Summary:

- In this article, we will be valuing 3M, using multistage dividend discount models.

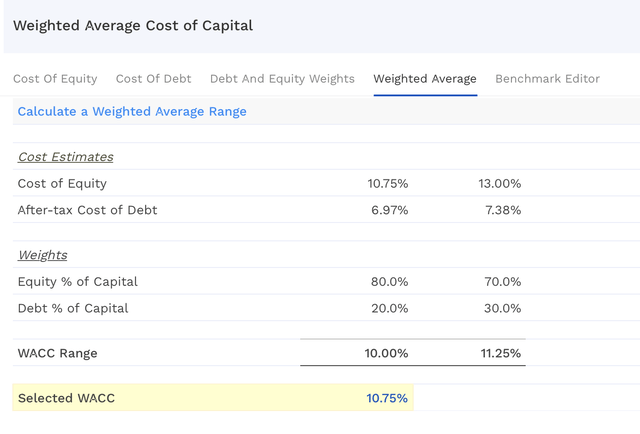

- We will evaluate 4 scenarios, assuming a required rate of return of 10.75% in all cases, based on the firm’s WACC, and different dividend growth scenarios.

- Based on our analysis, our view is turning neutral from bearish.

josefkubes

Introduction

3M Company (NYSE:MMM) provides diversified technology services in the United States and internationally. The company operates through four segments: Safety and Industrial; Transportation and Electronics; Health Care; and Consumer.

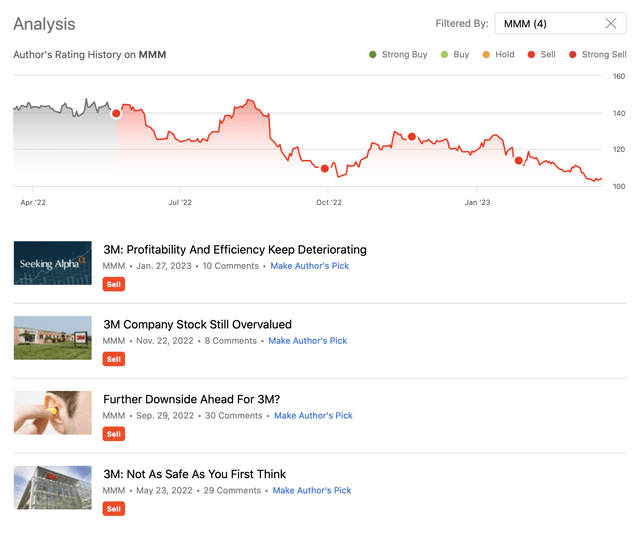

In 2022 and 2023, we have published four writing on the firm already, communicating our bearish outlook for the stock each time. Our primary arguments for the negative outlook have been the uncertainty with regards to legal filings against 3M and the challenging macroeconomic environment, including elevated inflation, rising interest rates, elevated energy prices and low consumer confidence.

In our article, published in November 2022, we have valued 3M’s stock using the Gordon Growth Model (GGM), a single stage dividend growth model. Back then, the stock price was $127 and our estimated fair value range came it at $90 to $130 per share, assuming a required rate of return of 8.75% and a perpetual dividend growth rate of 2% to 4%.

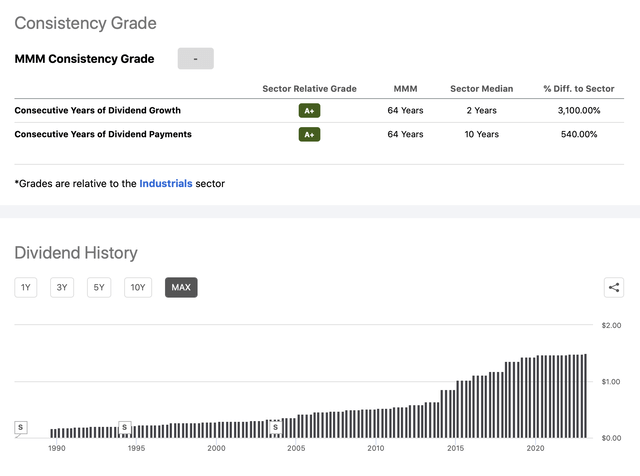

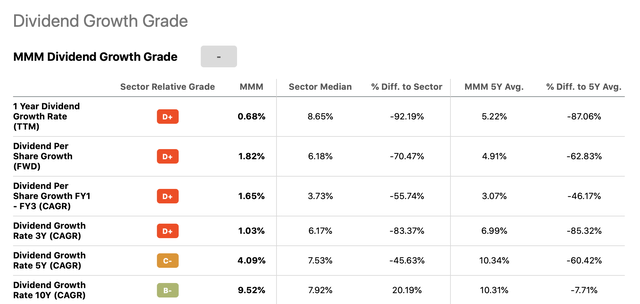

Back then, we have decided that the dividend discount model is a suitable tool to value 3M’s stock, as the firm has a long history of returning value to its shareholders through dividend payments, and as it is in the mature growth phase. To illustrate this once again, the following picture shows 3M’s dividend history.

Dividend history (Seeking Alpha)

Today, we have decided to take a look at the valuation of 3M’s stock once again, but instead of using a single stage dividend discount model, we will be using multistage DDMs. To account for the deteriorating interest rate environment and the continuing elevated inflation levels, we are going to use a higher required rate of return, 10.75%, based on the increased weighted average cost of capital for the firm.

Further, to account for different macro- and microeconomic scenarios, we will be using scenario analysis. While we will keep the required rate of return the same in each case, we will be assuming different dividend growth rates, both in the near-term and in perpetuity. We will describe our motivation for our dividend growth rate choice in each case.

So let us start our analysis.

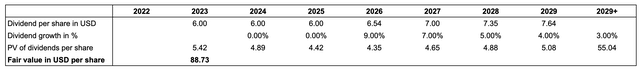

Scenario 1

In this scenario, we assume that 3M will not be able to increase its dividends in the upcoming two years. This assumption reflects both macro- and microeconomic headwinds in the near term. The impact of the legal battles and the economic slowdown are the primary reasons, why we would assume no growth for these years. From 2026 onwards, we expect 3M to start increasing its dividends once again, at a rate that corresponds to the 10Y CAGR of dividends. This growth, however, would not last long and would gradually decline to 3%, at which the dividend would grow in perpetuity.

Dividend growth history (Seeking Alpha)

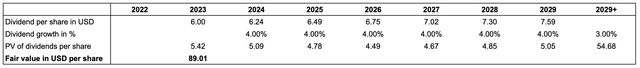

The following table shows the results of our calculation:

Based on the assumptions and forecasts, the fair value of 3M’s stock comes in at about $89, which is about 13% below the current share price and which about corresponds to the lower range of our valuation from our previous writing.

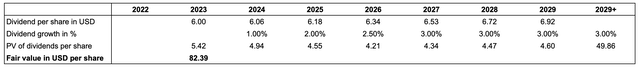

Scenario 2

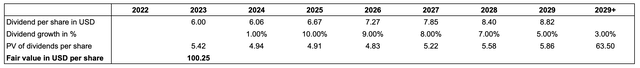

As 3M has actually managed to increase its dividends in each year during the last 64 years, they may be reluctant not to increase in the upcoming years. To reflect this we will assume a gradually increasing growth in the next years, but eventually also end up with a perpetual growth rate of 3%.

This is essentially our worst case scenario, resulting in a fair value of only $82 per share.

We believe that this scenario may be too conservative. The perpetual growth rate of 3% we still expect to be realistic, but in the mid-term, due to the improving macroeconomic environment and potentially the decreasing uncertainty related to the legal issues, 3M may be able to hike its dividends at a much faster pace.

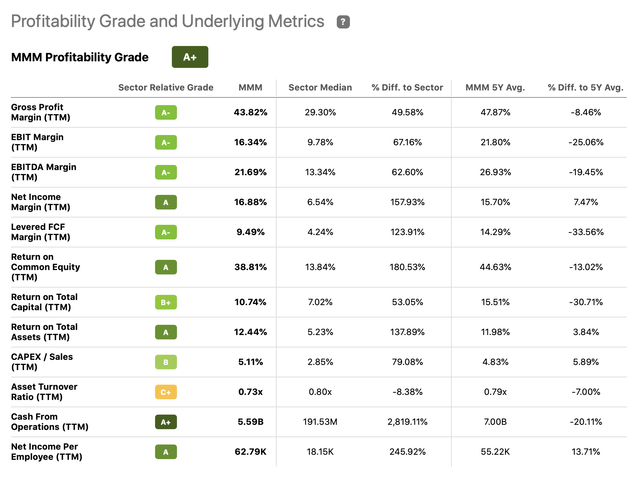

From a profitability point of view, 3M is still above-median in its sector. While in our previous article, we have elaborated in detail on decreasing efficiency and profitability, we believe that with the improving conditions, the described measures would also improve, justifying a higher growth rate in the mid-term.

Scenario 3

In the third case, the near-term growth rate corresponds to the 5Y CAGR of dividends, with a perpetual growth rate assumption of 3%.

This forecast also results in a fair value of $89 per share, just like our first example. While the 5YR CAGR of dividends may be a good average for the near- and mid-term, this case ignores the impact of the micro- and macroeconomic headwinds on 3M’s financial performance and on the firm’s potential to hike the dividend. While it yields the same results as the first example, we believe that it may not be the most realistic representation of the coming years.

Scenario 4

Our last scenario assumes that despite the headwinds, 3M will be able to hike its dividends minimally next year, but due to the potential improvement of the financial performance, the firm could start increasing at a much higher rate once again.

Using this approach, the fair value is estimated to be $100 per share, about in line with the current price.

To sum up

In our previous article, we have estimated the fair value of 3M’s stock to be in the range of $90 to $130, assuming an 8.75% required rate of return and a 2% to 4% dividend growth rate in perpetuity.

Today, instead of using single stage DDMs, we used multi-stage DDMs, combined with scenario analysis. Our required rate of return has been also set higher at 10.75% to reflect the continuing uncertainty with regards to both micro- and macro headwinds.

The four scenarios have resulted in a fair value range of $82 to $100, with the lower end of the range being relatively conservative.

As we believe that the stock is trading already relatively close to its fair value, based on the dividend payments, we are upgrading our view from bearish to neutral.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.