Summary:

- Wells Fargo, which outperformed its peers, will report quarterly results on Friday before markets open.

- Wells Fargo stock traded in a narrow range between $57.00-$61.00, struggling to break above $60 despite strong stock grades.

- Last quarter (in Q1/2024), results met Wall Street estimates with strong earnings, lower credit losses, and net loan charge-offs.

- Second-quarter earnings forecast shows a consensus EPS of $1.28, with analysts raising estimates, giving WFC stock a revisions grade of B+.

- Breakout to $65 is discussed.

jetcityimage

In the three months since it reported first-quarter results, Wells Fargo & Company (NYSE:WFC) traded in a narrow range. WFC stock traded between $57.00 – $61.00, struggling to break out above $60. Despite a strong quant rating of 4.95 out of 5.0, markets are looking for positive catalysts that would justify a rally.

What should shareholders expect from the second-quarter earnings report? There are five things to consider ahead of its Q2 report scheduled for Friday. The firm will release its report alongside its peers, Citigroup (C), BNY Mellon (BK), and JPMorgan Chase (JPM) that day before markets open.

1/ Review of Q1/2024 Results

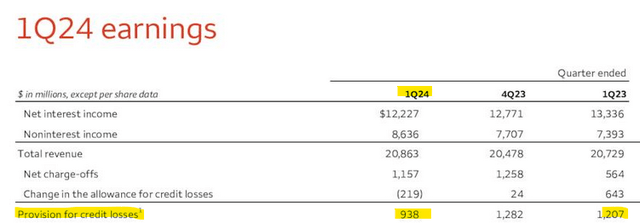

In the first quarter, Wells Fargo met Wall Street’s consensus estimates. It posted healthy credit quality, provision for credit losses (“PCL”) significantly below estimates, and strong earnings. The bank earned $1.20 a share, compared to $1.23 Y/Y. Had it excluded an FDIC special assessment, first-quarter earnings would have been $1.26, well ahead of the $1.09 average analyst estimate.

Its PCL of $938 million fell from $1.28 billion in Q4, but is above the $1.21 billion reported in Q1/2023. This contrasts with struggling Canadian banks. Bank of Nova Scotia (BNS) reported higher credit provisions, citing uncertain macroeconomic conditions. It also blamed the impact of sustained higher interest rates hurting various client segments. Bank of Montreal (BMO) posted a sharply higher PCL of C$705 million, up from C$318 million year-on-year.

Wells Fargo achieved lower net loan charge-offs related to auto losses in the quarter. This is a result of tightening actions it implemented starting in late 2021.

Wells Fargo Q1 2024

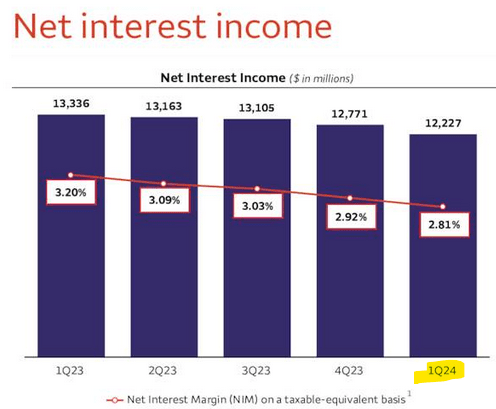

In the quarter, net interest income fell by $1.1 billion, or 8% Y/Y. Higher interest rates harmed funding costs. Customers moved to higher-yielding deposit products while lowering their loan balances.

Wells Fargo Q1

After the government posted the lowest level of payroll growth in over a year, the Federal Reserve will more readily lower interest rates by 25 bps sometime in 2024. This should boost Wells Fargo’s net interest margins in future quarters.

2/ Dividend Increase and Stock Buyback

After passing the Federal Reserve’s 2024 stress test, Wells Fargo said that it expects its stress capital buffer to be 3.8%. Since it will have capital above the minimum regulatory capital requirements, the firm expects to increase its dividend by 14% to $0.40 per share. Based on a closing price of $59.62, the dividend will have a forward yield of 2.68%. By comparison, BMO stock pays a dividend that yields 5.31%. Scotiabank pays a dividend that yields 6.85% annually. Its yield increased after the stock fell from a $51.98 high in April 2024 to trade recently at $45.21.

Wells Fargo will also increase shareholder returns by buying back shares. This starts in the third quarter of 2024 through Q2/2025. Investors will need to wait until Friday’s report to find out the size of the buyback program.

3/ Second-Quarter Earnings Forecast

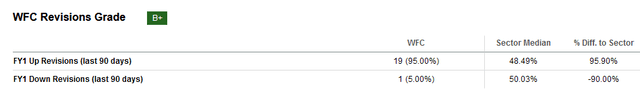

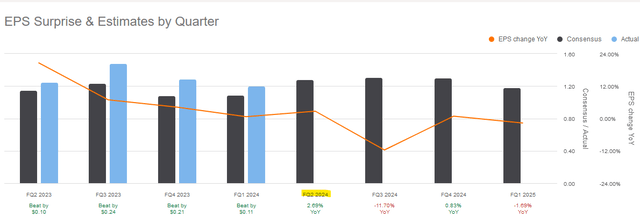

In Q2, 19 analysts raised their earnings per share estimate for Wells Fargo. This gives WFC stock a revisions grade of B+.

Seeking Alpha

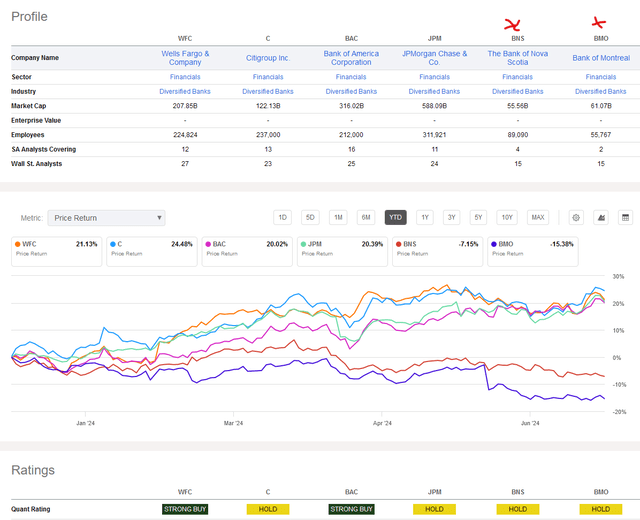

The consensus EPS is $1.28, up by 2.69% year-on-year. The small expected increase suggests that Friday’s earnings release will not move the stock. Last quarter, WFC was already the third top-performing bank stock of 2024. Still, it outperformed Citigroup, JPMorgan, and Bank of America (BAC).

Seeking Alpha

Investors who held SPDR S&P Bank ETF (KBE), however, are almost break-even in 2024. WFC stock is not among the top holdings. First Trust Nasdaq Bank ETF (FTXO) is an alternative holding. Wells Fargo is an 8.21% weighting. Invesco KBW Bank (KBW) is a better choice. Its assets under management are $1.53 billion. JPMorgan, Goldman Sachs (GS), Morgan Stanley (MS), Bank of America, and Wells Fargo are each at least 8% of assets or higher.

4/ Wells Fargo’s Stock Grades

Wells Fargo and Bank of America both have a strong buy quant rating. The four U.S. banks have nearly identical year-to-date returns of 20% or more. I included the two Canadian banks in the comparison since I compared their PCL to that of Wells Fargo earlier in the article.

Seeking Alpha

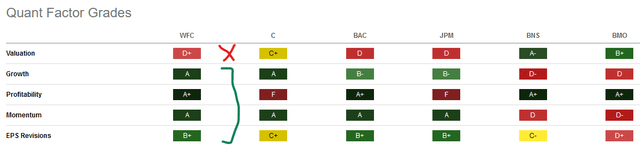

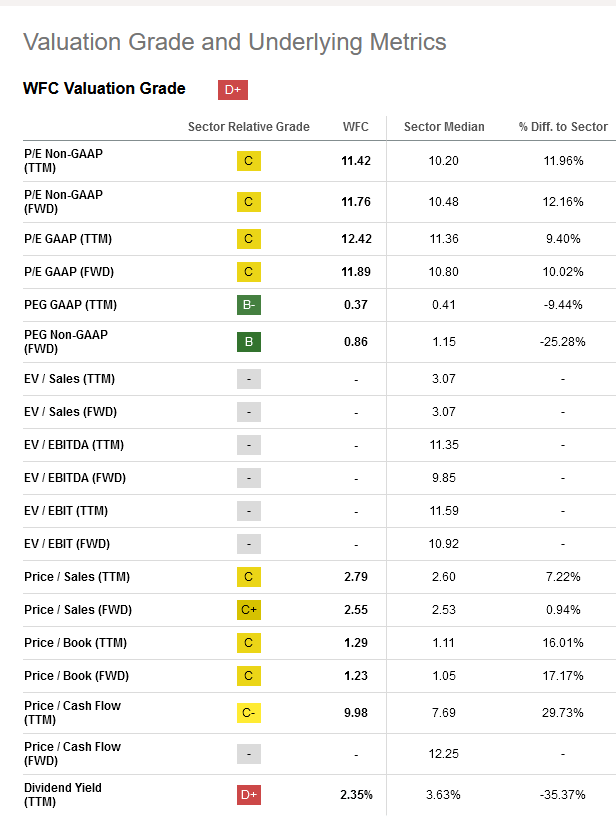

Wells Fargo scores poorly only on valuation. Just like BAC stock, it scores well on growth, profitability, momentum, and EPS revisions.

Seeking Alpha

The valuation scoring system appears to penalize Wells for its dividend yield of 2.35%. However, after the dividend hike increases the yield, the valuation grade should improve to a C+. This would match Citi’s value grade.

Seeking Alpha

5/ Risks

The bank mentioned longstanding issues among the regulatory pressures ahead. Additionally, its implementation of heightened controls and oversight may result in regulator actions. Furthermore, it has outstanding litigation, regulatory, and customer remediation matters that could contribute to operating losses.

The firm may offset those risks by offering more low-risk financing products to its customers. This would improve its trading flow in future quarters.

Your Takeaway

Investors have no reason to change their bullish outlook on Wells Fargo. The bank hiked its dividend and will buy back stock. This increases the attractiveness of the stock, especially as the Fed prepares to cut interest rates this year. After building support in the $40s since 2021, the uptrend that began last Nov. 2023 is unlikely to end. Helped by strong quarterly results, that sets up a rally to over $65, a price not seen since Jan. 22, 2018.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Please [+]Follow me for coverage on deeply discounted stocks. Click on the “follow” button beside my name. Get do-it-yourself tips and tricks for free here:

- Subscribe to the Free DIY Preview subscription for a regular preview of exclusive content. This service is separate from the article alerts you get when following me.

- The Basic tier is the second step.

- The Full Service is for readers who want to join the live chat forum.