Summary:

- Devon Energy’s strong production in key basins and strategic acquisitions drive its growth, positioning it as a major player in the U.S. oil industry.

- The company’s focus on shareholder returns, through dividends and buybacks, is supported by its low breakeven prices and healthy balance sheet.

- Despite recent underperformance, Devon’s attractive valuation and potential for substantial gains make it a compelling buy for those who can handle volatility.

grandriver

Introduction

Energy has been a huge part of my research since the pandemic. That is mainly due to my belief that the sector benefits from strong secular tailwinds, including peak production growth in U.S. shale, long-term demand tailwinds, and a very attractive valuation of the entire sector.

Although I promise readers that I will keep a balanced coverage mix, energy will remain a cornerstone of my research. This includes Devon Energy (NYSE:DVN), a stock that has been brought up a lot by readers in recent weeks.

One of the reasons is my aggressive investments in LandBridge (LB) and Texas Pacific Land (TPL), two landowners in the Permian Basin, America’s biggest oil basin.

These companies have deals with Devon Energy, including oil and gas royalties and water-related deals, that allow these two companies to participate in Devon’s rising production.

That said, while LB will soon announce its first-ever dividend, both LB and TPL are not likely to turn into high-yield stocks anytime soon. That’s one of the reasons why readers kept bringing up Devon Energy.

Although Devon Energy does not have an asset-light business model like my royalty investments, it has other benefits, including excellent drilling operations, increasing pricing tailwinds, and a focus on (special) dividends.

My most recent article on this company was written on May 14, when I went with the title “Devon Energy Believes It Offers ‘Incredible Value’ – I Agree.” Since then, shares have dropped roughly 9%, mainly pressured by lower oil and gas prices.

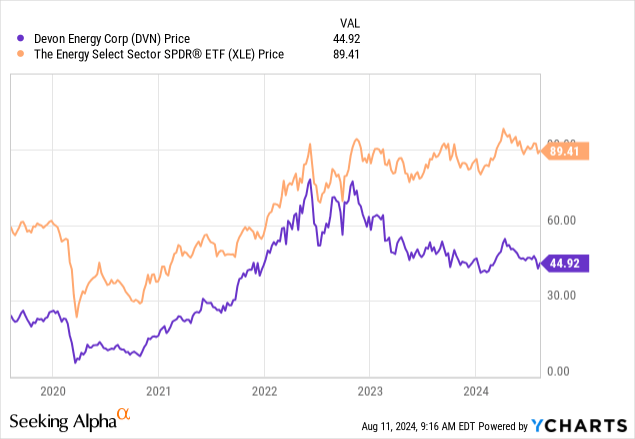

To make matters worse, the stock has shown a divergence from the broader Energy Select Sector SPDR Fund ETF (XLE), which has gone sideways since early 2023 – excluding dividends.

In this article, I’ll update my thesis and explain the pros and cons of buying what could be a highly attractive dividend stock in the energy space.

So, let’s dive into the details!

Devon’s Focus On Higher Growth

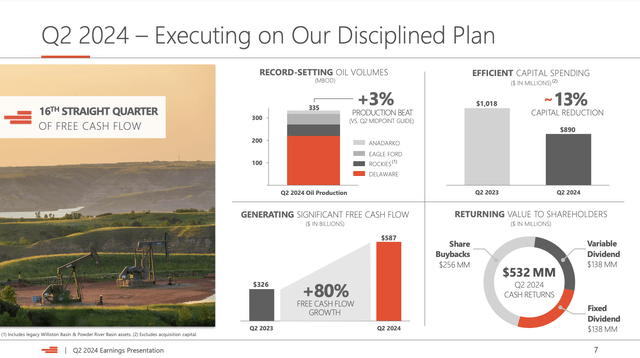

Devon Energy is a heavyweight in the Delaware Basin. The Delaware Basin is part of the Permian Basin. Its operations in this basin allowed it to boost oil production to a record of 335 thousand barrels per day.

According to the company, by optimizing its production processes, including the addition of a temporary fourth frac crew, it brought 62 new wells online in the Delaware Basin, with per-well recoveries expected to achieve an uplift of more than 10% compared to last year’s program.

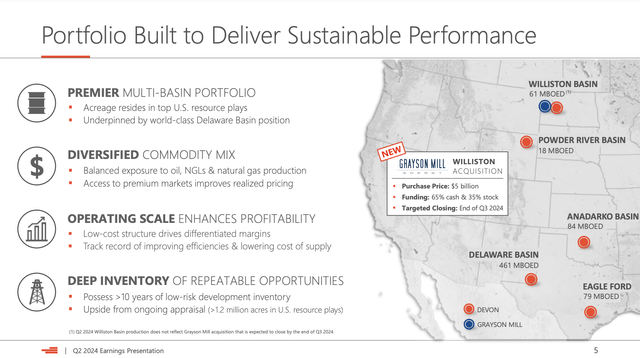

In general, the company is very upbeat about its successes in other places as well, including Eagle Ford, Powder River Basin improvements, and strong production from its legacy Williston operations.

As we can see below, while Delaware is its biggest operation, it also has operations in other areas, including an expansion in the Williston Basin through the acquisition of Grayson Mill Energy for $5 billion.

This transaction is expected to nearly triple Devon’s production in the Williston Basin, making the company one of the largest oil producers in the United States, with average daily rates estimated to be roughly 375 thousand barrels of oil per day.

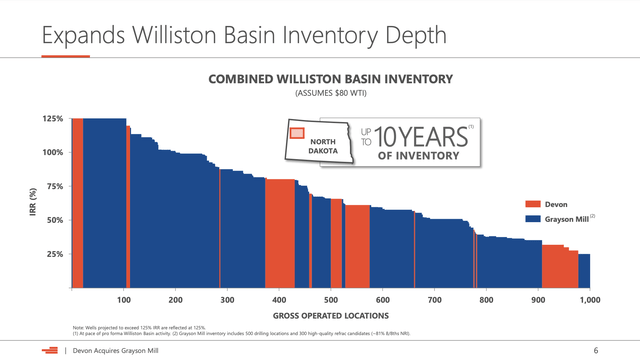

Even better, the acquisition not only increases Devon’s operational footprint but also improves its inventory, providing about ten years of Bakken inventory at the current rate of development.

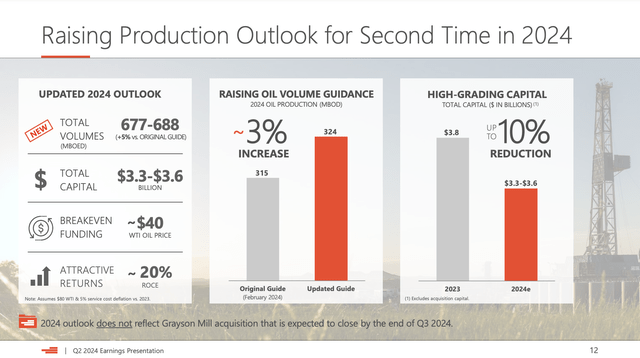

On a full-year basis, the company expects to produce between 677 thousand and 688 thousand barrels of oil equivalent per day. This is 5% more than initially expected. Oil production is expected to be 324 thousand barrels per day, 3% more than initially expected.

Oil production is expected to account for 47% of the company’s total production.

It also helps that the company is expecting to boost production with less capital spending.

All of this is great news for shareholders.

There’s Deep Value In Devon Energy

Devon Energy continues to do what it does best: reward shareholders. It can do this because it has low breakeven prices and a healthy balance sheet, two of the most important factors in the industry.

- The company has a net leverage ratio of just 0.6x EBITDA.

- It has $1.2 billion in cash.

Moreover:

- The company has initiated a $2.5 billion debt reduction program, expected to be completed “within the next few years.” Once this program is finished, I would not bet against higher shareholder distributions.

Especially in light of the Williston acquisition, the company is very upbeat about its future. That’s why it decided to boost its buyback program by 67% to $5 billion.

To use the company’s own words (emphasis added):

We expect sustainable accretion to earnings and free cash flow. Given the strength of this transaction, we’ve expanded our share repurchase program by 67% to $5 billion. This increased authorization provides us ample capacity to continue to opportunistically repurchase our stock and bolster our per share growth trajectory for the next few years. We expect free cash flow from this acquisition to be additive to our dividend payout in 2025 and beyond. – DVN 2Q24 Earnings Call

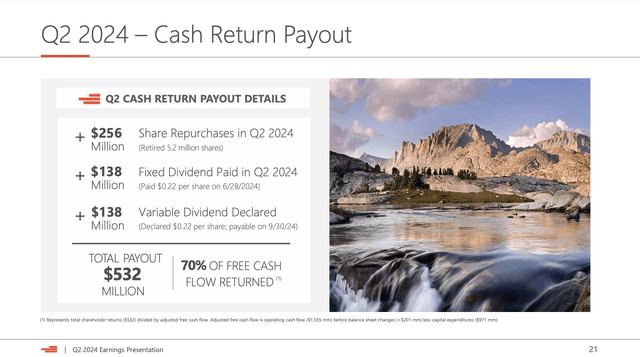

In the second quarter, the company returned roughly 70% of its excess free cash flow to shareholders through buybacks and dividends.

This consisted of $256 million worth of buybacks, $138 million of its fixed quarterly dividend, and $138 million in variable dividends.

The special/variable dividend is evaluated on a quarterly basis, depending on factors like free cash flow.

The current fixed quarterly dividend is $0.22 per share. This translates to a base yield of 2.0%.

When adding the special/variable dividend, the annualized yield jumps to 4.0%.

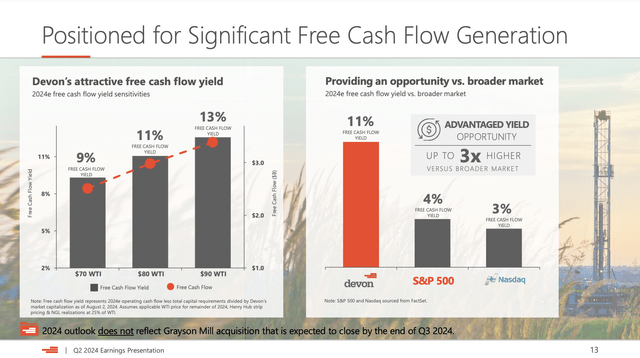

The good news is that there is a lot of room for income. At $80 WTI, the company expects to generate more than $3 billion in annual free cash flow. That translates to 11% of its market cap. A 70% distribution payout indicates an annualized shareholder yield of 7.7%!

Although oil is currently struggling due to weak global growth, a $90 WTI price indicates a return yield of 9.1% (70% of 13% FCF yield).

So, what about its valuation?

Valuation

Devon Energy has underperformed its energy peers recently. I believe this is due to a number of reasons:

- More than half of its production is non-oil. Especially in light of Permian takeaway constraints, pricing is an issue for low-margin natural gas. In 2Q24, realized pricing for natural gas was roughly $1.10 per Mcf, 42% below the benchmark. Personally, I believe there are better investments on the market to invest in natural gas (like these three). The good news is that the Matterhorn Express Pipeline will be operational soon, providing Permian producers with better natural gas prices.

- DVN distributes 70% of its free cash flow. While this is a lot, the company is competing with companies like Diamondback Energy (FANG). That company will soon boost its payout beyond 70% after reducing debt related to the Endeavor merger. FANG also produces more oil than non-oil with terrific operational improvements.

- Devon is using M&A to expand its reserves. Although DVN has good reserves, we should expect M&A to remain an issue due to slowing production growth rates in the best Permian drilling spots.

That said, the positives still outweigh the negatives, especially because DVN is very cheap!

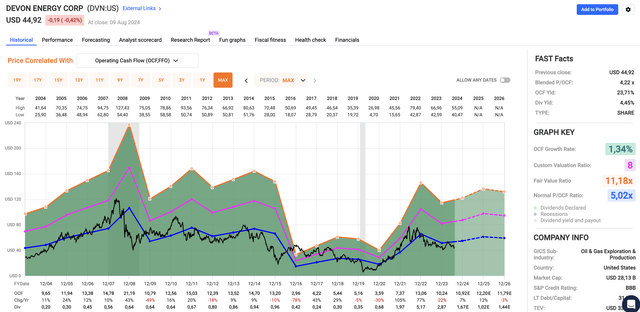

Using the data in the chart below, DVN has a normalized P/OCF (operating cash flow) multiple of 5.0x. Diamondback Energy has an 8.7x average. EOG Resources (EOG) and Occidental Petroleum (OXY) have multiples close to 7.0x.

Moreover, DVN currently trades at a blended P/OCF ratio of 4.2x, even lower than its average.

Using current analyst estimates of flat OCF growth (FactSet data from the chart above), which makes sense in the current oil price environment, we get a fair stock price of roughly $60, 33% above the current price.

However, as I wrote in my prior article, I do not believe a 5.0x multiple is fair. Especially if economic growth makes a rebound and more money rotates from growth to value stocks, I expect DVN to slowly but steadily move to an 8x multiple.

This would imply a $95 stock price target, more than twice its current price.

As such, I stick to the Strong Buy rating, expecting DVN to return substantial shareholder value in the years ahead.

Nonetheless, I need to mention that DVN is volatile. This is not a sleep-well-at-night dividend stock for most people. Please be aware of the volatility and its dependence on oil and gas prices.

Takeaway

My research in the energy sector remains focused on finding strong, value-driven opportunities for long-term growth, with Devon Energy standing out as a compelling candidate.

Despite recent price volatility, Devon’s operational strength, strategic acquisitions, and commitment to shareholder returns, especially through dividends, support its long-term potential.

While the stock is volatile and heavily impacted by oil and gas prices, I believe Devon is significantly undervalued, with the possibility of substantial gains in the years ahead, especially if natural gas and oil prices rebound.

Pros & Cons

Pros:

- Operational Strength: Devon’s record production in the Delaware Basin and strategic expansion into the Williston Basin boost its long-term growth potential.

- Shareholder Returns: With a focus on dividends and buybacks, Devon consistently rewards shareholders with elevated return potential.

- Valuation: Devon trades at a compelling valuation with significant upside potential, especially if oil prices recover.

Cons:

- Volatility: Devon is highly volatile, and its stock price and shareholder distributions are highly tied to the price of oil and gas.

- M&A: Acquisitions might raise concerns about long-term reserve sustainability and growth, as the company may have to dedicate more future cash to reserve-expanding M&A.

- Natural Gas Exposure: Weak natural gas prices have pressured Devon’s margins, making it less attractive compared to oil-focused peers. However, given my view on natural gas, I expect secular growth like new pipelines, data center demand, LNG exports, and other factors to create a favorable outlook for natural gas. So, this “con” could turn into a “pro.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TPL, LB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.