Summary:

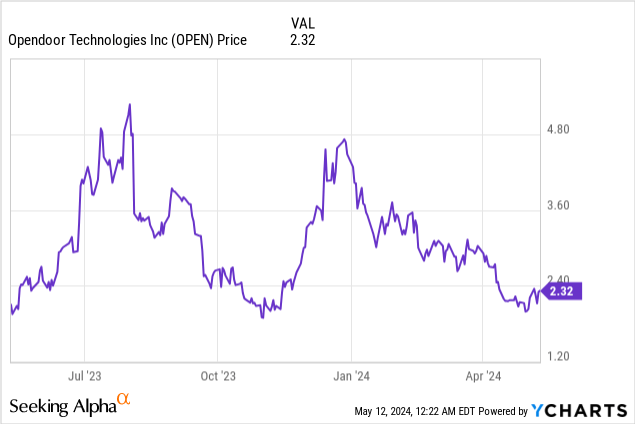

- Opendoor stock has dropped nearly 50% this year after a strong rally in 2023.

- Because of this, many investors might have lost hope for Opendoor stock.

- Yes, there are valid arguments against Opendoor stock.

- However, I believe the worst has already been priced in. At the same time, I believe the worst has already passed.

- That said, let me share 5 reasons to buy OPEN stock.

gesrey/iStock via Getty Images

Introduction

After rallying 150%+ in the last two months of 2023, Opendoor (NASDAQ:OPEN) stock has cratered back to where it was, down nearly 50% so far this year.

Bulls were partying in January — but now, there seemed to be no bulls left.

Just by looking at the chart, you’ll understand why some investors might have lost their conviction in the company.

It’s easy to get too emotionally attached to the stock price and lose perspective, so let me share five reasons why Opendoor’s stock is still a great buy today.

Reason #1: Amazing Value Proposition

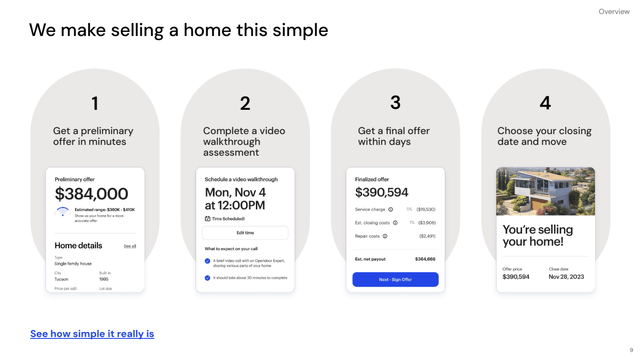

As we know it, the traditional process of buying and selling homes is incredibly complex, uncertain, and time-consuming. On average, it involves five home visits, six counter-parties, and over 60 days on the market. What’s more, there’s a 20% chance that the transaction falls through.

It’s a big headache.

Opendoor aims to eliminate this friction by transforming the home-selling experience into a simple, fast, certain, transparent, and online experience.

- No more back-and-forth negotiations

- No more waiting

- No more repairs

- No more open houses

- No more agents needed

Homeowners can just sell their homes directly to Opendoor and avoid all the hassles typical of a traditional home transaction.

Opendoor November 2023 Investor Presentation

As of Q1, 15% of Opendoor homes had been listed on the market for more than 120 days, as compared to 19% for the broader market, demonstrating Opendoor’s superior value proposition in terms of speed and certainty.

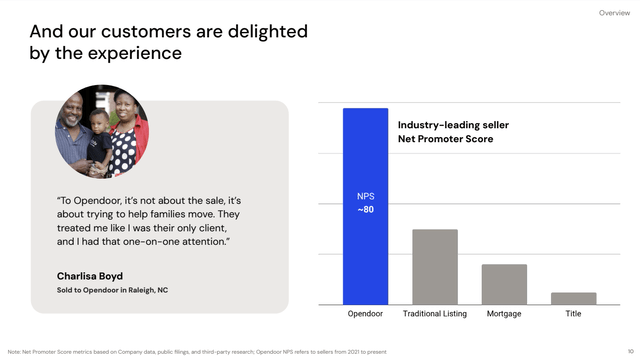

It’s a convenient value proposition that ought to redefine how homeowners transact over the next few decades. And with an industry-leading NPS score of about 80, it seems inevitable that Opendoor and ibuying will be much bigger components of the massive real estate industry.

The only place you can sell your home directly today and the only place you can buy a home directly with an e-commerce like transaction is Opendoor. We have the only direct platform in the industry. So no matter how the real estate ecosystem evolves, we’re really set up well to take advantage of that.

(CEO Carrie Wheeler — Opendoor FY2024 Q1 Earnings Call)

Opendoor November 2023 Investor Presentation

Reason #2: Virtual Monopoly

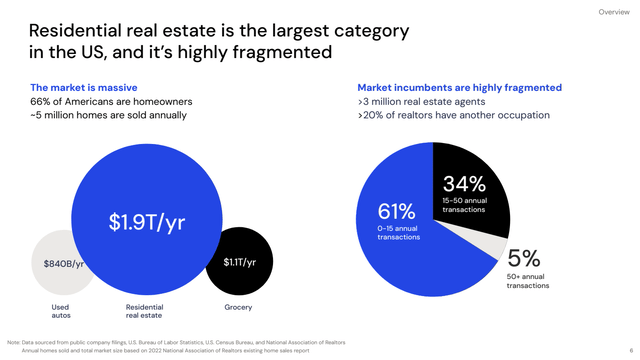

It will take some time for this shift to happen — the real estate industry is notoriously one of the most non-tech-savvy and stubborn industries. However, given the size of the industry, it is well worth the pursuit for Opendoor.

As you can see, the residential real estate industry is by far the largest category in the US, valued at a whopping $1.9T annually.

Opendoor November 2023 Investor Presentation

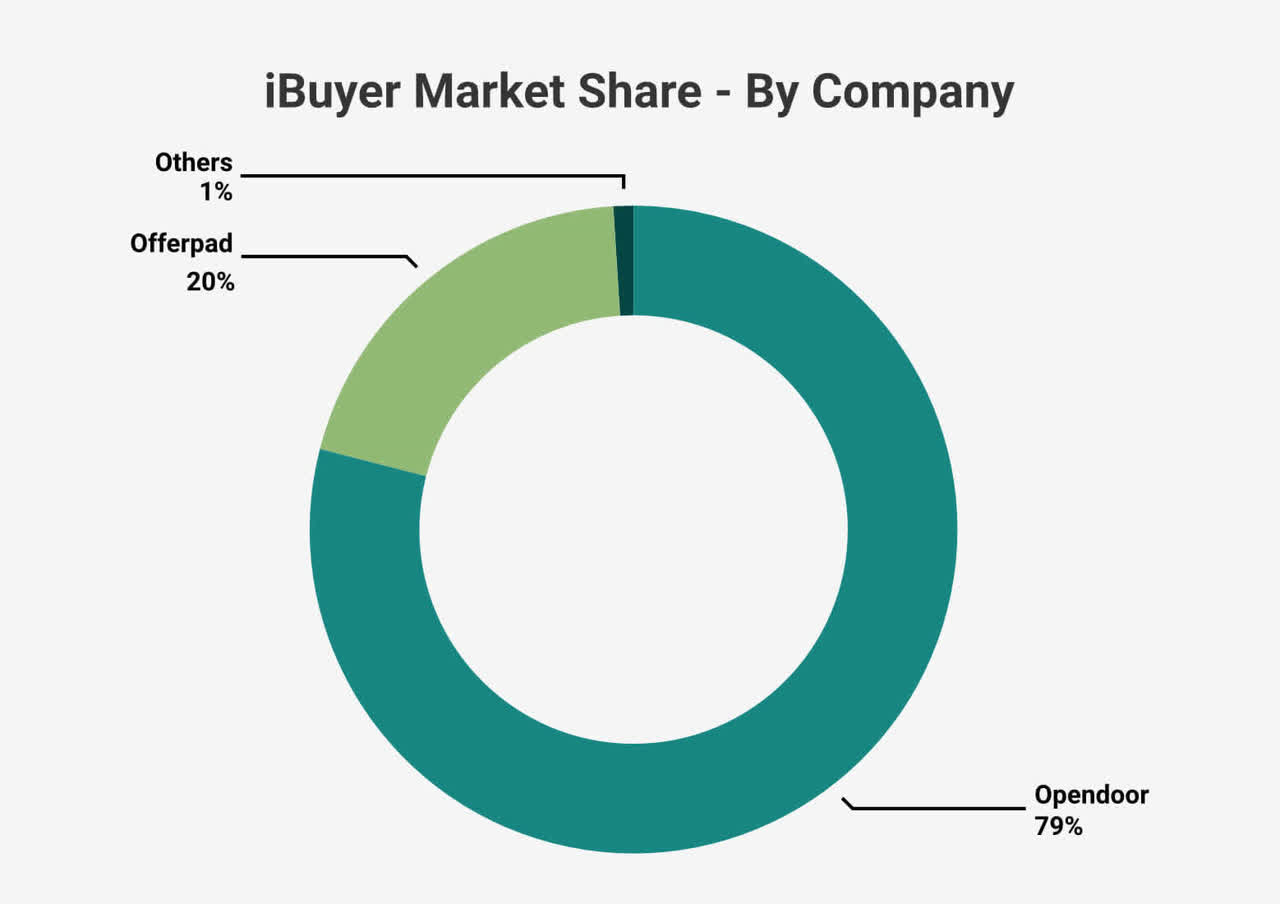

iBuyer penetration is only about 1% of this market — Opendoor still has a long way to go. The good news is that Opendoor is virtually a monopoly with a 79% market share in the ibuying space. Following Zillow’s (Z) and Redfin’s (RDFN) exit from the ibuying market, Offerpad (OPAD) is the only direct competitor with a market share of about 20%.

RubyHome

With a dominant position in the market, Opendoor has a clear runway to become a much bigger company in the next decade or so. In fact, it’s already happening as I’m writing this article.

We more than doubled our market share in the first quarter versus 1Q23 and increased market share sequentially from 4Q23.

In other news, the proposed NAR settlement is expected to drive down buyer-broker commissions, a substantial cost that Opendoor pays when the company resells its homes. As a result, this settlement should be net neutral to positive for Opendoor.

- Opendoor can pass on the savings to consumers in the form of lower spreads, increasing the attractiveness of Opendoor’s value proposition.

- Lower transaction costs for consumers mean that they are more likely to move, enabling Opendoor to capitalize on this increased volume.

- With greater fee transparency, more consumers may potentially opt to transact directly with Opendoor, instead of listing in the MLS.

All these should accelerate iBuyer penetration, solidifying Opendoor’s monopolistic position.

Reason #3: Rescaling Responsibly

In the meantime, Opendoor is rescaling its business following its taper as a result of the real estate shock a little over a year ago.

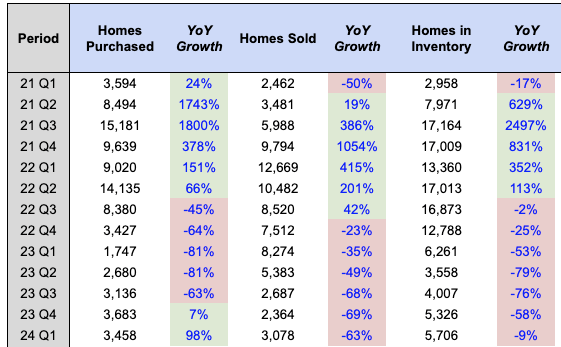

In Q1, Opendoor bought 3,458 homes. While this is down 6% QoQ, it is up 98% YoY, even despite listings in its buybox being up only 6% YoY. This is due to lower spreads embedded in Opendoor’s offers, which subsequently increased seller conversions and acquisition volumes.

As you can see, Opendoor is ramping up acquisitions gradually. In contrast, Opendoor was recklessly buying homes in 2021 and 2022, causing inventory to balloon, and unfortunately, interest rate hikes led to a housing correction and a massive inventory writedown for Opendoor.

Author’s Analysis

Opendoor doesn’t want to repeat the same mistake, and so they’re taking a more sustainable and cautious approach to growing the business.

That is also reflected in Opendoor’s Q2 guide. The company expects acquisitions of over 4,500 in Q2 — a decent bump from Q1, but not an astronomical rise by any means.

That being said, this should grow Opendoor’s resale business as well.

- In Q1, Opendoor sold 3,078 homes, down 63% YoY.

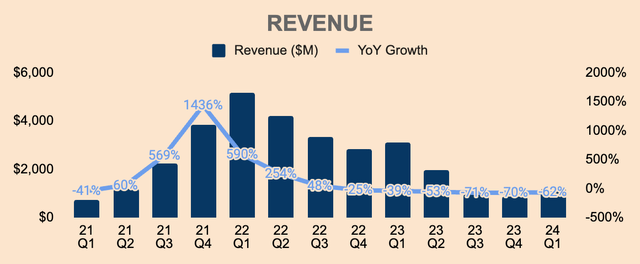

- This led to Revenue of $1.2B. This beat analyst estimates by $110M and beat management’s guidance range of $1.05B to $1.1B.

- While Q1 Revenue is down 62% YoY, it is up 36% QoQ. Moving forward, expect continued sequential growth as management guided for Revenue of $1.4B to $1.5B in Q2.

Author’s Analysis

The most important thing is that Opendoor is rescaling responsibly. This should translate to strong, stable unit economics, necessary for the company to achieve sustained profitability.

Reason #4: Improving Unit Economics

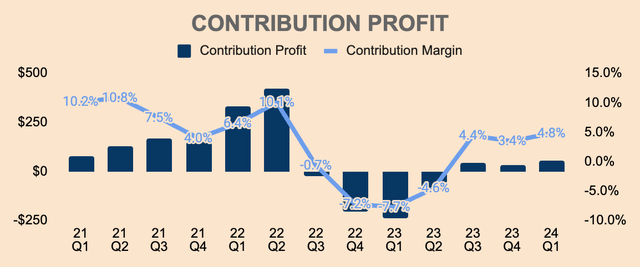

Q1 Contribution Profit was $57M with Contribution Profit Per Home Sold at about $19K, an improvement from $(29)K last year.

Contribution Margin was 4.8%, a 1,250bps YoY improvement. As you can see, the company’s Contribution Margin has been improving over the last few quarters, due to much lower home sales from the old book of inventory.

Author’s Analysis

Excluding the old book, Contribution Margin from the new book was over 5%, and has produced its seventh consecutive quarter of Contribution Margin above or within management’s target of 5% to 7% — talk about rescaling responsibly!

And since the old book is “effectively behind us”, Opendoor expects Contribution Margin to improve further, expected to reach 5.4% to 5.7% in Q2. For the full year 2024, the overall Contribution Margin is expected to be within its 5% to 7% target.

Unit economics are improving, but Opendoor needs to scale further — because the business is still unprofitable due to high fixed costs:

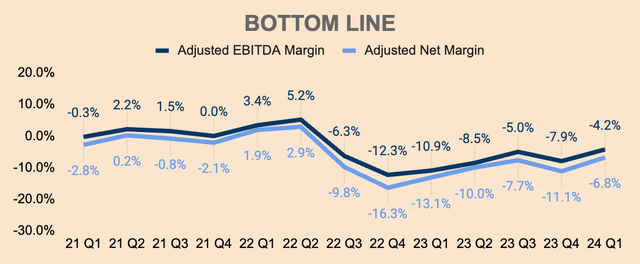

- Adjusted Net Income was $(80)M, at (6.8)% Margin.

- Adjusted EBITDA was $(50)M, at a (4.2)% Margin. This is actually ahead of the high-end of management’s guidance of $(70)M, driven by higher resale volumes, improving unit economics, and ongoing cost discipline.

Author’s Analysis

Moving forward, management expects Adjusted EBITDA to improve to $(35)M to $(25)M in Q2. At this rate, we could expect Adjusted EBITDA breakeven by the end of the year, which could be a major catalyst for the stock.

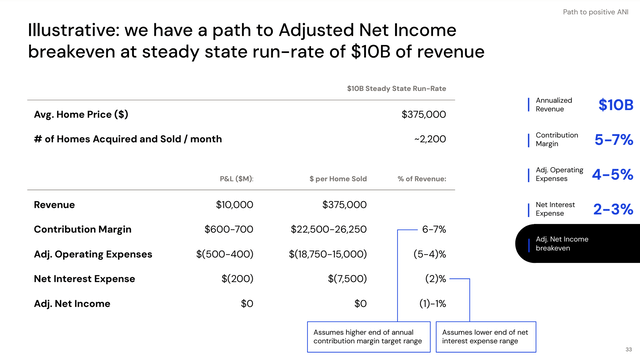

Whatever it is, Opendoor’s goal is to achieve Adjusted Net Income breakeven, which requires $10B of Revenue on an annual run rate basis, or roughly 2,200 homes acquired and sold per month.

As a reminder, Opendoor sold 3,078 homes in Q1, or 1,000 homes per month. In Q2, Opendoor is expected to acquire 4,500 homes, or 1,500 homes per month.

In other words, Opendoor is rescaling its business given its current healthy unit economics. It’s only a matter of time before Opendoor reaches the desired scale to generate positive Adjusted Net Income.

Opendoor November 2023 Investor Presentation

#5 Undervaluation

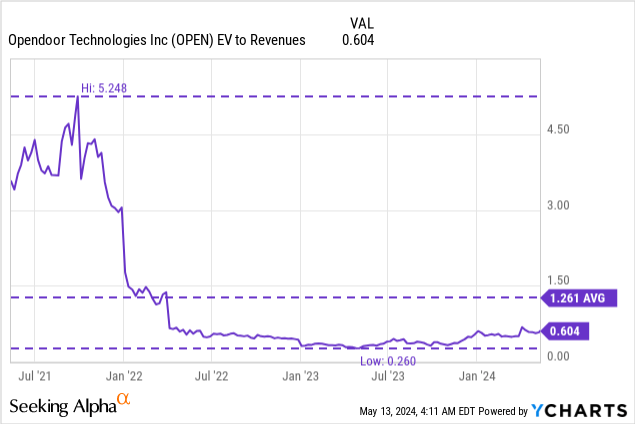

Opendoor currently trades at an EV to Revenue multiple of 0.6x which is a significant discount from its peak and average multiples of 5.2x and 1.3x, respectively.

Yes, Opendoor is unprofitable. Yes, Opendoor has negative growth. Yes, Opendoor is a low-margin business. Yes, the interest rates are high. Yes, the real estate market looks uncertain.

We all know that — that’s why the lower multiple is justified.

However, I believe the worst has already been priced in. At the same time, I believe the worst has already past.

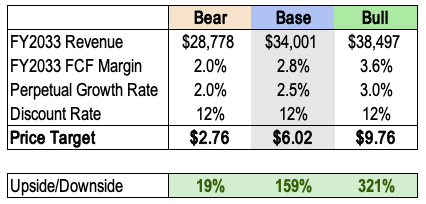

As for me, I maintain a price target of $6 for Opendoor stock, based on the following assumptions below.

Analysts have an average price target of $2.61, which represents an upside potential of 12%.

Author’s Analysis

The stock will continue to be volatile, but I believe there’s a wide margin of safety today, especially after its 50% drawdown this year.

In short, I believe Opendoor stock is undervalued relative to its market potential. In addition, the first four reasons laid out in this article show that there’s light at the end of the tunnel and that we can expect brighter days ahead for Opendoor.

Thesis

Opendoor stock has had a rough start to the year, down about 50% while the broader markets advanced 10% — It’s natural to feel discouraged and pessimistic.

Well, that’s why I wrote this article — to share with you five reasons to be bullish on Opendoor stock:

- The company offers a superior value proposition compared to traditional methods.

- Opendoor is a virtual monopoly in the buying space.

- Management is rescaling the business responsibly and sustainably.

- Opendoor is improving unit economics and focusing on profitable growth.

- The stock offers a wide margin of safety with decent upside potential.

Maybe I could add one more reason: interest rate cuts. But that’s nearly impossible to predict — I would rather focus on the fundamentals.

That being said, risks remain, such as prolonged high interest rates, housing instability, and a busted business model that will never turn profitable.

However, it doesn’t hurt to stay optimistic about Opendoor’s future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OPEN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.