Summary:

- Despite high market multiples, the Eli Lilly stock has outperformed the S&P 500 Health Care Index YTD, and this might just continue.

- Strong Q1 2024 performance leading to an upgraded guidance for the year is encouraging. The possible expansion of the remit of its diabetes and obesity treatments is another positive.

- The company’s dividend growth is worth noting too, making it a continued good buy for the medium-to-long-term at the very least.

JHVEPhoto

When I put a Buy rating on Eli Lilly (NYSE:LLY) a quarter ago, I didn’t believe that it was an investment for the short-term, but that it had potential from the longer term perspective. As it happens, it turned out to be one for short-term gains too, with an over 17% increase in price since I wrote. The stock is now up by 56% year-to-date [YTD], far outstripping the just 7% rise in the S&P 500 Health Care Index in this time.

Price Chart (Source: Seeking Alpha)

On the face of it, this is mind boggling, considering its market valuations. The stock’s forward non-GAAP price-to-earnings (P/E) ratio is at a huge 65.8x compared to its five-year average [5y avg] of 37.6x. Similarly, the forward GAAP P/E is at 67.8x compared to the 5y avg of 40.2x. But a closer look at the stock reveals that there are multiple reasons for Eli Lilly’s continued attractiveness. Here are five of them:

#1. Exceptionally successful treatments

A few days ago, the company released an open letter on concerns about the use of its diabetes and weight management treatments. These concerns range from their cosmetic use to the sale of fake versions of Mounjaro and Zepbound, which target the conditions. Unfortunate as the causes for concern are, they underline the high degree of popularity of these treatments and more generally, the demand for weight management solutions.

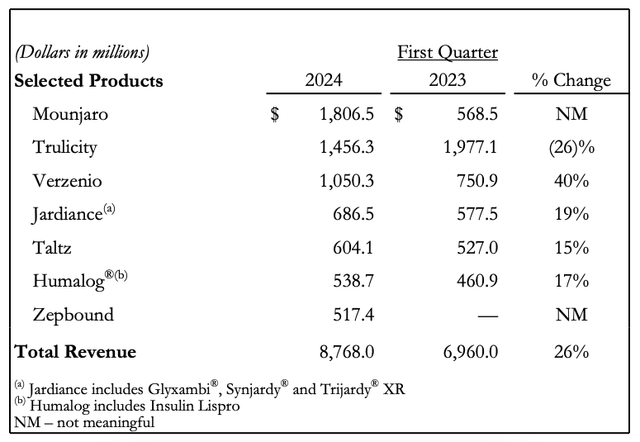

This demand is also reflected in the company’s own revenues from the segment. In the first quarter of this year (Q1 2024), its single biggest treatment, Mounjaro showed over 3x increase year-on-year (YoY) (see table below). Zepbound, which was launched only in December last year had already showed really early indications of being a blockbuster for Eli Lilly in Q4 2023 itself. That became more visible in its first full quarter of being in the market, Q1 2024, with a 6% contribution to total revenue already.

#2. Robust Q1 2024 earnings

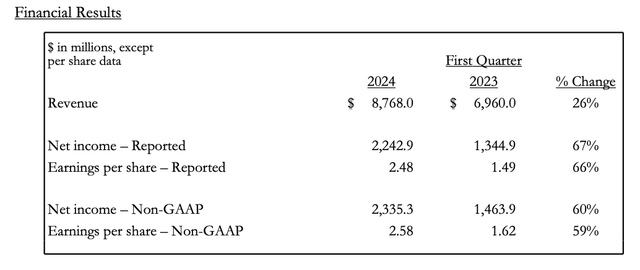

This, of course, reflects in the overall earnings for Eli Lilly in Q1 2024, with overall revenue growth of 26%. There’s a base effect at play here, though, as sales had contracted by ~11% in Q1 2023. This would otherwise indicate that the company’s sales growth could soften in the upcoming quarters, but as the next point notes, the guidance upgrade indicates that might not happen either.

Net income growth was also strong at 67% on a reported basis and 60% on a non-GAAP basis. In fact, unlike the revenue figures which came in slightly below analysts’ expectations, the earnings per share [EPS] surprised on the upside by ~4%. This is the second consecutive quarter of an upside surprise for the EPS.

#3. Upgraded guidance

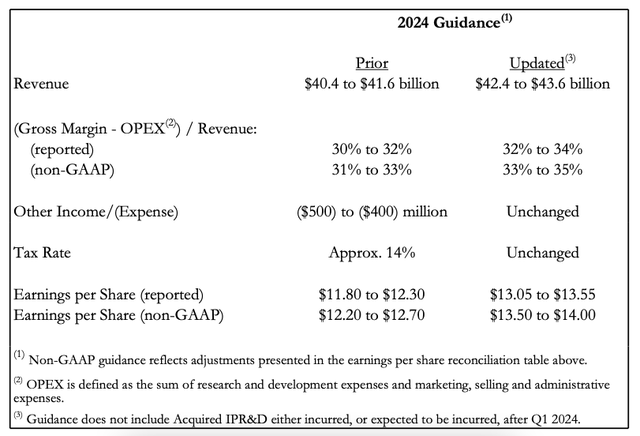

Particularly with Mounjaro and Zepbound’s strong performance along with “greater visibility into the company’s production expansion for the remainder of the year” as Eli Lilly puts it, it has upgraded its full year guidance as well.

At the midpoint of the guidance range, it now sees revenues to rise by 26% this year (see table below), the same as that in Q1 2024. This follows an already strong 20% growth in 2023, and the expectation for as much expansion as per the initial guidance as well.

The earnings per share [EPS] guidance has also been upgraded. Both GAAP and non-GAAP figures are now expected to grow by 10.4% at the midpoints of the guidance ranges. The company already expected a doubling in EPS this year YoY as per the initial guidance, it now sees a 129% increase in GAAP EPS and a 117% rise in non-GAAP EPS.

#4. Tirzepatide’s expanding usage

In the recent months, the company has also found promising expansion in the usage of tirzepatide, which is branded under both Mounjaro and Zepbound. For one, it has shown encouraging results in treating obstructive sleep apnea. The company points to the fact that 80 million people suffer from the disease in the US alone, which suggests the potential expansion of its treatments’ usage.

It has also shown promising results in treating metabolic dysfunction-associated steatohepatitis [MASH], a kind of fatty liver condition, which is the number one reason for liver transplants in the US. While it remains to be seen whether or not the usage of its key treatments will be used to treat the conditions in the near future, these developments do demonstrate the potential for even bigger growth ahead for them.

#5. Growing dividends

The company’s dividends are notable too. For 2024, Eli Lilly has increased them by 15%, in keeping with the 5y compounded annual growth rate [CAGR]. This fact can get blurred by the otherwise underwhelming forward dividend yield at just 0.6%. But this is only because the share price has on such a steep uphill climb, with nothing less than a 717% increase in the past five years. As I pointed out the last time as well, the better way to consider the company’s dividends is through the yield on cost, which is not bad at 4.4% over the last five years.

What next?

Based only on its market multiples, I’d still say that it can’t be assumed there won’t be a pullback in the short-term. But if the experience of the past quarter is anything to go by, it might not happen either. Especially not when there’s such strong momentum behind the stock.

In any case, there’s still a very strong case to buy Eli Lilly for the medium-to-long-term even from a fundamental perspective. The company’s numbers are robust and the upgrade in guidance for this year is notable too. That it’s partly based on healthy growth in treatments like Mounjaro and Zepbound, whose usage might just be expanded to treat conditions like sleep apnea and MASH, besides diabetes and obesity is particularly encouraging.

Finally, the company’s dividend growth remains strong, even as the dividend yield is low, because the price continues to rise fast. I’m maintaining a Buy on Eli Lilly.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LLY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—