Summary:

- 3M stock has plummeted, down 55% from its 2021 high, primarily due to lawsuits, an economic downturn, and negative sentiment.

- Despite the challenges, 3M’s earnings have remained strong, beating estimates and illustrating a solid operating position.

- 3M is dirt cheap – trading at a P/E around 8, paying out a hefty 7% dividend. Don’t worry, your dividend should be safe with 3M.

- 3M should benefit from earnings growth and multiple expansion, leading to a considerably higher stock price in future years.

Spondylolithesis/iStock Unreleased via Getty Images

You know, I was scared of COVID-19. Before all the vaccines came out, the idea of getting COVID-19 and suffering a life-threatening complication was terrifying. I spent a long time researching and searching the internet, countless hours looking for a suitable mask.

Well, I finally found it: a 3M (NYSE:MMM) mask.

3M operates through four segments: Safety and Industrial, Transportation and Electronics, Health Care, and Consumer, and its product lines are massive. 3M’s 2022 revenues were around $34.2 billion. However, due to the slow economic environment, “legal issues,” and other detrimental factors, 3M’s revenues and EPS should hit a low point in 2023, returning to growth in 2024 and future years. Also, 3M reported better-than-expected Q3 earnings and raised its EPS guidance range for the year.

3M Stock – Decimated

Meanwhile, 3M’s stock has been decimated. Its stock price has crashed from a 2021 high of around $185 to just $85. This fall represents a staggering 55% decline from the recent high. considering 3M’s ATH in 2018, its stock is down by approximately 66%. However, we’re not here to discuss the past. Let’s focus on the future instead.

3M has been in a downtrend for about 2.5 years. The stock is deeply oversold. The RSI recently registered in the 20-25 range, illustrating extremely oversold technical conditions. Despite its transitory issues, 3M has become exceptionally cheap. 3M trades at an 8.9 forward P/E ratio and pays a dividend of 7%. The lawsuits and other temporary negative elects should be resolved. 3M’s stock should stabilize soon, recover, and move higher in the coming years.

Why 3M Is Crashing

3M recently announced a $12.5 billion settlement with U.S. water providers, and it still faces civil litigation over water pollution. 3M also faces lawsuits over faulty earplugs sold to the U.S. military. Then there are 3M’s violations of the Foreign Corrupt Practices Act. 3M recently paid $6.5 million to settle the charges with the SEC. Therefore, we see the significant litigation overhang affecting sentiment in 3M, surpassing its stock.

However, when there is increased uncertainty, it may be the best time to enter 3M stock. This market-leading industrial giant is down by more than 65% from its ATH, and the company should return to growth and profitability once litigation issues are resolved and sentiment improves. Of course, $12.5 billion is a significant sum, but 3M will pay it over 13 years, equating to fewer than $1B per year in settlement payments.

3M Is Dirt Cheap – The Bottom Is Near

3M is going through a transitory decline phase, but its stock has been battered relentlessly. In recent years, 3M typically traded around a 15-18 P/E ratio. However, due to the lawsuits and the economic slowdown, its P/E ratio has cratered to below 10. This multiple contraction dynamic and a temporary decline in EPS has brought 3M’s stock down to its lowest level since 2014.

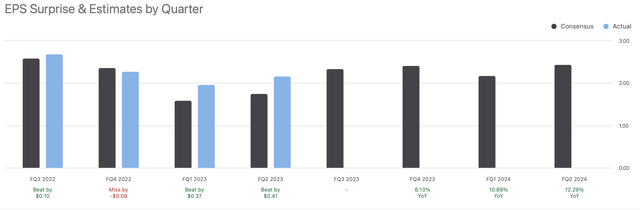

3M EPS Vs. Estimates

EPS vs. estimates (SeekingAlpha.com )

Despite all the negative press and the worsening sentiment, 3M’s earnings have held up well through the challenging phase. TTM consensus EPS estimates were $8.32, but 3M reported $9.11 instead. This outperformance demonstrates a beat percentage of 9.5%. Significantly, 3M can maintain earnings at a high level despite battling through this cheapening phase. This dynamic suggests that 3M remains in a solid operating position and may continue outperforming estimates as we advance.

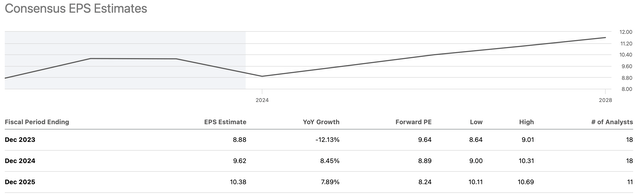

Consensus EPS estimates are $9.39 in its next four quarters and $9.62 in 2024. However, applying a similar 9% beat rate implies that 3M can achieve EPS of around $10.25 in the next twelve months and possibly slightly higher in 2024. The stock is around $85, which implies that 3M’s forward P/E ratio is around eight now. This valuation is much cheaper than its typical 15-18 P/E ratio, implying multiple expansion is highly likely in future quarters. Additionally, 3M’s revenues and earnings will probably increase.

EPS Growth to Rebound Soon

EPS growth (SeekingAlpha.com )

3M Announced Q3 Earnings

3M announced its earnings results earlier today, and the stock is up by around 4% in pre-market. 3M beat estimates again, outperforming substantially, delivering $2.86 in EPS vs. the expected $2.35. This is a much better-than-expected 22% outperformance rate and illustrates how significant 3M’s earnings power is and how the stock is likely considerably undervalued here. More importantly, 3M hiked up its forecasts for 2023, elevating its full-year EPS range to $8.95-$9.15, ahead of the previous $8.60-$9.10 2023 full-year guidance. So, we’re already seeing progress here from 3M, and we should see better-than-expected future earnings reports as the company moves forward.

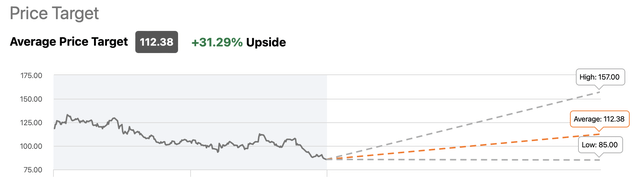

What Wall St. Thinks – Significant Upside Ahead

Price targets (SeekingAlpha.com )

Wall St.’s lowest one-year price target is $85, while the average anticipated price tag is more than 30% above current levels. Therefore, the downside in 3M stock is minimal while the upside potential could be 30% or more over the next year. Higher-end estimates range up to $157, implying that 3M can nearly double in the next twelve months. While I have an above-average outlook for 3M from these depressed levels, realistically, its share price can achieve the $160-$200 range in the next 2-3 years. While the turnaround story may not be instant, it could be worth the wait, especially considering 3M pays a juicy 7% dividend here.

3M: The Tectonic Sentiment Shift Is Coming

Sentiment dropped horrendously due to transitory issues like lawsuits, a broad economic slowdown, a high interest rate environment, and other temporary detrimental variables. However, as these issues pass, 3M will remain an industrial giant that is selling at a deep discount right now.

Despite its present issues, 3M is a well-run company, financially. 3M has a healthy balance sheet and generates more than enough free cashflow to cover its $3.3 billion annual dividend payment. Some market participants may be concerned about 3M’s 7% dividend getting sliced, but that’s highly improbable as 3M continuously generates more than $4B in free cash flow.

It’s much more probable that 3M will double in price, and the dividend will come down to the 3.5% range. Then we can expect 3M to increase its dividend as operations normalize. 3M should return to healthy revenue and EPS growth once the downturn is over. This dynamic could lead to a tectonic sentiment shift, enabling 3M’s stock to benefit from a dual element of EPS growth and an expanding P/E multiple, resulting in a much higher stock price in the coming years.

3M could go much higher in future years:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $34 | $36 | $39 | $42 | $45 | $47.7 | $50 |

| Revenue growth | 6% | 6% | 8% | 8% | 7% | 6% | 5% |

| EPS | $10.25 | $11.28 | $12.40 | $13.52 | $14.60 | $15.80 | $17.50 |

| EPS growth | 14% | 10% | 10% | 9% | 8% | 8% | 8% |

| Forward P/E | 12 | 14 | 16 | 17 | 17 | 16 | 16 |

| Stock price | $135 | $175 | $215 | $250 | $275 | $280 | $300 |

Source: The Financial Prophet

I’m using relatively modest estimates concerning revenue growth, EPS growth, and multiple expansion. 3M could outperform my revenue and EPS growth estimates, or its multiple could expand beyond the 17 P/E ratio range. Therefore, 3M’s stock is likely to stabilize and rebound soon. Moreover, 3M’s stock could surge as the company gets its house in order in future years.

Risks to 3M

Of course, 3M does not have the best look after its water-contaminating incident. $12.5 billion is no small fine for any company, no matter how mighty of an industrial giant 3M may be. 3M needs to avoid costly mistakes moving forward, or the stability of its dividend may come into question. 3M could also use modernizing and rebranding, especially after the recent litigation. Macroeconomic conditions could also impact 3M’s sales and profitability, potentially negatively affecting my projections. Investors should examine these and other risks before investing in 3M’s stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges. I purchased MMM shares in the am on 10/24/23.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!