Summary:

- The Meta stock has surged towards new heights this year before recently paring gains, as investors consider the impact of a raised capex guidance to facilitate AI developments.

- Yet Meta’s prescient AI strategy has played a key role in not only restoring its competitive advantage in social media advertising, but also reinforcing its self-sufficiency in the AI-first era.

- The company also remains well-positioned for upcoming cyclical tailwinds that should further narrow its valuation gap from comparable megacap peers at current levels.

Derick Hudson

Meta Platform’s (NASDAQ:META) upsurge this year has led the stock to a near-40% premium over its previous peak set in 2021 before paring some gains following its 1Q24 earnings release. The Meta stock emerged as the sole loner amongst its Magnificent 7 peers that was left out from a post-earnings rally this season. Management’s decision to raise Meta’s capex outlook for the year had left investors mulling on the forward implications, as the change was met without a matching incremental uptick to growth.

As discussed in our previous coverage, Meta has consistently demonstrated positive fundamental progress after overcoming industry-wide woes levied by Apple (AAPL) that had severed a critical data pipeline for its core advertising business. The initiation of quarterly dividends exiting 4Q23 also reinforced confidence in its strengthening balance sheet. And coming out of the latest 1Q24 earnings season, our updated fundamental analysis below continues to support a robust outlook for the stock from current levels despite the raised capex surprise. Specifically, the following analysis will dive into how Meta continues to present itself as one of the few self-sufficient leaders in both supporting and adopting the emerging industry-wide AI transformation. This accordingly reinforces the company’s sustained long-term growth and margin expansion trajectory that underpins its valuation prospects.

Specifically, much of Meta’s appreciation over the past year has been underpinned by the restoration of its competitive advantage in social media advertising – one of the fastest growing and largest digital ad formats. Despite management’s recent decision to up Meta’s current year capex spend without raising the growth outlook, relevant investments will continue to reinforce its strong moat in the high margin digital advertising business.

The company’s early investments into AI as a mean to overcome post-ATT (or App Tracking Transparency) woes has also resulted in significant self-sufficiency, especially amid a broader industry transformation. This continues to bode favorably with Meta’s ever-expanding reach across its diversified Family of Apps across text, image and video formats. Meanwhile, Meta’s non-ad businesses, such as WhatsApp Business, are also starting to ramp and is becoming an increasingly additive source of growth and margin expansion. The combined result of Meta’s prescient investments in AI has resulted in a robust competitive advantage against peers, which further reinforces its leadership.

Trading at about 7.4x estimated sales and 23.5x estimated earnings, Meta currently leads its digital advertising rivals’ valuations by wide margins, yet remains largely consistent with its megacap peers on a relative basis to their respective growth profiles. Looking ahead, Meta is likely to remain in ramp mode, with limited visibility on any new valuation-changing catalysts in sight in the near-term. However, cyclical ad tailwinds later this year could potentially harbinger a better-than-expected growth outlook for Meta given its market leadership, and compensate for multiple compression headwinds stemming from its raised capex guidance for the year.

Meta’s Unmatched Self-Sufficiency

Since Apple’s introduction of App Tracking Transparency (“ATT”) two years ago, Meta has been presciently upping its investments into AI. This has, and continues to be, a critical means to restoring Meta’s severed targeting capabilities, critical to the survival of its core advertising business. Much of Meta’s $70+ billion capex spending, in addition to R&D, over the past two years have been dedicated towards the development and deployment of AI technologies. These include recommendation systems for app users, as well as campaign creation, placement and measurement tools for advertisers.

1. For Users

To date, not only has Meta successfully recovered from the peak of its post-ATT ad woes, but it has also emerged as one of the leading developers of generative AI solutions. For app users, Meta’s flagship discovery-based timeline enabled by its AI recommendation engine continues to facilitate expanding reach. Recent industry data has confirmed that more than half of content viewed by Instagram users were recommended by the AI-enabled algorithm. This is corroborated by the expanding share of Reels screentime across both Facebook and Instagram, which now exceeds 60% and is a key source of growth for the company. Management had also recently disclosed that Meta’s proprietary recommendation products have driven up to 10% performance gains for Facebook Reels.

These metrics continue to reinforce Meta’s mission-critical role in the accelerating content creator economy. Specifically, both Facebook and Instagram remain leaders in social media, delivering consistent positive improvements to their share of user screen time in recent quarters.

A recent survey conducted by RBC Capital Markets indicates that more than 53% of Facebook / Instagram users have spent more time on the apps compared to levels last year. 36% of surveyed respondents indicated they have spent less time on the apps over the same comparative period, implying a net positive in share of user screen time gained. Meanwhile, key competitor TikTok saw a 25% increase in users who have spent more time on the platform over the past year, while 24% have spent less, representing a net neutral showing.

This accordingly corroborates the effectiveness of Meta’s continued leverage of its prescient AI investments in improving user acquisition, retention, and more importantly, engagement that is critical to the broader creators’ economy that is expected to expand at a 20%+ CAGR over the next decade. Coupled with other value-add features for users, such as the recent integration of Amazon (AMZN) checkout on Facebook and Instagram, Meta also effectively reinforces the attractiveness of its walled garden to advertisers.

2. For Advertisers

Although the open internet accounts for 80% of global viewership, walled garden ad platforms remain the preferred choice for advertisers. Specifically, Meta currently represents the second-largest digital advertising format after Google Search (GOOG / GOOGL), and places alongside other walled garden peers in capturing 80% of ad dollars due to their better reach, conversion and, inadvertently, return on ad spending (“ROAS”). ROAS remains the most important performance metric for advertisers, especially Meta’s price sensitive SME-focused customer base.

And Meta has consistently improved ROAS for advertisers with its increasing provision of AI-enabled tools. The industry currently estimates that 70% of ad content creation will be overtaken by AI-enabled computer generation over the longer-term. And Meta remains a leader in this foray. Adding to the roll-out of its post-ATT “Advantage+” advertising format, Meta has also introduced additional AI-enabled tools to help advertisers streamline the ad creation to deployment process. This follows Meta’s reiterated commitment to furthering its AI solutions portfolio offered through Advantage+ for advertisers:

We’re also building out our Advantage+ portfolio of solutions to help advertisers leverage AI to automate their advertising campaigns…We’re also now exploring ways to apply this end-to-end automation to new objectives. On the ads creative side, we completed the global rollout of two of our generative AI features in Q4, Text Variations and Image Expansion, and plan to broaden availability of our background generation feature later in Q1.

The developments continue to be primarily enabled by Meta’s proprietary AI technologies. These include its open-sourced Llama foundation models, as well as its in-house developed Meta Training and Inference Accelerators (“MTIA”).

Despite recent reports on observations of mixed performance metrics from advertisers on Meta, the social media giant’s ad formats remain a superior choice due to its proven effectiveness and efficiency. Specifically, the number of ad impressions served by Meta grew 20% y/y, while the average price per ad also increased 6%, reversing previously declining trends. This continues to bode favorably with increasingly structural ad spend optimization trends coming out of the cyclical slowdown observed in the past year, and reinforces Meta’s market share gains bolstered by its AI advantage.

3. For Merchants

Meta’s continued commitment to in-house AI developments has also benefitted its merchant base across non-advertising verticals. This is evident in persistently outsized growth of “other revenue” generated from the sale of business messaging services such as WhatsApp Business.

And the non-ad business’ growth continues to be reinforced by the ramp-up of newly introduced value-add services such as Channels – an exclusive chat channel utilized by merchants to broadcast updates for subscribed users. Meta has also been pushing forward with its prioritization of AI-enabled business messaging services through WhatsApp and Messenger for merchants. This is expected to reverse the current trend of limited ad monetization through the business messaging apps by addressing the historically higher costs of engagement for merchants through replacing chat agents with generative AI. We expect this to further reinforce Meta’s non-ad revenue stream, and become a key accretive factor to its profitability over the longer-term as paid messaging opportunities expand.

4. For Meta

More importantly, Meta has continued to prioritize investments into the development of its proprietary AI technologies. As mentioned earlier, the Llama LLM and MTIA have been critical developments for Meta’s AI prowess. These technologies have been underpinning key generative AI capabilities for its core advertising business, including the recent roll-out of Text Variations and Image Expansion features for automating and optimizing the ad campaign creation process.

Looking ahead, Meta’s continued commitment to relevant developments are expected to reinforce its current strategy for expanding monetization of its massive user and merchant base. For instance, Meta is readying its next-generation Llama 3 LLM for deployment in the coming weeks. The open-sourced LLM will continue to reinforce Meta’s aims in facilitating rapid improvements to AI technology by inviting participation from the broader developer community. The impending upgrade will likely underpin the roll-out of additional generative AI features across the Family of Apps that will further reinforce both users and advertisers’ experience over time.

Meanwhile, Meta is also working on the next-generation MTIA. This follows the footsteps of its megacap peers, who are also in the process of bolstering their in-house silicon game to reduce reliance on third-party hardware critical for enabling AI developments. Specifically, MTIA v2 will be optimized for Meta workloads, such as its recommendation engine, which will further enhance the self-sufficiency of its AI strategy. The development is expected to complement the company’s AI investment cycle this year, which also includes the purchase of as many as 350,000 Nvidia (NVDA) H100 GPUs.

Continued vertical integration and diversified reliance on third-party hardware is expected to bolster the long-term success of Meta’s AI strategy, while also driving margin expansion at scale. This is already evident in Meta’s maintenance of profit margins over recent quarters, despite widening losses at Reality Labs. We expect the continued ramp of Meta’s AI developments to reinforce growth of its higher margin advertising business and become incrementally accretive to its profitability at scale. This effectively bolsters Meta’s AI self-sufficiency, which we view as a key competitive advantage for the company’s ad-reliant business strategy and a fundamental support to the stock’s valuation at current levels.

Fundamental Considerations

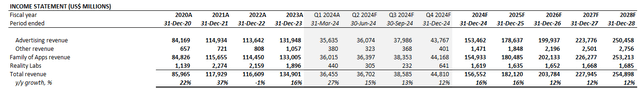

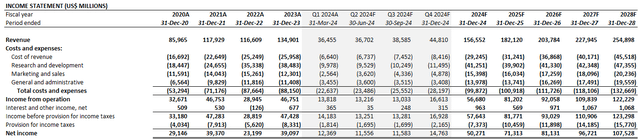

Adjusting our previous forecast for Meta’s actual Q1 performance and forward outlook, we expect 2024 revenue growth at 16% y/y to $156.6 billion. This will be primarily driven by continued strength in the Family of Apps advertising demand, alongside penetration of additional business messaging opportunities. Meanwhile, Reality Labs sales are expected to remain a seasonality-driven revenue stream within the foreseeable future as consumer interest for the mixed reality devices segment remains mixed.

Taken together, we expect relatively flat profit margins this year compared to 2023. Specifically, margin expansion driven by continued strength of ad demand at scale are expected to be offset by widening losses at Reality Labs alongside incremental near-term investments into the AI roadmap.

Price Considerations

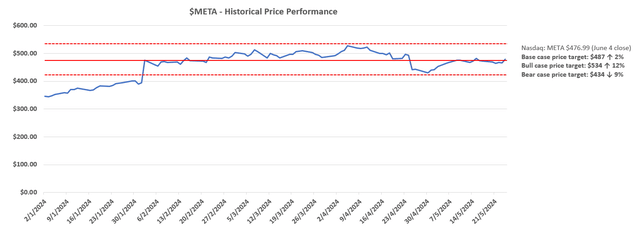

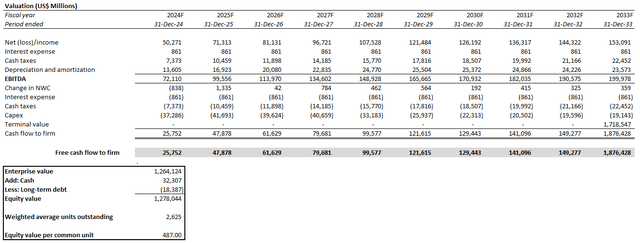

Our updated price target for Meta is $487. This is largely in line with the stock’s current performance.

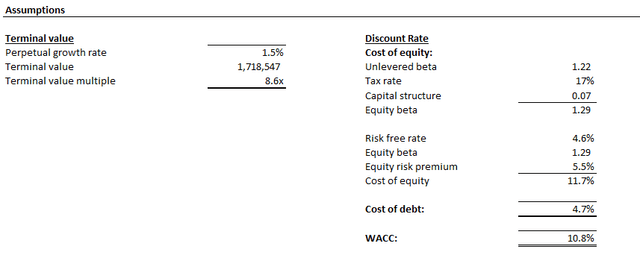

The price target is derived from the discounted cash flow valuation approach. The DCF analysis considers cash flow projections taken in conjunction with the fundamental forecast discussed in the earlier section. A 10.8% WACC in line with Meta’s capital structure and risk profile is applied. The analysis also assumes a 1.5% perpetual growth rate on 2033E EBITDA to determine Meta’s terminal value when its business conditions are expected to normalize. The assumed terminal value is consistent with a 4.8% premium perpetual growth rate applied on 2028E EBITDA. This is reflective of Meta’s anticipated strength over the near- to medium-term as emerging secular opportunities in AI and digital advertising continue to ramp.

We remain confident that Meta remains well-positioned for the upside scenario, underpinned by its leadership in social media advertising, leading up to several cyclical tailwinds in 2H24. This is further complemented by the 6% increase in Meta’s average price per ad during the first quarter despite the seasonal slowdown, accelerating from the preceding quarter and reversing previous declines. Relevant tailwinds are likely to be reinforced by continued performance gains realized through Meta’s integration of AI-driven improvements to its products.

In considering upside scenario cash flows, while maintaining base case scenario valuation assumptions (10.8% WACC; 1.5% perpetual growth), Meta is positioned for +12% upside potential to $534 apiece. This would take the stock to new record levels, which we believe is likely by year-end considering upcoming cyclical tailwinds for Meta and its persistent delivery of company-specific strengths discussed in the foregoing analysis.

Risk Considerations

Meanwhile, execution risks on Meta’s AR/VR ambitions through Reality Labs remain an immediate overhang on the stock. Although much of Zuckerberg & Co.’s focus has shifted towards AI-related developments, AR/VR remains a key piece to the company’s long-term investment roadmap and growth strategy, nonetheless. Looking ahead, Reality Labs losses are likely to expand further and weigh on margins. This is consistent with management’s caution for Reality Labs’ operating losses to “increase meaningfully” from the prior year, as the company remains committed to relevant developments pertaining to its mixed reality headsets and glasses, as well as the broader Metaverse ecosystem.

However, the advent of mainstream AI adoption and transformation could potentially be an offsetting tailwind for the company’s Metaverse ambitions. Specifically, management has been touting overlapping opportunities between generative AI and its ongoing build-out of the Reality Labs ecosystem during the latest earnings season. This is evident in the recent integration of Meta AI – the company’s multimodal generative AI assistant – in its latest edition of the RayBan Meta smart glasses. We believe the joining of hands in Meta’s ongoing investments in both AI and AR/VR developments could become an emerging accelerant to monetization improvements in Reality Labs over the longer-term.

Conclusion

Meta has continued to deliver consistent positive progress supportive of its leadership in capturing secular tailwinds in digital advertising – particularly in social media formats. The results continue to support continued margin expansion at scale, which is critical to cash flow growth underpinning both its valuation and increasingly generous capital returns program observed over the past year.

However, management’s recent decision to increase Meta’s near-term capex spend without a similar raise to the growth outlook accordingly increase execution risks. As a result, the stock likely faces continued volatility in the near-term, given Meta’s compressed cost-returns spread. This could potentially represent opportunity to partake in longer-term upside potential, underpinned by Meta’s strengthening moat as its AI performance gains start to ramp.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.