Summary:

- With the SOLV divestiture completed as of April 01, 2024, we believe that MMM is well poised to invest in its long-term opportunities.

- Reader must note that MMM’s balance sheet is much healthier now, with the new management team and the settled legal issues implying fresh start ahead.

- The nearly halved dividends are to be expected as well, as the management expects to intensify their “investments in high growth and attractive end markets.”

- Combined with MMM’s inherent undervaluation and improving bottom-line performance through restructuring efforts, we believe that the stock remains a compelling buy.

Richard Drury

We previously covered 3M (NYSE:MMM) in January 2024, discussing its oversold status then, due to the highly effective cost optimization efforts, growing bottom-line, and nearly resolved legal settlements.

We had rated the stock as a Buy then, with us concluding that its dividend investment thesis remained robust with a potential capital appreciation as the headwinds subsided.

Since then, 3M has reported a total return of +12.2%, outperforming the wider market at +11.6%. With the Solventum (SOLV) divestiture completed as of April 01, 2024, and its balance sheet much healthier, we believe that the company remains well poised to opportunistically invest in its long-term growth.

For now, readers may want to temper their near-term expectations, since the uncertain macroeconomic outlook remains a headwind to its industrial/ consumer businesses with the dividend cut triggering a nearly halved yield.

Otherwise, with a leaner and focused company, we are maintaining our Buy rating, especially since bullish support has already been established at $76s.

A Leaner & Healthier MMM – Thanks To The SOLV Divestiture

For now, MMM reported a double beat FQ1’24 earnings call in April 30, 2024, with adj revenues of $7.7B (inline QoQ/ +0.8% YoY) and adj EPS of $2.39 (-1.2% QoQ/ +21.3% YoY).

With the SOLV divestiture effective as of April 01, 2024, onwards, readers may expect FQ2’24 to bring forth a separate segment for discontinued operations, triggering numerous adjustments in the overall company’s financial reporting.

This is especially since the management continues to highlight impacted demand in the industry specialties and consumer segment, well negating the robust organic growth reported in the automotive/ electronics segment, with keen readers best monitoring its near-term performance.

Otherwise, based on MMM’s growing adj operating margin of 21.9% (+1 points QoQ/ +4 YoY) and adj Free Cash Flow margin of 10.3% (-15.7 points QoQ/ -1.3 YoY) in FQ1’24, it is apparent that the ongoing restructuring efforts have been bottom-line accretive.

This is while allowing the management to intensify their investments in water filtration systems across its global manufacturing plants along with other growth opportunities, as observed in the intensified capex worth $1.61B in FY2023, $1.74B in FY2022, and $1.63B in FY2021, compared to pre-pandemic averages of $1.4B, as they also aim to complete their PFAS water filtration lawsuit commitments before the end of 2025.

The bottom-line improvements are also attributed the drastic reduction in its headcounts by -7K YoY to 85K as of December 2023, with the SOLV divestiture likely to bring forth another drastic reduction, based on the latter’s “global team of approximately 22K employees” as of the latest filing.

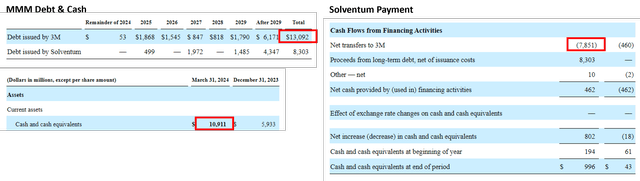

MMM’s Debt/ Cash

At the same time, the SOLV divestiture has already contributed to MMM’s much healthier balance sheet, with the latter only reporting $13.09B of adj debts (inline QoQ/ +1.1% YoY) and $10.91B of cash/ equivalents in FQ1’24 (+83.9% QoQ/ +185.6% YoY), implying a much lower net debt of $2.18B (-69.5% QoQ/ -76% YoY).

Much of the QoQ tailwinds are attributed to the SOLV divestiture, with MMM retaining $7.85B of proceeds after the separation.

As with most divestitures, a dividend adjustment is prudent, due to the large structural changes in the company’s top/ bottom-lines moving forward, especially since the divested Health Care segment comprises $2.03B/ 25.3% of its overall top-line and $1.6B/ 26% of its bottom line in FY2023.

However, we can also understand why there may be some hesitancy for dividend oriented investors, with MMM’s Free Cash Flow to Dividend payout ratio drastically cut from 65.4% in FY2023 to 40% moving forward.

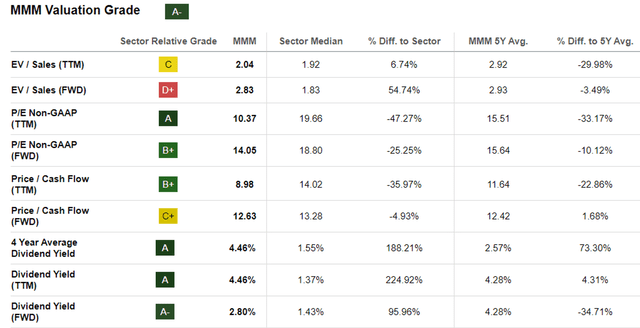

The change in payout ratio has also ended the Dividend Aristocrat’s 65 years of consecutive dividend growth, with the stock now offering an underwhelming forward yield of 2.80%, compared to its 4Y historical average of 4.46% though still higher than the sector median of 1.43%.

Then again, we believe that there is another way of looking at this, since MMM’s management has pledged intensified “investments in high growth and attractive end markets” namely in automotive electrification, climate technology, and industrial automation. This is attributed to the growing sales for hybrid vehicles, intensified renewable investments, and generative AI boom, implying that the cash flow will be put to good use while driving new growth opportunities.

If anything, readers must remember that the company is set to pay $10.3B in Public Water Suppliers settlement through 2037 and $5.3B in Combat Arms settlement through 2029, partly contributing to the reduced dividend payouts in the intermediate term.

MMM Appears To Be Reasonably Valued Compared To Its Peers

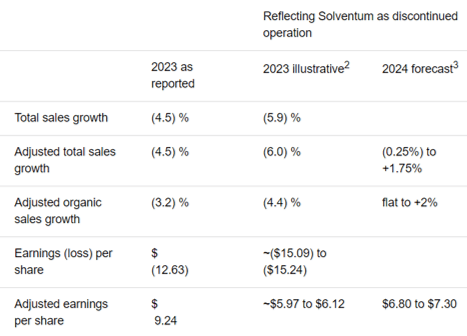

MMM’s FY2024 Guidance

Seeking Alpha

At the same time, the MMM management already guides decent FY2024 pro forma revenue growth of +0.75% YoY and adj EPS growth to $7.05 at the midpoint (+16.7% YoY), implying accelerating bottom-line growth thanks to its ongoing restructuring efforts through 2025.

These numbers are not overly aggressive as well, since the management has guided improved semiconductor market activities from H2’24 onwards, with automotive OEM build rates likely to grow once borrowing costs moderate, as similarly observed in the Transportation and Electronics segment’s revenue growth to $2.1B in FQ1’24 (+1% QoQ/ +2.4% YoY).

MMM Valuations

As a result of these developments, we believe that MMM does not look expensive at FWD P/E valuations of 14.05x, despite the recent upgrade from the October 2023 bottom of 9.01x and the previous article at 12x.

This is because the stock is still inherently undervalued compared to its 3Y pre-pandemic mean of 20.39x and its direct peers, including Honeywell International (HON) at 20.34x and DuPont de Nemours (DD) at 22.73x, implying an opportunistic upward re-rating for MMM upon a successful turnaround from the renewed growth opportunity.

This is on top of the recent management shakeup, with it likely to bring forth a fresh start after the settlement of legal issues and SOLV divestiture.

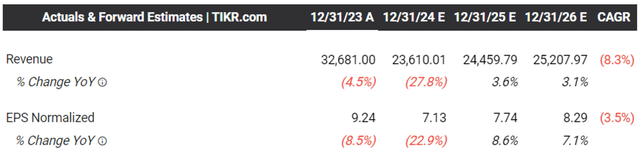

The Consensus Forward Estimates

The Consensus Forward Estimates (Tikr Terminal)

This is especially since the management’s promising pro forma FY2024 guidance has triggered the consensus’ relatively accelerated top/ bottom line growth at a CAGR of +3.3%/ +7.9% between FY2024 and FY2026, respectively.

This is compared to the historical growth at +1.2%/ +1.8% between FY2016 and FY2023, thanks to the smaller and focused company moving forward.

When compared to HON’s top/ bottom line growth projections at +5.1%/ +9.1% and DD at +4.3%/ +11% through FY2026, we believe that MMM’s discounted valuations at FWD P/E valuations of 14.05x look attractive here.

So, Is MMM Stock A Buy, Sell, or Hold?

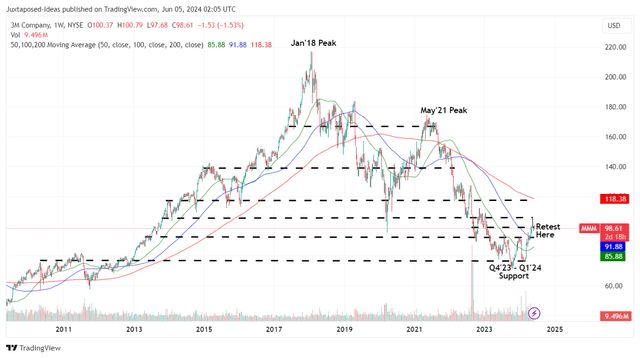

MMM 14Y Stock Price

For now, MMM has already charted a robust support at the Q4’23/ Q1’24 bottom of $76s, while considerably recovering to retest its next resistance levels of $99s.

Based on the consensus FY2025 adj EPS estimates of $7.74 (updated from the previous article of $10.57, accounting for the impact of SOLV divestiture) and the 5Y normalized P/E valuation of 16.29x (inline to previous article), there seems to be a decent upside potential of +27.8% to our long-term price target of $126.10 (updated from the previous article of $172.10, accounting for the impact of SOLV divestiture).

Assuming an upward rerating nearer to MMM’s historical P/E valuations of 20x, as discussed above, we may see a raised bull-case long-term price target of $154.80 as well, triggering an excellent upside potential of +56.9%.

Combined with the decent dividend yields, we believe that it continues to offer dual pronged return prospects, triggering our reiterated Buy rating.

It goes without saying that interested investors may want to observe the stock movement for a little longer and adding according to their risk appetite and dollar cost averages.

Otherwise, they may consider adding after a moderate pullback to its previous support levels of $91 for an improved margin of safety and expanded forward dividend yield of ~3.1%.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.