Summary:

- 3M reported Q1 earnings with revenue beating expectations and adjusted EPS at $2.39/share.

- The company issued EPS guidance for the year at $6.80 to $7.30.

- Adjusted organic sales grew 0.8%, showing improvement from previous declines accompanied by margin improvement.

- Dividend could be cut 50%.

enot-poloskun/E+ via Getty Images

3M First Quarter Earnings Report:

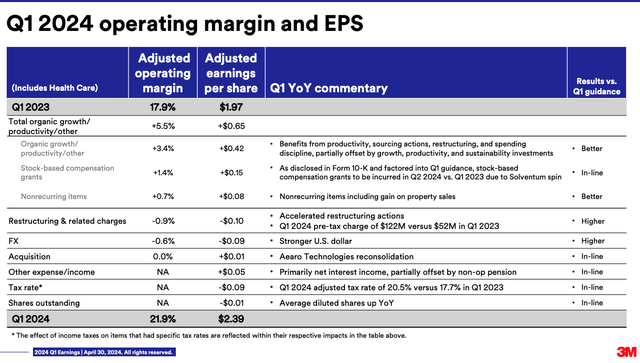

3M (NYSE:MMM) reported Q1 2024 earnings this morning; revenue beat by a small amount and adjusted EPS came in at $2.39/share. The adjustments were numerous and fairly large. Therefore, I recommend people to go through 3M’s quarterly presentation. The two biggest pieces were cost cuts, net of restructuring charges and a delay of stock compensation expense to Q2.

3m Q1 Earnings Adjustments (3M Quarterly Presentation )

The company issued EPS guidance for the year at $6.80 to $7.30. The Q1 report and 2024 guidance were all net of Solventum (SOLV), 80.1% of which was spun out on April 1. I covered that spin-out and its potential impacts in my previous article on 3M stock.

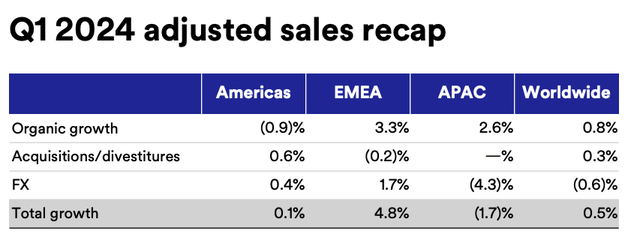

Adjusted organic sales grew 0.8%, while that is nothing to get excited about, it is better than the organic revenue declines the company has posted for most of the past two years. Much of the “improvement” in the revenue picture comes from the Electronics and Automotive division, where the company has won some contracts. Even then, these adjusted numbers are a mixed bag. The Americas are still down, while international is looking mildly better, but Asia FX is a major headwind.

3M Organic Revenue Breakdown (3M Quarterly Presentation )

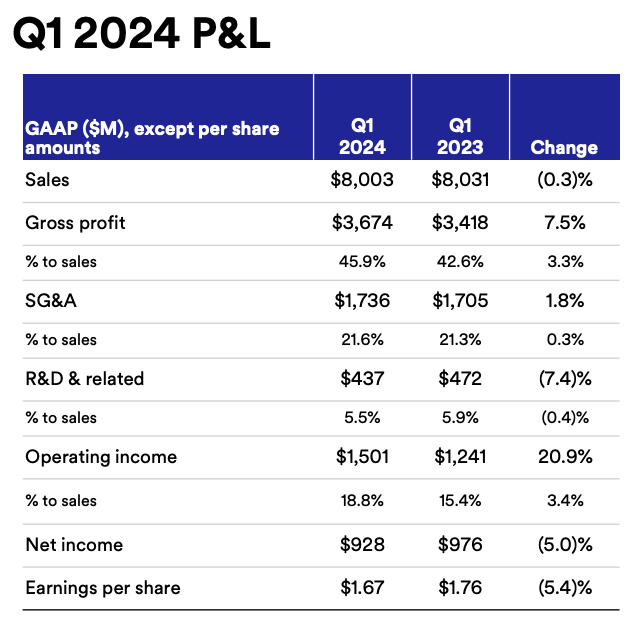

People (at least Wall Street analysts on the conference call) seem to be most excited about the margin improvement. The company’s cost cuts from last year are playing through to this year. Operating margin improved 400 basis points in Q1 of ’24 versus Q1 of ’23, and is expected to be 200 to 275 basis points higher for the full year.

While higher gross profit and lower SG&A are definitely helping on the margin front, the company also reduced R&D expenditure.

3M Q1 earnings comparison to last year (3M Quarterly Presentation )

For a company with organic revenue challenges, R&D is not where you want to see them saving money. In fact, I had to laugh when CEO, Mike Roman, was asked on the conference call about the company’s expected growth, he replied:

Importantly, when you look at what drives our growth, it’s really investing in the business. Organic investments have been the dominant driver of growth for us as a company and we expect that to continue as we move forward.

3M’s Dividend Cut:

I have been writing for over a year that 3M’s dividend after the SOLV spinoff would be unaffordable without destroying the balance sheet. The math is simple. The company barely covered the dividend, even with SOLV producing cash flow. Without SOLV or a massive improvement in sales and free cash flow conversion, there was no way the numbers worked. I did question whether 3M’s Board of Directors would cut the dividend or maintain the dividend aristocrat status it has maintained for decades at the expense of the balance sheet. Well, they did the responsible thing. The new dividend has not been announced, but the company said it would be 40% of adjusted free cash flow.

I believe that operating cash flow will be around $5 billion at best (likely $4 billion) without SOLV. Capital expenditure will be around $1.4 billion. Therefore, free cash flow will be around $3.5 billion. That would leave around $1.4 billion available for dividends, ~$3/share, around half of the $6.04 annualized value of the last dividend of $1.51.

Impact of MMM’s Dividend Cut:

As of this writing (noon on April 30th), the stock is 3% higher despite this dividend cut. People are really latching onto the margin improvement here and the end of the organic sales declines. At $95/share, 3M’s stock is trading at less than 14x the midpoint of the 2024 earnings guidance. However, that is very far from the end of the story here.

A dividend cut is almost universally bad for stocks. I can’t think of an example where a dividend cut was absorbed well. I never counted the number of people who commented on my past negative articles about 3M, who seemed enamored with the dividend. But the number was big. That ~6% dividend yield seemed like the major big draw, even with fed funds over 5%.

I would be very surprised if these people will still love the stock, if I’m correct, and the dividend is cut in half.

Environmental Liabilities Still Lingering:

While 3M settled the water utility PFAS liability and the earplugs mass torts, PFAS remains an issue. The EPA looks almost certain to designate PFAS a hazardous material in the next few months. That could put the company on the hook for billions of cleanups. There are also state AG lawsuits, property damage and personal injury suits and liabilities to foreign countries suing the company for PFAS pollution.

The company will not (likely cannot) put any kind of number on these liabilities. I think they are likely quite large. While the margin improvement is good, and can add $500-$600 million to the company’s pre-tax earnings, the liabilities can dwarf these improvements. The Wall Street analysts seem like they are focusing on what they can see right in front of them, rather than big liabilities that are out there, but unquantified at the moment.

Risk to 3M short:

The main risk to the short thesis is some mass settlement of all PFAS liabilities. I don’t see that happening, but anything is possible. It’s also possible that the market will view the liabilities as problems, but priced in with the new $7 earnings profile.

Conclusion:

I think that 3M management has done a lot of what it can do, given its position. It cut costs to get more cash going through the company, and it settled what it could settle, at amounts and timeframes that wouldn’t destroy the company. However, liabilities remain and the reduction of R&D and capital spending indicate that revenue growth will be hard to come by. Usually, the market does not afford big multiples to companies that are cost-cutting stories, at least not those with big potential liabilities.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Members of Catalyst Hedge Investing had early access to this article. They have exclusive access to many other articles every month as well as an active chat board with regular updates on ideas and a best ideas portfolio.