Summary:

- The Abiomed acquisition enhances JNJ’s positioning in one of the most lucrative markets around and could be earnings accretive next year.

- The dividend narrative is hugely compelling and looks resilient enough, despite the weakening of some financial metrics.

- We like the stock’s defensive characteristics and think it could come in handy this year.

- The dollar’s weakness should reflect well.

- Forward valuations are cheap, and we are swayed by the risk-reward on the charts.

Mario Tama

Introduction

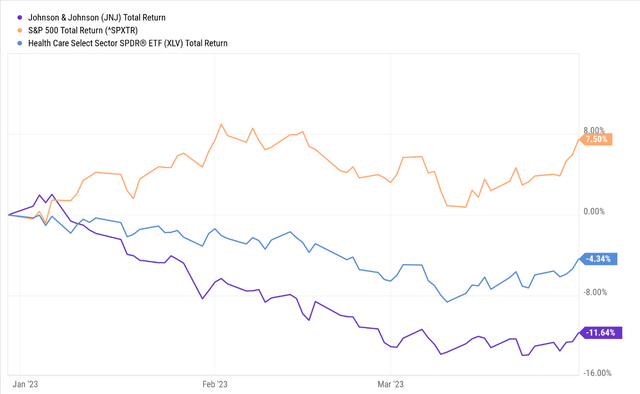

The stock of healthcare stalwart Johnson & Johnson (NYSE:JNJ) has been feeling under the weather of late. Over the last six months, it has delivered negative returns in double-digit terms, even as a portfolio covering the other large healthcare peers has seen only mid-single-digit declines; conversely, the broader markets have generated positive returns of over 7% during the same period.

Whilst a position in JNJ hasn’t been too rewarding off late, we think things could change. Here are six reasons why we are bullish on JNJ at these levels.

Med-tech Could Be An X factor

Recent investor attention has understandably been centered around the potential spinoff of Kenvue, but within the existing business, we think the Abiomed acquisition could prove to be a very useful fillip for the med-tech business, which also looks poised to have a much better H2, as healthcare staffing concerns ease and procedure volumes ramp up.

Cardiovascular diseases are considered to be the leading cause of death, and Abiomed only enhances JNJ’s positioning in catering to this market by filling gaps and giving it exposure to certain high-growth segments that could each provide over $1bn in annual sales. In effect, management implied that Abiomed could potentially contribute close to 100bps of sales growth this year, with the acquisition expected to be earnings accretive by at least $0.05 in FY24 (with the accretion factor potentially increasing even more in the periods after).

The Dividend Is Still Resilient Enough

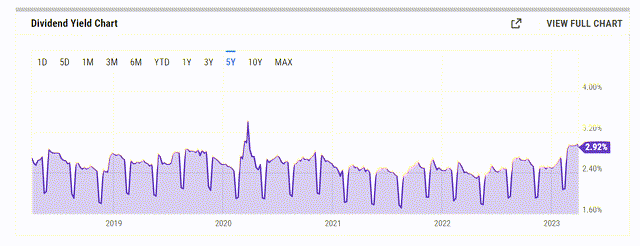

A lot of shareholders pursue JNJ purely for its dividend reliability, as the company has now paid and grown its dividend for 60 straight years. Besides, if you enter at the current price point you can pocket a yield of nearly 3% which is almost 50bps higher than what you normally get. Also note that the current yield is incidentally at its highest point since March 2020.

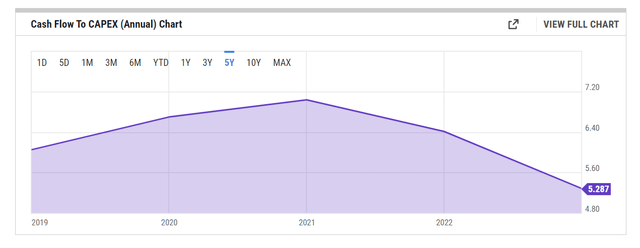

Given a -14% annual decline in earnings recently, weak cash flow conversion from sales (JNJ’s CFO to sales ratio dropped to its lowest point in 10 years), and a weak coverage of the CAPEX (the operating cash flow coverage of CAPEX dropped to its lowest point in five years), a few dividend-oriented investors may be wondering if JNJ can comfortably service its dividend commitments.

I’d like to assuage these investors’ fears, as firstly, earnings and cash flow were hampered by high inflation (which will ease off as we progress through the year and one-off vaccine manufacturing costs. It’s also worth noting that even under those difficult circumstances, JNJ was still able to generate around $17.1bn of free cash flow last year, which should comfortably cover the dividends.

JNJ has grown its dividends at the mid-single digit range, but just to be aggressive, let’s assume a 10% hike in dividends from the recent DPS of $1.13. Also, JNJ has previously reduced its share count (on account of buybacks) by 0.7% on average per year; assume a continuation of the same. That would eventually translate to an aggregate FY23 dividend bill of just $13bn, which could be easily covered (even if you add the pending $2.5bn buyback ammunition, JNJ will still have ample FCF leftover).

The FX Angle

Close to half of JNJ’s sales come from outside the US, making the company sensitive to FX dynamics. Looking ahead, I think this could reflect well on JNJ.

We’ve recently seen the Fed turn on the taps of liquidity, whilst the probabilities linked to the Fed Funds Target Range at the May meeting have seen some drastic adjustments of late. Over a month ago, there was no probability whatsoever of the Fed funds target range being maintained at 4.75-5%. Now that probability has grown to 41%. All in all, additional liquidity, and potentially lower-yielding US assets will dampen the inflows to the USD sending it lower.

The chart below shows that after peaking in September, and then breaking down from an ascending channel in November, the dollar index has been following a descending channel. Recently the dollar has been struggling to break past the upper boundary of its channel and looks likely to kick-start another journey to the lower boundary of the channel.

For JNJ, prospective dollar weakness would reflect well, as every 1% correction in the dollar, typically boosts the company’s top line by $500m.

Defensive Qualities

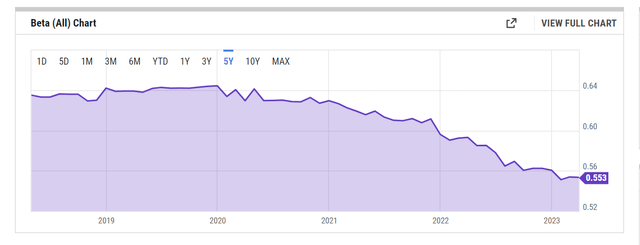

Factors such as slowing economic growth, a crumbling banking ecosystem, excessive tightening, geopolitical risks, a potential credit event, etc. could all dampen risk sentiment and stimulate the volatility quotient in the broader markets. You’re also likely to see plenty of harmful volatility in the months ahead. During times like that, you ideally want some exposure to stocks that are less sensitive to the movements of the benchmark. In that regard JNJ fares quite highly; traditionally it has always been less sensitive to the movements of the benchmark, but in recent years the sensitivity quotient has become even less pronounced with the beta dropping to 0.55x (the 5-year average is 0.61x).

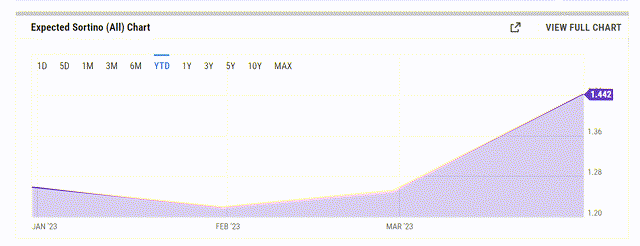

The JNJ stock has also demonstrated a good track record of adequately handling downside deviation or harmful volatility, and this reflects well on the expected Sortino ratio (a reading above 1.0 highlights the ability of a stock to facilitate excess return over the risk-free rate, in the face of downside deviation) which has only improved in recent weeks, even as risk-off conditions gather steam.

Cheap Valuations

As noted in an earlier section, the Abiomed acquisition could provide a useful fillip to the FY24 EPS, even as the core business continues to improve. All in all, consensus currently expects an FY24 EPS figure of 10.94, which would imply improved earnings growth of 4.0% YoY, up from the 3.6% level expected in FY23. On a forward P/E basis as well, the FY24 EPS reflects rather well, translating to a multiple of just 14.1x, a 13% discount to the stock’s long-term P/E average of 16.1x.

Good Risk-reward On The Charts

Finally, we’re also enthused to note the attractive risk-reward dynamics on JNJ’s long-term standalone chart, as well as its relative strength chart.

The chart below tells us that over the last eight years or so, the JNJ stock has trended up in the shape of a healthy ascending channel, respecting the upper and lower boundaries quite consistently. Recently, we’ve seen the stock drop towards its lower boundary, and it was also encouraging to watch the stock bounce off the psychologically crucial landmark of $150 (which coincides with the lower boundary) and close the month of March in the green. Given how long this ascending channel has played out, we think this would represent a good zone to build long positions. We also think this is a zone where management could deploy a greater chunk of the pending $2.5bn share buyback outlay.

We also think that JNJ could work as a promising rotational play within the broad healthcare universe. The Health Care Select Sector SPDR ETF (XLV), is a financial product that focuses on healthcare stocks of the S&P500. If we measure JNJ’s stock in relation to XLV, we can see that this ratio looks very oversold, trading a long way from the mid-point of its long-term range.

Crucially, we can also see that there have been two separate instances over the last decade when this ratio has bottomed at the 1.2x levels and recovered; now again we’re at that point (implying potential bullish momentum in favor of JNJ)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in JNJ over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.