Summary:

- Microsoft Corporation and Apple Inc. are both tech giants that currently have similar stock valuations based on forward P/E ratios.

- However, Microsoft should be viewed currently as a better investment option due to several factors.

- We highlight four key reasons for that assessment in the paragraphs below.

skynesher/E+ via Getty Images

Investing in the market is a matter of doing comparative analysis and choosing the best investment against your investment goals given myriad options. Today, we are going to compare Microsoft Corporation (NASDAQ:MSFT) to Apple Inc. (AAPL). Both are tech giants and two of the largest companies in the stock market based on capitalization. Both stocks trade roughly 28 times forward earnings. However, Microsoft seems clearly the better stock to own over the near and medium term at current trading levels. Here are four core reasons for that assessment.

Growth Prospects:

Microsoft clearly has the better growth prospects, at least for the next couple of years. The current analysis firm consensus has Apple’s earnings growing 7.5% in FY2024 on revenue growth of just one percent. They predict profits improving by 9.5% on just over six percent sales growth. On the other hand, Microsoft is projected to clock in with 20% earnings growth in FY2024 on a 15% rise in revenues before adding earnings gains of 12.5% on just over 14% revenue growth in FY2025. Microsoft is the clear winner as far as growth comparisons are concerned.

Focus on AI:

As I noted in my recent article about Apple earlier this week, the current analyst consensus is that the tech giant from Cupertino is playing “catch up” in the artificial intelligence, or AI, space compared to its large rivals. This is important, as AI has the potential to be the biggest paradigm shift for the economy since the emergence of the Internet in the 90s. It has also been a huge driver of the gains in the market in recent quarters. Based on comments from the company’s recent fiscal Q2 earnings call, Apple management seems to be taking a “hybrid” approach to AI, which doesn’t involve major investments like building new data centers.

Microsoft, on the other hand, seems to be going more whole hog building out its AI capabilities. It is announcing a $3.3 billion investment to build out a new artificial intelligence data center in Wisconsin this week. The company invested $1 billion in OpenAI, creator of the ChatGPT chatbot, way back in 2019. It has extended and invested another more than $10 billion in this partner since. Microsoft seems to have the clear lead over Apple in AI.

Exposure to China:

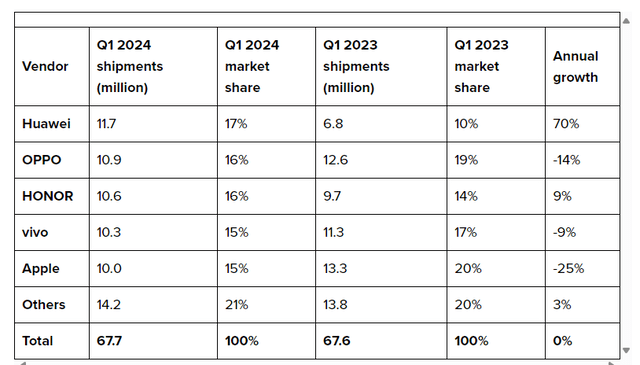

Apple outsourced a good portion of its manufacturing capacity to China more than a decade ago and has massive exposure in the country. It also did over $70 billion in sales in China in 2023. No tech company has more exposure to China than Apple. Apple’s market smartphone market share fell significantly in the first quarter of 2024, but still is at 15%.

Smartphone shipments in China – 1Q2024 (9to5 Mac)

The company has started to move some manufacturing to places like India but will still have huge exposure in China for the foreseeable future. With China and the U.S. competing for geopolitical pre-eminence for the foreseeable future and trade tensions mounting, this could develop into a major headwind for Apple. This is especially true if a new administration levels large tariffs against China in 2025 and/or China ever invades Taiwan (a low probability, granted). In the latter scenario, AAPL stock would surely get pummeled. In contrast, Microsoft’s CEO reiterated that China is not a “focus area” for the company late last year.

Margins:

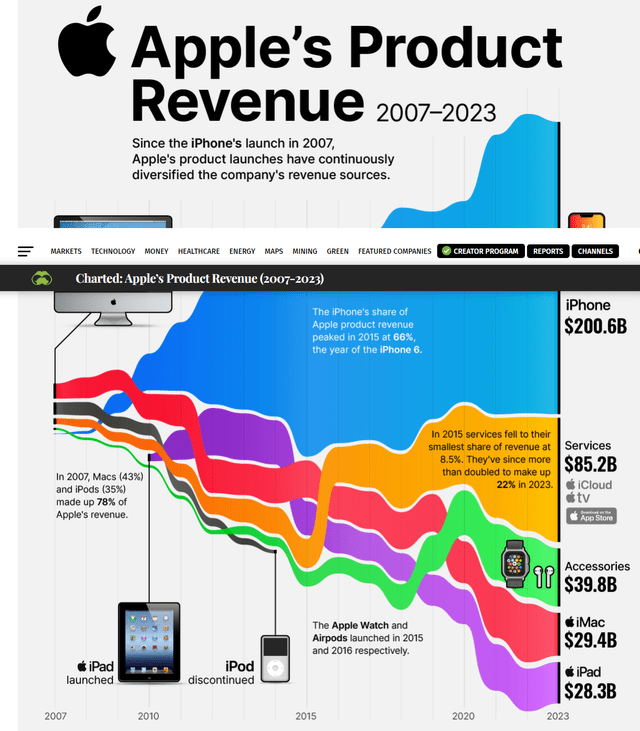

Microsoft is primarily a software company, while Apple is mostly a manufacturing company. Margins are historically higher for software, which is why the highest margin part of Apple is its large App Store/iCloud business.

That is unlikely to change for the foreseeable future, giving Microsoft a sustainable advantage when it comes to higher margins. To put in perspective, Apple had a gross margin of 36.6% in 1Q2024 for its product revenues. For Services? 74.6%.

Conclusion:

Given these four factors, Microsoft Corporation seems a much better stock investment than Apple Inc., even though both stocks are currently trading at roughly the same forward P/E valuation. However, is that primarily because Microsoft is undervalued or due to the overvaluation of Apple? I am clearly in the latter camp. I currently own neither AAPL nor MSFT in my current portfolio, although I have owned both stocks several times over the past decade and a half. If the overall market pulls back, which I think it has a high probability of doing by the end of summer, MSFT would clearly be the choice to buy on that dip.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Live Chat on The Biotech Forum has been dominated by discussion of lucrative buy-write or covered call opportunities on selected biotech stocks over the past several months. To see what I and the other season biotech investors are targeting as trading ideas real-time, just join our community at The Biotech Forum by clicking HERE.