Summary:

- Accenture offers diversified exposure to AI without excessive risk, thanks to its focus on professional services.

- The company has a proven track record of consistent growth, with annual returns averaging 14.6% since 2003.

- Accenture holds a leading market position in the professional services industry, providing a competitive edge.

SvetaZi

Introduction

I have to admit that my coverage of artificial intelligence (“AI”) has been somewhat muted. I haven’t covered any of the major semiconductor stocks or their high-tech clients, like the FANG+ stocks.

This is due to a number of reasons. One of them is the fact that I believe that many AI stocks quickly became too expensive. The other reason is that my investing style is different. I have a multi-decade investment horizon, which makes me a bit nervous when it comes to trends that may quickly change.

Especially in the technology sector, innovation leaders often change quickly.

That said, I have covered AI-related stocks, including data center real estate trusts like Equinix (EQIX) and industrial giants like Eaton (ETN).

These two companies have one thing in common. To them, it doesn’t matter who’s the leader in AI or who has the best microchips. All that matters is the “bigger picture.” If AI demand is strong, they benefit.

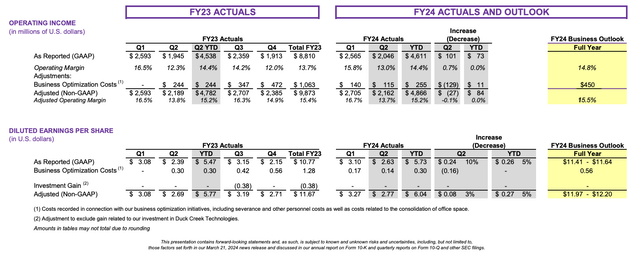

In this article, I will give you another stock that benefits from AI without being overly exposed to competition. That company is Accenture plc (NYSE:ACN), the information technology service giant that has returned 14.6% annually since September 2003, making it one of the biggest wealth compounders on the market.

Currently, the company is trading 11% below its all-time high, yielding 1.4%, and is expected to see accelerating growth in the years ahead.

So, let’s dive into the details!

Well-Diversified Tech Exposure With Rapid Growth

Accenture is a Dublin-based professional services company whose roots go back all the way to the early 1950s when the company began as the business and technology consulting division of the accounting firm Arthur Andersen.

At the end of its 2023 fiscal year, the company had a workforce of more than 730,000 people in 120 nations, focused on supporting businesses, governments, and organizations worldwide in building their digital infrastructure, optimizing operations, and boosting revenue growth.

In order to drive customer satisfaction, the company employs something called “360°.”

We define 360° value as delivering the financial business case and unique value a client may be seeking, and striving to partner with our clients to achieve greater progress on inclusion and diversity, reskill and upskill our clients’ employees, help our clients achieve their sustainability goals, and create meaningful experiences, both with Accenture and for the customers and employees of our clients. – ACN 2023 10-K

Moreover, the company operates through five industry groups: Communications, Media & Technology, Financial Services, Health & Public Services, Products, and Resources.

Roughly half of its revenues come from North America.

Accenture plc

Essentially, it’s all about employee engagement, as advising businesses completely relies on the competency of one’s workforce.

Although I’m not necessarily a fan of labor-intensive companies, there’s no denying that in AI, the company is making the right moves.

For example, on March 27, the Wall Street Journal wrote an article dedicated to the fight for talent in the AI industry.

Wall Street Journal

According to the article, the surge in AI development demand is fueling a talent war in Silicon Valley, with tech companies offering massive compensation packages to attract individuals skilled in generative AI, which is the technology behind systems like Chat GPT.

Apparently, only a few hundred people in the world have these capabilities. If you’re one of them, you can easily clear $1 million a year.

Moreover, sales professionals with AI knowledge are in high demand.

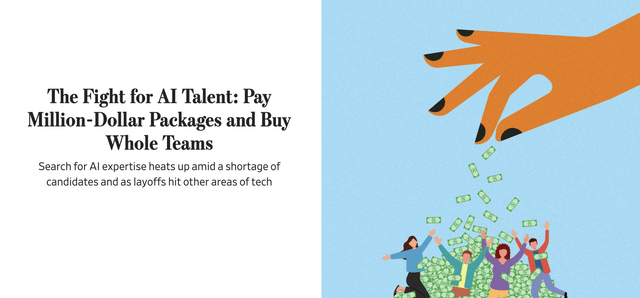

Accenture has the right talent to advise companies on major AI developments. It is also a major M&A giant. Through FY2022, for example, the company has boosted M&A spending to $4 billion.

Accenture plc

Even better, the company also uses its own automated equipment to streamline operations and improve its service offerings:

We also design, manufacture, and assemble our own advanced automation equipment, robotics and other specialized commercial hardware to support our clients’ operations. Through the use of data and transformative technologies such as AI, Internet of Things, artificial reality/virtual reality, advanced robotics, digital twins and metaverse we help our clients reinvent to achieve greater resilience, productivity and sustainability in their core operations and design and engineer intelligent products faster and more cost effectively. – ACN 2023 10-K

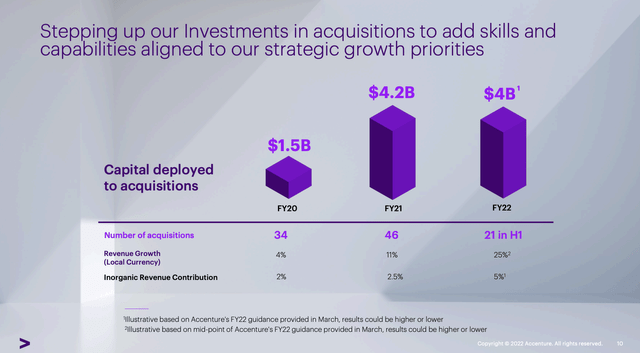

As we can see below, this has provided Accenture with a leading market position, allowing it to benefit from partnerships with all leading AI/tech companies and emerging companies at different stages of the technology “supply chain.” This includes data centers, chip producers, cyber security providers, and so many other companies.

It has a 2x larger market share in its field than its largest competitor.

Accenture plc

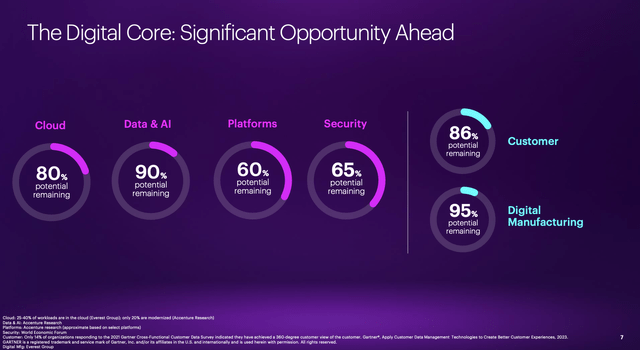

The company also makes the case that the segments it targets are still underdeveloped.

For example, with regard to the cloud industry, roughly 25% to 40% of workloads are in the cloud. Only 20% are modernized.

Accenture plc

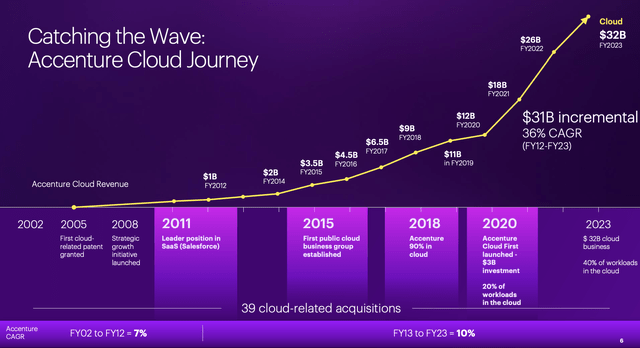

Speaking of the cloud, in FY2023, the company had a $32 billion cloud business. In 2019, that number was “just” $11 billion.

Accenture plc

All of this is fantastic news for shareholders.

Shareholder Returns

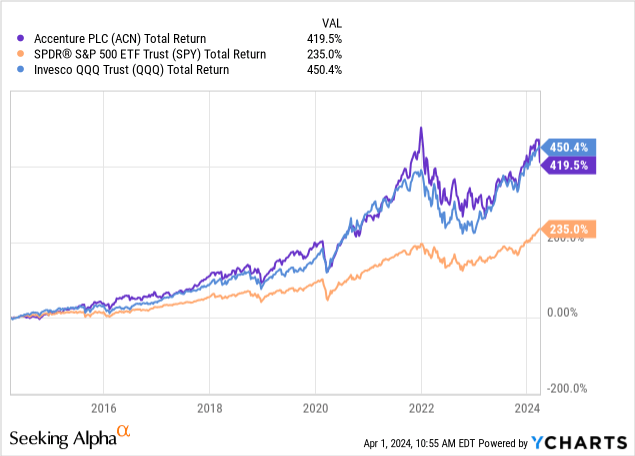

These qualities and benefits have allowed the company to become one of the most consistent compounders on the stock market. Over the past ten years alone, ACN shares have returned 420%, beating the S&P 500’s 235% return by a wide margin. If it weren’t for its recent stock price decline, it would have also beaten the Invesco QQQ ETF (QQQ).

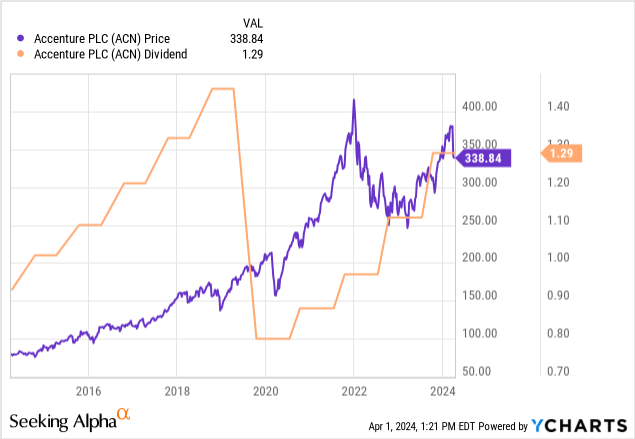

All of this also bodes well for its dividend.

After hiking its dividend by 15.2% on September 28, the company currently pays $1.29 per share per quarter. This translates to a yield of 1.5%.

This dividend comes with a payout ratio in the low-40% range and an 11.6% five-year CAGR.

Please note that the company did NOT cut its dividend in 2019. Back then, it went from a semi-annual dividend to a quarterly dividend. This makes it look like it cut its dividend.

Now, the question is how attractive ACN shares are after their recent dip.

Recent Events & Valuation

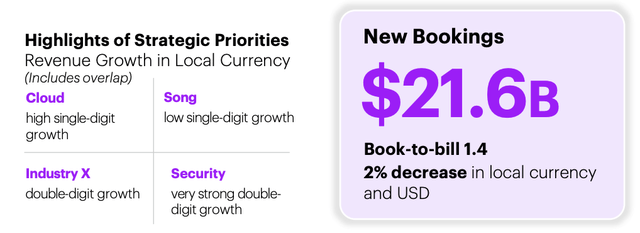

Last month, the company released its quarterly numbers, which were highly favorable.

For example, the company secured 39 new clients with quarterly bookings exceeding $100 million. Its GenAI sales alone exceeded $600 million in new bookings. In the first half of the 2024 fiscal year, these bookings totaled $1.1 billion.

Total quarterly bookings were $21.6 billion, which is the second-highest result in its history. Quarterly bookings in North America were $10 billion, its highest result ever!

These bookings were so good that the book-to-bill ratio for the quarter came in at 1.4x, which indicates $1.40 in new orders for every $1.00 in finished work.

Accenture plc

Moreover, it has roughly 53,000 data and AI-focused employees. The goal is to bring that number to 80,000 by the end of the 2026 fiscal year.

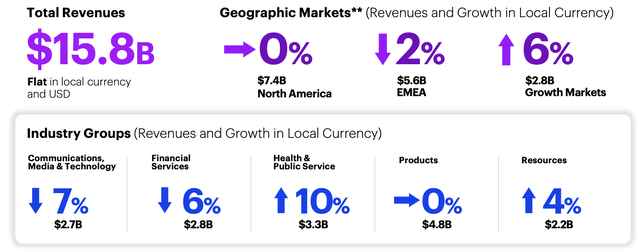

Meanwhile, technology services grew in the low single digits, while strategy consulting declined in the low single digits. Geographically, revenue in North America remained flat, with growth in public service but declines in other sectors.

Accenture plc

So far, so good.

During its earnings call, the company also provided guidance.

As we can see below, 3Q24 revenue expectations indicate a range of $16.25 billion to $16.85 billion. This includes a 1% expected foreign currency headwind and indicates 1-3% growth.

On a full-year basis, the company expects 1-3% revenue growth, potentially including up to 3% of inorganic growth.

This leads the company to believe that it can achieve a full-year adjusted EPS result between $11.97 and $12.20, indicating at least 2.6% growth compared to FY23.

Accenture plc

Analysts agree with the company, as they expect the company to generate at least $12.20 in EPS this year. This implies 4% growth.

Next year, EPS is expected to grow by 7%, potentially followed by an acceleration to 11% growth in the 2026 fiscal year.

FAST Graphs

That’s good. The problem is that the stock is not as cheap as one might expect/hope.

After all, a lot of good news has been priced in.

Using the data in the chart above:

- ACN currently trades at a blended P/E ratio of 29.1x.

- Its normalized P/E multiple going back to 2003 is 21.1x.

- Over the past five years, the company had a normalized P/E ratio of 28.5x.

Using a 28.5x multiple, the company has a theoretical annual return of 8.8% through 2026, which is well below its long-term total return.

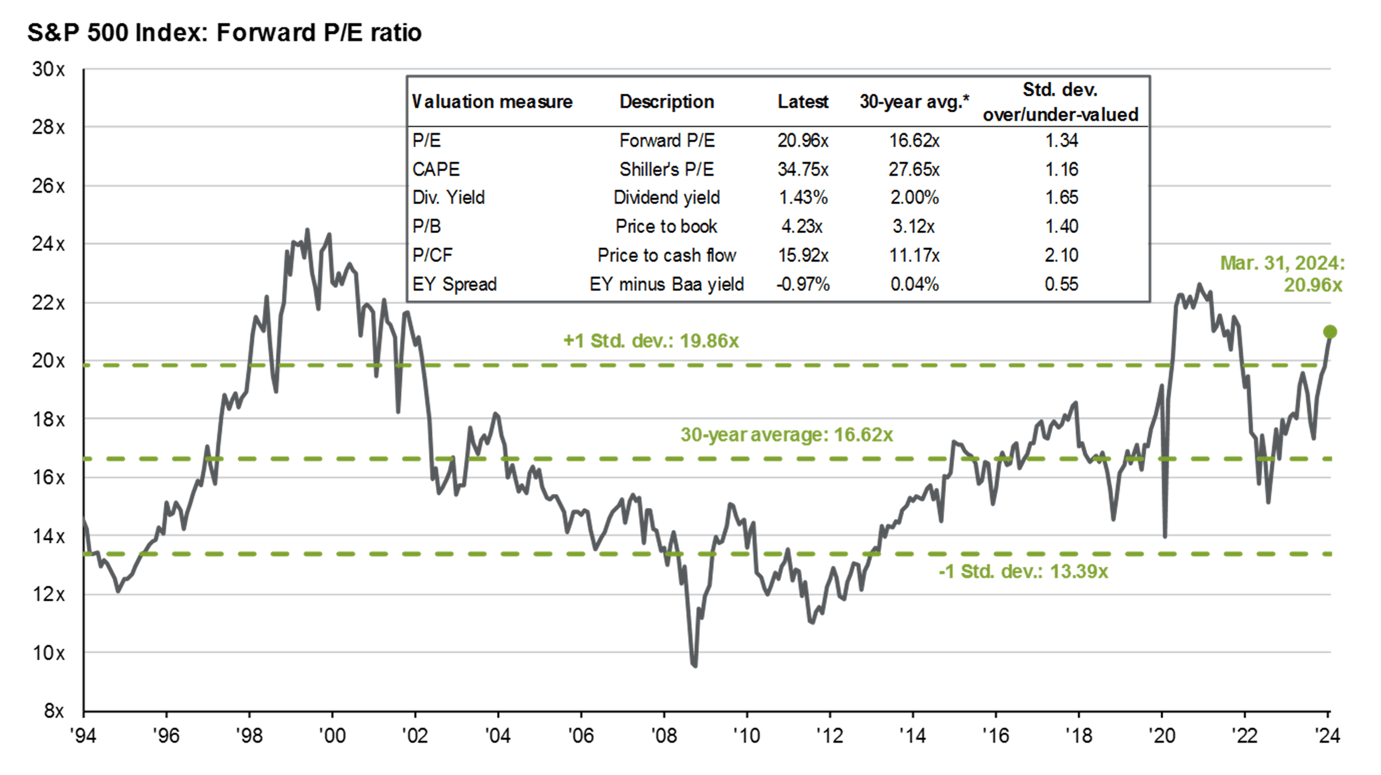

Although I will give the stock a Buy rating, I believe a further stock price decline is needed to make this a really competitive buy. After all, we’re dealing with a current market with a lofty valuation, trading at roughly 21x earnings.

JPMorgan

If we get a market pullback, I believe ACN would make for a great AI-focused long-term investment, benefitting from its dominant position in the professional services industry.

Takeaway

While AI stocks might seem overvalued and volatile, Accenture offers a unique opportunity for long-term investors seeking exposure to AI without excessive risk.

Unlike high-flying semiconductor or tech giants, Accenture’s diversified approach and focus on professional services position it to thrive regardless of which company leads in AI or chip manufacturing.

With a proven track record of consistent growth, strong fundamentals, and a leading market position, Accenture presents a compelling investment case, especially for those with a multi-decade horizon.

Pros & Cons

Pros:

- Diversified Exposure: ACN offers stability in the unpredictable world of AI-related stocks, thanks to its diversified business model and focus on professional services.

- Consistent Growth: With a history of annual returns averaging 14.6% since 2003, ACN has proven to be a reliable wealth compounder.

- Leading Market Position: ACN’s dominant position in the professional services industry, with a 2x larger market share than its largest competitor, provides it with a competitive edge.

- AI Exposure Without Overexposure: Unlike pure-play AI stocks, ACN offers exposure to AI trends without the excessive risk that comes with the current innovation cycle.

Cons:

- Valuation Concerns: ACN’s current P/E ratio of 29.1x, compared to its historical normalized P/E of 21.1x, raises concerns about (short-term) overvaluation.

- Market Dependency: ACN’s performance is tied to overall market conditions, making it prone to broader market fluctuations and potential downturns.

- Economic Risks: A potential economic downturn or recession will likely hurt its order book.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.