Summary:

- 3M is undergoing a challenging transformation with stagnant revenue, rising debt, and significant legal risks from PFAS litigation, leading to a 32% stock price decline since 2021.

- Despite a strong global product portfolio and solid cash flow, current free cash flow is insufficient to cover dividends and share buybacks, raising concerns.

- New CEO William Brown brings valuable experience but skepticism remains about his ability to drive a radical transformation, given past performance and substantial PFAS liabilities.

- I estimate 3M’s value at $125 per share, slightly lower than its current price, and recommend holding due to unclear recovery path.

josefkubes

Context

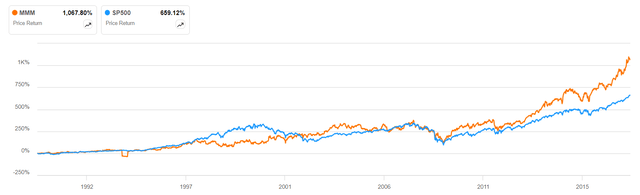

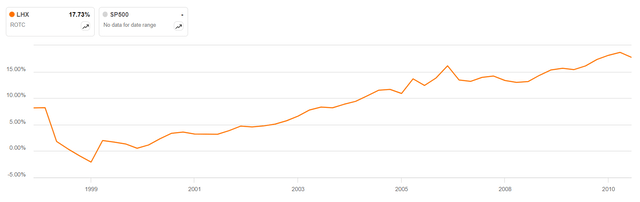

3M (NYSE:MMM) is a global industrial conglomerate and has been a solid business based on three pillars: innovation and R&D, operational efficiency, and a diverse product portfolio with a global reach. Until 2018 the company has beaten the market (Figure 1). 3M created the Post-it notes in 1974, creating a reusable adhesive. It also invented the Scotch Tape, N95 respirators, 3M Thinsulate, multilayer optical film,… Until 2018, the company had a gross margin of 50%, which has decreased since then. Similar to the operating income margin of over 17% before that year.

3M still has a diverse and global product portfolio. It has around 45,000 industrial, consumer, and safety solutions products and sells in about 55 major industry sectors, including automotive, aerospace, manufacturing, construction, electronics, and consumer products. 3M sells its products in over 200 countries globally.

The company’s stock price has fallen 32% since 2021, and it is facing a disruptive turnaround. I recommend waiting to see if there is more evidence that the transformation will materialize.

At this path, cash flows won’t be able to fund shareholders’ retribution. Current financial performance has modest improvement but is insufficient to identify a meaningful change. The new CEO brings hope, but there is not much evidence for me to be entirely sure. Lastly, PFAS litigation can bring new charges and worsen the situation.

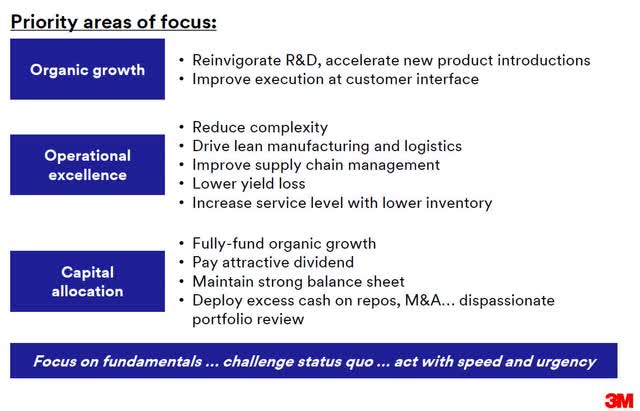

Capital Allocation

The company aims to fund shareholders’ retribution through organic growth and maintain attractive dividends with a healthy balance sheet (Figure 2). However, it is far from there at this point. In Q1 2024, long-term debt rose from $13 billion a year ago to $20.6 billion, around 77% of capital. In Q2 2024, there has been a slightly reduced debt, but it isn’t significant. My estimation of EBITDA over interest expense is 5.0, which is not alarming but near a dangerous level.

Figure 2: Q2 2024 3M Investor Presentation

The primary reason for raising debt in Q1 2024 was to fund the healthcare spin-off, and I expect this debt level to be reduced over the years, but it will depend on the cash generation capacity of the company. 3M generates free cash flow at $1.2 billion in the quarter, a 19% of revenue. That is insufficient to fund shareholders’ retribution of $1.2 billion in dividends and $0.4 billion on share repurchases. This cash generation is less than almost $2.0 billion in the same quarter last year due to a reduced operating cash flow. And to raise the free cash flow level depends on the transformation program. Let’s see if the program is bearing fruit.

Financial Performance

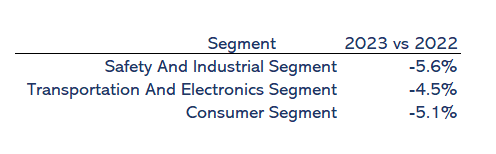

Adjusted organic sales growth guidance remains flat because the research and development advancement translation will require more time. But I see some improvement in the tendency of revenue. All segments declined year-over-year (Figure 3), so stable Q2 2024 revenue is not bad news. The Transportation & Electronics segment grew organically by 3.3% due to strength in semiconductor and automotive electrification, but the industry pushes this growth more than the company’s efforts. Safety & Industrial grows at 1.1%, and the Consumer segment is the more challenging, with a revenue decline of 1.4%.

Figure 3: Author

In Q2 2024, there were some good signals that the company is working on its transformation initiatives related to “Operational excellence,” driving lean manufacturing and logistics, lower yield loss, increased service level, and lower inventory. Gross margin improved from 40.7% in Q2 2023 to 42.9% in Q4 2024. Adjusted operating margin guidance has increased slightly from +200 to +275 bps to +225 to 275 bps, which is a good signal that progress is a work in progress, and management shows confidence in it.

Higher restructuring costs in 2023 impacted financial results, making the picture slightly better. This effect has improved adjusted operating income non-organically by $167 million, or 13%. 3M charged $415 million in restructuring expenses; in the first half of 2024, the impact was $138 million. Since the initiative began, 6,400 positions have been affected. The program will end in 2025 with 8,000 positions.

There is little evidence that the transformation is getting traction. My conclusion so far is that we cannot assign a high probability of success. Let’s see if the new CEO gives guarantees that even when we don’t see results yet, his experience and capabilities will raise this probability of success.

William Brown

On May 1st, William Brown, a 61-year-old mechanical engineer and former CEO of L3Harris Technologies, was named 3M CEO, substituting Michael Roman. The question is whether he will be able to turn around 3M.

Indeed, Harris Corporation and L3 Technologies merger is a clear experience in transforming two big businesses, and working in such a regulated business gives him the expertise needed to deal with the legal challenges relative to PFAS litigation.

He has been focused on research and development, stating that the 4.5% spent in 3M is low if they want to regain their previous innovative culture. I like its dispassionate view of the 3M portfolio with no hesitation in eliminating businesses that don’t add value to the whole company.

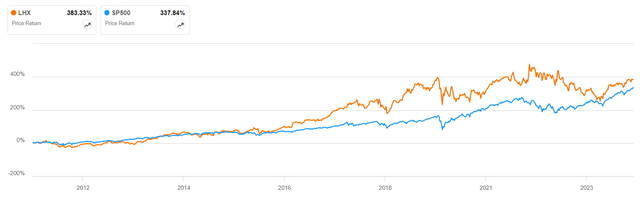

Now, let’s examine Brown’s performance in L3Harris Technologies to see how likely it will be replicated in 3M. Over its tenure from 2011 to 2024, the stock has gained 383.33% vs. S&P500, which gained 337.84%, beating the market (Figure 4)

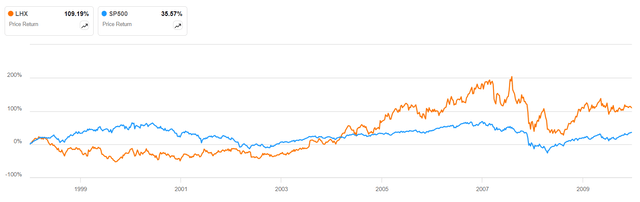

But before working for the company, it also beat the market. L3Harris Technologies gained 109.19% vs 35.57% S&P 500. So the performance of Brown wasn’t too spectacular with what has been doing the company (Figure 5).

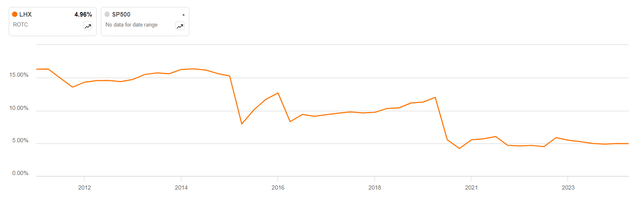

If we analyze a more business-like indicator like return over the capital, we can see that the results of its tenure vs. before being CEO are not good. Certainly, the merger influences it, but you can’t see him beating the company’s past (Figure 6).

If, in its tenure, the return on capital decreased from 15% to 5%, the company before raised from negative to almost 20% (Figure 7). I think Brown has the experience for the job, but I don’t have the assurance of success.

Legal challenges relative to PFAS litigation

3M deals with litigation and regulatory scrutiny about per- and poly-fluoroalkyl substances (PFAS), the so-called forever chemicals. PFAS are synthetic chemicals used in various industrial applications, and they are widely used due to their durable and heat-resistant properties. They do not break down easily in the environment, and concerns have grown over their potentially harmful effects on human health and the environment.

The company has decided to shut down PFAS manufacturing by 2025. However, 3M is exposed to substantial fines, settlements, and regulatory penalties. As of June 30, 2024, 3M has recorded liabilities of $11.3 billion. This represents the probable loss in connection with environmental matters and PFAS-related matters. I estimate that could be higher. It is hard to come up with a precise figure. I don’t expect to exceed 10% of current liabilities so that it could approach $1 billion in additional charges.

Valuation

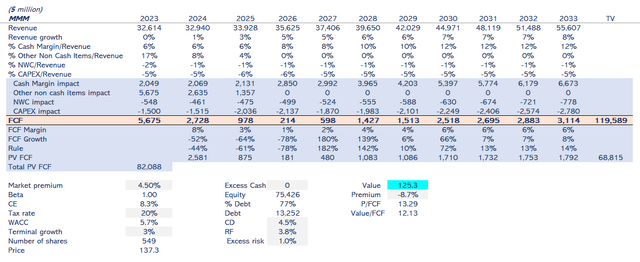

To value 3M, I will use the discounted cash flow methodology. I will project free cash flows for the next ten years and estimate a terminal value. All the cash flows will be discounted at WACC, the weighted average cost of capital. To calculate free cash flow, I will estimate revenue, margin, and investment (net working capital and CAPEX).

I estimate revenue will grow just 1% in 2024. Innovation efforts will bear fruit smoothly, adding 1 or 2 percentage points each year to reach an 8% growth rate in ten years. I am assuming Brown’s leadership will be successful, but it won’t be able to change its engine growth radically.

Regarding margins, I utilize a measure I call Cash Margin, which involves adjusting net income for non-cash items such as amortization and depreciation, stock-based compensation, and deferred income tax. Cash margins will grow to 12% in ten years from the current 6%. I estimate operational excellence efforts will reduce complexity, improve the supply chain, and lower yield loss. But, again, the improvement won’t be radical.

Investments will be reasonably stable. Networking capital will improve slightly due to lower inventories for the transformation program, from 2% of revenue to 1%. CAPEX will grow modestly in 2025 and 2026, one percentage point, improving the supply chain.

Cash flows will be discounted at a 5.7% WACC because the beta is 1.00 and risk-free at 3.8%. I am assigned an extra one percentage point of risk due to the PFAS litigation. Given the company’s low leverage of 77% of the total capital debt, WACC is weighted towards the cost of debt, which is why it is so low. The terminal growth rate is set at 3%.

As shown in Figure 8, my value estimate is $125.3 per share, a 9% discount over its current stock price.

Conclusion

3M is undergoing a business change, with stagnant revenue, rising debt, and significant legal risks from PFAS litigation. While the company maintains a strong global product portfolio and generates solid cash flow, free cash flow evolution will be insufficient in the future to cover dividends and share buybacks. Recent restructuring efforts to improve operational efficiency are beginning to show progress, but the turnaround is still in its early stages.

The new CEO, William Brown, has valuable experience leading the L3Harris merger, but his past performance makes me skeptical that he can drive a radical transformation. Additionally, 3M faces substantial PFAS-related liabilities, with $11.3 billion already charged, and I expect more likely to come. While Brown’s focus on innovation and restructuring offers some optimism, the path to recovery lacks clarity.

I estimate the company’s value to be $125 per share, slightly lower than its current stock price. The discount is 9%, which is not meaningful to me, so I recommend holding.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.