Summary:

- 3M Company has shown stabilizing results and improvements in key metrics, indicating a potential turnaround.

- The company has settled major legal cases, clearing ambiguity and allowing them to focus on operations and growth.

- Despite legal challenges, 3M has entered into valuable partnerships, demonstrating commitment to expansion and growth.

josefkubes

Thesis

3M Company (NYSE:MMM), has had a rough couple of years to put it lightly. With scorching legal woes and unprecedented reputation damage as a result of various lawsuits, 3M has seen its stock fall to a decade low. However, in its most recent earnings report, 3M reported stabilizing results as well as some improvements in some key metrics that show the prospects of a turnaround. In addition, a few months ago 3M was able to settle their ‘forever chemicals’ case and also their defective earplugs case. This clears the ambiguity from their business and will now allow them to focus on their operations and growth moving forward. Furthermore, despite these legal challenges, 3M was able to enter into many valuable partnerships throughout the year, demonstrating their commitment to growth and expansion. Although 3M seems to be starting its strong comeback, its stock is trading at rock-bottom valuations. Therefore, I believe 3M is currently undervalued and deserves a Buy rating.

Earnings

Overview

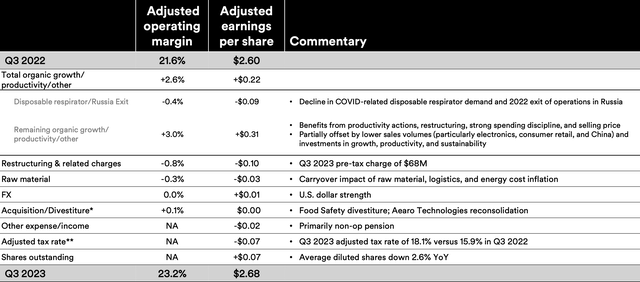

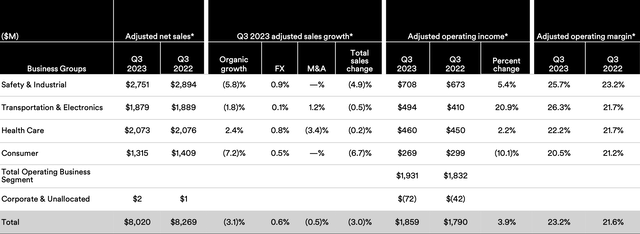

In my view, 3M showed strong resilience in their earnings as many metrics showed improvement YoY. For adjusted sales, they reported $8.0 billion versus guidance of $7.9-8.0 billion, which reflects an adjusted organic growth rate of -3.1%. This negative growth is attributed to a 1.7% disposable respirator decline and Russia exit headwind as well as softness in electronics, consumer retail and China. The strength in automotive OEM was able to offset some of these negative factors. For adjusted operating margin, they reported 23.2% which is up 160 bps YoY and 390 bps sequentially. There were significant sequential margin improvements for all of their business groups. They also had an adjusted EPS of $2.68 versus guidance of $2.25-2.40 and is a 3% YoY increase. Lastly, adjusted FCFs were reported to be $1.9 billion which is up 39% YoY. Their adjusted FCF conversion was up 360 bps YoY to 130% as a result of strong inventory management. Overall, I believe that these earnings show that 3M has steadied the ship and that the worse is likely behind them.

Business Group Performance

For their Safety & Industrial division, they reported adjusted net sales of $2.751 billion which is down from the prior year quarter’s $2.894 billion. However, they did manage a 5.4% YoY gain for their adjusted operating income as they reported $708 million. The overall organic growth in this division was -5.8%. The worst organic growth performer in this division was closure and masking as they recorded low double digit declines. This is followed by industrial adhesives and tapes and personal safety as they showed high single digit declines. Abrasives reported mid-single digit declines while declines in electrical markets and automotive aftermarket were held to just low-single digits. The largest bright spot for this division was roofing granules as it showed a high-single digit increase in organic growth. Lastly, this division showed an adjusted operating margin of 25.7% which is up 250 bps YoY and 350 bps sequentially. Overall, I believe these results were a mixed bag as they had YoY declines in most categories for organic growth but was still able to manage a YoY increase in operating income and margin.

For their Transport & Electronics division, they reported adjusted net sales of $1.879 billion which is down from $1.889 billion in the prior year quarter. However they managed to pull off an impressive 20.9% YoY increase in adjusted operating income as they reported $494 million. Their organic growth was -1.8%. For this division’s organic growth, the worst performers were electronics, commercial solutions, and transport safety as they all reported mid single digit declines. For advanced materials they had a low single digit increase and their best performers were automotive and aerospace which showed low double digit increases. Lastly, this division reported an adjusted operating margin of 26.3%, up 460 bps YoY and 650 bps sequentially. In my view, this division had strong results since although there were some YoY declines in some figures, they were very modest numbers in contrast to the large YoY gains in most metrics in this division.

For Health Care, they reported adjusted net sales of $2.073 billion which is down slightly from the prior year quarter’s $2.076 billion. On the other hand, adjusted operating income saw slight improvement as it had a 2.2% YoY gain with a reported figure of $460 million. The organic growth for this division was 2.4%. The worst performer, in terms of organic growth was health information systems as it recorded a low single digit decline. Medical solutions and separation and purification had a low single digit increase while the best performer was oral care as it had a high single digit increase. This division had impacts from post-Covid biopharma demand normalization as well as tighter hospital budgets. Lastly, the operating margin was 22.2% which is a 50 bps improvement YoY and 240 bps sequentially. I believe this division’s result were very strong as most metrics were up YoY and although net sales declined, it was so minor we could treat it as being flat YoY.

For their Consumer division, adjusted net sales were $1.315 billion, down from $1.409 billion a year ago and adjusted operating income also decreased 10.1% YoY to $269 million. They reported a subpar -7.2% organic growth. All categories within this division had organic growth declines. Leading the way were home improvement, home health, and auto care as they all showed high single digit declines. Reporting a mid-single digit decline was stationary and office. Overall organic growth was impacted by back-to-school demand being muted and also housing and DIY spending being affected by rising interest rates. Lastly, operating margin was down 70 bps YoY to 20.5% while still being up 230 bps on a sequential basis. From my analysis, this was by far the worst performing division for 3M but it is quite understandable as consumers are rapidly cutting discretionary spending due to the rise in interest rates and economic uncertainty.

Guidance

As part of their earnings, 3M provided strong guidance for Q4 and FY23. For Q4, they are expecting adjusted sales of $7.6-7.7 billion as a result of electronics stabilization, consumer weakness, and mixed demand for industrial end-markets. They also expect an adjusted EPS of $2.13-2.33. This guidance reflects normal seasonal trends with the holidays coming up and less business days. For the full year, adjusted EPS guidance was raised from $8.60-9.10 to $8.95-9.15 and adjusted FCF conversion guidance was raised from 90-100% to 100-110%. I believe these are impressive guidance figures as despite the many challenges the company has faced this year, they were still able to raise their estimates on important metrics.

Positive Developments

Settlements

In a June Seeking Alpha news post, it was reported that 3M was paying $10.3 billion for the PFAS water pollution settlement. The stock rose 4.5% in after-hours trading showing investor relief. The payment will reportedly be paid over 13 years and was recorded as a pre-tax charge in their Q2 earnings. This funding will go to US public water suppliers that detected or might detect in the future PFAS in drinking water. It is reported that 3M will stop production of PFAS by the end of 2025. In late August, it was reported that the settlement had been granted preliminary approval as 22 states/territories dropped their objections to the settlement.

As a separate development, in an August Seeking Alpha news post, it was reported that 3M has reached a settlement for its earplugs lawsuit. The stock rose almost 7% as a result and once again demonstrates investor relief and optimism. 3M had promised to pay over $5.5 billion to settle over 300,000 lawsuits regarding selling defective combat earplugs to the US military. They will reportedly pay this amount over the period of 5 years.

In my view, even though these two settlements involve a very significant amount of capital over many years, these settlements are positives for 3M’s operations moving forward. The investor optimism after both reports of settlement indicates that investors believe that 3M will benefit from being able to move past these legal woes and being able to finally refocus on operating and growing the business. These lawsuits have been a nightmare for 3M and its shareholders. However, I would argue that, in the long-run, these incidents could potentially make them stronger as a company moving forward as these serious incidents will likely make them never forget to focus on quality control and safety testing ever again.

Partnerships & Collaborations

Despite the many legal challenges that 3M faced this year, they were still able to enter into numerous meaningful partnerships with innovative companies. Earlier this year, in a Seeking Alpha news post, it was reported that 3M Health Information Systems was working with AWS to advance 3M M*Modal ambient intelligence technology. 3M will reportedly use AWS machine learning and generative AI to accelerate and scale delivery of 3M’s ambient clinical documentation and virtual assistant solutions. I believe this is an important collaboration as is shows that 3M is not likely to fall behind in the race to implement AI into their company. Despite all the challenges they are facing, 3M is still able to keep up and adopt important next-generation technologies to their business and offerings.

In another collaboration, earlier this year Seeking Alpha reported that 3M is teaming up with Svante Technologies in developing a material that will help trap CO2 and remove it from the atmosphere. 3M Ventures was reportedly part of a $318 million fundraising round that will accelerate Svante’s carbon capture tech production. It is reported that these technologies can be applied to 85% of the total carbon capture and removal segment. In my view, this deal is important in terms of their growth as well as repairing their reputation. After events related to the ‘forever chemicals’ and other lawsuits, I believe it is very important for 3M to invest in areas that promote ESG. This deal accelerates the potential for a way to deal with air pollution, likely improving their public image.

In early October, Seeking Alpha reported that 3M is entering into a partnership with MediWound to conduct a Phase 3 trial for their wound care product EscharEx. 3M’s 2 layer compression systems Coban 2 and Coban 2 Lite will reportedly be used as standard care in the global trial to test safety and efficacy using a debridement method. It is reported that 3M’s system will be used during debridement and healing phases and the trials are to begin in early 2024. I believe this deal is a positive development as this is their first major deal since settlement of both legal issues. It shows to me that 3M is seemingly putting its past behind it and is working to grow their business.

Valuation

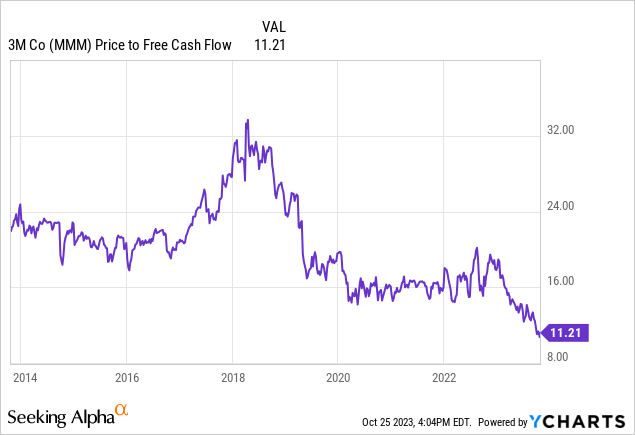

3M’s P/FCF ratio sits at around 11 at current levels and is at a decade low. Only a few years ago, it was trading at a P/FCF over 30. Admittedly, 3M is still in a much more challenging environment than it was a few years ago but it is clear to me that the worst is behind them and that they are starting to refocus their efforts in actually trying to improve business performance rather than deal with lawsuits. Therefore, I believe that the worst is over for 3M and that its valuation should have rebounded due to the positive developments that were discussed.

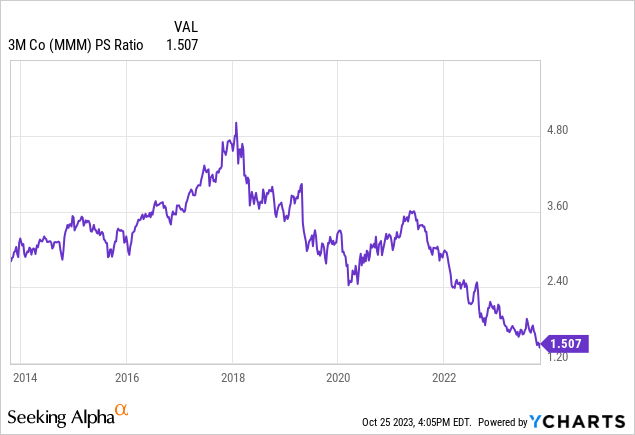

It is a similar story with the P/S ratio as it is also at a decade low. I believe that 3M also deserves a higher P/S ratio with its turnaround underway in the form of strong earnings as well as promising developments for its business.

From my analysis, although its current challenges would justify a much lower valuation than in the 2017-19 period, I believe the current situation should be able to support a higher valuation. I believe that 3M would be correctly valued at a P/FCF of around 15 and a P/S of around 2.2 since, in my view, with recent developments, 3M is in a much better position than at the start of the year or the end of last year when it traded at higher P/FCF and P/S ratios. With its legal woes behind it, 3M should be able to see multiple expansion from here. Therefore, I initiate 3M with a Buy rating.

Risks

A main risk to 3M is their seemingly deceleration in innovation. Earlier this month, a Seeking Alpha news post reported that investors were doubting 3M’s product innovation. It is reported that some investors and former employees say that 3M is not coming up with blockbuster products like it used to. It is reportedly partly as a result of a change in corporate culture that previously allowed for experimentation, serendipitous discoveries, and spontaneous collaboration among scientists. However, CEO Mike Roman says that innovation remains a priority at 3M. The company still invests 5% of net sales into R&D even though it is down from 7% in the 1990s. In fact, 3M still invests more into R&D than Honeywell (HON) and DuPont (DD). It is reported that management expressed it is focused on quality over quantity of new products. Another argument for 3M is that they have 2 large research areas of EV tech and carbon capture, that could bring large earnings potential. In my view, although 3M is collaborating significantly with innovative companies as discussed above, they may need to do more internally to reassure investors that their innovation has not slowed. In order to grow their valuation, they will no doubt have to continue to have product innovation and so I believe it is essential that they better communicate to investors and other stakeholders that 3M is still very much dedicated to their own innovation.

Conclusion

3M has been in a rough patch in the past few years but things are starting to change. With the legal challenges now history, 3M is free again to focus on actually doing business. With their most recent earnings report, 3M’s financials are already showing signs of improvements as many key metrics have improved YoY. With recent deals, like the MediWound deal, it seems that the worst is over and 3M has survived the storm of the last few years. I do believe that going forward 3M will be a company that will be much more focused on quality control and safety and that could be highly beneficial for them in the long-run. Combine all of these positive developments with a rock-bottom valuation and I believe this a strong contender for being a top quality value play. Despite some risk with the potentially slowing product innovation, I believe 3M is undervalued currently and deserves a Buy rating.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.