Summary:

- Smoking causes cardiovascular diseases, even with minimal cigarette consumption. Nonetheless, its production has played a major role in America’s history.

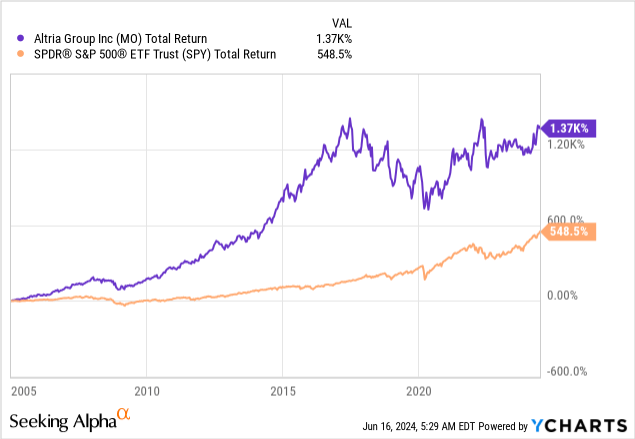

- Since 2005 Altria’s stock performance has outperformed the S&P 500 but has stagnated since 2017.

- Altria’s strategic shift towards e-vapor products and strong dividends make it a compelling option for income-focused investors.

Terroa

Introduction

I don’t smoke. I never tried a cigarette and don’t recommend it to anyone.

After all, it’s not healthy.

According to the CDC:

- Smoking causes stroke and coronary heart disease, which are among the leading causes of death in the United States.

- Even people who smoke fewer than five cigarettes a day can have early signs of cardiovascular disease.

- Smoking damages blood vessels and can make them thicken and grow narrower. This makes your heart beat faster and your blood pressure go up. Clots can also form.

That said, I don’t have a problem with it. In a free country, people should be able to decide what’s right for them. Smoking and drinking alcohol are two of the things that have been around for centuries.

In fact, one could make the case that tobacco built America, as Tim Stanley wrote more than 13 years ago:

And free market governments should bear something else in mind when thinking of banning the weed: tobacco built America. Jamestown was England’s first successful colony on American soil, but its survival was initially uncertain. From 1607-1611, it floundered from famine to epidemic and nearly disappeared off the map. It was rescued in 1611 when colonist John Rolfe experimented with planting some tobacco. By 1619, Jamestown had become a major commercial port, flourishing on sales of the demon weed to England.

The other day, someone told me “America was built on coffee and cigarettes,” which is something I often think about.

Even hundreds of years after these events, smoking is still popular, as roughly 12% of all U.S. adults over the age of 18 smoked in 2021. That’s 28.3 million Americans.

In 2005, nearly 21% of adult Americans smoked.

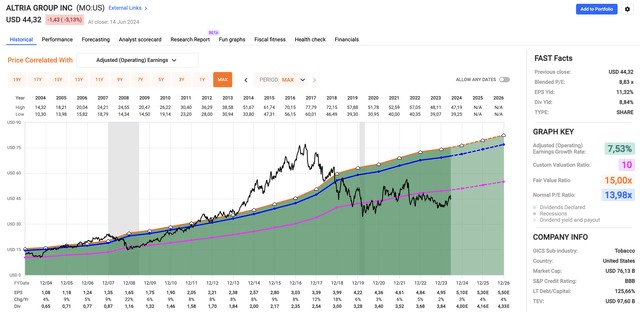

Nonetheless, since 2005, cigarette producer Altria Group (NYSE:MO) has returned 1,370% on the stock market, beating the 549% return of the S&P 500 by a margin that can be seen from space.

Unfortunately, since 2017, the share price has been a disappointment.

Including dividends, investors have not seen any gains, which means they lost money after inflation.

Hence, in recent years, people started to doubt if they now own a pet rock.

- Demand for tobacco continues to decline, as people are becoming increasingly health conscious.

- (Unrelgulated) competition for cigarette alternatives is fierce, making it hard to establish a moat.

- The market prefers tech stocks. With the advance of AI, this seems to be the only game in town.

That said, I believe Altria continues to offer great value for income-focused investors, as it is doing a terrific job finding its way in a changing market.

My most recent article on this $76 billion giant was written on January 21, when I said: “This May Be The Last Chance To Buy 10%-Yielding Altria This Cheap.“

Since then, shares have returned 15%, beating the 12% return of the S&P 500.

In this article, I’ll update my thesis and explain why I continue to believe that MO offers tremendous long-term value for income-oriented investors.

So, let’s get to it!

Despite Challenges, Altria’s On The Right Path

Altria is changing.

On March 14, The Wall Street Journal reported that Altria is selling a part of its stake in Anheuser-Busch (BUD) to “return more cash to shareholders.“

Altria currently holds about 10% of Anheuser-Busch, or 197 million shares. The company said it would use the proceeds from selling shares for buying back its own common stock. – The Wall Street Journal

Essentially, moves like these reduce diversification for the sake of short-term benefits from stock repurchases.

In this case, I think it’s smart, as the company is focusing on what matters, which is its core business, and diversification into areas like e-vapor while using buybacks to support the per-share value of its business.

During its 1Q24 earnings call, the company noted the acquisition of NJOY has shown promising early results, putting it in a great spot in the legal U.S. e-vapor market.

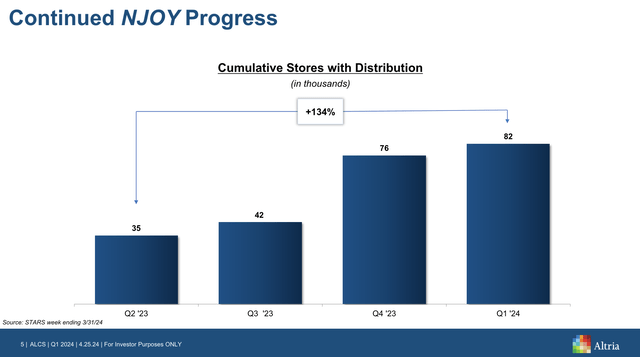

In the first quarter of 2024, NJOY’s distribution expanded to more than 80,000 stores, with plans to reach roughly 100,000 stores by year-end.

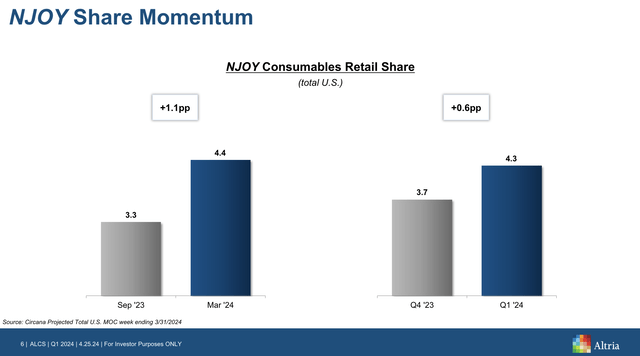

According to Altria, the implementation of NJOY’s first retail trade program has secured premium positioning in more than 70% of contracted stores, which has significantly boosted its visibility and product space, allowing it to improve its market share.

Moreover, NJOY’s share of devices in the multi-outlet and convenience channel increased to 11.5 share points. That number was 5.1 in 3Q23.

It seems like the company’s move into alternatives is protecting its moat, which Morningstar considers to be “wide.” I added emphasis to the quote below.

An addictive product and almost insurmountable barriers to entry in the tobacco industry form strong intangible assets and give Altria a wide economic moat, in our opinion. Tobacco contains nicotine, an addictive substance that suppresses the cessation rate. According to data from the Tobacco Atlas, more than 60% of all smokers intend to quit, and 42% have attempted to quit over the past 12 months. Yet in most markets, the smoking rate is in only a very modest decline, implying that the majority of smokers attempting to quit fail to do so. – Morningstar

So far, so good.

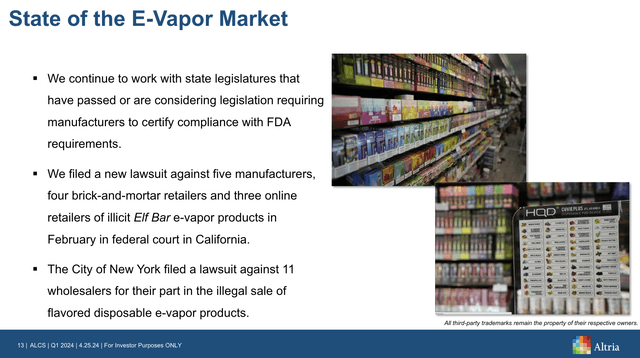

One of the biggest problems facing MO and its peers is unregulated peers in the smoke-alternatives space.

The company is addressing these challenges and dealing with the FDA, lawmakers, and others to make the case for stronger enforcement against illegal e-vapor products.

According to Altria, in the first quarter, the collaboration between the FDA and U.S. Customs and Border Protection resulted in more than 450 e-vapor-related import refusals.

While this is just the start, regulations could come to the rescue, as an increasing number of states are banning the sale of e-vapor products that are not certified by the FDA.

According to Altria, eight states have passed regulations, while 12 other states are considering it.

Virginia is one of them:

Flavored vape products lacking Food and Drug Administration approval could be pulled from Virginia shelves, as a pair of identical bills head to Gov. Glenn Youngkin’s desk for his signature.

[…] Willett said the bills would create a registry of non-flavored products that can be sold in the commonwealth which are FDA-approved and currently undergoing the agency’s application process, of which there are “literally thousands.” – Virginia Mercury (April 1, 2024)

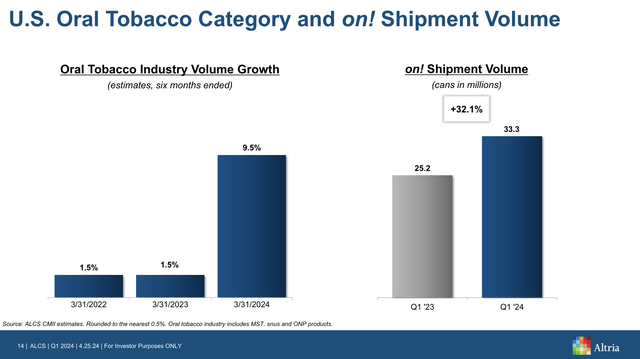

Another area of great potential is oral tobacco, which reported a 13.8 share point increase on a year-over-year basis.

Altria’s Helix subsidiary reported a 32% increase in on! shipment volume, which reached roughly 33 million cans in the first quarter. The retail share also grew by 0.7 points to 7.1%, supported by strategic investments and pricing.

Like its other products, the company’s trade programs have secured premium positioning for on! in more than 80% of contracted stores, which supports market share growth.

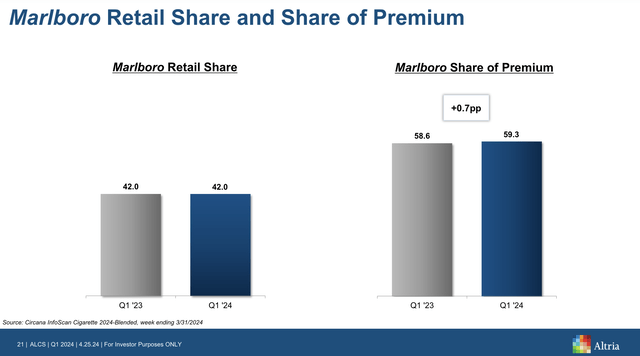

Last but not least, its bread and butter, Marlboro, maintained leadership with a 42% market share in retail and grew its market share in the premium segment, as the charts below visualize.

Nonetheless, the numbers above do not reflect that the entire segment was having issues, which continues to pressure volumes.

Total smokeable products segment reported and adjusted cigarette volumes declined by 10% in the first quarter. When adjusted for trade inventory movement and other factors, we estimate that industry volumes declined by 9% over the same period. We believe that industry volume trends have been negatively impacted by the proliferation of illicit disposable e-vapor products and continued pressures on tobacco consumer discretionary income. – MO 1Q24 Earnings Call

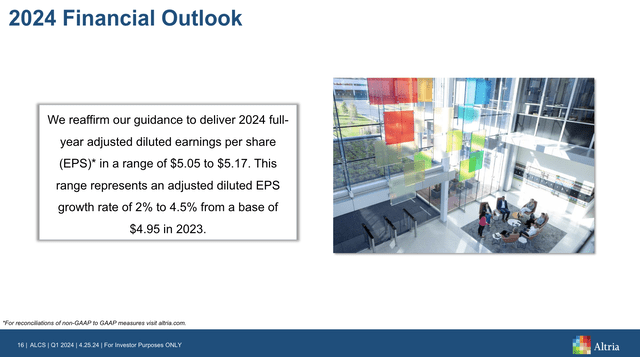

The good news is that when combining headwinds and tailwinds, the company was able to reaffirm its full-year guidance, expecting EPS of at least $5.05, with 2.0% to 4.5% year-over-year growth, as we can see in the overview below.

This bodes well for shareholders!

So Much Shareholder Value

If there’s one company known for its dividends, it may be Altria. In 1Q24 alone, it spent $1.7 billion on dividends and $1.1 billion on the retirement of notes.

It maintains a favorable 2.1x debt ratio, which comes with an investment-grade credit rating from Standard & Poor’s.

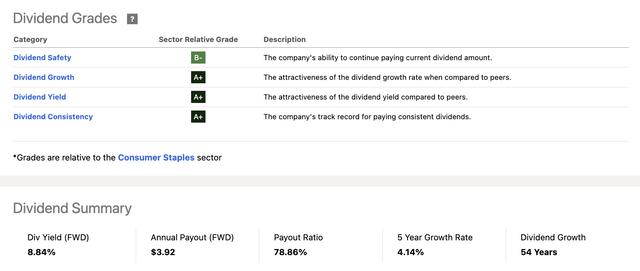

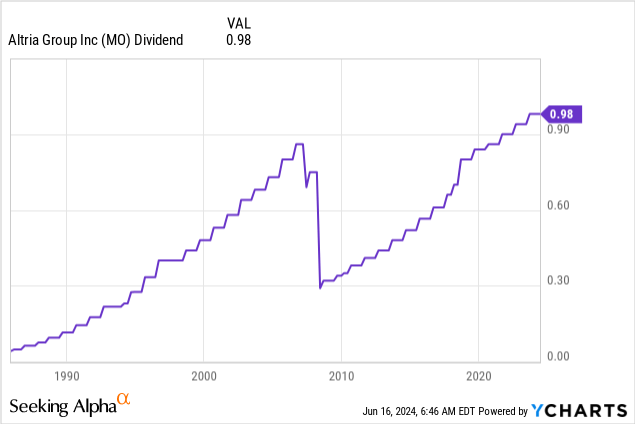

After hiking its dividend by 4.3% on August 24, the company currently pays $0.98 per share per quarter, which translates to a yield of 8.8%

On top of protection from a healthy balance sheet, this dividend comes with a 2024E payout ratio of 77%, using the midpoint of company EPS guidance.

Over the past five years, the dividend has been hiked by 4.1% annually. It also comes with Dividend King status, thanks to more than 50 consecutive annual hikes, which screams consistency. That number is adjusted for the 2008 spin-off of Phillip Morris International (PM).

In general, it has one of the most favorable dividend scorecards, showing A+ scores for growth, yield, and consistency – relative to the consumer staples sector.

It also has an attractive valuation.

Valuation

Altria’s valuation is fascinating – for a number of reasons.

- Despite its stock price peak in 2017, the company has not seen a single year of lower per-share earnings.

- The mix of buybacks, growth in emerging products like e-vapor, and pricing power in traditional tobacco have resulted in analysts expecting roughly 4% annual EPS growth going forward (see the FactSet data in the chart below).

Due to the mix of consistent EPS growth and poor stock price performance, MO trades at a blended P/E ratio of just 8.3x, which is a mile below its long-term normalized P/E ratio of 14.0x.

While I would not apply that multiple due to industry challenges like regulatory uncertainty in e-vapor and more health-conscious consumers, even a 10x multiple would imply a $55 fair stock price target, 25% above the current price.

When adding its juicy yield of roughly 9%, investors are in a great space to enjoy double-digit annual gains for many years to come, especially if Altria pulls off the transition to faster-growing non-tobacco products.

As much as I believe my own thesis and my bullish views on value stocks, in general, I am not buying MO due to my focus on faster-growing dividend stocks.

If I were older and more focused on income, I would be a buyer of any corrections.

Takeaway

Altria has an impressive history, and despite challenges, it continues to offer significant value for income-focused investors.

Its strategic shift towards e-vapor products and strong dividends make it a compelling option.

With a current yield of around 9% and the potential for double-digit annual gains, Altria stands out as a fantastic income stock.

Pros & Cons

Pros:

- High Dividend Yield: Altria offers an impressive yield of around 9%. This dividend is protected by a healthy payout ratio and a strong balance sheet.

- Consistent Earnings Growth: Despite challenges, Altria has consistently grown its per-share earnings.

- Strategic Diversification: The move into e-vapor products and other alternatives is promising, supported by good collaborations with lawmakers and law enforcement.

- Attractive Valuation: Trading at a blended P/E ratio of 8.3x, Altria offers deep value.

Cons:

- Declining Cigarette Demand: Health-conscious trends and regulatory pressures continue to reduce cigarette consumption.

- Regulatory Uncertainty: Ongoing regulatory challenges, especially in the e-vapor space, could impact future growth.

- Competitive Market: In general, the tobacco market is highly competitive. The good news is that MO enjoys strong brand recognition and a wide-moat business model.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.