Summary:

- Devon Energy’s Q2 2024 oil production hit a record 335 MBOD, surpassing expectations and showcasing the company’s robust operational performance.

- Devon boasts a top-10 net profit margin among large-cap US energy firms, with a 21.5% margin and strong profitability indicators.

- The company’s solid balance sheet, with a cash flow-to-debt ratio allowing debt payoff in one year, underscores its financial strength.

- Despite a potential dividend reduction, Devon’s forward yield of 5% and attractive valuation with a P/E of 7.2 suggest significant upside potential.

ugurhan

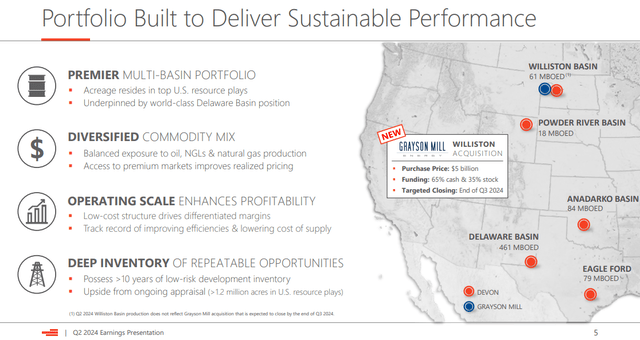

Devon Energy Corporation (NYSE:DVN) is a classic oil company engaged in the exploration, development, and production of oil and gas onshore in the United States in five main areas: the Delaware Basin, Eagle Ford, Powder River Basin, Anadarko Basin, and Williston Basin.

According to the results of Q2 2024, oil production reached an all-time high of 335 MBOD (Thousand Barrels of Oil per Day), which was better than the company’s expectations.

Devon Energy Portfolio (Devon Energy)

Devon Energy isn’t the biggest company; its stock isn’t a hot one. Its business model isn’t unlike most of its competitors. But Devon is currently at a point in the cycle that makes its stock a unique investment. Here are 5 reasons why.

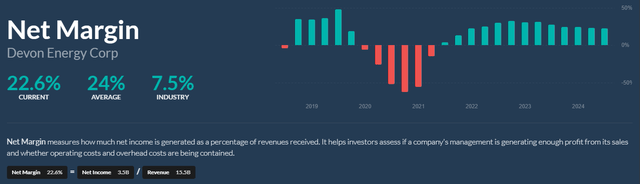

Reason 1: Net Margin

According to the results of the second quarter, the company’s revenue almost reached $4 billion, and net profit increased by 22.3% compared to the same period in 2023 to $844 million, which brings its net profit margin to 21.5%. If we take the last 12 months as the basis for calculation, this profitability indicator is almost equal to 24%.

This is a top-10 result among all mega and large-cap energy companies in the US. Overall, an excellent result, along with a high gross margin of 54%, EBITDA margin of 51%, and earnings quality of 192%, demonstrating the viability of the business model and profitability of production.

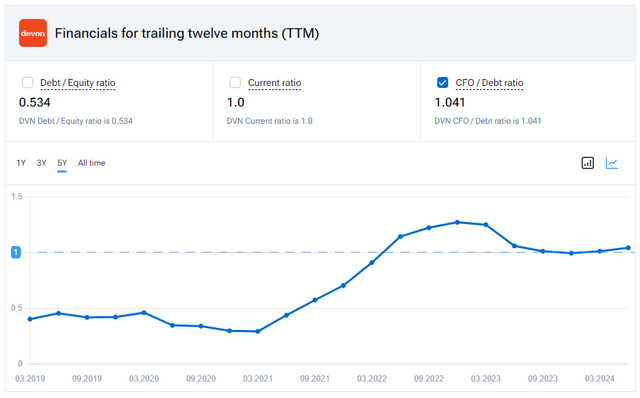

Reason 2: Cash Flow-to-Debt Ratio

To evaluate the balance of companies, especially companies producing real goods, I prefer to use not the classic D/E ratio or even the Current ratio, but an indicator that can be called a stress test tool in the hands of a financial analyst. We are talking about the cash flow-to-debt ratio, unfairly avoided by many investors, in my humble opinion. It stands for the possibility of paying off the entire debt, directing cash flow from operating activities towards this.

And Devon Energy can do it in 1 year. Of course, no rational company would do that, but I have no doubts about the strength of Devon’s balance sheet based on this test. Add to that a Current ratio above 1 and sufficient equity despite regular buybacks and cancellations of own shares, and we get a fairly solvent oil company.

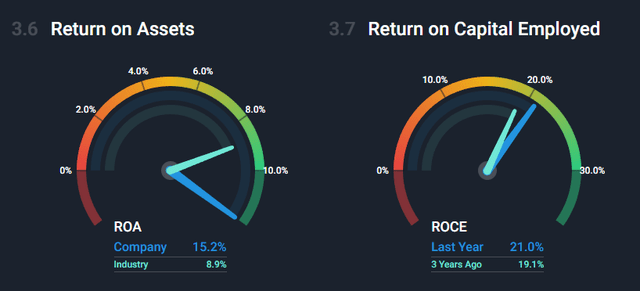

Reason 3: Return On Invested Capital

ROIC considers profit before tax and only that part of assets that is used in production. For example, it fundamentally does not consider in the denominator all the cash that accumulates in the accounts of companies. Therefore, I consider ROIC to be the best measure of the efficiency of capital use.

Devon’s ROIC is 18% TTM. Only EOG Resources, Inc. (EOG) and Texas Pacific Land Corporation (TPL) have higher, and even then, TPL has an entirely different business model and business environment.

Adding to this value a fairly high ROA, ROE, and ROCE, I get a solid level of capital management, especially for the oil and gas industry.

Reason 4: Dividend Yield

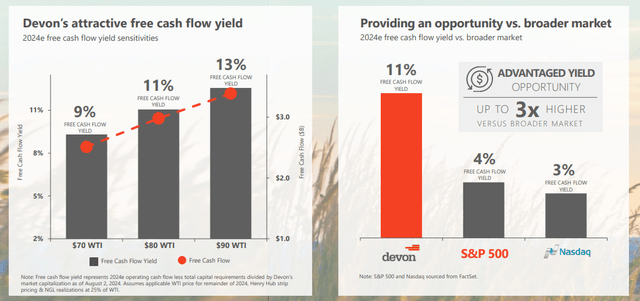

The forward dividend yield is exactly 5%. According to my calculations, the actual yield currently is 6%, and this is even lower than the average yield over the last 3-5 years (~7%).

And here Devon Energy is in the top 3 of its sector. And all thanks to the declared priority of returning value to shareholders. Target payout is 70% of free cash flow, in the generation of which the company succeeds relative to the average level of the American market.

However, analysts expect a reduction in dividend payments, which will lead to an almost twofold drop in profitability.

Reason 5: Valuation

Here again, Devon ranks among the top US Energy Sector stocks, but with one of the lowest multiples. The current P/E is 7.2, forward is 7.5.

simplywall.st

But what’s even more important to me is that the current valuation of the company’s business is quite close to the average minimum valuation (5.8 P/E) and almost matches its median level (6.9 P/E).

Wall Street price targets give us positive signals: the average forecast has an upside of 41%.

The company itself in the presentation modestly hints that the Energy Sector, which occupies 4% of the S&P500, generates more than a tenth of the profit of the entire market, which is also a confirmation of some underestimation and existing upside.

Bottom Line

US oil reserves are at 2024 lows, according to the latest data. The Fed has started a rate-cut cycle, which usually stimulates economic activity and energy prices are the first to feel it, as they start to rise. This is not a forecast, but only a scenario in which Devon Energy management can implement its plan to increase free cash flow and maximize return of value for shareholders.

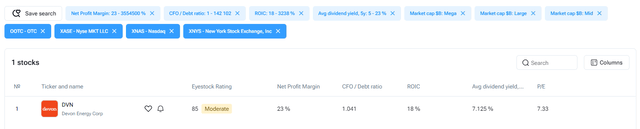

Finally, I put together all the above-mentioned metrics in the screener filter settings, and it turned out that among all the companies with a capitalization above $3 billion on US exchanges, there are no analogs of DVN: companies with high profitability, a stable balance sheet, and generous dividends. That is why I called them unique at the beginning of the article.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.