Summary:

- 3M Co. stock price surged 23% after positive quarterly results and raised profit guidance for 2024.

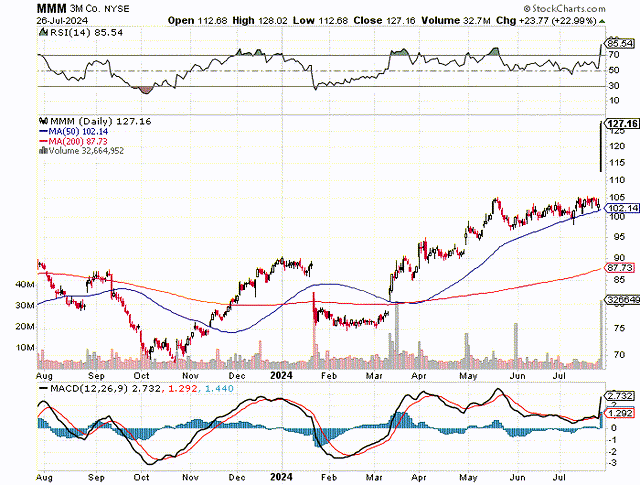

- Margin growth and cost-cutting contributed to strong earnings, but the stock is now overbought with RSI at 85.5.

- Despite positive outlook, 3M’s stock is now overvalued at 16x profit multiple, prompting caution and profit-taking.

jetcityimage

The stock price of 3M Co. (NYSE:MMM) skyrocketed 23% on Friday after the industrial conglomerate gave its shareholders fresh hopes of a progressing turnaround.

The company saw its biggest price gain since the 1980s amid growing signs of a turnaround, with 3M seeing margin growth. 3M also presented a higher midpoint guidance for 2024 estimated profits.

I think that investors have reasons to be hopeful about 3M’s prospects for growth, but taking into account the big price leap on Friday, I think investors might want to think twice about selling at this time of irrational exuberance.

The industrial conglomerate’s stock is probably fairly valued now, and I actually see growing down-side risks once the enthusiasm following the 2Q24 release dissipates.

My Rating History

A robust and healthy profit and free cash flow forecast for 2024 underpinned my stock classification of Buy. The industrial conglomerate profits from strong demand for its products and was able to grow its margins. Taking into account Friday’s extreme price response, I think this may be a good time to close out a position in MMM.

Solid 2Q24 Performance

3M presented quarterly results for its second quarter at the end of last week that highlighted ongoing progress in the company’s turnaround. 3M has been focused on slashing costs, and cost-cutting made a major contribution to the company’s second quarter earnings.

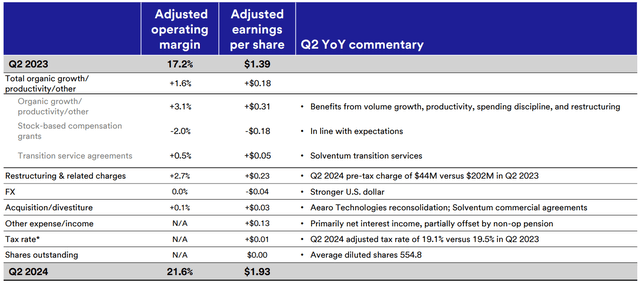

3M’s total adjusted sales hit $6.0 billion, up 1.1% YoY and, importantly, the industrial company has been able to grow its margins: In 2Q24, 3M had an adjusted operating margin of 21.6%, reflecting 4.4 percentage point growth YoY. This growth was supported by organic growth related to higher product sales (particularly in electronics) and higher productivity, as well as positive restructuring results (lower costs).

Adjusted Operating Margin (3M Co.)

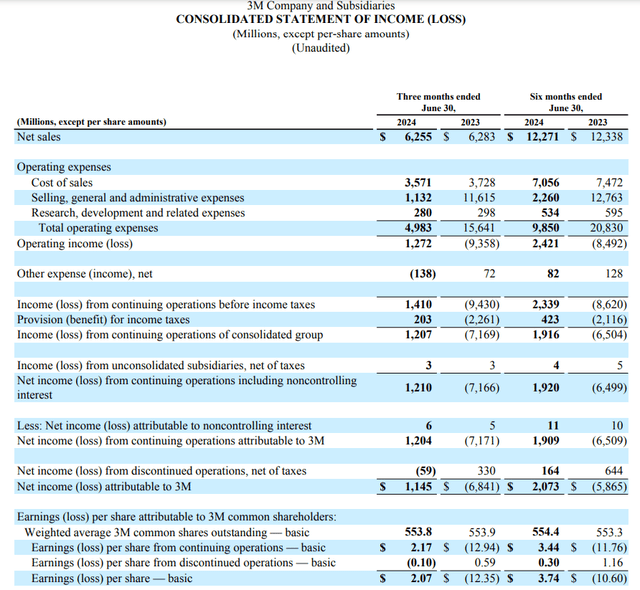

3M’s earnings profile has improved substantially over the course of last year, primarily because last year’s results included a settlement with public water suppliers relating to the presence of fluorochemistries in drinking water, which distorted results in 2Q24. 3M’s earnings last year reflected a $10.3 billion accounting charge (equal to the present value of its liability). With the settlement out of the way, 3M was able to focus on its operating business again, which includes Safety & Industrial, Transportation & Electronics and Consumer.

The conglomerate’s healthcare business was spun off earlier this year and now trades as a separate company on the stock exchange. 3M’s total operating income in 2Q24 was $1.3 billion, reflecting a $10.6 billion swing in profits YoY, and the outlook for the segment is positive, too.

Consolidated Statement Of Income (3M Co.)

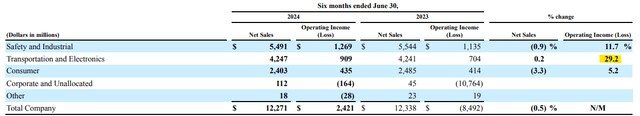

3M’s results were primarily supported by strength in the Transportation & Electronics segment, which produced 3.3% organic sales growth, the fastest of the three remaining operating segments. In this segment, 3M primarily benefits from demand strength related to its electronics and advanced materials products.

Transportation & Electronics is also where the income momentum is for 3M. Between January and June, the segment produced by far the biggest jump in operating income: It was up 29.2% and segment income grew more than twice as fast as it did in Safety & Industrial, the biggest segment in terms of sales and operating income.

Transportation And Electronics Operating Income (3M Co.)

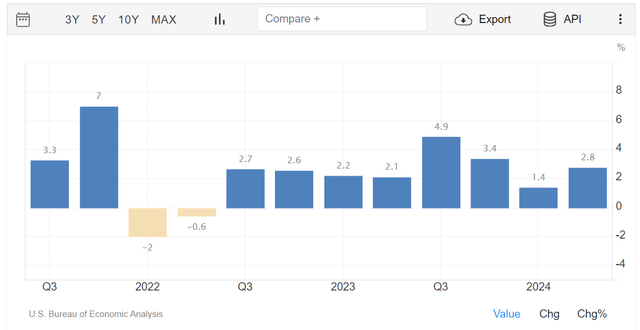

Basically, 3M is a pro-cyclically positioned conglomerate whose sales and earnings will rise and fall with the general swings of the U.S. economy. The U.S. economy grew at an annualized rate of 2.8% in 2Q24, which represented an acceleration of 1.4 percentage points compared to 1Q24, thereby fundamentally supporting an investment in cyclical conglomerates.

I am particularly optimistic about the Transportation and Electronics segment to carry forward its positive sales and margin momentum in this environment.

Inflation (Tradingeconomics.com)

Technical Setup

Following 3M’s earnings release for the second quarter on Friday, the industrial conglomerate’s stock surged 23%. As a consequence of this stock price move, 3M is now widely overbought based on the Relative Strength Index, indicating that investors are getting carried away in their optimism.

The RSI is a relative strength measure that shows how bullish or bearish investors are about a company’s potential for growth. Right now, investors are over-the-top bullish with respect to 3M and the Relative Strength Index shows a value of 85.5. RSI values above 70 are considered to reflect overly bullish sentiment.

3M’s stock already traded above both the 50-day and 200-day moving average lines ahead of the earnings release, which is generally a bullish trend indicator. Taking into account the 23% stock price increase on Friday, I think MMM is at risk of a sharp correction in the coming days and I, consequently, have closed out my position in the industrial conglomerate.

Guidance For 2024 And Widely Inflated Multiple

3M lifted its low-end guidance for 2024 full-year profits by 20 cents, and the industrial conglomerate now forecasts between $7.00 and $7.30 per share in profit. 3M also raised the lower end of its adjusted operating margin forecast by 25 basis points and now forecasts at least a 2.25% YoY margin gain. This expected growth comes from a resilient Electronics segment, as well as lower operating costs associated with the conglomerate’s cost-cutting program.

While the increase in the guidance represented, without a doubt, a positive surprise, 3M did not raise its upper end of the guidance and the absolute amount of the anticipated profit increase was relatively small. Thus, I think the market reacted overly bullish to the profit forecast and since a major stock re-rating now has taken place, I think that this might be a great time to take profits, or at least wait for a drop before establishing a long position.

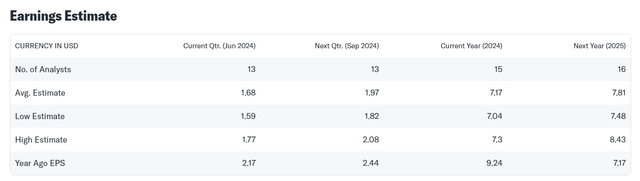

Good news often makes for outsized stock price gains, and 3M’s price reaction on Friday is a good example of this. The market presently models $7.17 per share in profits this year and $7.81 per share in profits for next year, which reflects a 9% YoY profit growth rate. Though a 9% YoY growth rate is robust, it doesn’t justify the kind of multiple expansion we have seen on Friday.

Presently, 3M’s stock is selling for 16.3x next year’s profits. Before the price surge at the end of last week, 3M was selling for a profit multiple of 13.2x, so the multiple expanded substantially, even though the actual gains in margins were not that significant.

Honeywell International Inc. (HON) is selling for 18x next year’s profit, so the stock is slightly more expensive. However, Honeywell International is looking at 10% profit growth YoY next year.

Earnings Estimate (Yahoo Finance)

The midpoint of 3M’s profit guidance, for instance, has only been raised by 10 basis points to 7.15%, which is not a big enough increase, in my view, to justify such a large expansion in the company’s multiple. Given how exuberant investors were last week after getting to read 3M’s 2Q24 earnings release, I think this may be a great time to sell.

Why The Investment Thesis Might Not Work Out

Exuberance can last longer than expected, particularly if 3M can top expectations in the next quarter and potentially raise its guidance again. With that said, though, 3M is a conglomerate with a cyclical profit profile and its earnings can be anticipated to contract in a recession.

Though a recession is not yet in the cards, conglomerates tend to have less durable earnings than other non-conglomerates. A strong performance in 3M’s cyclical businesses, like Transport & Electronics, could potentially allow 3M to keep posting robust results, which may further support the stock’s multiple expansion.

My Conclusion

Friday was a big win for 3M: Earnings for the second quarter were robust, the industrial conglomerate raised its profit outlook and investors cheered the progressing turnaround at the company, which resulted in higher adjusted operating margins.

With that said, though, the profit forecast was raised by only 10 cents at the midpoint, and I am getting real cautious here after the company’s stock skyrocketed on what, I think, is unfounded exuberance.

3M is now selling for a 16x leading profit multiple, while not even raising its profit forecast at the high end of its guidance. The stock just had its best day in nearly 40 years of trading, so I have decided to sell into the strength and taken profits.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.