Summary:

- Agnico Eagle Mines Limited continues to see an uptick, driven by rising gold prices and robust production levels.

- With a bullish outlook for gold, along with Agnico’s rising revenues and expanding margins, its financial forecasts have been upgraded.

- AEM’s forward P/E ratio now suggests a 17% upside, with continued earnings growth into 2025 further supporting the case for the stock.

mikulas1

Since the last time I wrote about gold miner Agnico Eagle Mines Limited (NYSE:AEM) in July, its price has seen an uptick of ~12%. This isn’t surprising. Gold prices (CUR) continued rise coupled with the company’s own robust production, further upside to the stock was apparent even two months ago.

With AEM’s over 50% rise year-to-date (YTD), it would be natural to wonder how much longer it can keep inching up. But as it happens, both the outlook for gold price and its performance have increased the stock’s price potential yet again. Here are four distinct arguments for staying bullish on the stock.

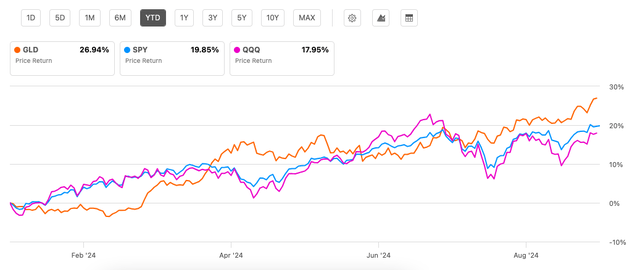

#1. Gold price breaches forecasts

The first point to note is the price of gold. The gold bullion price tracker, SPDR Gold Shares ETF (GLD) is up by almost 30% YTD. This compares favorably with the S&P 500 (SP500) tracker, SPDR S&P 500 ETF Trust (SPY) and the NASDAQ-100 (NDX) tracker, Invesco QQQ Trust ETF (QQQ), which have seen increases of ~20% and ~18% respectively during this time (see chart below). When I last checked, GLD was trading neck-to-neck with the indices, but now it has a clear lead, partly due to the stock indices’ weak performance recently.

But the lead is also because gold price continued to rise. At its latest price of USD 2,630 per ounce, the metal has breached JPMorgan’s forecast, referred to the last time, for the last quarter of the year (Q4 2024) by over 5% already. There’s of course a possibility that the price can soften from here on, but going by Goldman Sachs’ latest forecast, that appears unlikely. The bank recently projected that by early next year, it will be trading at USD 2,700 per ounce, due to expected geopolitical uncertainties, lower interest rates and central banks’ gold purchases.

Price Returns: GLD, SPY and QQQ (Source: Seeking Alpha)

#2. Robust performance continues

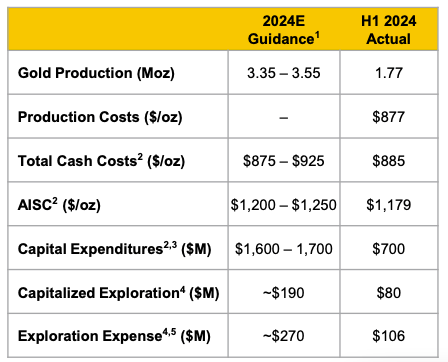

Next, the company’s own performance continues to be robust. In Q2 2024, it reported a production of almost 0.9 million ounces, which brings the figure up to 1.77 million ounces for the first half of 2024 (H1 2024). If it continues at this rate in H2 2024, full-year production will land at the upper end of the company’s guidance range (see table below).

Source: Agnico Eagle Mines

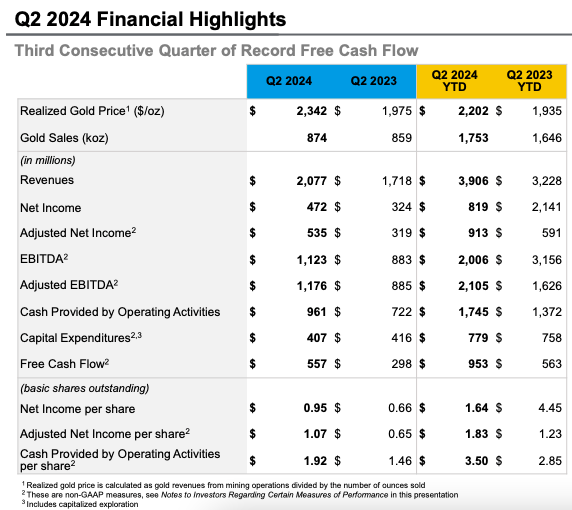

With strong production and continued gold price rise, revenue continued to see an uptick in Q2 2024 as well, increasing by 20.9% YoY. For H1 2024, revenue has seen a slightly higher increase of 21% YoY. But that’s not all. The company’s margins have remained strong. After a 16.5% adjusted net margin in 2023, the number rose to 20.7% in Q1 2024 and has risen to 23.4% in H1 2024 on further improvement in Q2 2024 (see table below).

Source: Agnico Eagle Mines

#3. Projection upgrade

These latest numbers call for an upgrade in projections. Not only do higher gold prices need to be factored in for 2024, the company’s performance in H1 2024 indicates the likelihood of higher revenue growth and margin expansion from 2023. The assumptions for the latest projections are as follows:

- Gold price: With the gold price for Q3 2024 18.8% higher than the projection assumptions, a higher figure for Q4 2024 is also considered. For the sake of simplicity, it’s assumed that by the end of Q4 2024, the metal would trade at USD 2,700/ounce, which Goldman Sachs otherwise targets for early 2025. This is 15.9% higher than the previously considered projections. As a result, the average gold price for 2024 is now seen at ~USD 2,564/ounce, which is 8.3% higher than earlier.

- Revenue: Besides the gold price assumptions, to project the revenues, it’s also assumed that the company’s production will come in at the top end of the guidance range.

- Net margin: The company’s adjusted net income margin in H1 2024 is higher compared to the 16.5% for 2023, which was used for the previous projections. Even if the margin in H2 2024 is the average of that in 2023 and in H1 2024, the full-year margin would average at 22%.

These assumptions indicate that the revenue will increase by 19.5% for 2024, which is higher than the earlier forecast of 14.1%. The adjusted earnings per share (EPS) is now seen at USD 3.45, which is over 10% higher than the previous forecast of USD 3.13.

#4. Attractive stock metrics

With the latest projections, AEM’s forward non-GAAP price-to-earnings (P/E) ratio comes to 23.9x. This is just a shade higher than the 23.6x the last time and still lower than the stock’s five-year average of 28.1x. This indicates an over 17% upside to AEM even now.

It’s also worth noting that analysts estimates on Seeking Alpha forecast continued earnings growth in 2025, which is instructive considering that we are now just a quarter away from the new year. With a further 12.3% increase expected in adjusted EPS next year, the forward P/E for the year declines to 19.7x. This in turn, suggests that upside for the stock can potentially continue well into the next year.

Further, AEM also pays a dividend. The trailing twelve months (TTM) dividend yield at 1.94%, as the per-share dividend has stayed static in Q2 2024 and the price continued to rise, the number is lower than the 2.16% the last I checked. But there’s something to be said for the company’s dividend consistently since 1983.

What next?

Essentially, the AEM story remains unchanged as more of the good stuff keeps piling up. Gold prices have risen more than anticipated, and are expected to see further rise. The company’s production is solid and with higher gold prices, revenues are rising at a healthy rate. Its expanding net income margin is another positive. The improved outlook for gold and its own superior performance has led to a forecast upgrade for 2024, which indicates further upside for AEM. Its dividend payouts are another sweetener. I’m retaining a Buy rating on Agnico Eagle Mines.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AEM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—