Summary:

- 3M’s turnaround has likely stunned the market, as it recently overcame significant pessimism to outperform the S&P 500.

- 3M demonstrates why its fundamentally strong business is critical to its recovery.

- It expects to post an improved profitability outlook amid an increasingly likely soft landing possibility.

- I have been bullish on 3M for a while. However, the recent surge has closed the door on its previous undervaluation thesis.

- I explain why it’s timely for investors to return to the sidelines as we reassess 3M’s ability to drive organic growth again.

josefkubes

3M’s Turnaround Thesis Played Out Brilliantly

3M Company (NYSE:MMM) investors who didn’t give up likely marveled at the remarkable turnaround as the stock emerged from peak pessimism. I urged investors to remain vested in my bullish MMM article in July 2024. I highlighted that while the new management team needs to get up to speed quickly, its valuation seemed attractive. Therefore, it was still early in its turnaround, as it demonstrated its ability to execute.

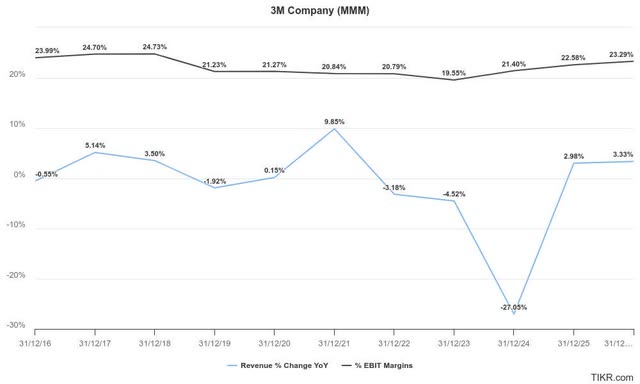

As a result, I’m not surprised with 3M stock’s significant outperformance against the S&P 500 (SPX) (SPY) since then. In 3M’s Q2 earnings release in July 2024, MMM assured investors of an improved outlook, bolstering its turnaround thesis. In addition, the company also outlined its priorities, focusing on returning the leading industrial conglomerate to organic growth above the market average.

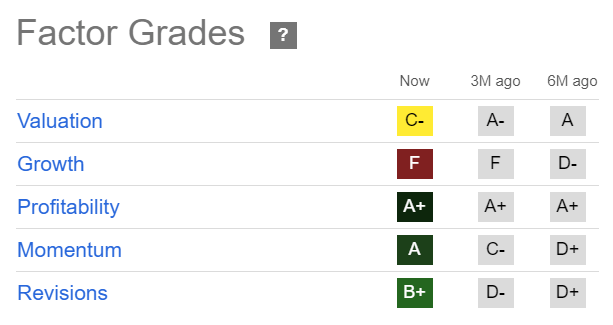

MMM Quant Grades (Seeking Alpha)

Given the transformation roadmap under the new team, I assess that the valuation re-rating is appropriate, underpinned by its best-in-class profitability “A+” profitability grade). Notwithstanding its challenges (including legal liabilities), the company’s fundamental thesis has not changed. Its ability to maintain an “A+” profitability grade underscores the fundamentally strong proposition across several markets.

3M Shows Profitability Resilience Amid Challenges

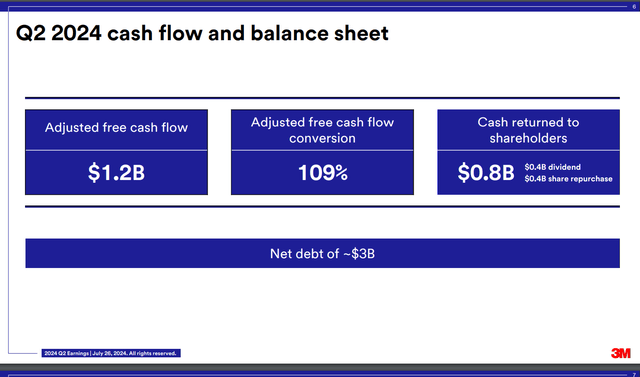

3M cash flow conversion and key balance sheet metrics (3M filings)

As seen above, 3M posted healthy cash flow conversion metrics in Q2, allowing it to maintain a highly constructive capital return framework. Hence, I assessed it has provided more confidence for value and income investors to remain vested as they awaited the opportunity to ride 3M’s turnaround.

MMM’s “A” momentum grade marks a stellar turnaround from its “D+” grade over the past six months, as bearish investors realized how foolish they have been.

The company has further renewed its focus on improving operational performance while driving efforts to lift its organic growth. As a result, investors should expect more clarity on the company’s performance from streamlining its manufacturing processes. In addition, its ability to improve yield and operating equipment efficiency are key metrics to assess its operational performance.

I also assess the company’s confidence in upgrading its adjusted profitability outlook adds credibility to its optimism about improved operational performance. As a result, 3M expects its adjusted operating margin to improve by 225 to 275 bps. Despite that, 3M didn’t revise its full-year adjusted organic growth outlook (flat to 2% growth), tempering investor optimism. Hence, the company continues facing challenges in reigniting organic growth, although the market seems optimistic that the worst is likely over.

3M Needs To Justify Its Ability To Drive Organic Growth

Wall Street’s estimates on 3M have been upgraded to reflect the reduced pessimism on its ability to execute. While its adjusted operating margin is expected to remain robust, topline growth metrics seem relatively tepid. In other words, I assess that the valuation re-rating on MMM as it emerged from its battering has likely reflected its mean-reversion opportunity. Therefore, unless management provides a more robust growth outlook from 2025, its risk/reward could be limited.

MMM’s forward adjusted EPS multiple of 18.3x is less than 10% below its sector median. It’s also almost 20% above its 5Y average, corroborating my observation. In addition, management attempted to temper investor optimism by highlighting potential macroeconomic risks affecting its guidance. However, the Fed is poised to reduce interest rates starting in September, while a soft landing looks increasingly likely. Hence, I assess that the market seems relatively confident that the hard landing challenges that could untether MMM’s recovery seem unlikely.

Risks To MMM’s Thesis

3M’s “F” growth grade represents a substantial risk to its recovery optimism. While its improved adjusted profitability outlook has mitigated its tepid organic growth guidance, there are potential limits to its cost-cutting efforts without rejuvenating its revenue growth prospects. Therefore, management correctly identifies the need to drive organic growth as one of its key pillars. However, given the maturity of MMM’s markets, near-term improvement could be challenging. The company’s ability to engage in more intensive R&D efforts to drive new product launches might need more time to pan out.

3M’s core business segments are sensitive to macroeconomic risks. While the recent economic data suggests a soft landing seems increasingly likely, investors must still reflect potential execution risks, given its turnaround efforts. Hence, an unanticipated hard landing could wreak havoc on MMM’s investor sentiments, as its valuation is no longer assessed as undervalued.

I’m satisfied that my bullish thesis on MMM has played out accordingly. However, maintaining a Buy rating seems increasingly challenging given its recent surge and its valuation is no longer that attractive. Moving back to the sidelines at the current levels seems the right thing to do as we await more clarity on the company’s organic growth efforts.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!