Summary:

- Johnson & Johnson might be the worst performing big pharma stock YTD, but there’s upside possible for it in the remainder of 2024.

- Revenue growth guidance was upgraded and even with a downgrade in EPS guidance, the number is still expected to see a YoY increase.

- Its market multiples indicate the possibility of some uptick, and there are dividends to consider too.

- JNJ isn’t without its risk, due to Stelara’s patent expirations and litigation against it, but for now, it’s a safer stock than not.

yuelan

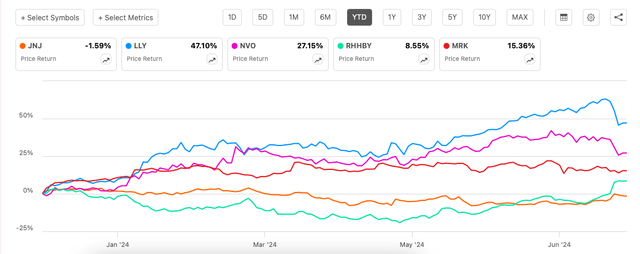

Among the big five pharmaceutical stocks by market capitalisation, Johnson & Johnson (NYSE:JNJ) has been the worst performer year-to-date [YTD]. While the rest of them have all seen at least some uptick, it’s actually down slightly (see chart below).

Price Returns, Big 5 Pharmaceutical Stocks (By MCap) (Source: Seeking Alpha)

Additionally, along with the release of its second quarter (Q2 2024) results last week, the company reduced its adjusted reported earnings per share [EPS] guidance. For the full year 2024, the number has been reduced by 6% at the midpoint of the guidance range, due to M&A activity. The EPS is now expected to come in at $10.02.

Despite these lackluster signs for JNJ, it’s hard to miss that the stock rose by 3.7% on the day of its earnings release. To put this in context, it’s the biggest single day rise seen in the past year. This, of course, begs the question, why? As it turns out, there’s plenty to like about both the company’s latest numbers as well as the stock. Here are four key reasons.

#1. Revenue growth picks up

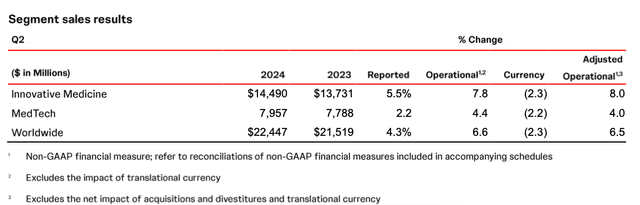

Compared to a five-year compounded annual growth rate [CAGR] in sales of just 1.26%, the company’s reported sales grew by a better than expected 4.3% year-on-year (YoY) in Q2 2024, as it sheds some drag after the spin-off of its consumer health division. This growth was driven by the bigger of its two segments, Innovative Medicine, which covers its pharmaceuticals treatments and accounted for 65% of total sales in Q2 2024. On the other hand, MedTech lagged behind (see table below).

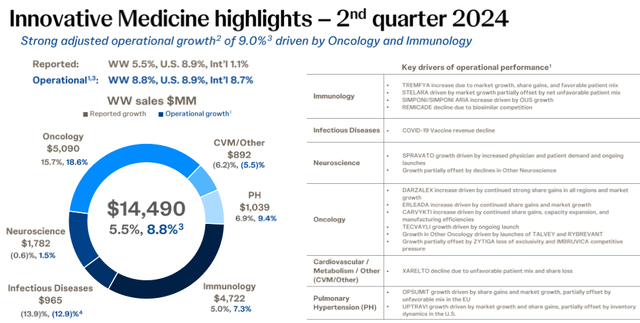

Within innovative medicine, oncology and immunology led revenue growth, even as all others, save pulmonary hypertension, saw contracting sales (see chart below). With the growth segments bringing in ~75% of Innovative Medicine’s revenues, the company still managed to see decent growth, however.

It also bears mentioning that Johnson & Johnson increased its operational sales forecast to 6.4% at the midpoint of the guidance range from 5.8% earlier due to the acquisition of medical technology company Shockwave Medical. This could well reflect on the reported figures as well, which, as distinct from the operational figures, include the exchange rate impact.

Source: Johnson & Johnson

Source: Johnson & Johnson

#2. Tremfya to the rescue

The prospects for the company’s oncology division continue to look good with the segment’s leading treatment, Darzalex, bringing in over half of oncology’s revenues, showed a strong 18.4% YoY increase in Q2 2024.

Within immunology, however, there are concerns around Stelara, the single biggest contributor to the company’s revenues at ~20% and which brings in over 60% of the segment’s revenues. The treatment’s revenues grew by just 3.1% YoY, and could see further slowing down due to expired patents.

However, support is at hand. Tremfya, the company’s treatment for skin condition psoriasis as well as psoriatic arthritis, stands out as promising. It contributed to little under 20% of the segment’s revenues, but with its 28.3% YoY growth during the quarter, its share could well increase in the coming quarters.

As the company seeks regulatory approval for Tremfya from the US FDA as well as to the European Medical Agency for treatment of Crohn’s disease, its prospects are positive. Importantly, the treatment for Crohn’s disease has shown superior results to Stelara recently, indicating that it might just be able to pick up some slack from its sales.

#3. EPS increase and market multiples reflect price upside

The next point to note is the earnings. Even with the latest reduction in guidance, at the midpoint, the company is still expected to see an +1% increase in the adjusted reported figure over the adjusted diluted figure for 2023. In fact, even as the reported diluted EPS saw a 5.9% YoY decrease in Q2 2024, the corresponding adjusted figure actually saw a 10.2% YoY increase.

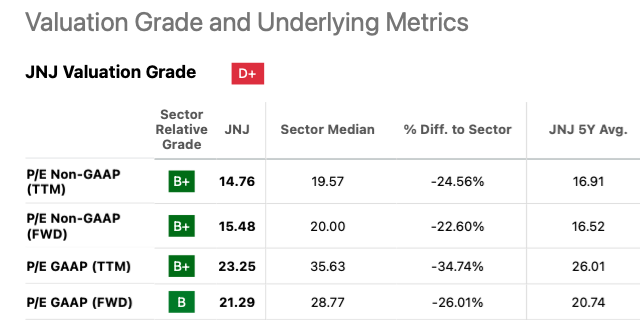

The midpoint guidance results in a forward non-GAAP price-to-earnings (P/E) ratio of 15.43x, which is lower than its five-year average of 16.5x. This indicates a 7% upside to the stock, which isn’t significant. In fact, its other market multiples don’t indicate very differently either (see table below). But there are dividends to consider too, which I come to next.

Source: Seeking Alpha

#4. Dependable dividends

The company increased its dividend by 4.2% in Q2 2024 to $1.24 per share, and has, of course, maintained that for Q3 2024 as well. With the Q1 2024 payout at $1.19 and the increased payout for the rest of the quarters, the forward dividend yield comes to 3.17%. This is an improvement from the trailing twelve months [TTM] yield of 3.11%, as the company increased dividends for the 62nd consecutive year.

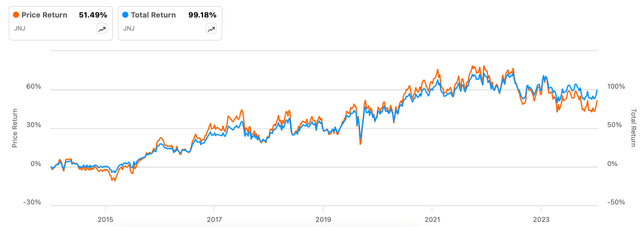

Among the biggest five pharmaceutical stocks by market cap, the yield is second only to Roche (OTCQX:RHHBY) at 3.44%. In fact, over the past decade, JNJ’s total returns, supported by dividends, have almost doubled its otherwise underwhelming price returns (see chart below).

Price and Total Returns, JNJ, 10y (Source: Seeking Alpha)

The risks

The stock isn’t without its risks, though. It remains to be seen whether the company’s ~$6.5 billion settlement offer for court cases alleging that its talcum power products are carcinogenic will pass a vote, due later this week. It has also offered settlement to the talc miners related to the same allegations. If the company is able to settle the disputes at the present levels, the dues are already significant, amounting to half the company’s net income in 2023.

There’s also a risk to future revenue growth with Stelara’s contribution expected to decline going forward. It’s worth noting here, that analysts’ estimates on Seeking Alpha put the company’s revenue growth in 2025 at a much softer ~3%.

Even considering the bump expected in 2024 due to the Shockwave acquisition, the fact is that even without the development, JNJ was expecting to see a 5.8% increase, higher than the expectation for 2025. Still, there’s solace to be had from the fact that the company has internally developed the maximum number of blockbuster drugs after Eli Lilly (LLY) over the past decade, which gives hope for the future.

What next?

For now, the company can see some increase in total returns in the remainder of 2024. Its EPS guidance and market multiples don’t suggest it can rise as fast as JNJ’s pharmaceutical peers, but with improved performance, it can continue to inch up.

JNJ’s updated revenue guidance is encouraging, too, and while there’s a risk due to Stelara’s expired patents, the oncology segment as well as Tremfya’s growth are positives. For these reasons, it’s a good time to Buy JNJ while it’s still weak.

The cloud of litigation still hangs over JNJ, which can change the outlook on the stock. Also, the company’s 2025 guidance will be key in determining what’s in store for it next year. But for now, it’s a relatively safe stock to buy with potential for the future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—