Summary:

- Palantir stock is up 40%+ YTD, outperforming the S&P 500 by a significant margin.

- That is largely driven by AIP and its renewed go-to-market strategy.

- That being said, is Palantir stock still a buy?

- In this article, I will highlight 7 major reasons to buy Palantir stock.

Luke Sharrett/Getty Images News

Introduction

Palantir (NYSE:PLTR) stock is up 40%+ YTD, outperforming the S&P 500 by a huge margin. However, the stock is down nearly 10% ever since the company reported Q1 earnings.

The question is: is the recent sell-off a buying opportunity?

In this article, I highlight seven reasons to buy PLTR stock as well as one caveat for owning Palantir stock.

Reason #1: Technological Prowess

In a nutshell, Palantir offers big data analytics and custom operational software solutions, helping enterprises integrate data, decisions, and operations at scale — through its four platforms: AIP, Gotham, Foundry, and Apollo.

The company was founded over two decades ago by some of the most talented and smartest people on the planet, including Alex Karp, who has served as Palantir’s CEO since day one.

More importantly, through decades of investment and refinement, Palantir has built one of, if not, the most powerful software platforms in the world, applicable to a diverse set of clients across a multitude of industries.

In Q1, our US commercial business had customers from 56 of the 74 GICS industries.

(CRO Ryan Taylor — Palantir FY2024 Q1 Earnings Call)

While Palantir caters to a diverse use case, its customer base is even more intriguing. In particular, Palantir serves category leaders and some of the most important institutions in the world. Here are some examples:

- Pacific Gas and Electric (PCG), the largest utility company in California, uses Palantir Foundry to make sense of the 8 to 10 billion data points PCG receives every single day, allowing the company to make data-driven decisions to protect high-risk parts of the electrical grid.

- Since 2017, Airbus has partnered with Palantir to run its Skywise platform, which helps Airbus connect and optimize the complex value chain of the aviation industry.

- Palantir is also winning on the government side. Just recently, Palantir won a $480M contract from the US Department of Justice, to create an AI surveillance and targeting system to detect potential targets. In Q1, Palantir also won a $178M contract from the US Army, to be the sole prime contractor to develop the Army’s first AI-powered vehicle under the TITAN program.

Palantir FY2024 Q1 Investor Presentation

Cloud giants like Oracle (ORCL) and Microsoft (MSFT) also partner with Palantir to help deploy Palantir’s software.

Not only that but industry analysts also agree with Palantir’s differentiated technology: In 2023, Dresner Advisory Services recognized Palantir as a winner in eight categories, including being the #1 Vendor in AI, Data Science, and Machine Learning.

These kinds of deals and acclamations speak volumes about Palantir’s technological prowess.

Reason #2: Bootcamps

Prior to the launch of Palantir’s bootcamps, Palantir was highly criticized for its go-to-market strategy, particularly its strategic commercial contracts whereby Palantir signs deals with a bunch of loss-making SPAC companies. These deals artificially inflated Palantir’s customer count — the majority of them were lower-quality customers.

However, since the launch of AIP and the AIP bootcamps last year, Palantir has cracked its marketing and distribution problem, from being a “consulting company” to being a true SaaS company. Through these bootcamps, Palantir focuses on “showing” — rather than “selling” — its software.

Other companies engage in intricate and elaborate efforts to sell and market their offerings. Their resources are focused on marketing at the expense of actually constructing the software and building the systems that they hope to sell.

We have taken a different approach and are now investing even more heavily in simply letting potential partners use our software in order to decide what works and what does not for themselves.

(CEO Alex Karp — Palantir FY2024 Q1 Letter to Shareholders)

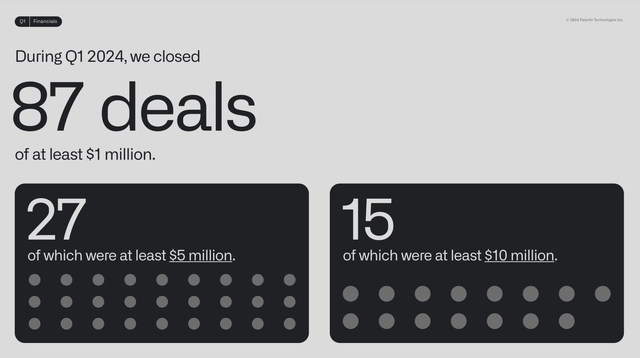

In just about nine months, management reported that 915+ organizations have participated in the bootcamps. This was up from 465+ organizations at the end of Q4, almost doubling in a single quarter, so Palantir is seeing huge success with its bootcamps. More importantly, the bootcamps led to a “substantial deal cycle compression”, enabling Palantir to maintain a robust deal pipeline with 87 deals of at least $1M closed in Q1.

Palantir FY2024 Q1 Investor Presentation

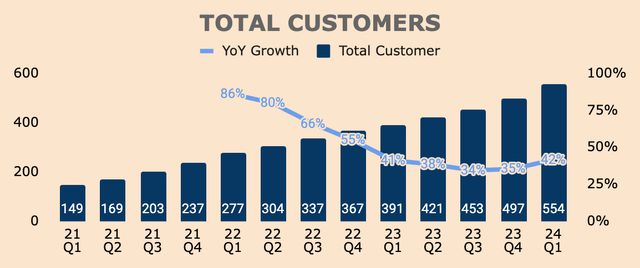

This is also reflected in the accelerating growth of Total Customers, which grew 42% YoY in Q1, to 554. Net New Customers added in Q1 was 57, the highest ever in a single quarter.

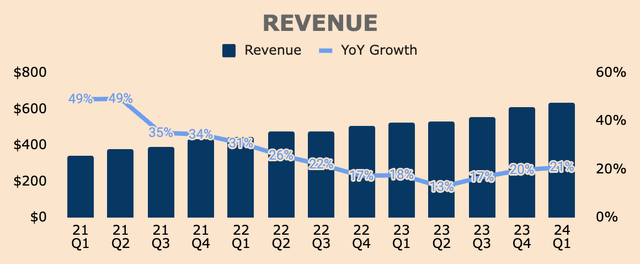

Such strong customer and deal growth led to a reacceleration of Revenue growth, to 21% in Q1, up from 13% three quarters ago. Revenue was $634M in Q1, beating management’s guidance by $20M and analyst expectations by nearly $17M.

Given the positive reception around the bootcamps, it’s safe to say that Palantir will continue to experience strong Customer growth over the next few years, which should also drive rapid Revenue growth moving forward.

Reason #3: Government Reacceleration

Having witnessed the incredible traction produced by the AIP bootcamps, management intends to replicate this success within its Government segment, which could reaccelerate its flagship government offering.

Our growth is being driven by the incredible dynamism of the US commercial market and we believe the US government will follow. With this momentum, we have launched builder bootcamps in the US government.

(CTO Shyam Sankar — Palantir FY2024 Q1 Earnings Call)

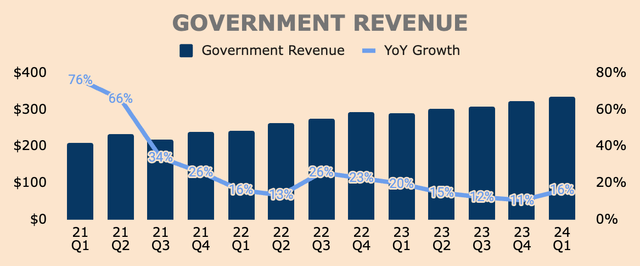

That said, after five straight quarters of growth slowdown, Palantir’s Government segment growth finally accelerated to 16%, up from Q4’s growth of 11%. The government bootcamps have yet to make their impact on the company’s Revenue line, so when these bootcamps gain traction, Government Revenue growth could accelerate further.

In Q1, Palantir’s Government Customers grew 14% YoY to 127 — the company added only 5 Net New Government Customers in the quarter. In my opinion, the government bootcamps could attract a new wave of Government Customers.

A couple of years ago, Palantir’s bull thesis revolved around its flagship Government business but over the last few quarters, growth for the segment has slowed down to discouraging levels, which weakened the investment thesis on Palantir stock. A revival in the government segment — fueled by government bootcamps — could be a major catalyst for the stock.

Reason #4: Commercial Explosion

While Palantir sets up its government bootcamps, its Commercial segment continues to eclipse the aging Government segment as AIP takes center stage.

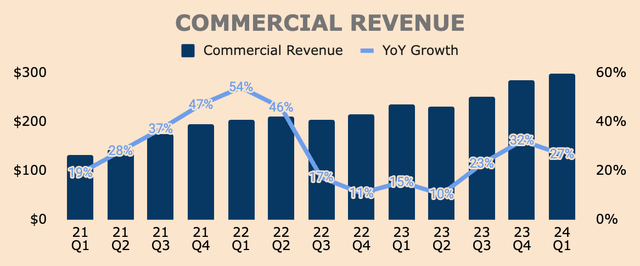

Q1 Commercial Revenue was $299M, up 27% YoY, mainly driven by AIP and the bootcamps.

- US Commercial Revenue was $150M, up 40% YoY.

- International Commercial Revenue was $149M, up 15% YoY.

Revenue from strategic commercial contracts was $24M in Q1 — management expects this figure to drop to $7M to $9M in Q2. Excluding the impact of strategic commercial contracts, US Commercial Revenue would have grown 68% YoY in Q1. In other words, the underlying fundamentals of Palantir’s US Commercial business are stronger than meets the eye, which is why the segment will remain one of the most significant drivers of growth for Palantir.

This is also supported by a solid US Commercial deal pipeline:

- US Commercial Customers of 262, up 69% YoY.

- US Commercial Remaining Deal Value up 74% YoY.

- US Commercial Deals Closed of 136, up 94% YoY.

- US Commercial Total Contract Value of $286M, up 131% YoY.

As a result, expect an explosion in Commercial Revenue in the next few quarters as Palantir aims to make AIP the most powerful AI tool in the world.

Our intention is to make our Artificial Intelligence Platform (AIP) the most dominant infrastructure in the market and power the effective deployment of artificial intelligence and large language models across institutions.

(CEO Alex Karp — Palantir FY2024 Q1 Letter to Shareholders)

Reason #5: GAAP Profitability

“Palantir is destroying shareholder value”

“Palantir is diluting shareholders”

“Palantir will never be profitable”

Blah…blah…blah…

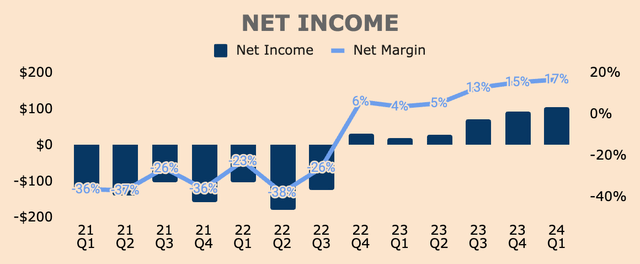

As of Q1, Palantir sports an:

- 82% Gross Margin, the fourth consecutive quarter of 80%+ Gross Margin.

- 13% Operating Margin, the fifth consecutive quarter of positive GAAP Operating Income.

- 17% Net Margin, the sixth consecutive quarter of positive GAAP Net Income.

Mind you, these are all on a GAAP basis — no sneaky accounting tricks here.

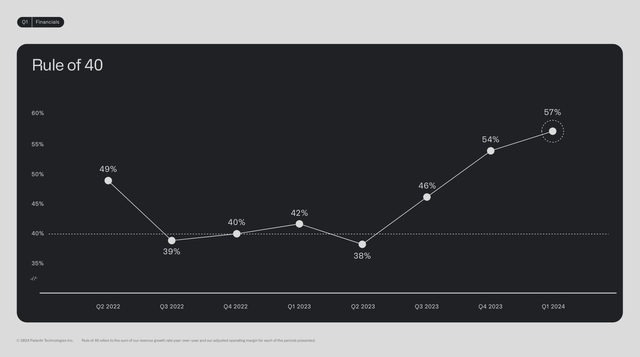

On a Non-GAAP basis, Adjusted Operating Margin was 36%, up 1,200bps YoY and 200bps QoQ, signifying strong operating leverage. Adding Q1’s growth of 21%, Palantir achieved a score of 57 against its target Rule of 40. As you can see, this was the third consecutive quarter of improving Rule of 40 score.

Palantir FY2024 Q1 Investor Presentation

Judging by Palantir’s growth and profitability momentum, it’s safe to assume that margins will trend higher from here and that the company will maintain a high Rule of 40 score moving forward. These translate to high earnings potential for Palantir shareholders.

Reason #6: Favorable Outlook

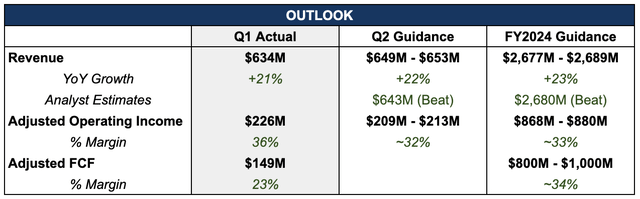

In terms of the outlook, management expects Q2 Revenue of $651M at the midpoint, up 22% YoY, which beat analyst estimates by $8M. This also means that growth is set to accelerate further in Q2.

What’s more, management raised their sales and profit guidance:

- Raised 2024 Revenue guidance by $23M to $2,683M at the midpoint, up 23% YoY. Additionally, management now expects US Commercial Revenue to grow at least 45% YoY, up from 40% a quarter ago.

- Raised 2024 Adjusted Operating Income guidance by $32M to $874M, representing an Adjusted Operating Margin of 33%.

This is further confirmation that things are tracking in the right direction for Palantir and that demand for Palantir’s software has been stronger than anticipated. Moreover, Palantir is at the forefront of the digital transformation and AI revolution — this should be a major tailwind for Palantir for decades to come.

Reason #7: Cash Flow Machine

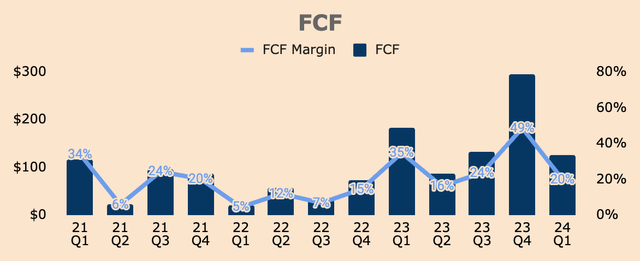

Another reason to like Palantir stock is that the company is a cash flow machine:

- In Q1, Free Cash Flow was $127M at a 20% FCF Margin.

- On a trailing 12-month basis, FCF was $641M at a 27% FCF Margin.

As profitability continues to improve, we can expect Palantir’s FCF profile to improve as well.

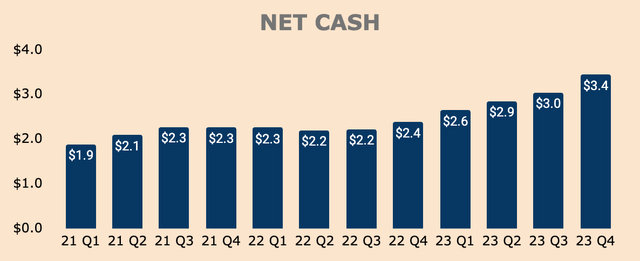

The cherry on top is that Palantir has virtually no debt with a Net Cash position of about $3.4B — and expanding.

Caveat

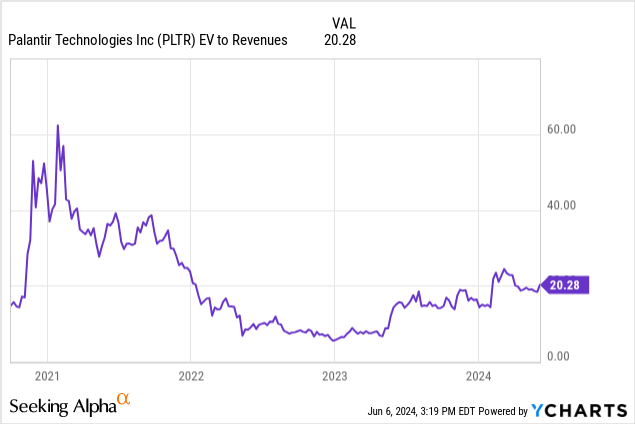

The only caveat is that Palantir’s valuation is quite rich, which means little to no margin of safety for shareholders.

Palantir now trades at an EV to Revenue multiple of 20x, making Palantir one of, if not, the most expensive software stock in the market. Any stock that trades at a sales multiple of 20x growing at only 20%+ is probably priced to perfection.

On the other hand, maybe Palantir’s valuation premium is well-justified given reasons #1 to #7. As I’ve discussed in my previous article, quality comes at a price.

That said, I wouldn’t be a buyer at these prices. At the same time, I wouldn’t be a seller either.

Thesis

As I’ve discussed throughout this article, Palantir is gaining momentum, driven by its early success with AIP and its renewed go-to-market strategy. Palantir seems to be unstoppable right now, with major corporations flocking to Palantir for its differentiated platforms.

As data, AI, and automation become increasingly important with each passing day, Palantir will benefit from this secular trend, lifting Palantir’s top and bottom lines in the process.

The caveat is valuation. But valuation is subjective — one might deem Palantir as severely overvalued while another might regard Palantir as a future $ 1T market cap company.

Whatever it is, there are still 7 major reasons to buy Palantir stock:

- Unique technology moat

- Bootcamp success

- Government re-acceleration

- AIP boom

- Sustained, positive GAAP Net Income

- Strong outlook

- Cash flow machine with $3.4B in Net Cash

That said, I remain bullish on Palantir stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.