Summary:

- PayPal just reported a triple-beat on Q2 earnings — sending shares higher.

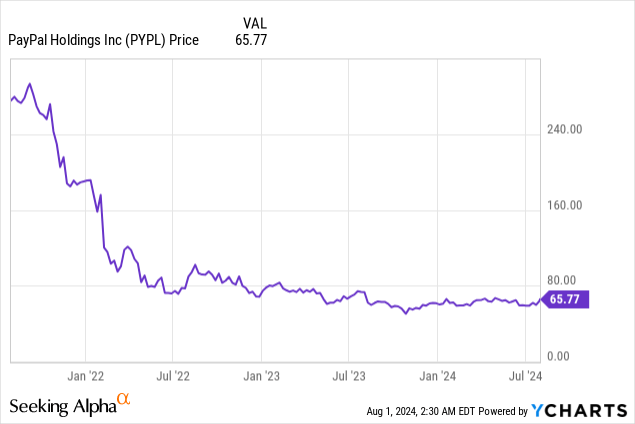

- Even so, PayPal stock is still down 80% from its peak.

- In this article, I highlight eight reasons why PayPal is a strong buy at current levels.

- After being dead money for the past two years, these eight reasons, altogether, might turn around the stock for good.

Justin Sullivan

Introduction

PayPal (NASDAQ:PYPL) just reported strong Q2 results – a rare triple-beat on analyst estimates – which sent the stock higher the following few days.

As you know, the stock has been dead money for the better part of the last two years as the fintech giant faced growth headwinds and underwent managerial changes.

However, following its recent report, investors probably sensed that the tide is turning for PayPal stock as major progress has been made regarding PayPal’s potential turnaround story.

Is this the start of a multi-year rally for the stock?

Is this the beginning of the end of PayPal’s decline?

Is this the inflection point for the company’s fundamentals?

These are questions left unanswered – and will be answered in the next few quarters.

Meanwhile, the stock is still down 80% from its all-time highs, and with business momentum shifting to the upside, I make the investment case that PayPal stock is a strong buy at current levels.

Here are 8 reasons why.

Reason #1: Unmatched Scale

PayPal is the leading digital wallet and payment processing company in the world, with a presence in over 200 different markets worldwide. That is, perhaps, PayPal’s strongest competitive advantage: its scale.

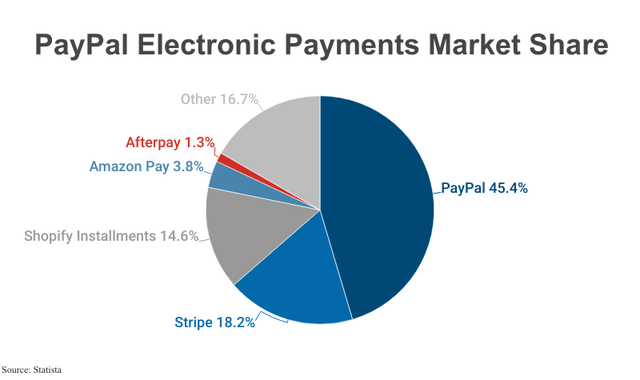

According to Capital One, PayPal is the most popular online payment processor, with a 45.4% market share globally – even despite fierce competition in the fintech space. During the earnings call, CEO Alex Chriss also confirmed PayPal’s leadership position:

So the reality today, we are the number 1 branded experience across all platforms and devices. If we narrow down into desktop web, which is still 40% to 50% of all checkout, we see no degradation in our share over the past four years. So let me say that again. We’ve held share despite competition.

(CEO Alex Chriss – PayPal FY2024 Q2 Earnings Call)

What’s more, PayPal is miles ahead of the competition. As you can see above, the second-largest payment processor is Stripe, with an 18.2% market share. To put that into perspective, PayPal is 2.5x larger than its biggest competitor.

This unmatched scale is a byproduct of owning some of the most well-known brands in the fintech industry, including PayPal, Venmo, Xoom, Honey, and Braintree.

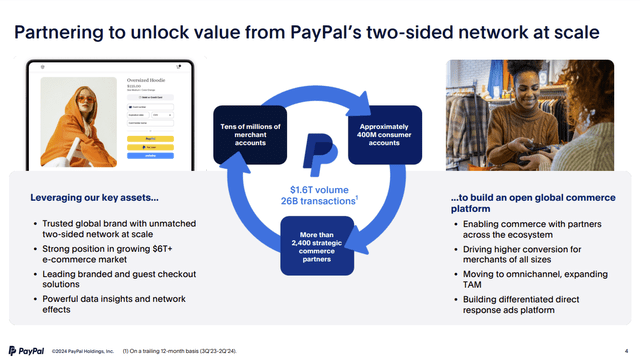

But more importantly, its scale moat is further amplified by PayPal’s two-sided payment network, which consists of more than 400M consumer accounts and tens of millions of merchant accounts.

PayPal FY2024 Q2 Investor Presentation

As mentioned by the CEO, “PayPal is one of the only players” with a two-sided network at a global scale, which is “incredibly hard to replicate and a powerful foundation on which to launch new innovations”.

In addition, its closed-loop, end-to-end platform enables PayPal to collect invaluable data in each stage of the payment ecosystem, allowing PayPal to leverage that data to provide “superior customer experiences and sales conversion”.

As new users – whether consumers, merchants, or commerce partners – join the platform, PayPal enjoys powerful network effects that could compound results and value over time.

Such strong scale, brand, and network effect moats shouldn’t be underestimated.

I’m just excited that we are in a strong position of being the most complete platform and two-sided global network, driving the highest value and benefit to our consumers and our merchants.

(CEO Alex Chriss – PayPal FY2024 Q2 Earnings Call)

Reason #2: Increasing Engagement

The strength of PayPal’s two-sided payment ecosystem can be seen through its ability to continuously grow platform engagement.

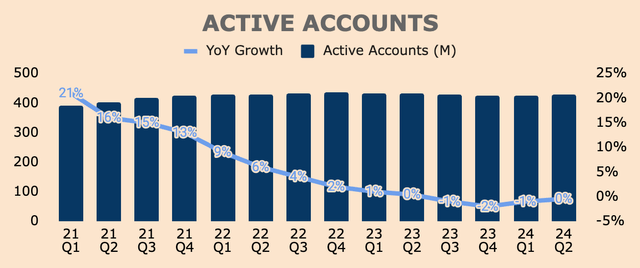

While Active Accounts (AA) have flatlined over the last couple of years, PayPal saw improvements in the metric for two straight quarters, with Q2 Active Accounts up 0.4% QoQ to 429M, driven by lower churn and account growth. While two quarters of positive QoQ growth do not make a trend, it is a welcome sign that more users are joining the platform.

Besides, Monthly Active Accounts (MAA) grew 3% YoY to 222M, driven by Venmo and PayPal account growth. MAA is more important than AA as it represents the more engaged accounts on the platform.

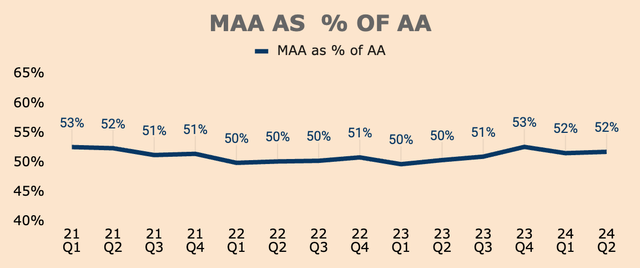

MAA as a % of AA – a metric of mine to keep track of the level of engagement on PayPal’s platform – also improved 2pp YoY. The higher the percentage, the more engaged the platform is and the higher the quality of the accounts.

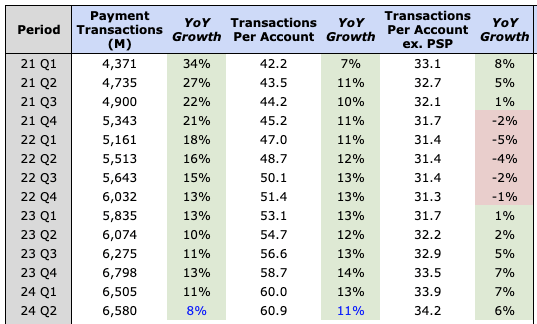

Moreover, despite the small growth in AA and MAA, PayPal grew the number of Payment Transactions at a faster pace, up 8% YoY to 6.6B. Transactions Per Account also grew 11% YoY and Transactions Per Account ex. PSP grew 6% YoY. This shows that PayPal is driving higher paying frequency and engagement within the platform, even with minimal account growth.

Author’s Analysis

Furthermore, PayPal is rolling out new products and initiatives to further boost engagement. Some notable ones include:

- Smart Receipts drove nearly 20M app logins from post-purchase experiences in June, up 70%+ YoY.

- Expanded partnerships with Meta (META) and DoorDash (DASH).

- Venmo Debit Card and Pay with Venmo monthly actives were up about 30% YoY, leading to a 5% YoY growth in Venmo users.

As PayPal continues to roll out new products over the next few months, we can expect robust engagement growth moving forward, which should also lead to robust topline growth in the future.

Reason #3: It’s Not Dead

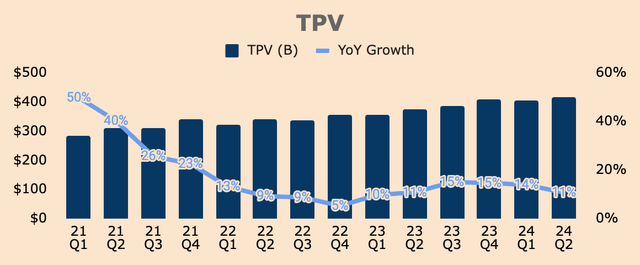

As a result of growing engagement, Total Payment Volume (TPV) grew 11% YoY in Q2, to $417B, which is an all-time high for PayPal.

Breaking it down by segment, Branded Checkout TPV grew 6% YoY, in line with Q1.

Unbranded Card Processing (or PSP) grew 19% YoY, which is a deceleration from Q1’s 26% YoY growth. Before you turn negative, the slowdown was intentional as management shifted their strategy from “price-too-low” to “price-to-value”, so while PSP growth decelerated, it positively impacted overall Transaction Margin Dollar (TM$) growth. More on this later.

Venmo TPV grew 9% YoY, which is in line with Q1. Despite lackluster growth, management is optimistic about the future of the P2P network as monetization is still low. That said, management intends to leverage Venmo’s strong brand and its 62M user base and introduce new products and services to maximize monetization.

What excites me most about Venmo is that we are only scratching the surface of its potential, starting to drive customer-led, profitable innovation, and we see substantial headroom for growth. Said simply, Venmo is primed for growth.

(CEO Alex Chriss – PayPal FY2024 Q2 Earnings Call)

Geographically, US TPV grew 11% YoY while International TPV grew 10% YoY.

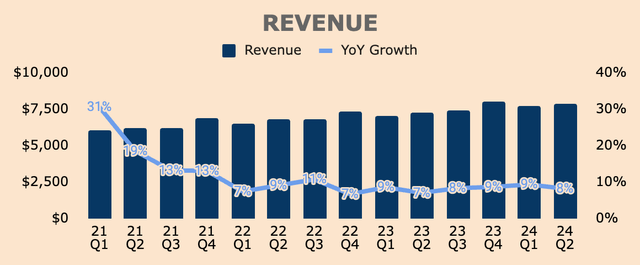

As a result of all these, Q2 Revenue grew 8% YoY to $7.9B, which beat analyst estimates by $80M. Broken down by type:

- Transaction Revenue grew 9% YoY to $7.2B, driven by Braintree, Branded Checkout, and Venmo.

- Other Value-added Services Revenue was flat YoY, at $0.7B.

All things considered, PayPal continues to be underestimated – and as you can see, PayPal is certainly not dead.

TPV and Revenue are at record highs. PayPal processed the most number of Payment Transactions in a single quarter. Transactions Per Account is the highest it has ever been. AA and MAA grew sequentially.

Who said PayPal is dying?

Whoever did, they are clearly holding the chart upside down.

Not only that but PayPal is just beginning to introduce its new innovations, which could boost growth for years to come.

This includes Fastlane, which will be generally available to merchants in the US in August. The Fastlane launch will be quite swift as PayPal will distribute it to existing merchants under Braintree and PPCP, as well as through commerce partners like Salesforce (CRM), Adobe (ADBE), and BigCommerce (BIGC).

Management shared that early Fastlane adopters saw returning Fastlane users convert at nearly 80% as compared to the industry average guest checkout conversion of 50%.

With that kind of result, demand for Fastlane will be robust – and this will allow PayPal to capitalize on the “60% share of e-commerce purchases made without a branded mark.”

As a reminder, a large part of that 60% is still manual card entry, has low conversion today, and is generally a poor experience for consumers and merchants. Much of that is now changing with Fastlane.

(CEO Alex Chriss – PayPal FY2024 Q2 Earnings Call)

Reason #4: Transaction Margin Bottoming

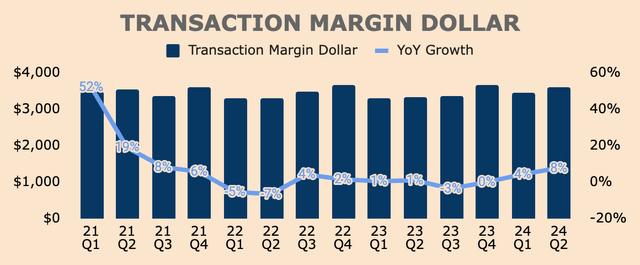

For the first time in three long years, PayPal recorded the strongest quarter of TM$ growth, up 8% YoY to $3.6B. This was mainly driven by Branded Checkout growth as well as Braintree positively contributing to TM$ growth as a result of the company’s change in pricing strategy.

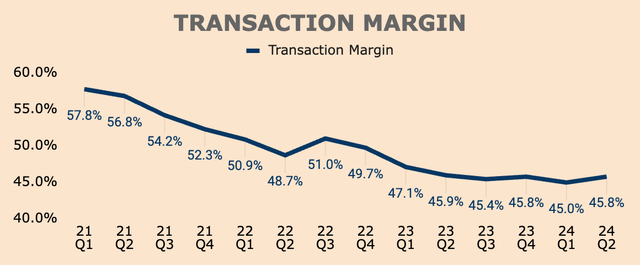

Though still in a major downtrend, robust TM$ growth led to an 80bps QoQ expansion in Transaction Margin to 45.8% in Q2. This may be an early sign of the Transaction Margin bottoming.

While the Transaction Take Rate fell 3bps YoY, it was better than Q1’s decline of 5bps YoY, due to “PSP volumes and Venmo”. This is important as it means that management’s price-to-value strategy and Venmo monetization are starting to materialize.

And again, management is still rolling out new features, which should boost engagement, monetization, and ultimately, Transaction Margin.

For one, management is still ramping up its PPCP product, which offers SMBs a full-stack payment solution including PayPal’s latest branded checkout integration (e.g., Fastlane). Per management, SMB volume is trending nicely, up 40%+ through the first half of the year. As more SMBs migrate to PPCP, we should see margins tick up.

On average, merchants who adopt PPCP use more products, which deepens our relationship, reduces churn, and drives higher average revenue per account.

(CEO Alex Chriss – PayPal FY2024 Q2 Earnings Call)

Then there’s PayPal’s new advertising platform.

In the second quarter, we launched in-app offers with major brands including Best Buy, Priceline, Lyft, Instacart, Ticketmaster, Walmart, and Nordstrom. We are seeing positive trends in consumer engagement with gross merchandise volume driven by one of our offers nearly tripling in June compared to March. And while still early days, the initial interest from advertisers is encouraging.

(CEO Alex Chriss – PayPal FY2024 Q2 Earnings Call)

In my opinion, PayPal’s advertising platform could be a major margin booster.

For context, Meta, the social media giant, derives 98% of its Revenue from advertising… and the company has a Gross Margin profile of over 80%.

I’m not saying PayPal will reach that level. I’m saying that the advertising platform is a high-margin business that will be accretive to PayPal’s overall Transaction Margin.

Whatever it is, given the monetization opportunities ahead and given management’s primary focus to drive durable profitable growth, I believe Transaction Margin might have already bottomed – and as the metric trends higher, I think the markets will start to appreciate PayPal stock more.

Reason #5: Operating Leverage

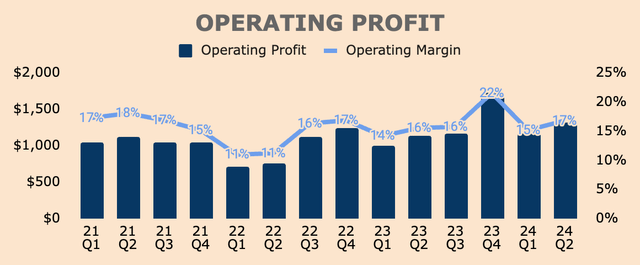

Even without PayPal’s new products, PayPal is already delivering strong operating leverage.

- Q2 GAAP Operating Profit was $1.3B at a 17% Margin, which is up 1pp YoY.

- Q2 Non-GAAP Operating Profit was $1.5B at a 19% Margin, which is up 3pp YoY.

Improvements in Operating Margin were due to strong TM$ growth and lower Non-Transaction Operating Expenses, which decreased 1% YoY.

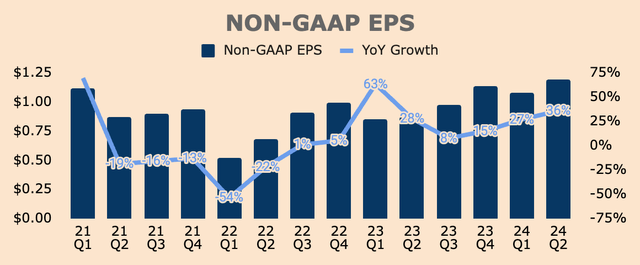

In terms of the bottom line, PayPal recorded GAAP EPS of $1.08, up 17% YoY. Non-GAAP EPS was $1.19, beating estimates by $0.20, and up 36% YoY!

As you can see, Non-GAAP EPS growth has accelerated over the last few quarters, signifying strong operating leverage within the business. As PayPal continues to grow earnings, shareholders will be rewarded in the long run.

Reason #6: Buyback Machine

Another reason for PayPal’s strong earnings growth is that the company has been buying back shares very aggressively.

In Q2, share repurchases were $1.5B, and over the last twelve months, that figure was $5.0B, which helped reduce shares outstanding by 6% YoY.

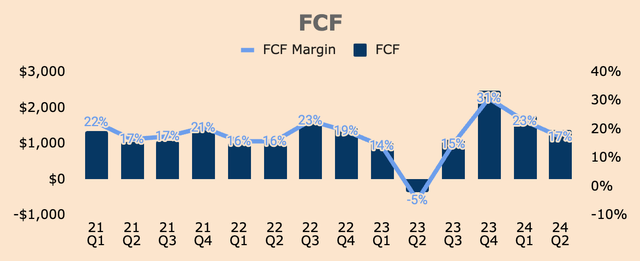

This was possible due to robust Free Cash Flows of $1.4B in Q2 and $6.7B over the last twelve months. This represents an FCF Margin of 17% and 22%, respectively.

Whatever it is, I think the power of buybacks is hugely underestimated.

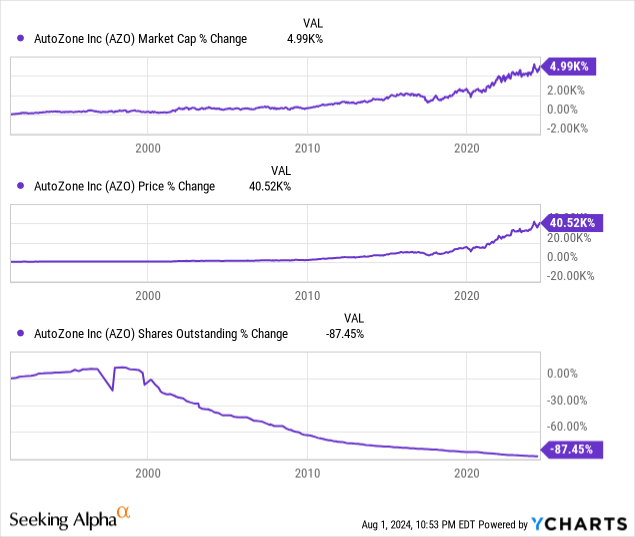

Case in point. Ever since AutoZone (AZO) went public in 1991, its Market Cap has expanded by 5,000%, or 50x. Over the same time frame, AutoZone’s share price has increased by 40,000%, or 400x, which is 8x more than its Market Cap increase. This is possible because AutoZone has been buying back shares aggressively, reducing its share count by 87% since it went public.

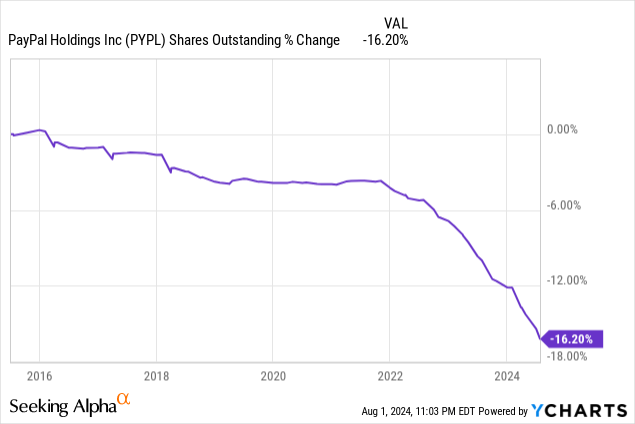

Having said that, PayPal can increase its share price way more compared to its market cap, and that’s because of aggressive share buybacks. So far, the company has reduced shares outstanding by 16% ever since the company parted ways with eBay back in 2015. And as you can see, its share count has been on an accelerated downfall since 2022, when its share price began its collapse.

As long as shares remain depressed, I expect PayPal to continue to devour itself, especially given that the company has a Net Cash position of $3.9B in Q2 and robust FCF all year round. This should lead to an even lower share count, thus magnifying EPS growth.

At the same time, I think the buybacks are going to act as a support for the stock price, which means downside risk is quite limited here, and over the long run, I think its share price could be a major compounder for investors.

Reason #7: Raised Guidance

PayPal is not slowing down its share repurchase program either – management just increased 2024 share repurchases to “approximately $6B”, up from “at least $5B”, due to stronger FCF generation.

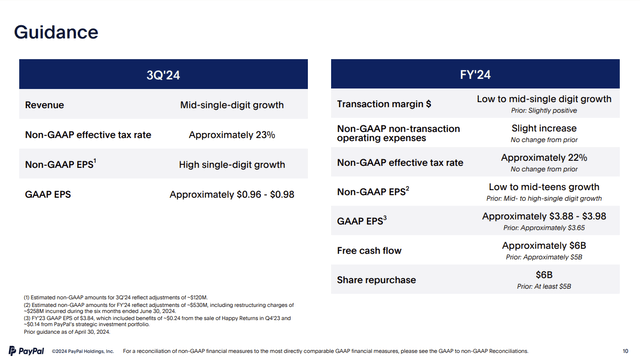

Furthermore, management also raised guidance for the following metrics:

- Transaction Margin $ to grow by “low to mid-single digit”, up from “slightly positive”.

- Non-GAAP EPS to grow by “low to mid-teens”, up from “mid-to-high-single digit growth”.

- GAAP EPS of $3.88 to $3.98, up from “approximately $3.65”.

- FCF of about $6B, up from “approximately $5B”.

PayPal FY2024 Q2 Investor Presentation

During the earnings call, management mentioned that they have a “slightly more positive view of the second half of the year” and that they “feel confident in the progress our teams are making” with regard to their “initiatives related to price to value, as well as ongoing product enhancements in areas like P2P”.

In addition, it appears that management is sandbagging guidance:

We really not built any Fastlane upside into guidance. And part of that is because of our go-to-market is going to be very focused on just getting adoption, not around monetizing in this half of the year. Now, to be clear, we are pricing in the contracts that we’re signing with customers, and so pricing is built in and as I said before, the TAM is every guest checkout. That’s what our focus is. But it’s not built into the second half of the year.

(CEO Alex Chriss – PayPal FY2024 Q2 Earnings Call)

That being said, the raised guidance is a clear indication that momentum is building up, and considering that Fastlane is not baked into the guidance, I believe this sets PayPal nicely for outperformance in the back half of the year.

Reason #8: Still Undervalued

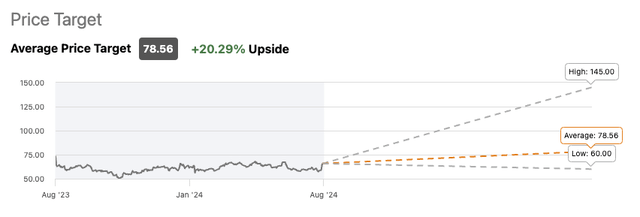

Following its Q2 earnings results, the stock rallied some 10%+ but even with the rally, I believe shares still provide meaningful upside potential.

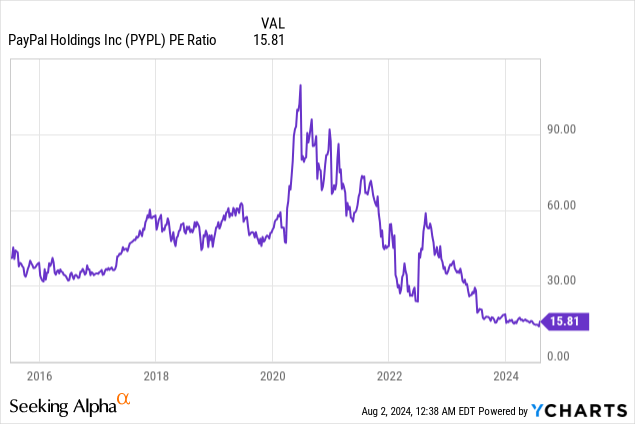

As it stands, PayPal trades at a PE ratio of just 15.8x, which is the lowest it has ever been for the company. I believe this multiple is cheap considering renewed business momentum and accelerated buybacks.

Since its earnings report, there has been a wave of analyst upgrades for PayPal stock. On average, they now have a price target of $78 a share, which is a 20% upside from here.

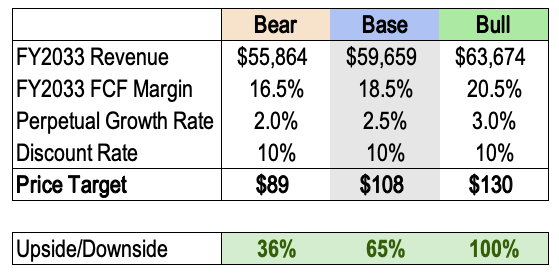

As for me, I have a base-case price target of $108, which assumes a Revenue CAGR of just 7% and no margin expansion, so my assumptions are very conservative. This price target represents an upside potential of 65%.

Author’s Analysis

Risks

- Competition: The commoditization of digital wallets and payment processing services could eat PayPal’s margins over time, significantly reducing its earnings potential. Investors need to keep an eye out for PayPal’s Transaction Margin.

- Growth Slowdown: With its new “price to value” strategy, Unbranded Processing volume growth will likely be negatively impacted, slowing down the growth of the entire company. Investors may not react positively to this news.

Thesis

The last three years have been nothing but painful for PayPal shareholders. However, investors are finally seeing a glimmer of hope as the company delivered a rare triple-beat on analyst estimates.

While shares rallied 10%+ following its Q2 earnings, it is still down 80% from its all-time highs. That said, I believe PayPal remains a Strong Buy at current levels.

Here’s why:

- Massive two-sided payment network with 45% market share.

- Growing engagement within the ecosystem with AA increasing QoQ.

- Record TPV with a long growth runway ahead.

- Transaction Margin might have bottomed with ongoing monetization opportunities.

- Strong operating leverage with robust EPS growth.

- Rapid buybacks could compound investor returns.

- Raised guidance signals strong business momentum.

- PE ratio at an all-time low.

The stock has been struggling, but considering all these reasons, I think we are at the beginning of PayPal’s turnaround story.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.