Summary:

- 3M Company reported weak earnings results, causing a 10% share price decline.

- Guidance for 2024 is below analyst expectations, leading to investor discouragement.

- Legal challenges and lack of business growth make 3M a lower-quality choice for investors.

AmnajKhetsamtip

Article Thesis

3M Company (NYSE:MMM) has reported weak earnings results which caused a steep share price decline of more than 10%. While that has made the dividend yield jump higher, I do not see a reason that would make 3M Company an immediate “Buy” despite a solid yield and an undemanding valuation.

Past Coverage

I last covered 3M Company on Sept. 14, around four months ago. In that article, I noted 3M’s many challenges, but also its income generation potential. I gave the company a neutral rating back then. Shares rose for a while following the release of the article, but when we account for today’s share price drop in the double digits, 3M is now trading below the price it was trading at in mid-September. It was thus a good decision to not buy into the embattled company back then. In this report, we will update the thesis and take a look at recent news that is of importance.

3M’s Quarterly Earnings Results

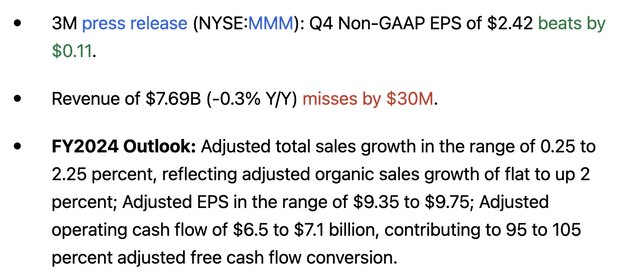

3M Company reported its most recent quarterly earnings results, for its fiscal fourth quarter, on Tuesday morning. The data is available here on Seeking Alpha. The headline numbers looked like this:

3M earnings results (Seeking Alpha)

We see that the company missed revenue estimates slightly, reporting a small revenue decline. While that’s not a disaster, it surely isn’t good news, either – once we account for inflation, which was well above the norm over the last 12 months, real revenues were down quite meaningfully compared to the previous year’s quarter.

Looking at the company’s bottom-line number, things were better than expected – the $2.42 profit per share was around 5% higher than expected, and earnings per share were up by a nice 10% compared to the previous year’s period. Considering the unconvincing revenue performance, that was a rather nice result.

Still, the market sent 3M’s shares lower by more than 10% following the release of these results – which can be attributed to the fact that many investors were not happy with the guidance for the current year, 2024.

3M is expecting marginal sales growth of around 1% at the midpoint of the guidance range, both on an operational basis and on a reported basis. On top of that, earnings per share are forecasted at around $9.55, which pencils out to around $2.40 per share per quarter – marginally below what we have seen in Q4. When we look at the earnings per share result for all of 2023, which was $9.24, then the guidance implies that profits will grow slightly on a per-share basis. On the other hand, it’s important to note that 3M hit an earnings per share level of $9.88 in fiscal 2022, which means that profits will be down compared to two years ago – especially when we account for the inflation we have seen since then, that’s far from an encouraging result.

Probably most important, the earnings per share guidance is considerably weaker compared to the analyst consensus estimate, which stood at north of $9.80 prior to the earnings release. Wall Street analysts, and, by extension, many investors, had thus expected stronger profits for the current year. While one can argue whether a guidance shortfall of around 3% warrants a share price crash of more than 10%, it’s not surprising that investors were discouraged by management’s guidance for the current year.

3M: Challenges Remain

While the weaker-than-expected guidance for the current year explains the most recent share price decline, that doesn’t explain why 3M Company is down by a hefty 50% over the last five years.

Instead, the factors for 3M’s weak share price performance in recent years are mostly tied to the legal challenges. 3M is one of the companies that face a range of legal problems due to so-called forever chemicals, while 3M also faces legal issues due to faulty hearing protection equipment that was sold to the US military on top of that.

It’s impossible to know how high the costs of these legal issues will eventually be, as things could drag on for years and since it’s not known how many cases 3M will eventually lose. But the risk of hefty multi-billion dollar costs in the future alone is reason enough for investors to be not too eager to buy into the stock, which is why the weak performance in recent years makes sense.

One can argue that 3M Company has been punished too much by now, but I do not believe that it would make sense if 3M traded where it traded five years ago – that would make for an earnings multiple of around 20, which is not justified for a company with barely any revenue growth and the legal issues.

It’s important to note that 3M’s guidance does not account for payments for settlements. Likewise, the guidance for the current year does not account for the planned spin-off of the healthcare business, as the company notes in its earnings report:

This 2024 outlook continues to reflect the Health Care business as part of the company for the full year, but does not reflect the potential impact of funding amounts due under the PWS and CAE legal settlements absent receipt of cash payments in the Health Care business spin.

The $6.5 billion to $7.1 billion operating cash flow guidance should thus be taken with a grain of salt – actual cash inflows on a company-wide basis could differ materially from the midpoint of close to $7 billion.

If 3M were to generate cash flows in line with the current guidance, that would be sufficient to finance the dividend. 3M’s capital expenditures totaled $1.8 billion over the last year, assuming that capital expenditures remain at that level going forward, free cash flows could total around $5 billion this year.

Since 3M Company currently pays out a little more than $3 billion per year in dividends, the dividend would be covered. The company would pay out around two-thirds of its free cash flows in the form of dividends, which does not make for a low payout ratio, but which isn’t dramatically high, either. That being said, depending on future lawsuit payments and legal costs, the dividend might still be at risk, although I do not see a dividend cut as very likely for now.

Is 3M A Good Investment?

3M Company yields more than 6% following the current share price slump, which means that not a lot of share price appreciation would be needed to make 3M a solid investment. A 3% annual share price gain would make for 9% annual returns already. While growth has not been strong in the recent past, it’s possible for 3M to get back on growth track – add the potential for some multiple expansion in the coming years, and a case can be made for 3M being an investment with compelling return potential.

On the other hand, 3M has legal challenges and those pose risks. It’s likely, I believe, that the stock will remain highly volatile. The lack of business growth, both in absolute terms and compared to peers such as Honeywell (HON), makes 3M a lower-quality choice.

Whether one decides to buy into an inexpensive, high-yielding, lower-quality company with major issues or not depends on one’s investment approach: Value and turnaround investors could be happy with 3M Company, but investors that seek a high-quality investment that lets one sleep well at night will likely favor foregoing 3M in its current state.

I thus am neither particularly bullish nor particularly bearish on 3M Company – instead, I give it a neutral rating and believe that staying on the sidelines could be a good idea. Once business growth picks up meaningfully and legal problems are in the rearview mirror, 3M could be a more compelling investment. The downside, of course, is that 3M will likely be more expensive by then, which is why more risk-hungry investors may favor buying into 3M right now, when demand for its shares is low.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

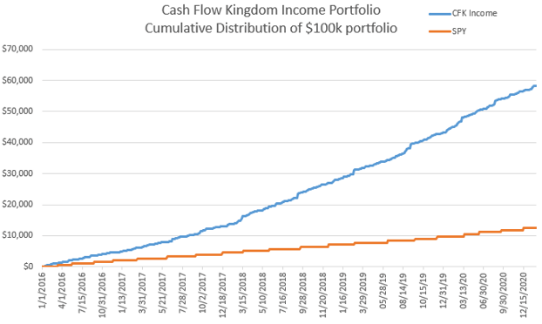

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!