Summary:

- 3M’s Q3 earnings beat expectations with $1.98/share, driven by margin expansion from restructuring, despite lackluster 1.5% organic revenue growth.

- The company repurchased $700 million in stock, raising concerns about prioritizing buybacks over addressing future PFAS liabilities and debt reduction.

- 3M faces significant PFAS-related lawsuits, posing potential billions in liabilities, making stock buybacks questionable given the financial risks.

- Despite a 30% stock appreciation, driven by multiple expansion, revenue growth remains below inflation, and future liabilities pose significant downside risks.

josefkubes

3M Third Quarter Earnings Review:

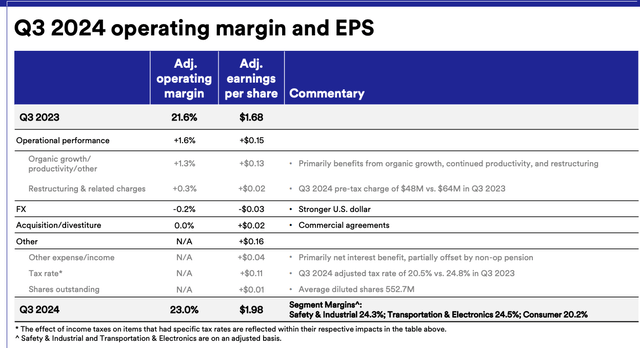

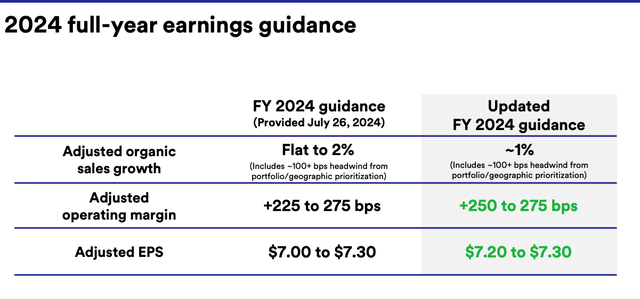

3M (NYSE:MMM) reported earnings this morning (October 22nd) reported adjusted earnings of $1.98/share, which beat expectations by $.08. The company raised the midpoint of its full-year guidance by $.10 from $7.15 to $7.25. “Other” line items in the adjusted EPS bridge laid out below represented 2x the $.08 beat, including $.11 of tax benefit. However, the market appears to focus on the 140 basis points of margin expansion, most of which is due to restructuring the company initiated last year.

3M Q3 Operating Margins and Earnings Bridge (Q3 Investor Presentation)

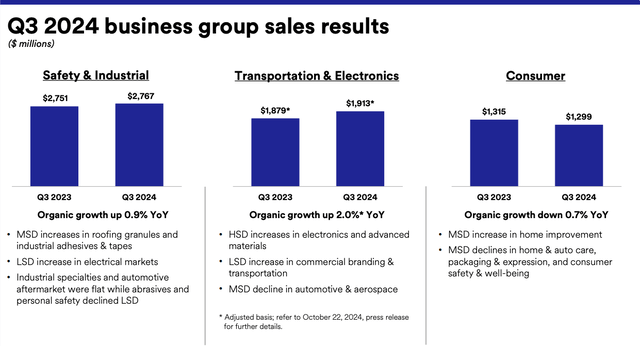

The company’s revenue growth continues to be lackluster. Total organic revenue grew about 1.5% y/y for the quarter, well below all measures of inflation. No vertical grew above inflation, and the Consumer division shrank.

3M Q3 Sector Organic Revenue (Q3 Investor Presentation)

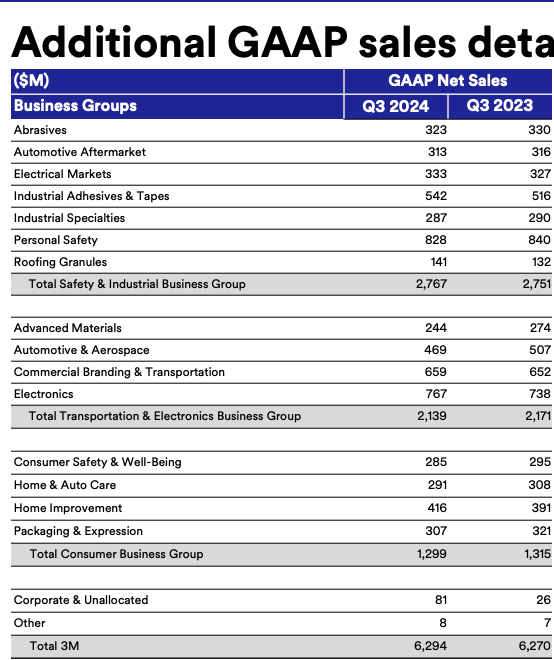

The company called out automotive as the lone revenue “bright spot”. It appears that the automotive growth occurred in adhesives and tapes, with that subcategory, growing about 5%.

3M Subsector Revenue Breakdown (Q3 Investor Presentation)

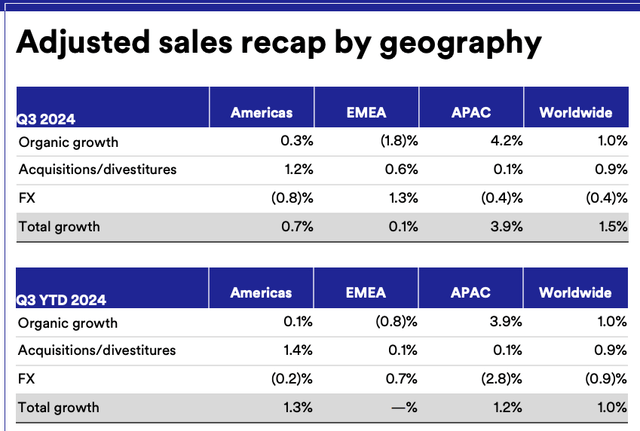

Growth in Asia was the lone bright spot, specifically electronics in China.

3M Geographical Organic Revenue Results (Q3 Investor Presentation)

Year-to-date revenue growth is about 1%, and the company expects that 1% for the full year. As I said above, the market appears much more focused on the operating margin expansion.

3M Revised Full Year Guidance (Q3 Investor Presentation)

3M’s Surprise Use of Cash:

The only other surprise this quarter was the company’s repurchase of about $700 million of stock. Those buybacks bring the YTD number to about $1.1 billion. The company hasn’t released a detailed statement of cash flows yet, but cash flow from operations heavily negative this quarter due to tax payments, which brought year to date cash flows from ops to flat. I assume cash flow will flip positive in Q4.

Even if it does flip, the cash flows are not super high quality. As of the second quarter, about $900 million of cash benefit came from company pension and post-retirement expenses, and another $200 million came from stock comp. The company has saved about $400 million from capital expenditures so far versus last year. With such lackluster growth, I question whether capital investment is where it wants to save money…unless, of course, previous capital investment was wasted, as indicated by sub-inflationary revenue growth.

In all, I frankly can’t believe the company is buying back stock here. At above $130/share and a midpoint of earnings at $7.25, which includes about $.16 or low-quality “other” items, it’s paying over 18x. In relative terms, 18x is well below the current 29x for the S&P. However, as we all know, the S&P is heavily skewed by the Mag 7, large cap tech stocks that make up over 30% of the market cap. The median S&P stock trades at about 15x earnings, and the mean is about 16x.

So management here is paying above the average and median S&P earnings multiple for a company with revenue growth still stuck below inflation. In isolation, that makes little sense. Earnings growth based on margin expansion from cost cuts is nice, but can’t last forever.

Lawsuits:

Most important in my mind, the company still faces PFAS lawsuits from over twenty state AG’s, six European countries, as well as personal injury and property damage lawsuits. In addition, now that the EPA has designated PFAS a hazardous substance, the company is vulnerable to Superfund (CERCLA) lawsuits.

No settlements or judgements are pending right now, but the company still spent $22 million on litigation this past quarter. I still see the potential for billions of dollars of future product liability tied to PFAS.

In light of these future liabilities, the company should continue to pay down debt and fortify its balance sheet rather than buy back stock. Of course, I realize that management is compensated in part for eps growth, so their incentives are to worry about the shorter term rather than potential problems down the road.

Risk:

The main risk to the short in my opinion is continued earnings expansion. The market has bought into the margin expansion here thanks to previous years’ cost cuts and some new initiatives by the new CEO. An above average and median earnings multiple is the result. Overvalued companies can become more overvalued.

An acceleration of top-line growth could occur here, too. The new CEO has made a lot of noise about improving innovation. That is laudable, but the rubber hasn’t met the road yet.

Conclusion:

I certainly did not see 3M stock appreciating 30% this year. In my defense, most of that move is pure multiple expansion. The market has forgotten about future PFAS liabilities and focuses on margin expansion despite revenue growth coming in below inflation. I think the liabilities are a significant risk here, and the company remains exposed to a slowing industrial economy as well. I see much more downside than upside and remain short the shares.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Members of Catalyst Hedge Investing had early access to this article. They have exclusive access to many other articles every month as well as an active chat board with regular updates on ideas and a best ideas portfolio.