Summary:

- I manage a 40-stock portfolio using a tactical YARP approach, balancing growth and yield while avoiding major losses, with MMM currently at a 1% position.

- Despite MMM’s recent strong performance, its valuation is stretched, and its dividend yield is low, prompting me to maintain a cautious “hold” rating.

- Technical analysis shows MMM hitting resistance, so I won’t increase my position until it breaks through, focusing on profitability and risk management.

- My investment strategy involves adjusting position sizes based on market conditions and using options and ETFs to complement my stock holdings.

Muharrem Adak/iStock via Getty Images

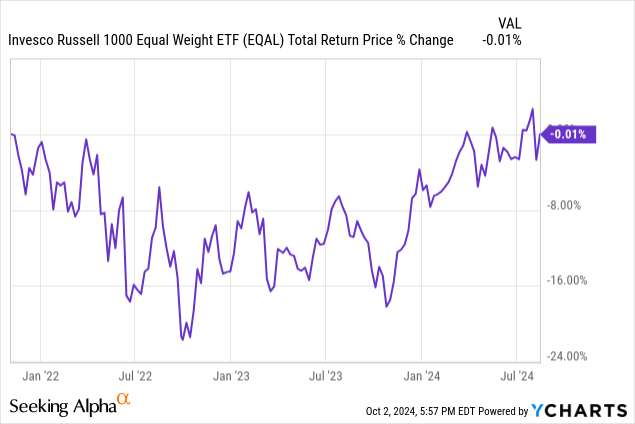

Earlier this week, I engaged in an exercise of taking myself to task for the worst investment decision I’ve made this year. Most importantly, the article was really about what I learned from that instance, one of many decisions an active like me makes in a given calendar year. I am a dividend seeker and a risk manager. Those two ideals are often at odds, especially when we consider that the average stock put up a “goose egg” for just under 3 years, until quite recently.

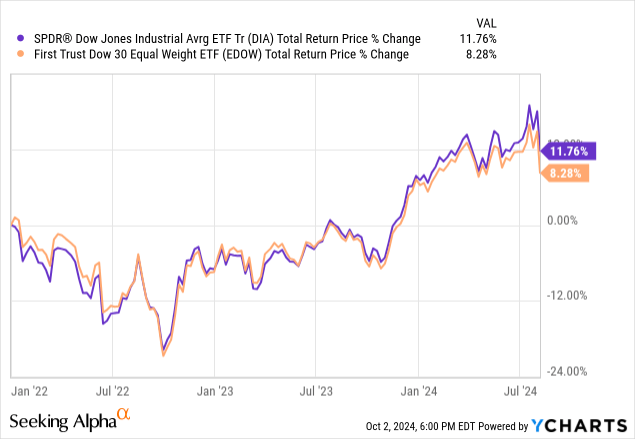

Within the Dow Jones Industrial Average, as shown by the main ETFs that track it in traditional price-weighted (DIA) and equal-weighted form (EDOW), the blue chips have done better but not been in the same league as the Magnificent 7-types. Here is the performance of that pair from the start of 2022 through the chaotic Monday in August (8/5/24) where we had a scare that turned into…what else? A buying opportunity for high-flying stocks.

Still, 32 months’ worth of mostly flat returns even for the Dow Industrials reflects more so than the Nasdaq how dividend investing has been very much a stock picker’s market. And by that, I mean very slim pickings!

Back on March 29 of this year, I was putting together my Yield At a Reasonable Price (YARP™) portfolio, which reached its 40-stock target level on the last day of April. I wrote about 3M (NYSE:MMM) which is one of those 30 Dow Industrials stocks. As the title of that piece read, I felt that MMM at the time was a perfect example of why stock ratings are overrated.

Perhaps I should have corrected that to “misleading,” because in the case of MMM, I summarized my thinking this way:

I see in 3M a stock that transcends a bottom-line opinion. As described below, I conclude 3 things about the state of affairs at this Dow Industrials component stock:

- It is not a permanent part of my long-term stock watchlist, but it is close. I have always put the Dow stocks on a pedestal, compared to companies that by their nature can’t dig themselves out of a hole if one occurs. Because it usually does. That’s the business cycle.

- MMM is clearly in a rut, with a combination of stagnation in some of its mature business lines, some legal concerns, the spinoff of its healthcare division, new leadership and oh yeah, that fact that it is a stodgy old Dow Industrial, and not a FAANG stock. But I am not evaluating this stock based on current issues, but rather their capacity to endure when things don’t go right. And I suspect astute Seeking Alpha readers will know what I mean when I say that I’m not the first investor to see opportunity in out of favor companies.

- The way I manage my stock portfolio involves identifying a core group of 40 stocks, replacing them slowly when needed, but driving total return by being willing to raise or lower my position size in a range of 1% to 5% for each of those 40 stocks. It is not an index, but it has some of the guardrails that have helped the index become the majority of managed equity assets over the course of my 30+ year career.

So in the current environment, I could call MMM a buy, a hold and a sell at the same time. I’ll settle on hold for this report, simply because it reflects my view that MMM is not as attractive as several other stocks in my basket, but is reaching an extreme to the downside where I am willing to hold a modest piece of it in my portfolio. And I am doing so with the expectation that my target position size will be higher 6–12 months from now than it is now, as the dust settles here.

6 months later…

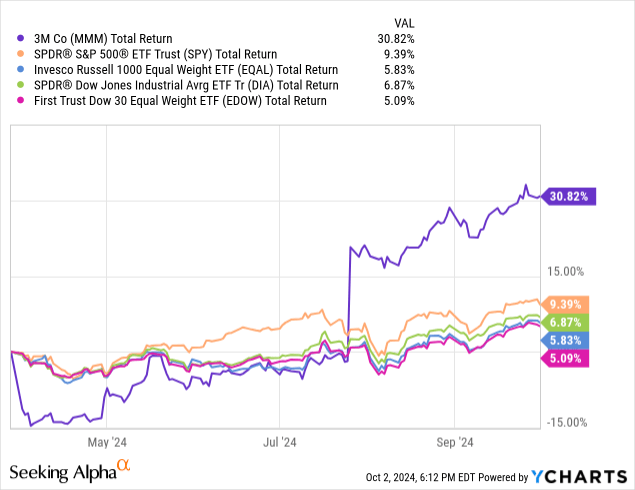

MMM has been a solid citizen within my portfolio. But a lot of that move came from a single day event. I’m a technician and a quant, not a deep-dive fundamental analyst, so while my process led me to own a modest position in this stock among 35 or so others at the time this happened, I certainly was not speculating on any specific spinoff or other event. Across a full portfolio of 30–40 stocks, some yield-oriented ETFs and a pair of options (call and put) I used to control risk and get some exposure to non-dividend stock performance, there’s a lot of activity and impacts to balance.

So MMM worked out well, and I still consider it a welcome member of my “top 40” that I own. But there’s a growing chance I could “send it to the minor leagues” which is my extended list of stocks I watch but don’t currently own. The watchlist is 75, the portfolio is 30-40 of those at any time. And it has nothing to do with quality, management, earnings projections or the other things that smart CFA-types devote their careers to doing.

I’m “just” a chartist approaching 40 years of market experience, most of that managing “other people’s money” as advisor and fund manager. But in my semi-retired phase, I see what MMM is doing and realize that any investor that doesn’t at least respect the role of technical analysis in these zany, emotional modern markets is asking for trouble.

So, when it comes to MMM, where have I been, what do I think now, and where am I going? That’s a much easier question to answer behind the keyboard than behind a steering wheel!

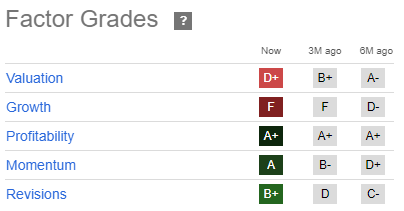

Seeking Alpha Factor Grades analysis

Profitability is what I put my chips on, much more so than the other aspects of the SA quant system. I incorporate the others, but since I chart stocks for a living, both their price and other characteristics and trends, my main filter from this data is to convince myself I don’t have hidden risks in the business. A+ rated MMM for profitability means it is still as viable a potential position as it was 6 months ago. Valuation is rich, growth is very poor and momentum is an A, so likely quite stretched in price. That all syncs with my own proprietary methods, so that’s a good sign. More on that below.

Seeking Alpha

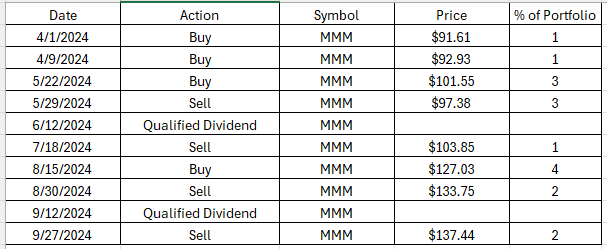

My MMM tactical position history (2024)

Seeking Alpha

Straight from my brokerage statement download, here is an example of when my YARP tactical approach gets very active. I can go months without adjusting a position’s weight in the portfolio, or it can be like this or anywhere in between. I don’t tell the market what to do, I just work with it. And I don’t see stocks as “owning a piece of a business forever” as some do (nor do I disagree with that or any other approach – I just do my thing, and called it YARP). I use the market as a tool to get what I want: growth and yield potential, while trying to avoid major loss.

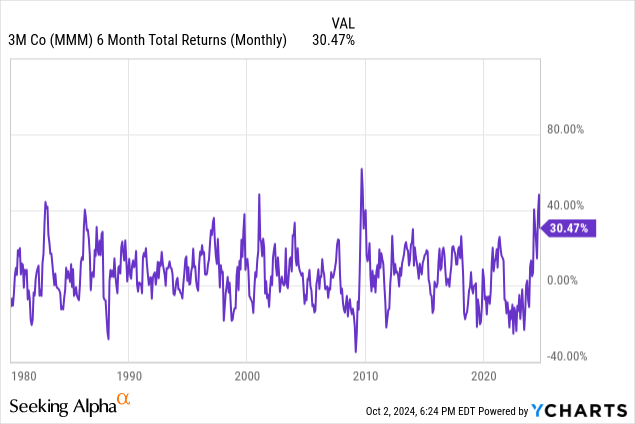

I just happened to catch MMM as it was preparing to lift off to one of its best 6-month runs in its history. That’s not a red flag going forward, but a yellow one for sure. To be clear, I don’t anticipate selling out of MMM any time soon. Ideally, it is a stock I keep well past a 12-month holding period.

However, where I differ from the crowd is that while I likely continue to own it, that position could be where it is for a while: at 1% of my portfolio. As shown above, that’s where I started, but then held as much as 5%, then 3%, and back down to 1%. The other possibility with a stock that has jumped like this one, “out of its shoes” so to speak, is to be willing to own a higher position but hedge it, either by applying covered call options, protective put options, or both. As I see it, owning a stock is one thing, but willingness to let it drop in the name of “buy and hold” investing makes less sense to me in the era of algorithms, Fed obsession by markets, and other factors that make stock prices do things based on everything except “fundamental value.” I respect those who put things like discounted cash flows at the center of their evaluation of a stock. I don’t. I just don’t want to see my stocks “go on sale” after I buy them.

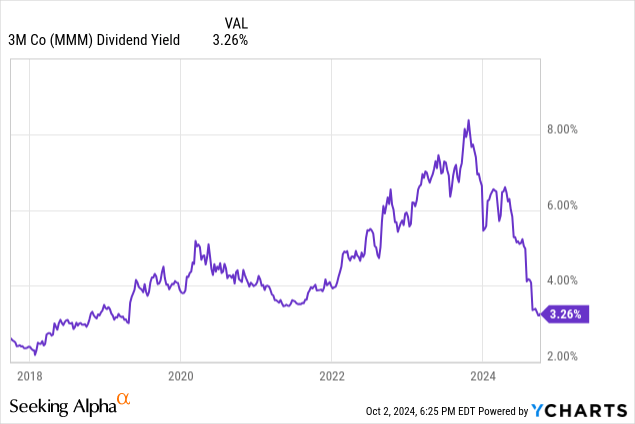

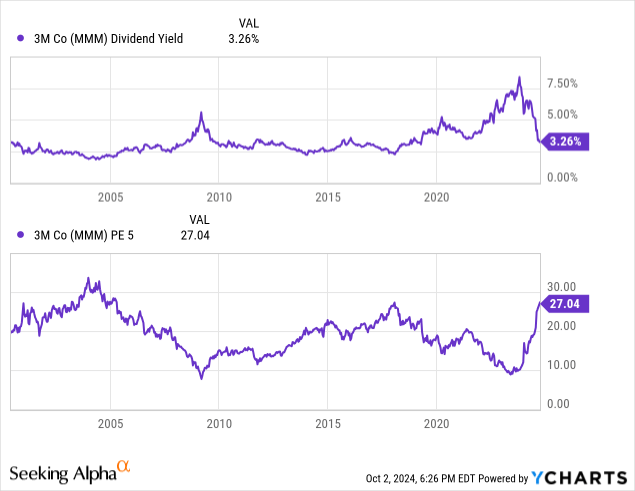

MMM’s dividend yield over the past 7 years is shown here. It is toward the bottom of that range. Translation (this is the YARP factor I created years ago): it can still go higher, but the risk attached to being aggressive with it at this point is extremely high.

Pictured above are 2 more signs that MMM is stretched out a bit much for me to own more than my minimum 1% position for now. The top shows that its yield is not only toward the “expensive” end of its 7-year range. It is also near a 20+ year low. No good.

And the other chart shows its P/E ratio based on 5 year trailing earnings. Near a 20-year-high. No good.

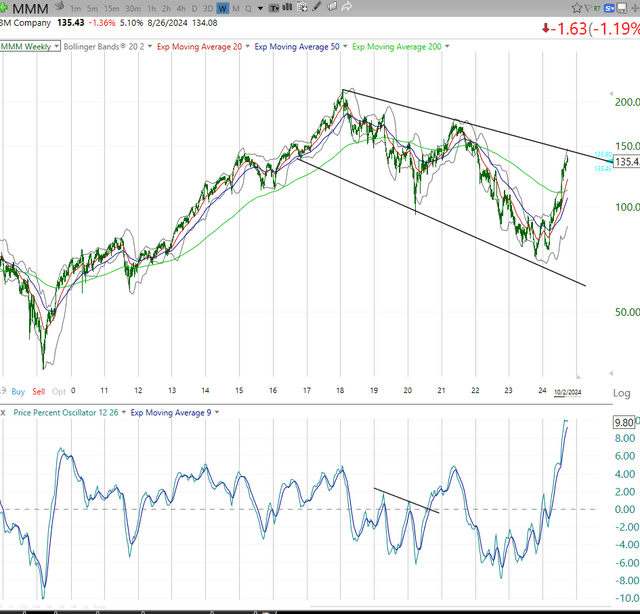

Finally, there’s the technical price chart itself, shown below. The big move that made me some nice total return the past 6 months is now hitting the top of a long-term downtrend line. That tells me to wait and see, but don’t expect it to burst through…and be thrilled if it does.

Conclusions on MMM

As I said in the March article and to start this one, ratings don’t mean the same to me as they do to many investors. What was my “rating” on MMM the past 6 months? I owned 1%, raised it to 2%, then to my maximum 5% weighting (at cost) in order to get as much of the quarterly dividend payment as I could on what was a “winning” position. Then I did the same thing during the next quarterly cycle.

I’ve booked some modest profits, and collected a pair of dividend payments that annualize to more than 10% of my original cost (since I owned a much bigger position when the stock went ex-dividend than I did much of the 6-month period. I currently still hold that 1% position, and am up 49% from initial purchase. So most of my gains are unrealized at this point.

Within my 40 stock holdings, some have not been traded since initial purchase, a few look like MMM, and with most of them I have adjusted the position perhaps 2–3 times over the6-monthh time frame. That’s the tactical aspect of YARP investing, as I’ve intended it to be.

That said, the stock research I do and the position size I take in a stock at any time are my personal decisions. If I wanted to limit turnover to do less position size activity, the adjustment there is fairly straightforward. And that’s where the options and ETFs I use to complement the stock basket can be used to limit trading.

So, what’s my updated “rating” on MMM? I rate it “I like the stock, but not enough to own more than 1% until I see if that heavy technical resistance area holds or breaks through. And, what other decisions I want to make with the other 39 positions. This may sound complex, but it is so process-driven, it is more like “same stuff, different day” to me.

So I land on a big giant “hold” rating on MMM. After all, despite all of the activity surrounding the company, the business and my position size, I do still hold this blue chip name. And as opposed to the last stock I wrote about my experience with, this one is “so far, so good.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.