Summary:

- 3M’s core was tired before the new CEO, Bill Brown, took over. In the recent earnings call, he spilled the beans on this fact.

- He is displaying leadership and didn’t mention AI one time, yet turning around the culture in a company like 3M is no small task.

- Investors who purchased 3M early this year and sold the Solventum shares have experienced gains exceeding 60%.

- My target price is $86. The market may move it to more like $110.

jetcityimage

A Tired Businesses

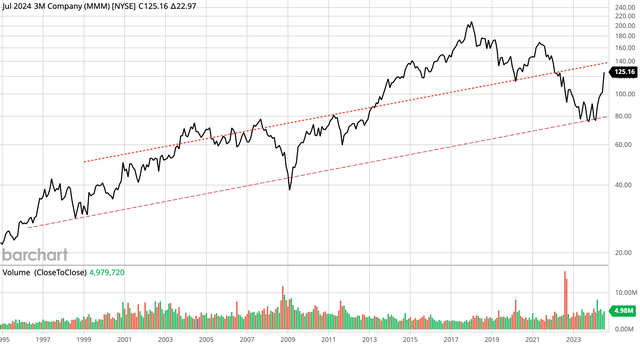

I took a position in 3M (NYSE:MMM) earlier this year when it was in the lower $90s after eyeing the then forthcoming value in its Healthcare spin-off (now Solventum – SOLV) and especially where the stock sat on this long-term, 30-year, monthly log chart:

The $80 level proved to be a very long-term low level. Now, the $140 level is looking like formidable long-term resistance, with $110 being more of a mid-range price level.

Before entering the stock, I spent time in the financials building a model for the stock. Throughout this process of financial analysis, there was a consistent message being communicated: this is a tired business. While the narrative focused (not unjustifiably) on the defective ear protection and “forever chemicals” legal liabilities, to me, the main issue was the business’ declining revenue growth. This is evidenced by the fact that revenues in its 2 largest segments, Safety & Industrial and Transportation & Electronics, are both still down from 2019 levels and 2019 wasn’t exactly a blow-out economic environment. Safety & Industrial’s revenue has been down 2.5%, on average, over the last 5 years and Transportation & Electronics’ revenue has been down 2.9%, on average, over the last 4 years. The Consumer segment has been roughly flat over the last 5 years. I mean, it’s not like there hasn’t been anything going on in the Industrial, Transportation, and Electronics industries over the last 5 years that 3M couldn’t have benefited from, on balance…

Enter CEO William (“Bill”) Brown

Shortly after I bought the stock, new CEO Bill Brown joined the company. CEO Brown was previously the Chairman and CEO of L3Harris Technologies (LHX).

In last week’s Q2 2024 earnings call, CEO Brown said the following early on in the call:

As a result of the decline in investment [R&D], along with a strategic shift to fewer, but larger innovation opportunities, the number of and revenue from new product introductions has steadily declined over the past decade. The simple fact is that our products are aging. While we’ve been shifting our portfolio towards higher growth markets like auto electrification, industrial automation, data centers and semis, climate tech and others, these efforts aren’t material enough today to offset erosion in our core.

They remain, for the most part, attractive growth platforms, and we need to continue to balance investing appropriately in markets that are evolving quickly, while also investing incrementally to sustain the core products we have today. But before we make any adjustments to our R&D budget, I want to first explore opportunities to get more from what we currently spend.

3M has spent $1.2 to $1.3 billion annually over the last 3 years on R&D. Just spending money doesn’t equal success. It takes a culture that is open to ingenuity. CEO Brown is at least saying he wants to get more from what they currently spend, but the fact of the matter is he may need to write the culture of ingenuity first before potentially allocating more revenue to R&D.

In the business strategy book, Good to Great, by Jim Collins, one of his research team’s findings about the ingredients of highly successful corporate turnarounds is facing the brutal facts. With this, “simple fact is that our products are aging,” statement, it sounds like CEO Brown is doing just that.

Time and Valuation

I think the market totally overreacted on the day of the Q2 earnings release when it took the stock up about 22%. I sold my shares the following morning. Those of us who bought the stock in the low $90s earlier this year, then sold the Solventum spin-off right away, and then sold after this move have made more than 60%. In hindsight, the stock was undervalued before the Solventum spin-off, but nothing has really changed from a fundamental standpoint other than the fact that 3M balance sheet is now rightsized. Nevertheless, the Seeking Alpha news feed reveals that several analysts are now upgrading their outlook and target prices. I think the contrarian time to get bullish on 3M has passed.

CEO Brown is charging forward here, but it is too early to tell if it will make any difference, and changing a company like 3M is no easy task. If we do see meaningful improvement, it will take time, especially in a large, complex organization like 3M. CEO Brown made 4 references to a (potential) turnaround taking time in the earnings call:

These efforts are essential to reinvigorating the 3M innovation machine, but will take time to bear fruit.

This year we’ll do probably less than 150. And as I reflect back over the last eight or nine, 10 years, at one point in time we did over 1000. So we’ve really got to turn that around. It’s going to take some time to do that.

I made a comment about 80% of our raw materials coming from a source. We’ve got to qualify other vendors to be able to reduce costs over time. So that’s going to take some time.

Yes, this is an — it’s a complicated problem. It’s a lot of products, a lot of SKUs across a lot of factories and distribution points. If you look at this on a global basis, you map all the DCs and all the flows, all the factories, it’s a spider’s nest. I mean, it’s a lot going on here. And we do have a great team in operations that is looking hard at this. We have outside advisors that have been involved and this will take some time. It’s not a quarter, two quarters away. We’ll continue to take a hard look at optimizing the networks and the flows.

I wish 3M’s new CEO all the best (the U.S. needs a stronger 3M) but I will follow the developments from the sideline for now. What I will be watching though is new product development, which CEO Brown mentioned above is about 6 times below its past peak. There is an opportunity to drive revenue growth through a virtuous R&D, CAPEX, and innovative investment cycle. But again, this will take time. I believe it takes a company like this a year just to reposition the R&D, a year to figure out what to do, 3 years to invest the CAPEX, and then we will see. In the meantime, we’ll get GDP-level revenue growth, some share repurchases, and disappointed investors.

I have 3M trading for a bit over 17 times 2025 free cash (17 times earnings also) so this stock is no longer cheap and the monthly chart at the beginning of the article reflects this. Over the long term and with improvement, I think 3M can grow earnings by 11%. In my evaluation model, this translates to an 11.5 target multiple with a Moderately Bullish outlook. I see the company earning $7.45 a share next year, assuming share buybacks continue, and we end 2025 with 532 million diluted shares outstanding. This is a target price of $86.

The market will likely overpay, perhaps settling on 14 times forward earnings, which translates to a target price of $110 on consensus 2025 EPS of $7.88 (the Street is more bullish than me). $110 is in the middle of the monthly chart channel, which gives credence to this view.

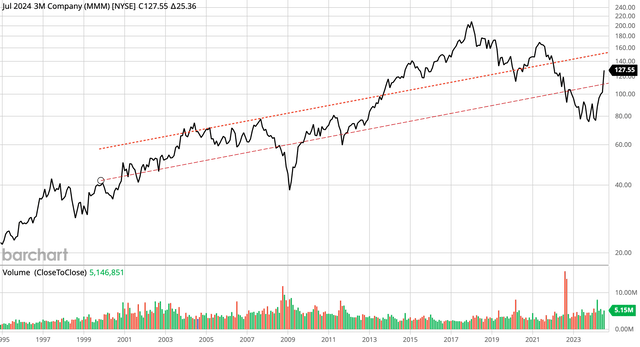

The Street wants to return 3M to this long-term, monthly log price channel:

If this holds—and this assumes the stock maintains a higher valuation multiple levels—then the stock is perhaps fairly valued here, with some follow through upside into the $140 to $160 range. I see this as simply a momentum view while we wait to see if the new management can rejuvenate this business.

To his credit, CEO Brown spilled the beans and I think this is positive because one has to face the truth first before there can be change. It is also a positive that he didn’t mention AI one time—a further sign of truth seeking and no buzzword hype. Still, I sold my shares. Let’s wait and see…

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information presented here is general in nature and designed for do-it-yourself and professional investors. It does not have regard to the investment objectives, financial situation, and the particular needs of any person who may read this. Recommendations are not personalized investment advice specific to the situation of any one individual, family, or organization. In no way should it be construed as personalized investment advice. True Vine Investments will not be held responsible for the independent financial or investment actions taken by readers. This content is never an offer to buy or sell any security. This content includes a disclosure of any relevant securities held by Joshua S. Hall or his immediate family. Client portfolios managed by True Vine Investments may hold positions in securities covered here. Securities in these portfolios may be bought or sold at any time in order for True Vine Investments to satisfy its fiduciary obligations to clients. All data presented by the author is regarded as factual, however, its accuracy is not guaranteed. Investors are encouraged to conduct their own comprehensive evaluation of financial strategies or specific investments and consult a professional before making any decisions. Positive comments made regarding this content should not be construed by readers to be an endorsement of Joshua Hall’s abilities to act as an investment advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.