Summary:

- The uncertainty of pending litigation for 3M is the 600-pound gorilla in the room.

- 3M’s attempts to shield itself from earplug-related litigation have so far failed.

- PFAS ‘Forever Chemical’ litigation is looming on the horizon as well.

- Once the uncertainty of litigation is resolved, 3M should thrive.

josefkubes

It Was The Worst Of Times

It’s tough to be a conglomerate these days, and no company understands that better than 3M (NYSE:MMM). The maker of Post-Its has been embroiled in multiple legal battles over the last few years, and is currently making pre-emptive moves to avoid costly potential litigation from its PFAS (Forever Chemical) business. The stock was battered in 2022, falling nearly 30% against a broader market decline of 18%. In this article we will examine what 2023 may hold for 3M, what investors should look out for in litigation claims, and explore whether or not this is an attractive entry point for investors.

Fighting It Out In Court

3M, the embattled maker of the CAEv2 earplugs, had a tough 2022. The company is currently being sued by over 200,000 veterans who allege that the company’s earplugs were defective and ineffective, resulting in hearing loss. 3M has resorted to the old playbook used by companies to avoid and deflect litigation, to little avail. In July, the company bankrupted the unit that made the earplugs, Aearo Technologies, and on the same day announced that it would pursue a spinoff of its healthcare unit. For those unfamiliar with corporate bankruptcies, filing for Chapter 11 is a tactic used to stall litigation because – generally – all lawsuits against a company are halted while the bankruptcy process plays out. Unfortunately for 3M, the tactic didn’t work and the bankruptcy judge allowed the suits to move forward unencumbered.

The announcement of the spinoff of the health care business seems to be another way to shield the new company from liability while presumably allowing the parent company to retain an ownership stake–but it could also be that 3M executives are simply waking up to the idea that sometimes conglomerates are not wholly efficient, and that a spinoff may be good for the health of the larger business. I The company plans to complete the spin off by the end of 2023. Veterans and lawyers have taken note, however, and a pair of litigants filed suit to block the spinoff as a fraudulent transfer, alleging that the spinoff is nothing more than another way for 3M to shield assets from liability. This claim, however, was struck down and as of now the spinoff is likely to go forward as planned.

The situation looks bleak for 3M. None of the hundreds of thousands of plaintiffs in the case have settled to date, and juries are well-known for awarding outlandish sums of money to plaintiffs when the defendant is an enormous, faceless corporation. So far, the company has bookmarked about $1 billion to settle legal claims related to earplug litigation, but according to Reuters, “3M has lost 10 of the 16 earplug cases that have gone to trial so far, with about $265 million being awarded to a total of 13 plaintiffs.”

3M, it appears, is going to need a bigger boat.

In fact, Bloomberg has estimated that, based on initial litigation outcomes, the company could be on the hook for $82 billion when it’s all said and done. Other, more conservative estimates peg liability around $10 billion. Still, that’s a lot of Post-Its.

All jokes aside, the lawsuits are serious business and have the potential to pose a serious threat to 3M. That being said, we believe that the hype surrounding the headlines and eye-popping jury verdicts should be taken with a grain of salt. Yes, the company will surely be forced to pay a very large sum of money to the plaintiffs, but the company will doubtless appeal each verdict and eventually pay a considerably smaller amount.

A Forever Headache

As if the earplug situation didn’t pose enough of a problem, 3M also faces difficulties with its exposure to ‘forever chemicals’ known by the shorthand PFAS, the existence of which—and problems posed by—was made widely known through the book “Dark Waters” and the subsequent 2019 film.

Forever chemicals are exactly what they sound like: extremely durable chemicals that are very useful in manufacturing but are potentially quite harmful when ingested in large quantities by living things. Their presence is so ubiquitous now that even babies are born with PFAS in their bloodstreams.

3M’s way ahead is, again, riddled with difficulties and lawsuits. In August 2022, the EPA announced a proposal to declare forever chemicals as hazardous substances. This proposal, if placed in effect, would allow the government for force polluting companies (such as 3M) to pay for cleanup of forever chemicals. In November 2022, California announced that it was suing 3M and DuPont in a broad-ranging bid to have the companies pay not just for cleanup, but ongoing health monitoring of people with high levels of exposure. The company’s management, apparently able to see where all this is likely headed, announced in December 2022 that the company would exit the PFAS business altogether. This will likely help to stem the bleeding from inevitable future litigation, but it will cost the company about $1.4 billion in annual sales, or a little less than 4% of overall revenues.

How Should Investors Think About The Lawsuits?

We believe that the core question investors should ask themselves when considering 3M is whether or not the threat to the company is existential. Is it likely that 3M will survive these suits, or any future litigation? Or will 3M be able to whittle away each earplug verdict in the appeals process to a manageable amount, and be able to line-item forever chemical clean-up efforts as a cost of business?

We firmly believe the latter is the most likely scenario. Blaring headlines aside, the final decisions of corporate litigations are most often hammered out in the appeals process, with the actual amount paid by a company being much less than the initial judgment. Plaintiffs tire of the endless hearings and plaintiff’s lawyers want to be paid – so there’s lots of incentives to reach deals when possible. Further, even if the final reckoning for the company is worse than expected, the stock will likely benefit from the sheer fact that the question of the amount will no longer be dangling over the 3Ms head. The market, after all, hates nothing more than uncertainty.

Similarly, the clean-up process for forever chemicals will not be a death sentence for 3M. Depending on how cynical you like to be, it’s not difficult to imagine the company turning a government order to clean up into a positively-spun PR campaign about cleaning up the environment or taking care of communities. The amount that California is after also pales in comparison to what’s at stake in the earplugs case–$850 million. And this isn’t the first time 3M has doled out such amounts. In 2018 it settled with Minnesota for similar clean-up efforts for just over $200 million.

If you’re wondering why we’re so optimistic about 3Ms prospects even in the worst case scenario, then we would like to offer up BP (BP) and its fortunes after the Deepwater Horizon spill in 2010. It’s estimated that BP has spent over $70 billion in clean-up efforts for the disaster, and the company is still moving along. To be clear, we do not believe at this time that 3M will incur legal fees anywhere close to that amount, but want to illustrate that companies can successfully navigate large, negative financial events.

The Worst Case Scenario

While we believe it is extremely unlikely that 3M will be bankrupted by these lawsuits, we will admit that the worst case scenario could indeed be very bad, even if unlikely. If 3M loses and its fight in the appeals process goes poorly, 3M could be staring down enormous fines. However, the same degree of uncertainty that hangs over the question of how much 3M could be on the hook for lingers over the question of how much it will actually have to pay.

If 3M is successful in spinning off its healthcare unit (and at this point in time all indications are that it will be able to), it could be an outcome that the sizeable assets of the spinoff are protected from liability. This would be positive for 3M since, as previously mentioned, it is likely to retain a stake in the new company and thus benefit from it.

We estimate that the probability of 3M being pressed into bankruptcy is low, but the very fact that we have to estimate that possibility means that buying into 3M at this point is very risky and should only be undertaken by investors with a serious appetite for risk.

For context, Moody’s agrees that while the lawsuits are relatively unlikely to be settled for $1 billion alone, but it points out that 3M is estimated to generate free cash flow after dividends of $2 billion annually through 2023. That is important because it shows that 3M has multiple levers to pull if it must provide additional capital to settle lawsuits rather than simply, as some investors fear, declare bankruptcy.

Is 3M Attractively Valued?

3M currently operates in four business units: Safety & Industrial (about 27% of revenues), Transportation & Electronics (25%), Health Care (25%), and Consumer (16%). In the current macro environment, the Consumer division is facing the greatest headwinds with recession on the horizon, while 3Ms more industrial segments have performed quite well. As mentioned before, 3M plans to spin off its health unit into another public company, and it is yet to be determined what stake the parent company will retain when that happens.

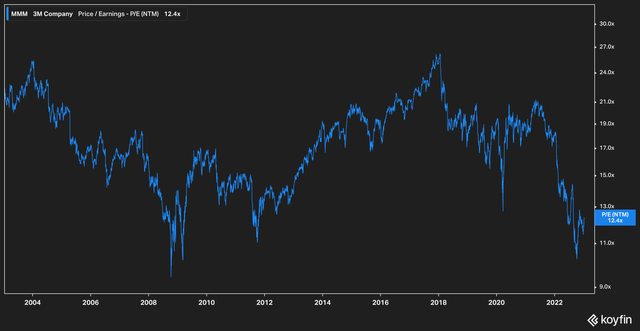

Trading around $125 per share, 3M currently sports a forward P/E of 12.4x. To see the last time 3M plumbed these valuation depths, you need to go all the way back to 2008.

This chart illustrates the years-long legal battle 3M has faced and investor’s uneasiness about it. And, as already discussed, their concerns are not without merit. We believe, however that Mr. Market’s reaction – to steal a phrase from Benjamin Graham – is now out of bounds, and that investors are doling out an undue punishment to 3M.

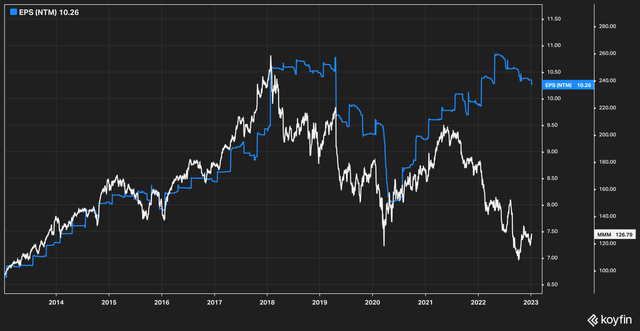

Price-to-earnings are rough, however, and not good to view in a vacuum. If the market really has mispriced 3M, it should be visible in a more stark way. To see the disparity, we look no further than 3M’s share price vs. its NTM EPS estimate.

Over the last ten years, 3M’s share price has correlated largely with its NTM EPS estimates, right up until 2021 where the share price fell off a cliff while EPS estimates continued their upward rise. We believe that the chart above illustrates in no uncertain terms that when you look beyond the headlines, 3M’s businesses are doing just fine. A full recovery of the share price to restore its historic relationship with EPS estimates would put the stock at around $240, but even a 50% recovery would place the stock in the $170 range.

Management, for its part, has consistently delivered, keeping operating margins steady despite seemingly every conceivable macro condition that could be thrown at them. Profit margins have also expanded steadily over the last ten years, from close to 15% in 2012 to an estimated 18.5% in 2022. Meanwhile, the company has continued to deliver steady dividend payouts and strong cash flows.

As far as 3Ms balance sheet health is concerned, the spinoff of the healtchare unit will still leave behind a trio of formidable businesses which collectively booked $27 billion in revenues in 2021 (2022’s actual numbers are yet to be presented), and provide strong returns on investments.

3Ms valuation at this level shows, we believe, a very attractive entry point for an investor who is able to stomach the risk of the pending lawsuits. Should these items resolve in a favorable manner for 3M, investors could be rewarded for taking the risk. Of course, if you aren’t that type of investor, we believe that watching 3M closely is the next best option.

In Conclusion

3M is trading at an historic discount to its earnings estimates, which is primarily due to pending litigation for both its earplug and PFAS businesses. With the company exiting the PFAS business entirely and the earplug lawsuits making their way through the court system, we believe that 3M stock has been overly punished by the market. We think that 3M warrants – at worst – a close eye from investors to wait until the legal troubles resolve themselves, while those investors with a strong appetite for risk and who are comfortable with a large potential investment loss may find it appealing.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.