Summary:

- 3M Company has completed the spinoff of its healthcare business, Solventum Corporation, allowing both companies to focus on their respective strengths.

- Solventum has a well-diversified business model with strong growth opportunities, but faces challenges such as low entry barriers and elevated debt.

- MMM is showing signs of stability and growth, with settled lawsuits and positive market trends, making it a promising investment with potential for a high total return.

Sushiman

Introduction

On January 2, I wrote an article titled “A Bold Prediction: I Believe 3M Could Double.” This was my second bullish article on 3M Company (NYSE:MMM) stock after I started covering the stock again on September 29. Back then, I called MMM stock a “30% Undervalued Dumpster Fire.”

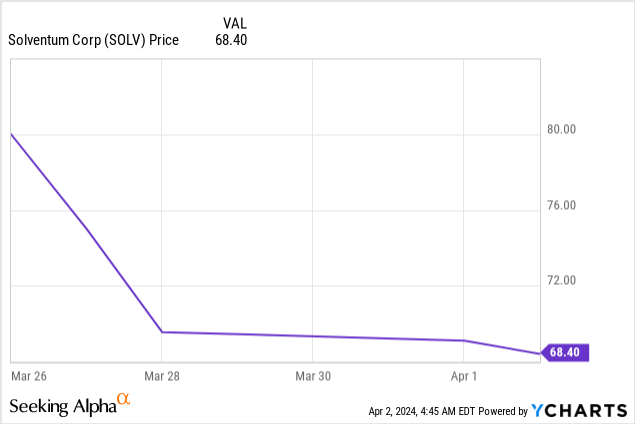

Since January 2, the stock price has been roughly unchanged. On some websites, it looks like the stock is down. However, that is due to the just-executed Solventum Corporation (NYSE:SOLV) spinoff, which was 3M’s healthcare segment.

I believe this spinoff was a fantastic move that will allow both companies to focus on what they do best. On top of that, MMM is seeing some progress when it comes to litigations and a bigger focus on growth areas, including climate technology, consumer electronics, and automation.

Hence, in this article, I’ll walk you through the spinoff, explain why I’m bullish on both the MMM and SOLV tickers, and why I stick to my bullish call that 3M may double in the years ahead.

As we have a lot to discuss, let’s get right to it!

Solventum – A Spinoff That Makes Sense

As expected, on April 1, 3M completed the spinoff of Solventum, which is the name of its healthcare business.

If you were a shareholder of 3M, you received one SOLV for every four shares of 3M in your portfolio. 3M currently owns 19.9% of the spinoff, which will be sold gradually over the next five years, freeing up cash to lower debt.

With that said, on March 19, the company held its first Analyst/ Investor Day, its “Inaugural Investor Day.”

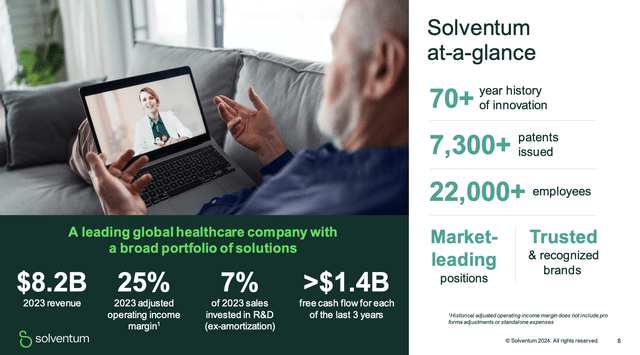

The company, which is led by CEO Bryan Hanson, started by making the case that it is one of the three biggest healthcare spinoffs in history, with the benefit of having enjoyed 3M’s massive R&D spending for many decades.

In fact, while SOLV may be a “new” company, it has more than 70 years of experience, more than 7,300 patents, and north of 22 thousand employees that generated more than $8 billion in revenue last year.

Speaking of innovation, the name “Solventum” is based on two things:

- Problem SOLVing.

- MomENTUM.

The slogan is “We never stop solving for you.”

Although it won’t influence my opinion of the company, I think this is a bit silly. It should be a given that companies never stop working on new solutions. I don’t think it adds any value to a name or slogan.

In general, I sometimes feel that companies spend too much time finding a good post-spinoff name to communicate how much they care about customers.

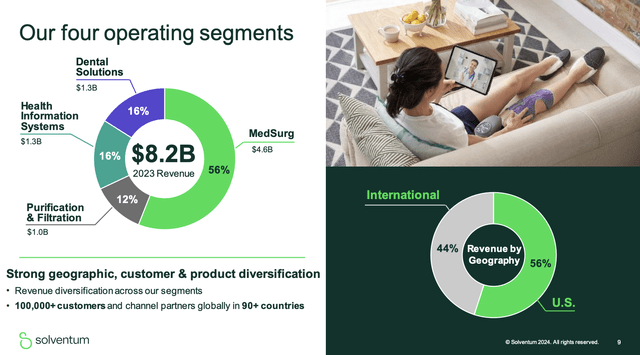

Anyway, going back to what matters, the company is highly diversified, both when it comes to its segments and international exposure.

Solventum, which generates $0.56 of every $1.00 in revenue in the United States, has four major business segments, with MedSurg accounting for 56% of total revenues.

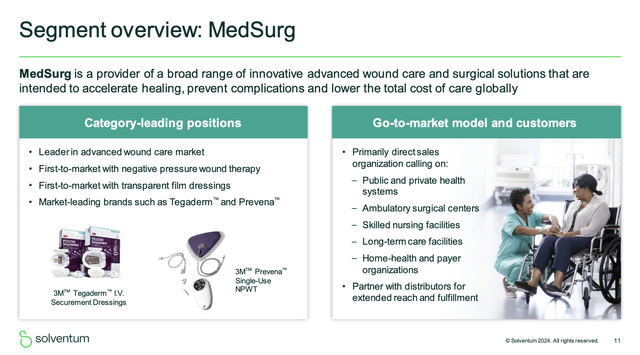

Within the MedSurg segment, the company focuses on bringing innovative solutions to market that facilitate accelerated healing and reduce complications.

For example, the company has established itself as a pioneer in multiple areas, including negative pressure wound therapy and transparent dressings to support accelerated healing and complication prevention. In healthcare, these are highly underestimated areas.

However, these products have low entry barriers as S&P Global notes. This could mean that the loss of the 3M name could make it easier for competition to take away market share. This is something worth keeping an eye on, as the same applies to other segments as well.

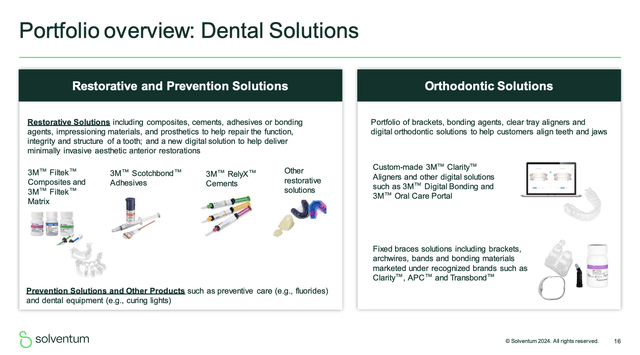

In its Dental Solutions segment, the company focuses on restorative therapies and orthodontics. This includes innovations like tooth-colored composites for cavity fillings, a wide range of aligners, fixed braces, and other products like adhesives.

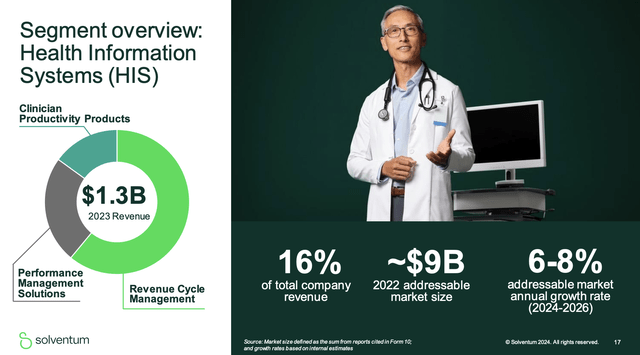

Then there’s Health Information Systems, which generated 16% of total revenue last year – similar to Dental Solutions.

This segment offers software solutions focused on revenue cycle management, performance management systems, and clinician productivity.

I really like this segment, as I believe it perfectly complements the other segments and focuses on a fast-growing, asset-light part of the market.

By using its experience in clinical intelligence and artificial intelligence, the company adds value by streamlining the caregiver process and optimizing reimbursement for healthcare institutions.

The company believes that this segment targets a $9 billion market that could provide 6-8% annual growth.

Last but not least, the company has a Purification & Filtration segment, which accounted for 12% of last year’s revenues. This segment provides filters and membranes for manufacturing and biopharmaceutical and medical technologies. This includes drinking water purification.

In this segment, the company competes with Veralto (VLTO), which was spun off from Danaher (DHR) last year.

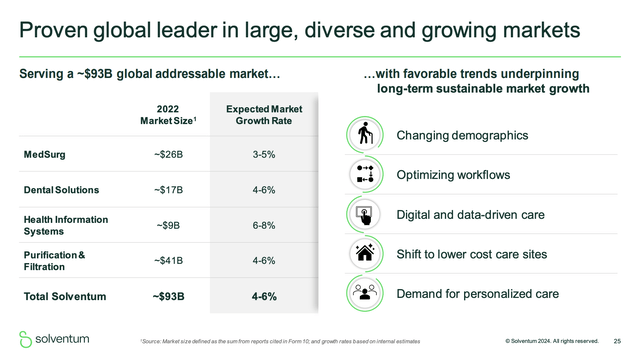

With all of these things in mind, the company has a total addressable market, or TAM, of more than $90 billion with an annual expected growth rate of 4-6%. This market is supported by secular growth in changing demographics (more older people needing better care), a focus on efficiency and workflows, AI, and personalized care.

One of the biggest benefits Solventum has is its long history under the 3M umbrella.

When you hear 3M, you think quality. […] So that brand is strong, but we have very strong sub-brands that will survive the spin and are meaningful to our customers, which means in these markets, we have trust, we have created markets through the technologies that we brought to bear. So we do have the trust of our customers in these attractive markets. – SOLV Analyst/Investor Day

Solventum has more than 100,000 channel partners and customers worldwide. It also has products in at least 75% of all hospitals in the United States and deep ties with the U.S. Centers for Medicare & Medicaid Services.

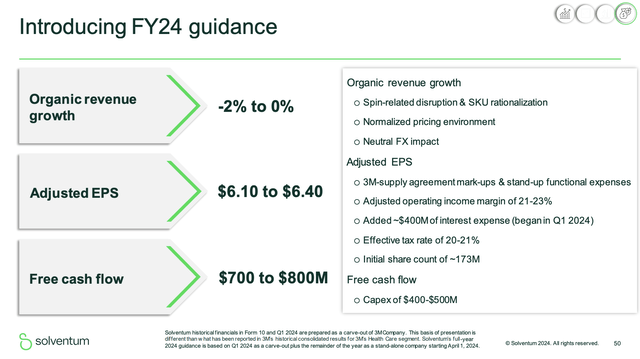

When adding that the company spent 7% of its revenues on R&D last year, we get a good foundation for growth that could allow the company to maintain more than 25% in adjusted operating income margins, $1.6 billion in operating cash flow, and $1.4 billion in free cash flow.

This year, the company is guiding for up to $800 million in free cash flow, which would be 7% of its market cap.

Moreover, as part of its growth strategy, SOLV is also focusing on expanding its global footprint and capturing opportunities in emerging markets. This includes investing in infrastructure, distribution networks, and local partnerships.

With that said, the company’s 7% implies free cash flow, or FCF, yield is a lot. It also makes SOLV look cheap. Applying a 20x FCF multiple would indicate a 40% stock price upside!

However, the company has a lot of debt. Looking at the quote below, it looks like MMM has used the spinoff to get rid of a lot of debt (but not too much to hurt SOLV shareholders).

We have a lot of debt coming out of the gate. Part of the reason why somebody spins is to get that midnight dividend, if they get the midnight dividend we get the debt. Now I didn’t want to have a lot of debt. I asked for less debt, but you get what you get, and you don’t get upset. – SOLV Analyst/Investor Day (emphasis added).

The good news is that the company has an investment-grade credit rating and opportunities to reduce debt in the years ahead.

While EBITDA leverage is expected to fluctuate between 3.0x to 4.0x, the CFO-capex/debt ratio is expected to remain above 10%. Fitch anticipates that Solventum will reduce debt by approximately $1.5 billion during the two years following the spinoff. – Fitch.

S&P Global makes the case that it will lower Solventum’s credit rating if the leverage ratio remains above 3.5x EBITDA, especially if the company engages in large M&A within the first two years of existence. This also includes unexpected operational headwinds that could trigger a lower rating.

Regarding its dividend, the company has not yet made a final decision. Once the Board of Directors has figured that out, it will be made public.

All things considered, I like SOLV. However, I do NOT love it.

Things I like:

- The company benefits from a rich history under 3M’s umbrella.

- It has a well-diversified business model with strong secular growth opportunities.

- It has a strong free cash flow profile.

Things I dislike:

- It has somewhat elevated debt, which often happens when struggling companies (like 3M) spin off assets.

- A large part of its revenue comes from products with low entry barriers. With the loss of the 3M brand, it will be tougher to compete.

- Strategic M&A comes with a razor-thin margin of error, as elevated debt levels will likely lead to a lower credit rating.

Although I believe that the stock could be 40-50% undervalued in the 2-3 years ahead if it is able to maintain strong growth and reduce debt, I have no interest in buying SOLV. I prefer to stick to healthcare companies in areas with higher entry barriers, including biotech and high-tech suppliers like Danaher.

That said, this is not a call to sell SOLV. Especially after its poor start, I believe the risk/reward is quite good. For what it’s worth, if I had post-spinoff shares, I would likely keep them.

So, What About 3M?

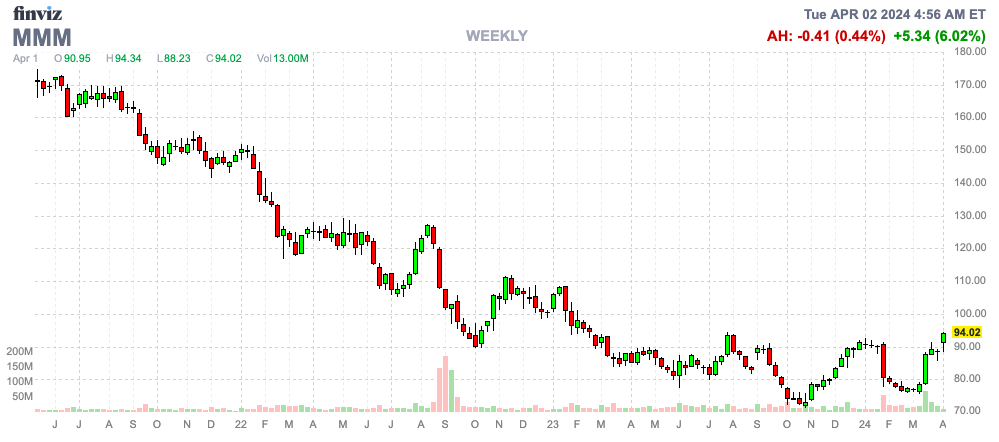

The 3M stock price hasn’t gone anywhere since early 2023. While the S&P 500 has skyrocketed since then, this is still fantastic news.

FINVIZ

After all, after being in a downtrend since early 2018, losing close to 60% of its value, investors aren’t punishing MMM anymore.

One big factor here is the settlement of major lawsuits.

For example, on April 1, the company announced that its settlement agreement with the U.S. public water suppliers received final approval from the U.S. District Court in Charleston, South Carolina.

This means there is now a lot of certainty with regard to the $10.3 billion 3M will have to pay over the next 13 years under this agreement, starting in Q3 2024. This assumes no further appeals.

Moreover, the company’s earplug lawsuit just saw a 99% settlement participation rate.

This, too, adds a lot of clarity, as the company is in the process of paying up to $6 billion ($5.3 billion pre-tax present value) to participants through 2029. Some of it will come in the form of common stock. Insurance will partially offset these headwinds.

In light of the earplug and FPAS issues, Fitch believes that 3M is in a good spot to maintain its investment-grade credit rating.

The Stable Outlook reflects Fitch’s view that 3M will have sufficient financial resources from its operating cash flows and proposed health care spinoff to address the Combat Arms Earplug and PFAS remediation for public water suppliers ((PWS)) settlement payments while maintaining EBITDA leverage at around 2x (less than 1.5x on a net basis). Furthermore, additional PFAS-related dockets, such as claims by state attorneys general and personal injury plaintiffs, as well as international claims and those that may arise under CERCLA, are in relatively early stages, and Fitch believes further potential payments can be addressed in a manner consistent with 3M’s ‘A-‘ credit profile. – Fitch (emphasis added).

Furthermore, we’re getting closer to consistent growth.

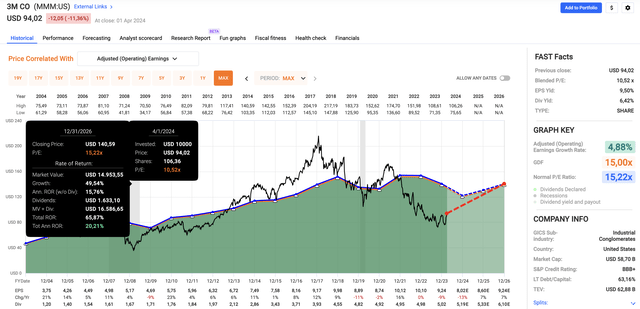

Using the data in the chart below, analysts expect the company to grow EPS by 7% in both 2025 and 2026, which would mark the first two consecutive years of growth since 2018.

This is supported by positive comments from management.

For example, during last month’s JPMorgan Industrial Conference, the company noted strength in certain industrial markets, including the automotive aftermarket and industrial minerals sectors. The electronics segment has performed better than anticipated, while the consumer business remains consistent with projections.

The U.S. market stands out as particularly robust, with Asia and China showing signs of improvement, especially in electronics.

Adding to that, overall stability is observed in channel inventory across industrial sectors.

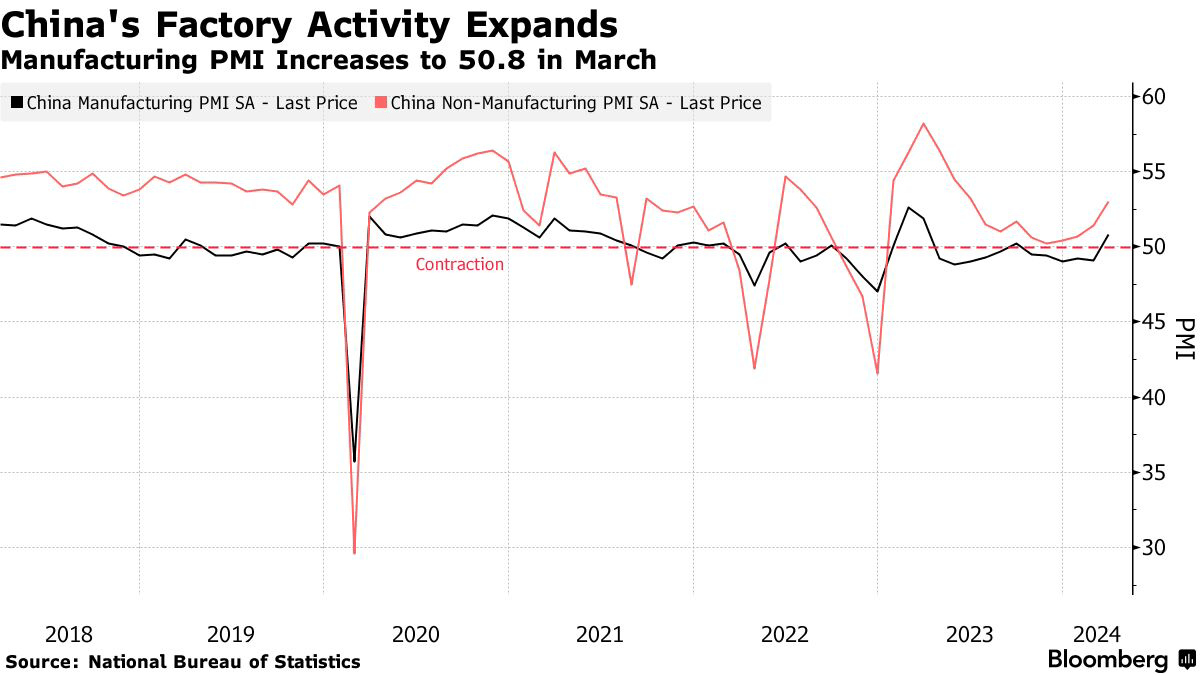

Two days ago, these trends were confirmed, as China’s factory expectations (manufacturing PMI) improved. Both manufacturing and services are now in expansion territory.

Bloomberg

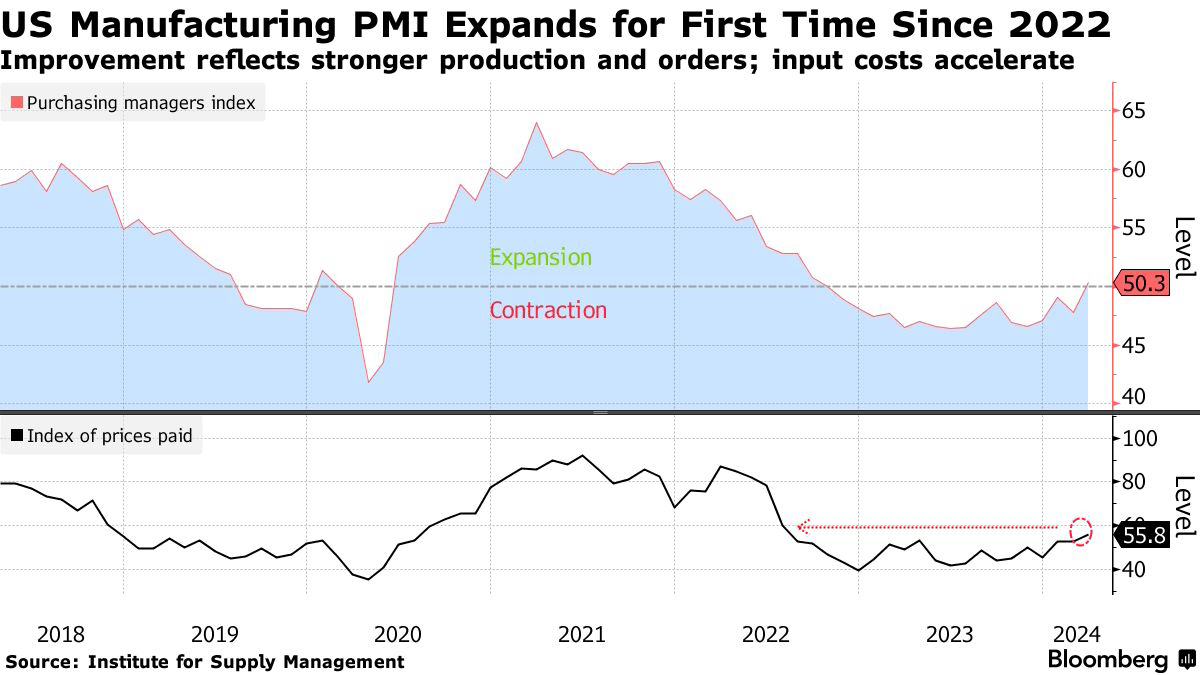

The same is happening in the U.S., where the ISM Manufacturing Index is now back in expansion territory.

Bloomberg

Historically speaking, these developments are highly favorable for 3M, which is now even more cyclical after spinning off its healthcare exposure.

Going forward, especially China is a great market for 3M to grow, as it has accelerated investments in recent years to improve regional manufacturing capabilities.

In general, the company actively pursues portfolio optimization by divesting from product categories lacking competitive advantages.

This strategic initiative aims to concentrate resources on segments with higher growth potential and synergy with the company’s innovation capabilities.

Short-term revenue impacts may result from these optimization efforts, but long-term growth and profitability are expected to be improved.

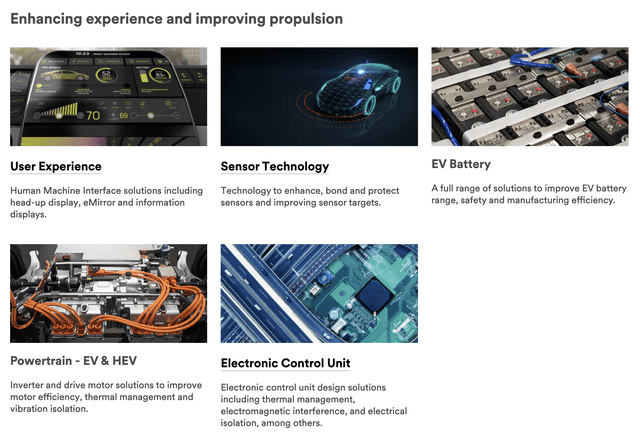

Some of these strategic initiatives include EV mobility, safety solutions, home improvement, consumer electronics, climate technology, industrial automation, and next-gen electronics.

Last year, the company saw 30% growth in its automotive electrification business, which has grown into a $650 million business.

3M Stock Dividend & Valuation

So, what does all of this mean for its dividend?

During the aforementioned conference, the company was asked what we can expect from the dividend going forward.

This is what the company responded (emphasis added):

Yeah. So with the focus with the spin coming up that’s one of the questions. I would start we are a strong cash generator as a company, and that’s been a hallmark for us. It’s put us in a position to have a very strong balance sheet.

What we talked about or what I talked about in my opening comments, the dividend through the spin the $7.7 billion plus the 19.9% stake those are going to strengthen 3M’s balance sheet even further and position us to execute a strong set of priorities and capital allocation.

The first is investing in the business. The second focus for us will be returning capital to shareholders including through an attractive dividend. And then it’s going to be positioning us and we’re well positioned to manage any required cost of settlements. And that’s what we’re focused on and something that will ultimately be a Board decision. And we’ll talk more about it as we go forward. – MMM JPMorgan Conference.

In other words, MMM management feels good about its balance sheet (rating agencies agree). It will also use capital for its core priority, which is growing the business. This, too, was expected.

Regarding its dividend, the company is not yet willing to make a commitment.

On February 6, the company hiked its dividend by 0.7% to $1.51 per share per quarter. This translates to a yield of 6.4%.

This dividend will soon be adjusted for the spinoff, which means it depends on what the Boards of MMM and SOLV decide before we know if pre-spinoff investors will see a lower total payout. Usually, total post-spinoff dividends are equal to pre-spinoff dividends.

However, I cannot guarantee that this will happen again, as SOLV seems to be very focused on debt reduction while 3M is dealing with the payments related to two massive lawsuits.

The good news is that MMM is a cash cow. This year, it is expected to generate $4.9 billion in free cash flow. That’s 9.4% of its current market cap.

It is also expected to lower its net debt to $3.3 billion by 2026, which would be 0.3x EBITDA.

In other words, it could be possible for MMM to maintain a >6% dividend.

Nonetheless, even if the company were to cut its dividend, I expect that dividend investors will be fine in the end, as free cash flow is strong. The balance sheet can take the lawsuit payments, and growth seems to be improving.

While MMM has been a horrible place to be for roughly six years, I believe its turnaround is looking very promising.

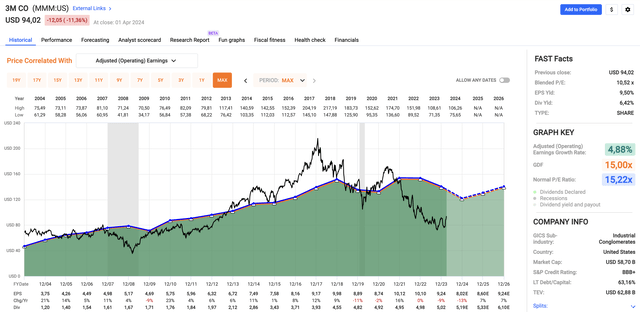

Valuation-wise, MMM trades at a blended P/E ratio of just 10.5x. This is well below its normalized 15.2x multiple. Although a low multiple was justified in recent years, I believe the company deserves a higher multiple, especially if it maintains high growth.

Currently, a return to a 15.2x multiple implies a $140 target price. This is 48% above the current price.

When adding its 6% dividend (assuming the dividend will be kept close to current levels in the years ahead), we get a theoretical 20% annual return.

In other words, if the company is successful in keeping further litigation risks limited, maintaining high-single-digit EPS growth, and supporting its dividend, we could see a >100% total return in the next 4-5 years.

Although economic and business risks are always factors that can impact these expectations, I’m extremely upbeat about MMMs future.

There’s finally light at the end of the tunnel, and it’s not a train.

Takeaway

Investors should closely monitor 3M’s trajectory post-spinoff, as the company navigates through significant legal settlements and operational restructuring.

While uncertainties persist, strategic moves like the Solventum spinoff and focus on growth areas signal potential for long-term value creation.

Meanwhile, Solventum presents opportunities with its diversified segments and strong market presence, albeit with cautious considerations regarding debt levels and competition risks.

Overall, while the road ahead may be bumpy, both 3M and Solventum hold promise for investors who can deal with short-term volatility and capitalize on their potential for sustained growth and shareholder value.

While I’m bullish on both SOLV and MMM, only MMM is a high-conviction idea.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MMM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.