Summary:

- Amazon closed the week down roughly 3% in the wake of its latest earnings report.

- This short-term fluctuation, however, doesn’t speak to what remains an outstanding long-term investment.

- Amazon has a unique business with a unique culture that I believe will propel it forward and ahead of the competition in the long term.

- In this article, I outline the core reasons why I believe this to be the case.

HJBC

Overview

Amazon (NASDAQ:AMZN) closed down almost 3% for the week in the wake of its latest earnings report. To many, it looks like the party is over for Amazon and that it is now relegated to a period of structurally slower growth. The middling (16% YoY) AWS growth results may have just been the nail in the coffin, proving out the bear thesis for Amazon.

I disagree. Today is still Day 1 for Amazon. I continue to believe that Amazon is a unique company with a unique set of core competencies. I also continue to believe that Amazon is more than the sum of its parts. In this article I will highlight 5 core reasons why I believe this is the case.

Reason One: Culture of Innovation

Amazon has a truly innovation-focused culture. The ultimate example of this is AWS. Amazon invented the modern cloud computing business model through the launch of its ‘Simple Storage Service’, essentially a pay-as-you-go online database, in Q1 2006. With this launch, AWS became the first modern cloud services provider and the blueprint for all those that have followed. Microsoft started providing cloud services in Q4 2008 and Google Cloud came into existence only in Q4 2011.

How did an online retail store invent a whole new business under the nose of its goliath technology competitors? The answer is that Amazon has developed an entirely new philosophy of scale. As it grew to be large, executives at Amazon created what became known as a ‘services oriented architecture’ that formed a schema for transmitting information between teams. The idea was to be able to integrate technology across the board without the need for engineers to even talk to each other. Essentially, Bezos and the team did for information technology what Henry Ford did for car production: they systematized it.

Fast-forward to today. Any and every truly large technology company, including much newer ones such as Airbnb and Uber, make use of a services-oriented architecture. This is the only way to achieve a certain level of scale. Amazon would not have done this were it not for the forward-thinking, risk-taking nature of its executives. Another great example of this would be Alexa and its associated pieces of hardware.

I believe that this culture persists at Amazon, and that it does so by design. Jeff Bezos may not be CEO anymore, but you can bet that he keeps an eye on things. He has been explicit about the nature of risk-taking and the payoff structure of bets.

“Let me assure you, I can guarantee you that none of these ideas are guaranteed to work,” Bezos said. “All of them are gigantic investments and they’re all risks … The only way to get above-average returns is to take risks and many won’t pay off. Our whole history as a company is about taking risks; many of which have failed and many of which will fail, but we’ll continue to take big risks. – Jeff Bezos (Source)

The value of this is difficult to quantify, but I believe it to be quite significant.

There will be new billion dollar businesses in the technology sector and I am willing to bet that Amazon will be first to market for a good number of them.

As the legendary management consultant Peter Drucker said:

Culture eats strategy for breakfast.

Reason Two: Advertising

Back when Amazon Advertising was established in 2012, many in the investment community looked at it with a skeptical eye. Why would companies buy advertisements on Amazon when they could do so on Google, Facebook, or any of the other myriad choices available to them?

The answer is simple: customer intent. Amazon.com is a website people go to for shopping. As many of us know, when you’re on there, you’re looking to buy. This gives Amazon advertisements a uniquely high level of value and what is driving the continued blistering growth of its advertising segment.

This growth will persist as Amazon’s retail operations continue to scale. The bigger Amazon Retail gets, the bigger the advertising operation will get. This makes sense because more instances of more people shopping for more things create the opportunity for more advertisements. Just like Google can sell more ads based on the more queries that it gets on Google.com, Amazon can sell more ads based on the queries that it gets on Amazon.com. This will be a major profit driver and one with immense scale going forward.

Reason Three: Revenue

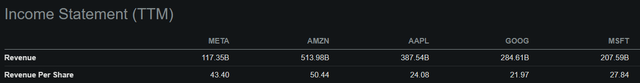

Amazon may not generate the gross or net margins that some of its peers do, but it certainly pulls in more revenue. The only other Big 5 company that comes close is Apple, and even then, Amazon is ahead by more than $100B yearly revenue.

Revenue, of course, is not net income and it’s not cash flow. It’s the bottom line that counts at the end of the day.

What I would advise investors to remember, however, is that the more revenue you have, the more profit you can ultimately have. No matter how high your margins are, you are ultimately limited by your top line. Here Amazon will not be overtaken; it is a growth engine par none. This is because it has exposure to more markets and more total addressable market size than any other company in the market – I’ll detail this in the next section. The point I want to make here is that as each of its business lines mature, they will turn into cash engines – and behemoth ones at that.

Reason 4: Scale Exposure

As mentioned above, Amazon has diversified exposure to massive markets. Looking at the total addressable markets for each of its 3 largest businesses, we can see that they are all massive. As crazy as it may sound, Amazon has barely scratched the surface of each of these markets. There will always be room to grow for the firm – and more market share to take.

|

Market |

Market Size (2022) |

|

Retail |

$27.34 Trillion |

|

Cloud |

$445 Billion |

|

Digital Ads |

$567.5 Billion |

Author’s Excel Spreadsheet

Reason 5: Cash Flow

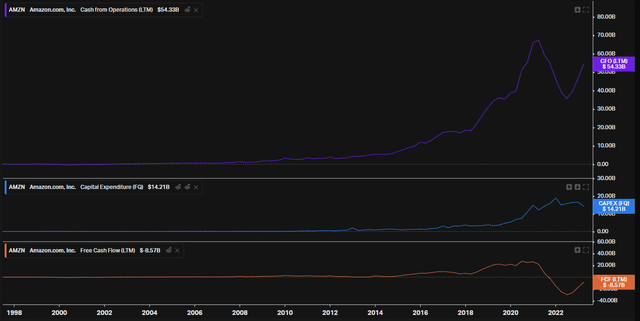

Amazon has begun turning the corner on cash flow but has stayed in growth mode throughout. Looking at the company’s progression across operating cash flow, capital expenditure, and free cash flow, we can note that Amazon scaled up capital expenditures as operating cash flows picked up. This continued reinvestment in itself turned free cash flow negative on an LTM basis over the last few quarters.

Due to macroeconomic pressures, however, management is now slowing down cash capital expenditures and cash spend more generally, including through layoffs. Reflecting market conditions, Amazon will be looking to prove out its cash generation in the year ahead – and I don’t expect it to disappoint.

Furthermore, the company’s sheer scale on revenues will allow these cash flows to continue scaling over time. Revenue can also continue growing as Amazon is a player in such massive markets. Together, these forces this will eventually create levels of cash flow that peer technology companies will be hard-pressed to match; they simply won’t have the revenue to compete.

This is the essence of Amazon: step into the biggest markets, grow rapidly until things slow down, and then use operating leverage to print cash. AWS and advertising are proof of this model, and it’s still early days for retail and the auxiliary businesses.

Recent Results

My perspective overall is that investors shouldn’t read too far into Amazon’s recent results. While AWS growth may have slowed, it is still growing in the double digits. As AI spend picks up, this growth rate may be maintained and may yet again achieve growth in the 20% range; Amazon is well-positioned to take advantage of this due to already having advanced AI products in the market. We should also keep in mind that AWS is less than 20% of Amazon’s revenue, and that its growth is contingent on much more than just cloud. Overall, my points here speak to a truly long-term horizon and should be considered in that light.

Conclusion

Amazon is simply not a company I would bet against long-term. Along with the factors mentioned above, it’s worth remembering that Bezos has always instilled a long-term mentality in his company and the people that work for him. I believe this also continues to be a part of Amazon’s culture.

I’ll wrap this up with another Bezos quote and reiterate that Amazon stock is a buy for a 10 year, 20 year, and 30 year investment horizon.

If we think long-term, we can accomplish things that we couldn’t otherwise accomplish. – Jeff Bezos

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.