Summary:

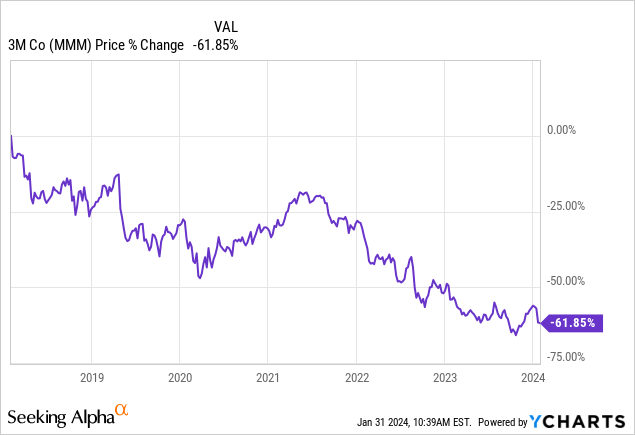

- 3M’s stock price has declined over 60% since 2018 highs. These price declines happen for a reason and they should not be dismissed as only good entry points.

- Weak earnings report, poor outlook, and numerous lawsuits reinforce the fact that a dividend cut is recommended to help the company’s recovery efforts.

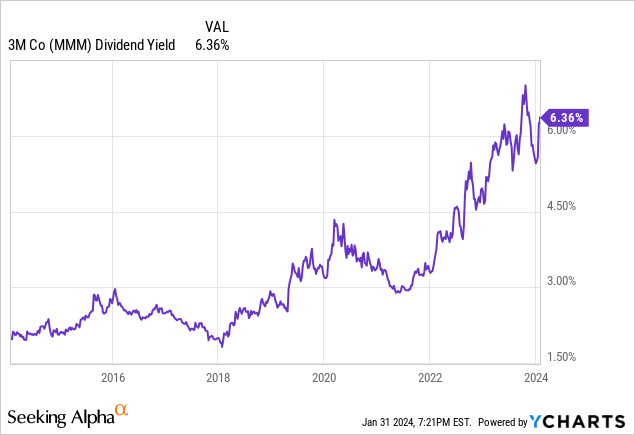

- The dividend yield sits at a high of 6.3%. The payout ratio is sustainable for now but when the settlements are due to be paid out, the sustainability may change.

jetcityimage

Overview

The price has come down substantially on 3M and now has us all wondering if this makes for a good entry price. We’ve seen the price come down over 60% since the 2018 highs, but I still don’t feel convinced that MMM deserves a spot in my portfolio. The weak earnings report, poor outlook for the next year, a bunch of lawsuits, and management’s poor track history all make it very difficult to recommend MMM. The dividend payout has been sustainable at 65%, but I really do think the dividend needs to be cut in order to help the price recover a bit. The high-conviction investors may not be happy with a cut, but it would severely help the business gain some traction towards a recovery through all of the issues.

If you weren’t already familiar, 3M (NYSE:MMM) delivers a range of diversified technology services globally, with operations spanning the United States and international markets. The company operates through four distinct segments: Safety and Industrial, Transportation and Electronics, Health Care, and Consumer.

In the Safety and Industrial segment, 3M offers industrial abrasives, autobody repair tools, and safety solutions. I wore 3M safety goggles every day when I worked in a lab as a college student. The Transportation and Electronics segment focuses on ceramic solutions, tapes, and signage materials. I’ve fixed a bunch of old wired headphones using 3M electrical tape. The Health Care segment provides wound care products, dental solutions, and filtration systems. Lastly, the Consumer segment offers a variety of consumer products, including bandages, cleaning items, and more. In short, I think 3M is one of those companies that a lot of us use on a daily basis, and we aren’t even aware of it.

Weak Outlook

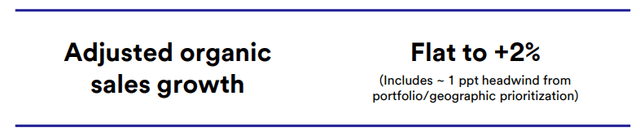

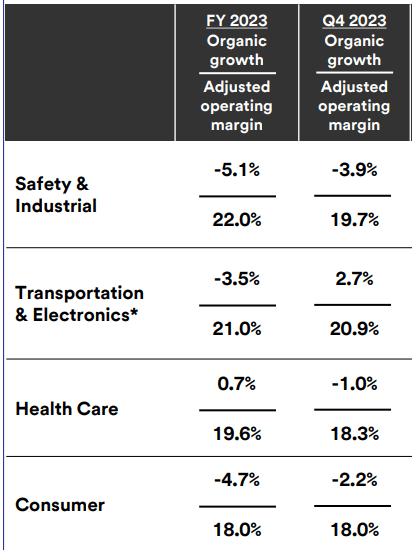

MMM Q4 Presentation

To start, the only business group that showed any growth over FY23 is Healthcare at 0.7%. All other segments of the business reported negative revenue growth. While not yet reaching an area to panic about, I also wouldn’t feel comfortable initiating a position into a business that reports negative growth while already having a dividend payout ratio that’s more than double the sector median.

MMM’s 2024 earnings forecast fell into a projected range of $9.35 to $9.75 which lags behind the consensus estimate of $9.82 per share. With the ongoing legal battles and weak revenue outlook, I think we’ll see MMM fall within the bottom end of the projected range. Speaking of revenue, in Q4, MMM reported lower-than-expected revenue of $7.69 billion.

On a positive note, it seems like the company is making a lot of changes to focus on efficiency and cost-cutting measures. Capital preservation is a priority here as sales slow. For example, they generated more than $400 million in savings during the year by streamlining the organization and reducing costs at the center. During the last earnings call, the CEO also touched on this point for further reinforcement.

At the same time, we have transitioned to an export-led model in approximately 30 smaller countries around the world, allowing us to reduce costs and complexity while still bringing 3M innovation to local customers. The simplification of our organization also frees up resources to prioritize exciting growth opportunities for 3M, such as automotive electrification, climate technology and industrial automation. While we have more work to do in 2024, our actions are helping us to improve our operational performance and create a more competitive 3M. – Mike Roman, CEO

Dividend Cut Recommended

As of the latest declared quarterly dividend of $1.50/share, the current dividend yield is a whopping 6.3%. This comes after a tiny dividend raise of 0.7% back in February of 2023. This is a historical high over the last 10-year period, as the yield usually floats anywhere between 2 – 3% under normal circumstances. The dividend payout ratio currently sits at 65% which is 135% higher than the sector median of 27%. However, MMM has managed to sustain this level of payout over the last 5-year period, considering that the average payout ratio over the last 5 years has been 64%.

While it’s very tempting to enter here at such an attractive dividend level, I think my money is better off elsewhere. After the poor outlook data I previously mentioned, the slew of lawsuits, and the crashing price, I think a dividend cut would help a lot here. I think that once these settlements are paid out, the dividend may be at threat. A dividend cut would allow the company to preserve cash flow and address immediate financial needs to settle the legal liabilities. It’s only a matter of time.

The retained funds could also be directed towards debt reduction, improving overall financial health and creditworthiness. While a dividend cut may initially disappoint income focused investors, it can signal that the company’s commitment to navigate challenges and keep our long shareholder value in mind. It’s a shame we reached this point, considering the dividend has been increased for 65 years in a row. Ultimately, a dividend cut can contribute to stabilizing the stock price and positioning 3M for a more sustainable and resilient future.

Risk: Lawsuits

Given the company’s ongoing legal battles, I can understand why a lot of investors are cautious here. The combination of multiple lawsuits, such as the combat arms earplugs case, raises significant concerns about the company’s future legal liabilities. The recent victory related to PFAS contamination provides only temporary relief.

I’ve seen lots of people here on Seeking Alpha argue that these issues are in the rearview mirror, but the PFAS manufacturing will still take place until the end of 2025. In my opinion, these are serious issues that have motivated parties involved on both sides. Take this comment from Jan 29th with a grain of salt since we can’t verify it, but it’s a good point of reference to see what some families are going through.

I just don’t think that one small victory really eliminates all liabilities. The dismissal of the PFAS lawsuit does not absolve the company from the broader issue of addressing potential health impacts of its products. The demand for companies to pay for studies analyzing the health impacts of PFAS chemicals, if consistently pursued in other cases, could pose a recurring burden. It’s not the best position to be in.

Valuation

With a low organic sales growth of “flat – 2%” as stated in their presentation, I don’t think we can expect much growth from MMM. Although Seeking Alpha gives a valuation grade of A-, the grade is ignoring the core issues that MM faces. For example, the P/E sits at 10.36x, which is roughly 50% below MMM’s 5-year average P/E. However, it’s trading at a discounted P/E for good reason.

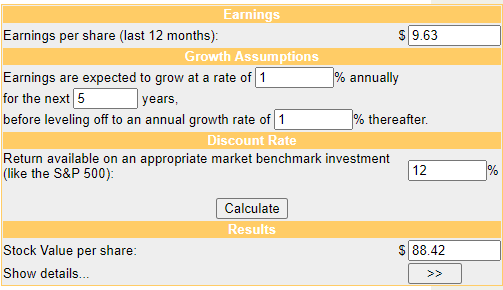

Running a quick DCF (discounted cash flow) calculation, we can get an estimated fair value for MMM shares. The expected EPS for 2024 is 9.63x. Combine this with 1% expected growth rate, which falls between management’s flat – 2% estimate, and we can see that shares are worth about $88.42. From the current price level, this would represent a downside risk of about 7%. The high dividend yield of about 6.3% somewhat mitigates this, but it’s not a risk I am willing to take here.

Money Chimp

Therefore, I believe it’s better to pass on this Dog of the Dow, as your money is probably better suited elsewhere. There is not a clear turnaround story here and is above my own personal risk tolerance level. I imagine that is these issues get resolved quickly and liquidity improves, the turnaround story here might be epic. The uncertainty leaves too many variables for comfort.

Takeaway

In conclusion, the recent decline in 3M’s stock price raises questions about its viability as an attractive entry point. With the stock down over 60% since its 2018 highs, the weak earnings report, bleak outlook for the next year, and a multitude of lawsuits make a compelling case against 3M. Despite a historically sustainable dividend payout ratio of 65%, the recommendation here is that a dividend cut could prove beneficial in the company’s efforts to recover from its current challenges.

While the company emphasizes cost-cutting measures and capital preservation, the challenges ahead are significant and therefore may result in a long road to recovery. Finally, a quick discounted cash flow calculation suggests a downside risk.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.