Summary:

- Nvidia Corporation’s stock peaked back in July, and failed to make new highs even after Q2 earnings.

- I highlight seven reasons the stock is a sell in my book, including growth slowdown, China risks and insider sales.

- The upside is all priced in, while the downside is not. Nvidia won’t collapse, but it will likely underperform the market.

matdesign24

Thesis Summary

Nvidia Corporation’s (NASDAQ:NVDA) Q2 Earnings have come and gone, and the reaction was somewhat subdued compared to what the stock has us accustomed to.

Nvidia reached a high on July 10th, and despite some positive catalysts, the stock price hasn’t moved much in the last few months.

In my opinion, Nvidia has entered a distribution phase, and investors should consider taking some profits at these levels.

In my last article on Nvidia, I pointed out institutions and insiders who were selling. Today, we will dig deeper into why you should consider doing the same.

I will highlight in this article seven reasons why Nvidia is a Sell in my opinion.

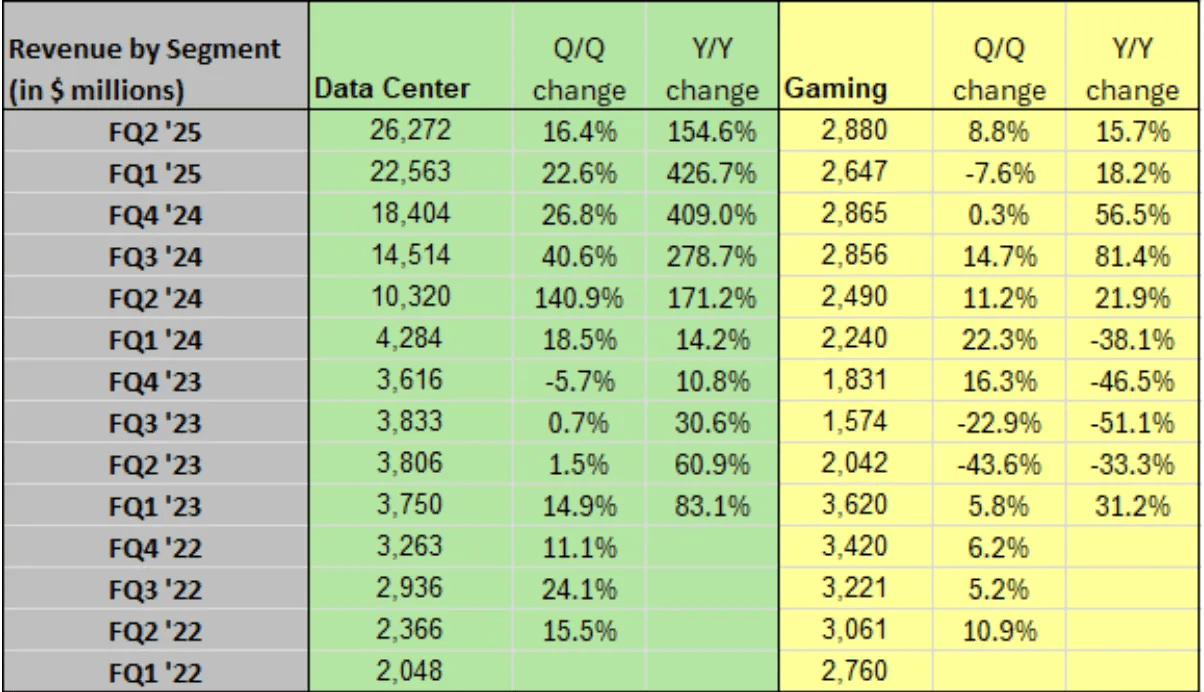

Growth slowdown

First and foremost, the last earnings report gave us solid confirmation that Nvidia’s growth is slowing down.

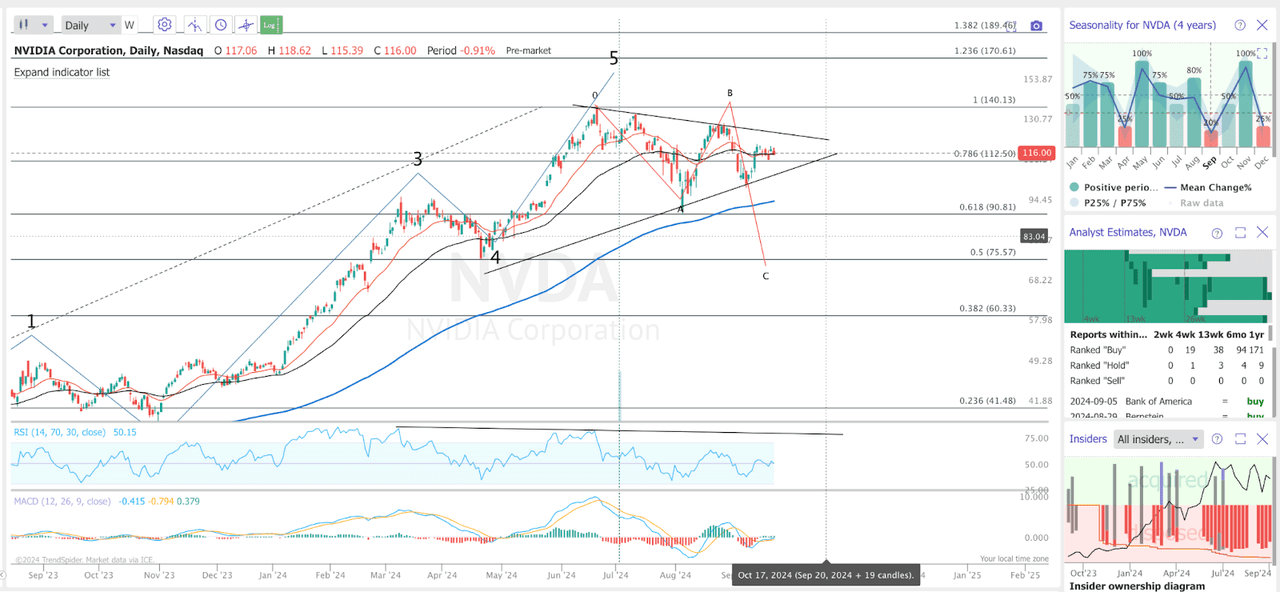

NVIDIA Segment growth (Seeking Alpha)

As we can see, QoQ revenue growth has been falling steadily for the last year and based on Nvidia’s estimates for next quarter, the growth rate will keep falling, coming in at around 15%.

Yes, this is still reasonable growth, but with the valuation so stretched it will prevent the stock from appreciating and could even lead to a sell-off.

CSCO vs NVDA (FT)

This is what happened to Cisco Systems (CSCO). What few people realize is that the company’s revenues kept growing steadily throughout the 2000s, and yet the stock lost 80% of its peak value.

More Sales From The Big Boys

In my last article on Nvidia, I highlighted how hedge funds and insiders had been selling stock. Well, this has not stopped over the last month. Recent 13F filings reveal that Citadel sold 9.2 million shares of Nvidia. We also saw DE Shaw slash its Nvidia stake by more than half.

And though the following is part of planned stock sales, we also know that the CEO, Jensen Huang, continues to unload, selling around 200,000 shares on September 12th and 13th.

Perhaps Jensen Huang himself was planning to time his sales just as Nvidia’s growth rates peaked.

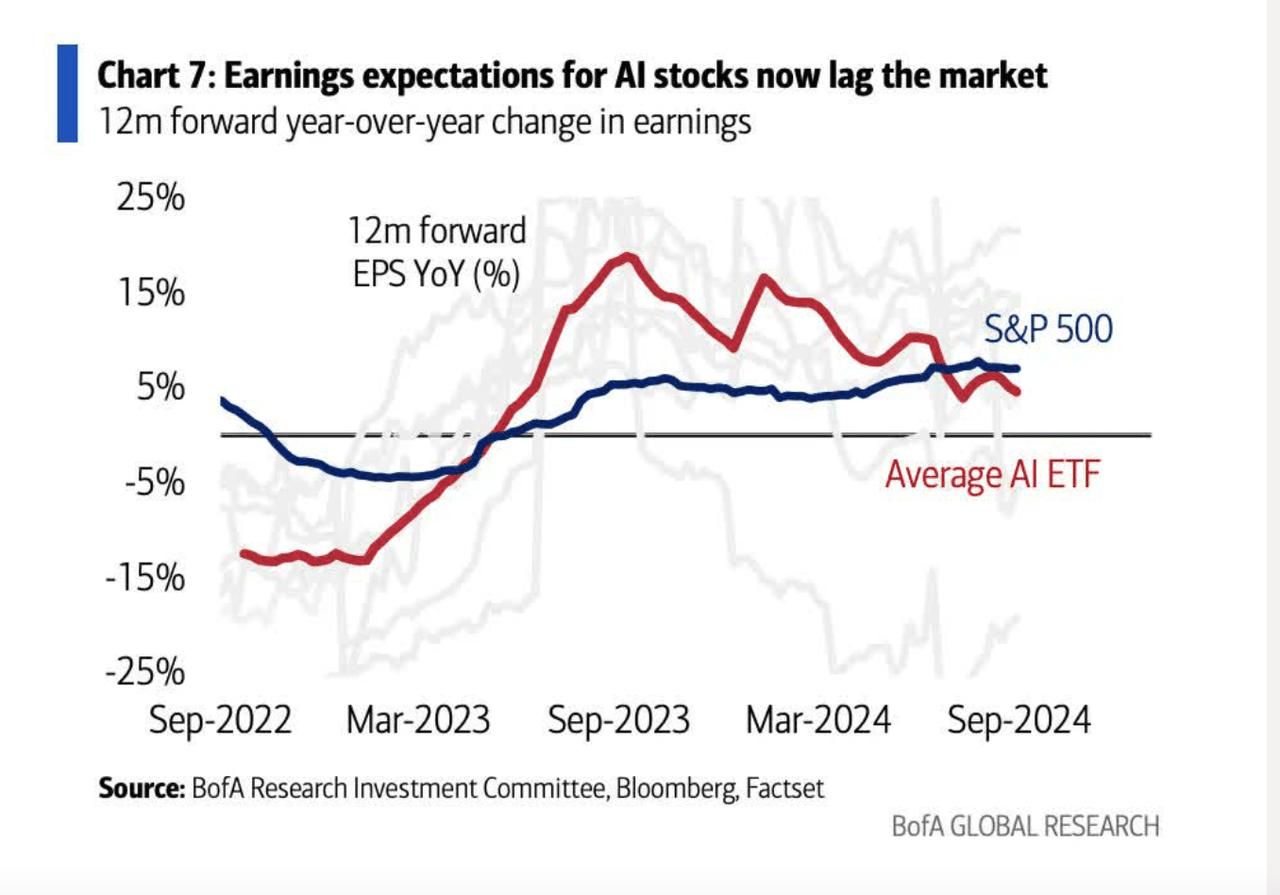

AI Exhaustion

While it is still early days with AI, we could argue that we are beginning to see early signs of exhaustion when it comes to AI applications and investment.

For example, the use of ChatGPT began to fall over the summer.

ChatGPT’s popularity began to wane in March, as users spent less time on the site, dropping from an average of 8.7 minutes to seven minutes by August. In June and July, the number of active users on ChatGPT decreased by nearly 10% each month. In August, it logged a 3% drop in global users. Experts have speculated that the decline might be linked to students going on summer vacation, but now that they are back, things are looking like they are improving.

Source: HTtech.

Even if it’s true that the decline has happened due to the summer vacations, it doesn’t seem like students would be the ideal target audience in terms of reaching profitability.

And while it is true that AI investments are not slowing down, investors are beginning to punish companies that overspend on AI without showing results, as was the case with Alphabet aka Google (GOOG) (GOOGL) following its most recent earnings.

In fact, as we can see below, the S&P 500 is expected to increase earnings faster than AI companies as a whole.

S&P vs AI ETF EPS expectations (BofA)

China Revenues

It is no secret that Nvidia still has substantial exposure to the Chinese market. In the last quarter, $3.67 billion of revenues were attributable to China (including Hong Kong) which represents 12.2% of their total revenues.

But, as we know, the US has been imposing curbs on chip exports to China, with new regulations coming out just two weeks ago,

Besides quantum computing items, the curbs will affect equipment for producing advanced semiconductors, additive manufacturing items to produce metal components and gate all-around field-effect transistor (GAAFET) technology, according to a Federal Register posting.

Source: CNN.

This is a two-way street, and while China is happy to buy Nvidia’s chips for now, it is quickly working hard so that Chinese companies can one day fill this void.

The risk here is not just that 10% of Nvidia’s revenues could soon dwindle, but also that Nvidia could face increased regulatory scrutiny and maybe even fines.

Competition

Without getting too technical, let’s talk about Nvidia’s chip performance versus its peers. For a long time, Nvidia has been head and shoulders above the competition, but where there’s money to be made, investments and resources will pour in, and the gap will eventually close.

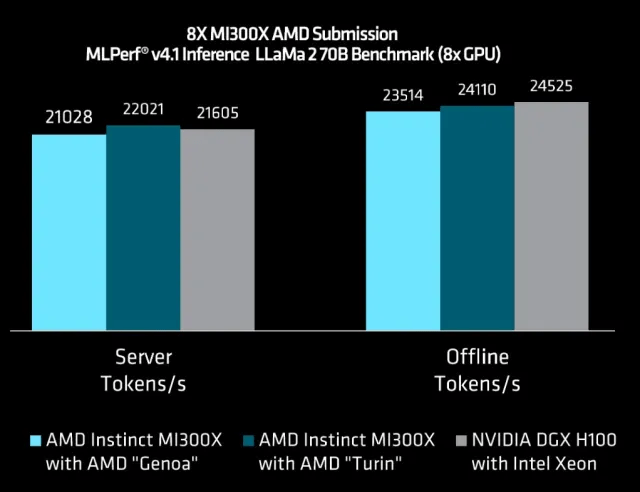

AMD vs NVIDIA chip (MLPerf Inference)

Advanced Micro Devices (AMD), Nvidia’s most direct competitor, has already shown that it can go head-to-head with Nvidia. Its latest generation of chips, the MI300x, are comparable in terms of inference workload to the H100.

Nvidia is no longer the only game in town, and AMD is coming for its market share with its new chips, which will also likely be priced more aggressively.

Moreover, plenty of other companies are also working on alternatives to Nvidia’s GPUs. Alphabet stands out as an interesting one, as it is currently working on TPUs which are already being used by the likes of Apple Inc. (AAPL).

Technical Analysis

Although we cannot confirm a bearish downtrend yet, we have seen some signs of exhaustion with Nvidia’s stock price.

As we can see, the stock has tried to break above its ATH twice and failed, making lower highs. Looking at the current structure, I think we are still in a corrective ABC or even ABCDE distribution.

Notice also the signs of exhaustion, with the RSI giving us a bearish divergence with the price, and the MACD potentially getting ready to give us a bearish crossover.

Now, that’s not to say Nvidia is going to lose 75% of its value like CSCO did, but we may see the valuation come down as the multiples contract. There’s strong support around $90, and I actually wouldn’t be opposed to adding some shares at that level.

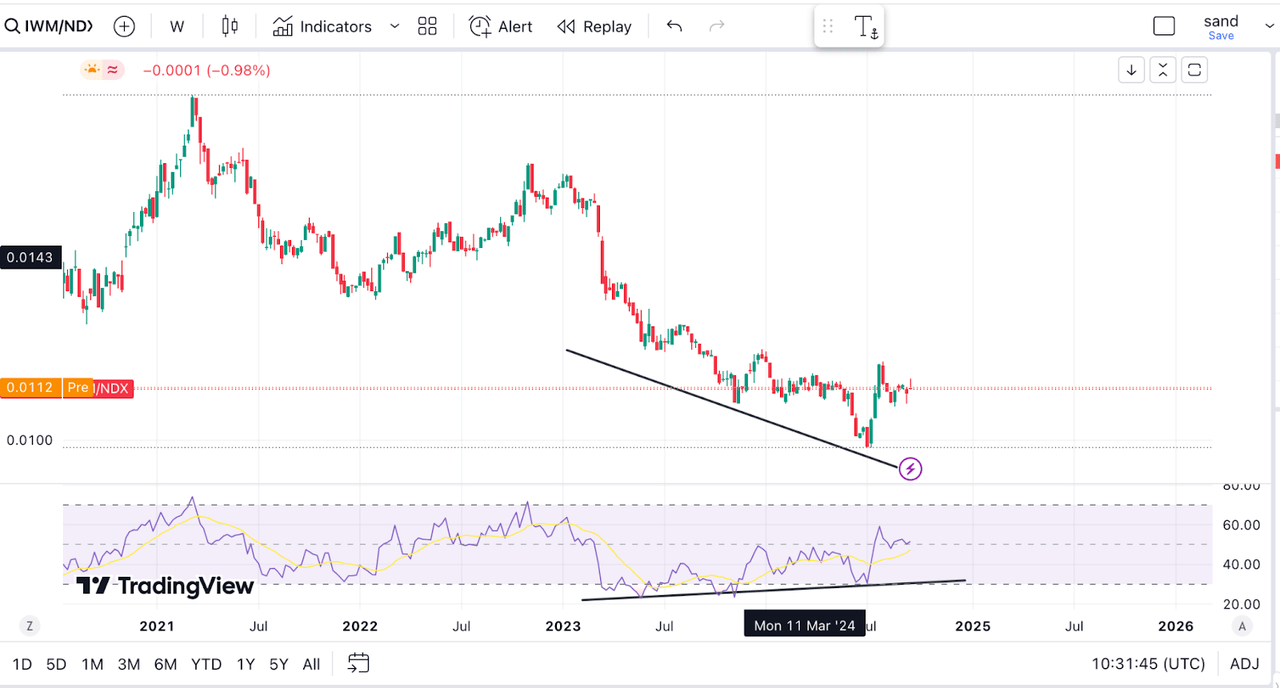

Small-cap rotation

Lastly, looking at the global macro perspective, I believe we will likely see the larger cap stocks underperform, while investors rotate into the more speculative small caps.

This is because the Federal Reserve has begun cutting rates, which directly impacts investors’ expectations and the economy. In essence, rate cuts will:

-

Reduce risk premiums and increase investors’ appetite for risk

-

Help companies in need of financing, something more common with small caps

-

Increase liquidity and support financial assets overall.

The chart above shows the Russell 2000 (IWM) in terms of the Nasdaq (NDX). As we can see, small caps have already begun to outperform after years of falling behind. I think this trend will likely continue and as we see this happen, more investors will move out of Nvidia Corporation stock, taking profits and reinvesting them in small caps.

Final thoughts

All in all, I still believe Nvidia is a great company, but the upside has been priced in, while the downside has not. That’s not to say I believe the stock will collapse, simply that we cannot expect it to give us the returns it did in 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Macro moves markets, and this is what I do at The Pragmatic Investor

Join today and enjoy:

– Weekly Macro Newsletter

– Access to our Portfolio

– Deep dive reports on stocks.

– Regular news updates

Start your free trial right now!