the company’s ability to turn things around any time soon, or at all. However, the company has shown improvements in gross margin, EBITDA margin, and operating margins in the last twelve months. Is this a trend reversal? Are better things coming for the company?

Forward Outlook

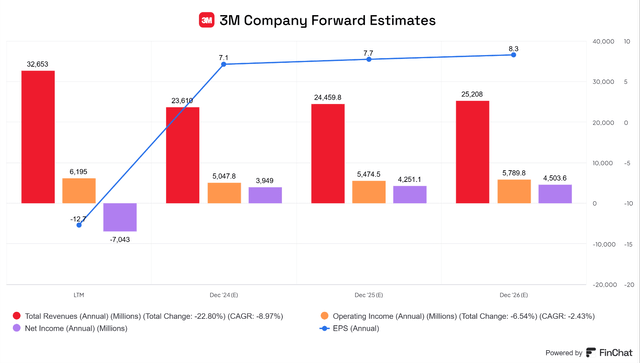

Analysts are not predicting great things for 3M, as the company is expected to see absolute declines in revenue, operating income and net income. However, the spin-off of its healthcare division, now known as Solventum (SOLV), clouds the picture a little bit.

Table 3: MMM – Analyst Forward Estimates (FinChat)

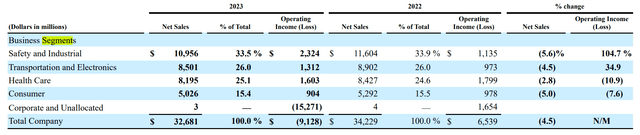

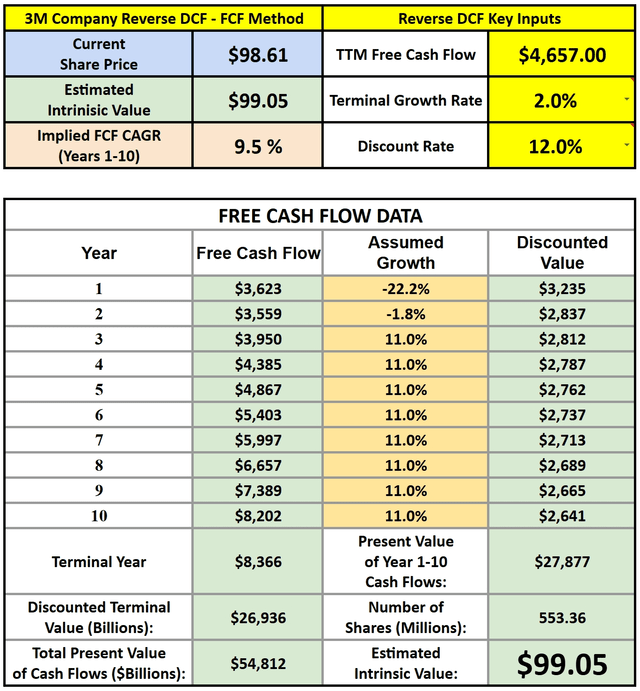

Based on Solventum’s (formerly MMM’s Health Care segment) full year 2023 reported financials, $8.2 billion in revenue, and $1.6 billion in operating income are leaving the company. According to analysts, The comparable decline in sales among the remaining 3M segments is expected to be 3.5%, from $24.5 billion to $23.6 billion. The company does not provide forward GAAP measures.

3M: Business Segments (MMM 2023 Annual 10-K)

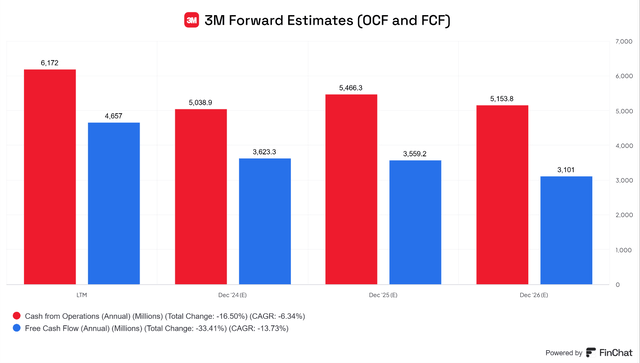

Free cash flow is expected to decline each year over the next three years. Based on the operating cash flow estimates, it does not appear that these analyst estimates are factoring in the most important issue that 3M is facing today, the significant litigation costs it will pay out over the next decade. I will cover this later.

Table 5: Forward Cash Flow Estimates (FinChat)

Based on the analyst’s estimates above, it’s expected that 3M will improve margins, except free cash flow margin, which is projected to improve before falling off in 2026.

Author-generated chart – using analyst’s estimates

Valuation

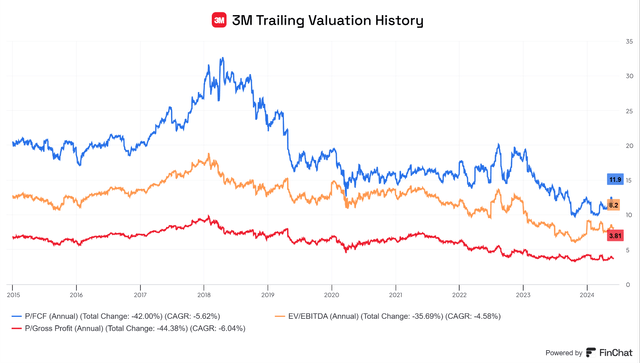

3M has seen P/FCF, P/GP, and EV/EBITDA contraction since 2018-2019, making it either a value stock or a value trap, in my opinion.

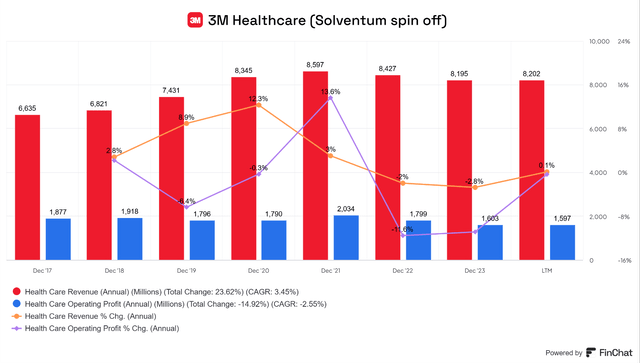

Reverse DCF

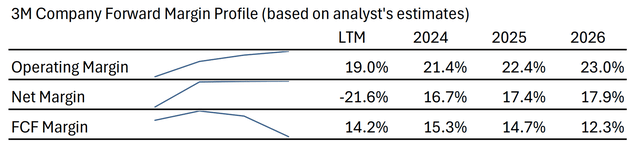

When I first do a deep dive into a company, I like to figure out what the current expectations are for the business. To determine what kind of growth 3M needs to justify the current stock price, I used a reverse DCF model. I factored in a 12.0% discount rate, which initially gave me a perceived margin of safety. Due to the legal overhang 3M has faced, its late-stage and potentially declining business prospects we will revisit this later. Despite weak top-line growth and declining margins, a terminal rate of 2.0% was chosen based on the company’s long track record, strong operating cash flow generation, and the fact that some of its products are essential. However, the company faces substantial competition in many of the business lines it engages in.

I used analysts’ estimates of free cash flow for 2024 and 2025 (years 1 & 2, from Table 5 above) but decided to go against the estimate for year 3 to challenge my bearishness on the company’s growth prospects and understanding that FCF estimates may not be as accurate or predictable as revenue estimates. To justify the current stock price, given these assumptions, 3M would need to grow its free cash flow at a CAGR of 11.0% during years 3-10, which would work out to a 9-year CAGR (years 1-10) of 9.5%.

Reverse DCF (Author-generated DCF Model)

To justify the current stock price, 3M needs to grow FCF at a 9.5% CAGR over ten years. If growth is any lower, multiple expansion might be needed.

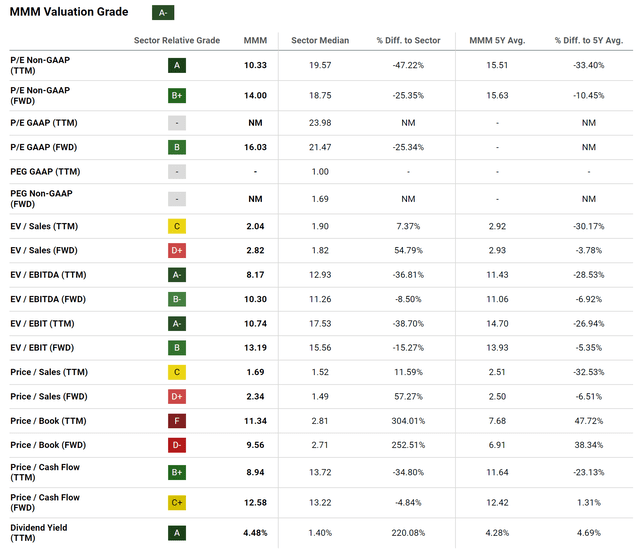

The stock earns an A- valuation grade by Seeking Alpha, and trades at a discount to its 5-year average trailing P/E and Price/Cash Flow multiples. However, MMM trades above its forward Price/Cash flow multiple. I’m inclined to ignore price-to-earnings multiples for 3M due to the highly distorted earnings and legal overhang.

The valuation grade of F doesn’t inspire much confidence in 3M’s ability to justify near double-digit free cash flow growth or warrant an expansion of valuation multiples.

Has something changed to justify the hope of double-digit FCF growth or a multiple expansion?

Going back to the company’s past financial results, it appears to be a company in decline. Margins are deteriorating, and financial figures are declining. 3M made a major change in jettisoning its healthcare unit. Did the Solventum spin-off unlock value for 3M?

Solventum

On April 1st, 2024, Solventum became the publicly traded company company that used to be 3M’s health care division. 3M retained 19.9% of SOLV stock, saddled the company with $7.7 billion in debt and might have shed a business line that wasn’t worth keeping around. That isn’t to say there isn’t value in SOLV as a public company, just that 3M can focus on other areas of the business.

Solventum Financial Profile (FinChat)

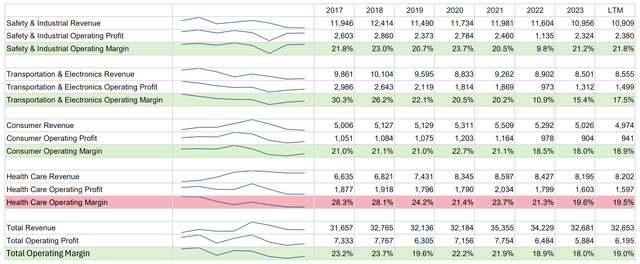

When we examine each segment’s performance over the last seven years and TTM period, we see that 3M is arguably addressing its weakest link by spinning off SOLV. Operating margins have begun to improve for each segment, except for healthcare (SOLV). 3M says it is making a strategic move to improve margins by focusing its efforts on higher-growth opportunities. SOLV may hold better margins than the Transportation and Electronics, and Consumer segments, but the margin contraction since 2017 is not a great sign for growth in the healthcare segment.

Comparison of 3M Business Segments (Author-generated table with data from SEC Filings and FinChat)

Now that we see the potential for margin expansion, do the remaining business segments provide reasonable hope for double-digit free cash flow growth?

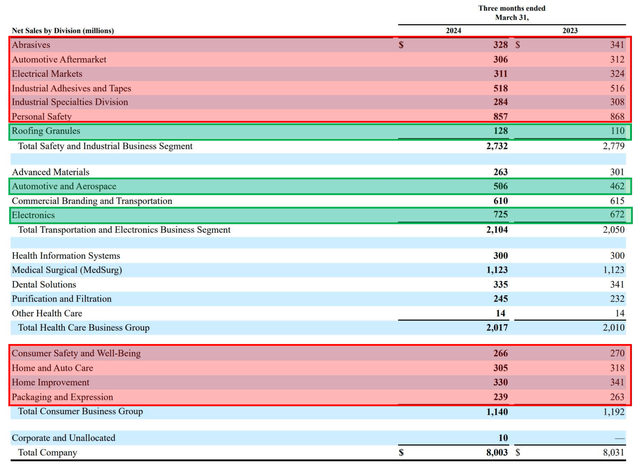

Based on management’s commentary and the presentation during the Q1 earnings call, during 2024, the business lines in green are expected to grow in mid-single digits or greater, and the business lines in red are expected to decline. Everything else is expected to be close to even or to experience low single-digit growth.

The company may have some promising prospects in its automotive and aerospace divisions, and roofing granules are expected to perform well this year, but these three higher growth areas account for only 22.7% of sales in Q1. The business lines, highlighted in red, that are expected to decline this year represented 62.5% of sales in Q1.

The diversified portfolio of 3M might provide stability in overall sales and cash flow growth, but I don’t see reason to believe in the higher growth narrative that management is presenting.

There is another big factor that has to be accounted for with 3M, the legal bills.

Litigation, The Pain Isn’t Over Yet

Current Litigation Liabilities

3M has been hit with two very large legal bills and could be facing more legal problems ahead.

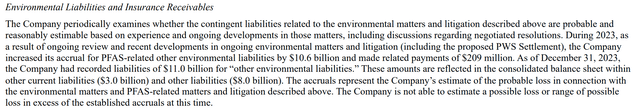

3M still owes $6.0 billion for the CAE settlement and $12.5 billion for the PFAS settlement. However, the impact has hit earnings without yet hitting free cash flow.

10-K Litigation Disclosures – MMM 10-K Litigation Disclosures – MMM

Let’s get into the mechanics of the settlement obligations. 3M has already set aside billions of dollars in accruals for these payments. This is what drove the net income to a substantial loss in 2023, meaning that there will be a minimal impact on net income and EPS going forward. That’s great for your numbers when you use a DCF factoring in traditional earnings growth. However, accruals and cash outflows are two different things. The big impact has yet to hit free cash flow.

Remember, the intrinsic value of a business is the present value of all expected future cash flows, discounted at the appropriate discount rate. Therefore, a DCF estimating future cash flows is the proper way to value 3M, in my opinion. Unfortunately, the free cash flow picture might look quite a bit worse for several years, and despite the likelihood that 3M will grow EPS from here, the negative impact on free cash flow is just getting started.

Future Litigation Liabilities

When I was in college, I got a job at one of the nation’s largest clothing retailers in my local shopping mall. Let’s just say the company didn’t always do things the right way or even the legal way. I received a class action settlement notification two years after working there. Then, a year after that, I received another, and then another came a year later. In total, I received four class action lawsuit payouts from this retailer. The same thing happened at another company I worked for, with the running joke at work asking co-workers, “How much did so-and-so get for you?”

My point with this story is that the frequency and magnitude of lawsuits that 3M is experiencing should be a giant red flag to investors. The “forever chemical” lawsuit momentum against 3M could only be building. Even though it appears that the largest litigation settlements are being or have been resolved by now, after reading through nearly twenty pages of disclosure in the latest 10-Q, I am now even more concerned that future legal risk remains for 3M.

The company disclosed a substantial risk in the 10-Q, stating:

As of March 31, 2024, approximately 7,844 lawsuits (including approximately 50 putative class actions and 746 public water system cases) alleging injuries or damages from PFAS contamination or exposure allegedly caused by AFFF use have been filed against 3M (along with other defendants) in various state and federal courts.”

This statement is regarding Aqueous Film Forming Foam (AFFF) Environmental Litigation for PFAS-containing products manufactured and marketed by 3M used in firefighting between 1963 and 2002. As recent as December 2023, a class action suit was filed against 3M in British Columbia on behalf of Canadian individuals alleging personal injuries from exposure to AFFF.

Many of these lawsuits, like with the PWS PFAS cases, are likely to end up as Multi-District Litigation (MDL) cases, where they are consolidated into one case, but some of these may fall outside the purview of the MDL and be litigated separately, which only adds to the legal fees 3M has to pay. There are still 35 PWS cases outside of the MDL and approximately 104 other AFFF suits outside the MDL, with 3M being a named defendant, according to the document.

Additionally, I saw at least five countries with potential or ongoing litigation procedures or investigations related to PFAS contamination, including Belgium, Germany, The Netherlands, Canada and The United States. This includes at least 35 states within the USA.

Further, the company has ongoing mesothelioma cases to fight, and even though these cases are expected to reduce in number over time, the potential cost associated with each one is expected to be greater per person than the PFAS settlements.

With so many outstanding domestic and international investigations ongoing beyond what has already been accrued, and the potential for other chemical litigation cases in the future, any bold assumptions of net earnings and free cash flow growth must be tempered by the risk that 3M will face more major lawsuits and substantial legal fees and settlement amounts.

Could this be one of the reasons that 3M stock is seemingly so undervalued?

DCF Valuation With Risk Adjustments

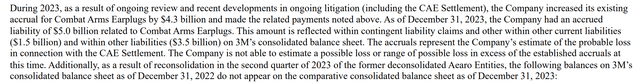

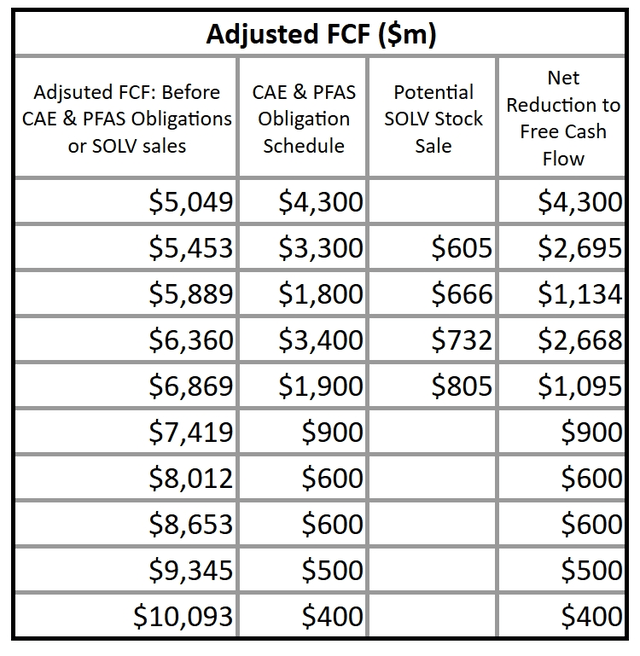

When I ran my DCF model, I made adjustments to cover scheduled litigation payouts as shown in the Q1 2024 earnings presentation.

3M – Litigation Damage Schedule (Q1 2024 earnings presentation)

However, I cannot properly estimate the other legal fees that will come with current and future lawsuits, which has prompted me to increase my discount rate to adjust for the uncertain risk profile. The cash totals above will come at the expense of free cash flow. Meanwhile, the company plans to monetize its SOLV holdings during the next five years, so I have modeled positive impacts to free cash flow, as well.

Using the payment schedules for 3M’s CAE and PFAS settlements above, I adjusted free cash flow by the net difference in CAE and PFAS litigation payments (an outflow) and the potential proceeds of liquidating its entire SOLV holding (a cash inflow). For the SOLV proceeds estimate, I factored in the current market cap of roughly $10 billion, a growth CAGR of 10% and the selling of ¼ of MMM’s SOLV stock starting at the end of year two and ending by the end of year 5, working out to $605 million in year 2, and $805 million in year 5.

Author- Adjusted Free Cash Flow for DCF (Author-generated table using SEC data and author’s assumptions)

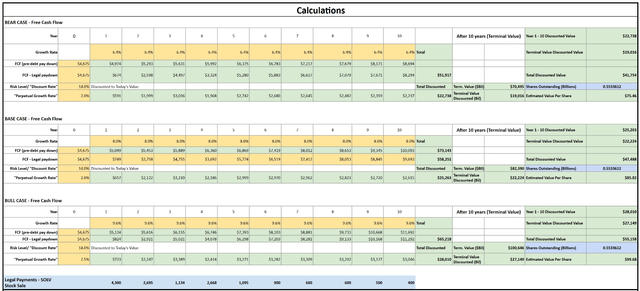

The last column, “Net Reduction to Free Cash Flow” is subtracted from free cash flow in the DCF calculations below (highlighted in blue).

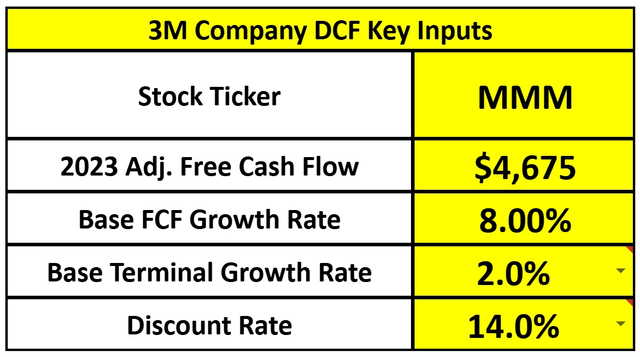

Key Inputs for DCF Model (Author Generated)

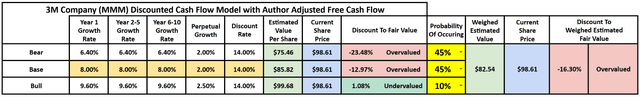

I am using a discount rate of 14% to account for the substantial litigation obligations and risk that 3M holds, a 2.0% terminal rate and will factor in a 8.0% base growth rate for free cash flow as adjusted by 3M. My bear case, weighted at a 45% probability, includes a FCF CAGR of 6.4%. My bull case uses a 9.6% CAGR and a 2.5% terminal rate, weighted at a 10% probability.

DCF Model – 3M (Author Generated)

My adjusted Free cash flow for each year and case can be seen in the calculations below, with the net adjustment amount highlighted in blue on the bottom row.

Given my perception of high risk, even free cash flow growth rates that are significantly higher than the last ten years show the stock to potentially be overvalued by as much as 16%.

Author’s calculations for DCF (Author Generated)

Risks

I have already mentioned the legal and litigation risks associated with investing in 3M, but another risk is that I have not even factored in is debt reduction. 3M has over $13 billion in long-term debt on its balance sheet. But with nearly $11 billion in cash on the balance sheet, I don’t think it’s necessary to worry about this debt.

Competition in 3M’s end markets is another risk, which may be a reason the company has seen slowing growth over the last decade.

Valuation flaws are a risk to my bearish thesis on 3M. I am using a 14.0% discount rate, meaning that if 3M is able to meet my bull case in my DCF model, the stock could be undervalued and return a roughly 14% total return if the market prices in 3M’s intrinsic value as outlined in the model.

Conclusion

I believe that 3M may be overvalued despite having traditional valuation ratios that look rather cheap on the surface. The company may be a late-stage value trap evidenced by its lack of growth. I also think some investors may be overlooking the fact that paper earnings have been negatively impacted by litigation loss reserves, but cash flows have yet to be diminished as payments begin to increase. As much as I’m tempted to call this stock a sell, I think it might have a chance to be a value stock if the company can capture the higher growth areas it talks about without watching the rest of its business lines decline. I rate 3M stock as a hold, with the potential to change my mind if the company turns it around or shows further signs of declining growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.