Summary:

- AT&T’s return to being a telecom after the Warner spin-off was an important step, but it’s not over yet.

- AT&T’s $130B debt and competition in telecom and ISP markets limit flexibility and growth potential, despite strong market share.

- Dividend growth is possible with a low payout ratio and buybacks, but debt repayment and reinvestment needs constrain significant increases.

- A 5% yield is decent but only to Hold, and 7% is needed for it to be a clear Buy.

Love portrait and love the world/iStock via Getty Images

AT&T (NYSE:T) was, for a lot of investors, the quintessential dividend stock. Amid these chaotic last few years in which it cut its dividend and spun off Warner Bros., now part of a new entity (WBD), that image of T came into question, and some wonder when or if it will return to that status.

In my view, AT&T’s return to being a simple telecom was the right move and provides a pathway to being a reliable dividend payer. There are, however, a few issues that make me want to quibble over the price, and until we get a higher yield, I think it’s better to rate it a Hold.

Brief History

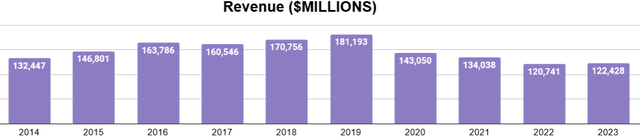

As a telecom, AT&T has been a natural, steady grower over time. This was briefly bolstered by its acquisition of Time Warner in 2018.

This quickly proved to be a problem for the company, as the COVID pandemic in 2020 struck a huge blow to the film industry, which naturally hurt Warner Bros. revenue, among other setbacks. Consequently, AT&T’s revenues are lower and never returned to pre-COVID levels.

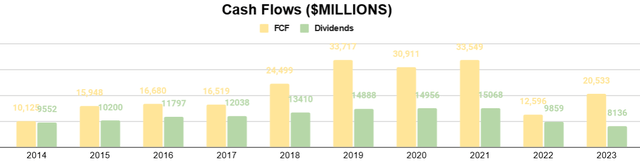

Free cash flow was initially unaffected, partly because AT&T was able to eliminate costs with its reduced activity. Eventually, however, management noted that costs increased as inflation picked up, ahead of their ability to raise prices, all while having to pay interest on the debt assumed to acquire Warner. Ultimately, this led to the spin-off of Warner and a dividend cut.

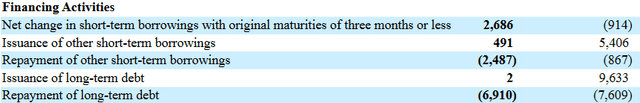

Q2 2024 Form 10Q

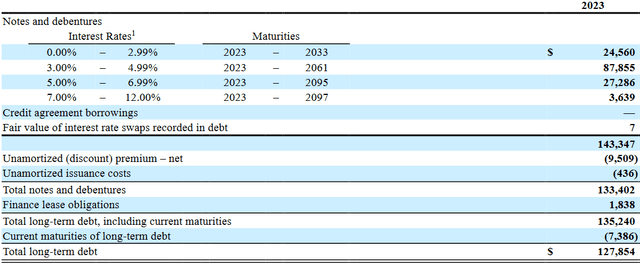

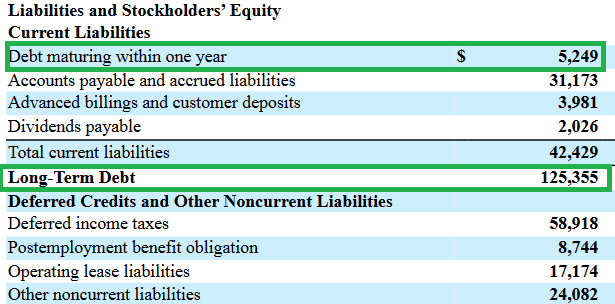

As of Q2, with Q3 results to come, AT&T was sitting on about $130B of debt.

The most recent breakdown of their debt is from their 2023 results. This shows that most of it is in staggered maturities that span more than a decade, but tens of billions are still due with the next decade.

2023’s and 2024’s YTD results show typical FCF of $15B – $16B and a dividend rate of about half that, with some of the excess cash flow being used in repayment.

Future Outlook

With that, the main question is whether we like paying a 5% yield today for whatever the yield on cost may be into the future. That will depend on our growth assumptions and what could help or hurt it.

Dividend Growth Case

One thing that helps the growth assumptions for the dividend is the fact that current levels only account for about half the payout ratio, and so there is room to distribute more.

Cash Flow Statement (2023 Form 10K)

Capital expenditures (specifically additions to property, plant, and equipment), are often about half of the operating cash flows from the continuing operations (its telecom business). With the roughly $16B in FCF this offers, the $8.1B in current dividends is covered.

Not only that, if we look at M&A activity as additional capex, their exit from Warner and other forms of “diworsification” significantly reduces their needs here.

Buybacks are another path to dividend growth. $159M has been spent in 2024, and share reduction allows individual dividends to be increased. With this lower payout ratio, a balance between distributions and buybacks could be a path toward dividend growth.

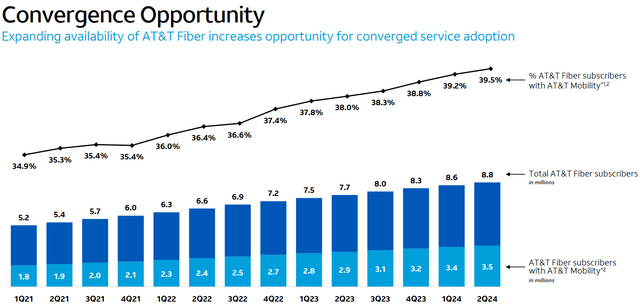

On the business side, AT&T’s main strategy for increasing revenue and competing with the likes of Verizon (VZ) and T-Mobile (TMUS) is “convergence,” wherein Fiber and Mobile customers converge. Data over the last several quarters has shown this trend, and I believe its continuation should allow AT&T to increase its revenues and protect its market share in both of those markets.

According to BroadbandSearch, AT&T is the leading Internet service provider in the U.S., with 22% of market share in 2023. Spectrum (CHTR) and Xfinity (CMCSA) stand close behind at 20% and 19% respectively. The rest of the ISP market is fragmented, and so this presents an opportunity.

Flat Dividend Case

With all those positive signs, there are still issues that make me hesitant to call T a buy at a 5%. Let’s start with the debt.

As the total is about $130B, paying this down diligently will be helpful in reducing interest expense and growing their operating cash flows. Interest expense in 2023 was $6.7B, and YTD it’s been $3.4B. It also makes the company much less risky into the future.

This is especially important because, in order to stay competitive, they will regularly need to reinvest in their technology or acquire businesses that have made the improvements they need. A heavily indebted balance sheet does not allow them to be nimble and opportunistic like this.

Its weakened standing in the wireless network market is a sign of this. A decade ago, AT&T was tied with Verizon in market share, at about 34%. Now they have fallen below 30%, while Verizon continued to grow. Similarly, the merger of Sprint and T-Mobile knocked AT&T down to third place.

Revenue to support dividend growth involves winning the two-front war of phone and Internet service, and AT&T faces strong competitors in both, some of which are not as leveraged and can weather hard times better.

Valuation

For companies that yield 5% or less and where the dividend is the key focus, I generally don’t consider them Buys unless there is some sign that the dividend could be increased at a double-digit rate or higher. If the yield is in the upper-single digits, low growth that can keep up with inflation is at least acceptable.

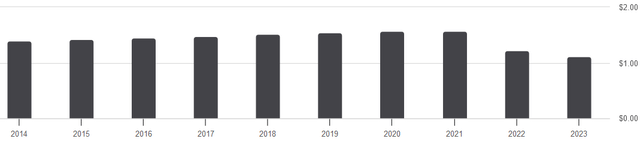

Between 2014 and 2020, T’s dividend grew at a CAGR of 2%, just enough to keep up with inflation. Most of this slow growth also preceded the ill-fated merger with Warner, giving an indication of what the telecom business can do. The main pathway to dividend growth today is an increase in the payout ratio, but the underlying business is likely to be slow, in my view.

That said, 5% isn’t a bad return. For folks reinvesting, it’s slightly better than a money market, and even slight growth over time is an improvement there.

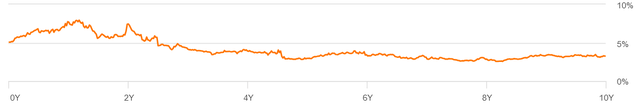

T 10Y Yield on Cost (Seeking Alpha)

If we look at what the yield on cost worked out to be, it seems that most of the past decade proved to be a disappointment for shareholders. The yield on cost I want only presented itself over the last couple of years, and the recent rally has pulled back into a range of being fairly valued. Thus, while they aren’t bad, AT&T shares simply aren’t priced at an attractive discount anymore.

If dividend investors want a better bargain and can’t do it through growth, they can do it through a better yield. I think AT&T should at least be at 7% again before it’s an obvious Buy.

Future Quarters

I am very curious what AT&T’s current appetite is for M&A. Over the last month, they’ve made moves to sell DirecTV, and I suspect their activity here will influence a lot of their ongoing decisions with cash flow and potentially additional leverage. Comments in the next earnings call and in any upcoming investor conferences will be valuable.

Conclusion

AT&T stands as a legacy telecom company, with large market shares in both phone and Internet service. By converging these customer bases, the company hopes to support long-term growth and turn these market shares into mutually supporting moats.

Mistakes of the past with leveraged M&A have strained this capital-intensive business. Some of the damage has come and gone, and some hasn’t. This casts shadows on the future of the dividend.

While a 5% yield is generally good, the growth story is incomplete, and I rate the shares a Hold until it’s priced for a better yield.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.