Summary:

- 3M reported adjusted earnings that beat expectations, but organic sales continue to decline.

- The company’s guidance suggests little improvement in the coming year, and legal liabilities pose significant risks including potential bankruptcy.

- The healthcare spin-off may not add much value, and the stock is overvalued considering the operational and legal challenges.

Education Images/Universal Images Group via Getty Images

The Update:

3M Company (NYSE:MMM) reported “adjusted” quarterly earnings of $2.42 that “beat” expectations of $2.31 this morning (1/23). It also issued “adjusted” earnings guidance of $9.35-$9.75 versus estimates of $9.81 according to Bloomberg.

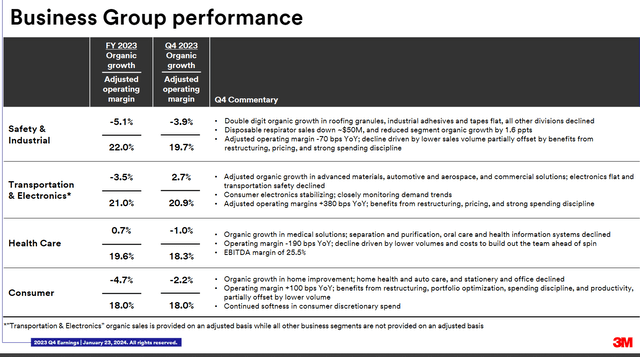

Organic sales continue to be moribund. Total organic sales for the quarter were -1.4% bringing the organic sales performance to -3.2% for the year. While the Transportation and Electronics division went positive for the quarter (on an ADJUSTED basis), Healthcare, which the company hopes to spin out as some growth engine, saw its organic revenue dip into negative territory.

3M Business Segment Performance (Q4 Presentation)

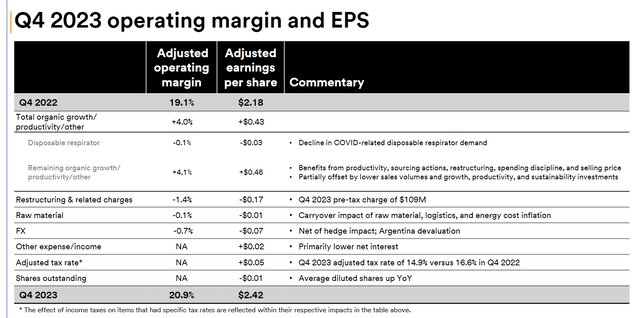

As I have stated several times, the potential legal liabilities this company faces largely moot the operational performance. That said, organic sales like the above show this company has very little going for it operationally. While margins are improving thanks to cost cuts, these “adjusted” earnings numbers are so adjusted that they’re hard to take too seriously. Just look at the number and scale of the adjustments below.

3M EPS Breakdown (Q4 Presentation)

The company got a $.05 benefit from taxes and somehow managed a $.02 benefit from interest rates. Just back those out and the company only hit $2.34 for the quarter.

The guidance also demonstrates that the company is not expecting much improvement in the coming year. Adjusted earnings guidance midpoint of $9.50 implies less than 3% improvement from the $9.24 adjusted EPS for 2023. That’s with guided organic sales of 0-2% growth. Given the low base of sales performance after the declines of 2023, the company is hardly expecting a major sales rebound.

That guidance also prices in healthcare remaining part of the company for the full year and does not count the impact of the extra debt funding required to pay the settlements the company has already agreed to. The company estimated that debt will impact earnings by $.20.

Net/net, even before consideration of legal liabilities, this is essentially a no-to-low revenue growth, no-to-low earnings growth company trading at about 12x earnings (at $108) going into the print (although it’s down at $100 pre-market). That hardly seems like a bargain.

The Liabilities:

I continue to believe that the continued legal liabilities are huge here and will continue to present themselves. While the company “settled” earplugs and many of the municipal water district lawsuits, there will still be opt-outs from the municipal settlement. Moreover, in August, the State AGs announced changes to the municipal settlement that made it likely more expensive than the company initially announced in June.

In addition to these already known legal liability costs, I believe the EPA should be getting a hazardous material designation on PFAS sometime this quarter. Once that happens, the agency can start declaring PFAS-polluted sites Superfund sites and start assigning clean-up responsibilities with little to no appeal.

There are also the remaining attorney general lawsuits from over 22 states, lawsuits from foreign governments, personal injury cases, and property damage cases. It is impossible to quantify the total potential costs to the company of all of these plaintiffs, but they could be massive.

The Healthcare Spin:

I still do not understand how the company can spin off an asset when it has so many large and known liabilities. That said, should the spin-out occur, I don’t see why it should be a large value creator. The division did not grow in 2023 and the company is only guiding for flat to low-single digit revenue growth for 2024. That type of performance should not garner a large multiple.

Valuation:

It is quite difficult to assign clean EBITDA to the company much less individual divisions, but I estimate the company did about $8 billion of adjusted EBITDA in 2023 ($6.14 billion operating income + $1.9 billion depreciation) with healthcare contributing about $2.1 billion ($1.6 billion operating income + ~$500 million depreciation). If that’s correct, I don’t see how a healthcare spin adds much value here.

| Market Cap (using $100/share) | $55 billion |

| Listed Debt | $16 billion |

| Legal Liabilities (~16 billion settled) | $16 billion |

| Cash | $6 billion |

| Enterprise Value | $81 billion |

| EV/2024 EBITDA (using $8 billion) | 10.125x |

If you remove the known legal liabilities, the multiple comes down 2x. I don’t see why anyone would do that since they are known and likely to grow. Therefore, walking through the numbers, if healthcare is $2.1 billion of EBITDA and the market assigns a no-growth business with 3 to 3.5 turns of leverage (management guidance) to a 12x multiple (in line with GE HealthCare Technologies Inc. (GEHC)), that leaves $56 billion of EV ($81 billion minus $25 billion). That would mean the no-growth industrial business with massive potential legal liabilities and about 3x leverage, would have to trade at 9.5x EBITDA ($56 billion divided by $5.9 billion).

I just don’t see either entity as having that kind of value.

Risks:

The risk to any short is that the market can completely abandon valuation as a benchmark for where the stock trades. The company could also figure out some great settlement for all of its legal liabilities. Lastly, there could be some incredible return to growth or margin expansion. I don’t see any of those scenarios happening here, but anything could happen. If one wanted to mitigate the downside to the short, one could own puts. The volatility isn’t particularly high, thereby making puts a reasonable way to express the short. Expiry and strike are dependent on how long you want to see the legal liabilities play out and where you think the stock should trade. I personally think the stock’s valuation could be cut in half. 7x EBITDA is more reasonable for a no-growth industrial facing large legal liabilities in my opinion.

Conclusion:

3M strikes me as a great core short. None of the businesses grow in a fashion that the market should take the stock massively higher. In fact, I think it’s easy to argue the company is overvalued now on core operations. Add in the risk posed by pending legal liabilities and I think the odds of a downside move are much higher than the upside with very real potential for a bankruptcy filing at some point.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

My new investment group, Catalyst Hedge Investing, is live. The launch has been terrific. The chat board is live and active as is the best ideas portfolio. There are still generous introductory prices for early subscribers that will continue for the life of your subscription. Come join the fun!