Summary:

- This article explores whether VICI is undervalued to the degree that many authors seem to think.

- VICI’s forward growth rate of AFFO/sh is likely to be much less than its past growth rate.

- VICI is a quality REIT, worth owning for some investors but not others.

Kwarko

If VICI Properties (NYSE:VICI) had dropped further this year, the stock would probably be in my portfolio. I was actively seeking opportunities to diversify into other quality REITs without loss of income.

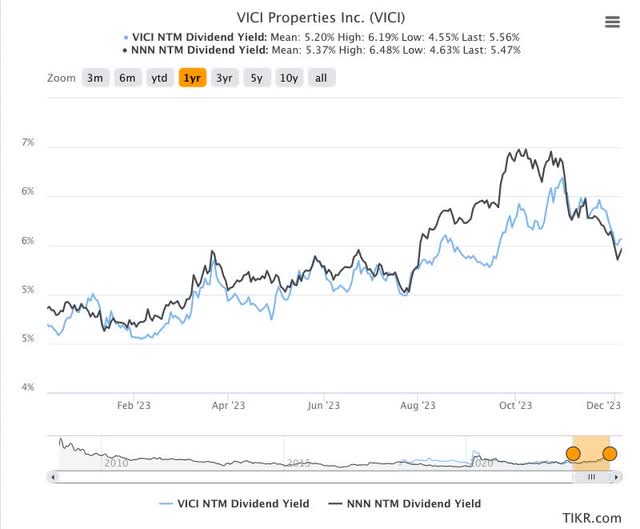

Ultimately though it was NNN REIT (NNN) rather than VICI that got my diversification this year. Here are their recent yields. Please note that while I do not use yield as a criterion for investability, I do use it to select among options I consider investable.

TIKR.com

[Here the gridlines are confusingly labeled by TIKR using only one digit. The yield for NNN peaked at nearly 7%.]

This comparison to NNN is relevant because both it and VICI are “Net Lease” REITs at their core. Neither of them operates properties or has significant ongoing capex.

Their leases are all “triple-net” leases under which the tenant pays all maintenance, insurance, and taxes. One key difference is that NNN invests in relatively small, retail properties while VICI invests primarily in much-larger, gaming properties.

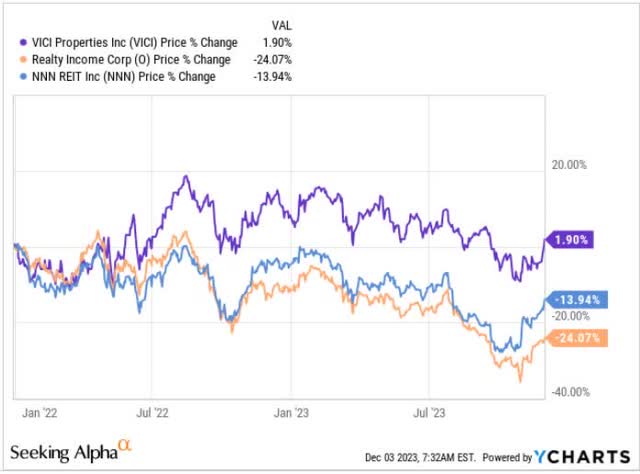

Over the past year, the price of VICI is flat while NNN is down 14% and Realty Income (O) stock is down 24%:

YCHARTS

My conclusion, discussed here, has been that typical triple nets have dropped just as far as interest-rate increases implied they should. That is to say, they are priced near where they were a year ago as a fraction of Net Asset Value based on reported market cap rates.

In that context, the plot just shown suggests one of three things. One is that VICI has created 20% of new value within the past year. Another is that the stock was undervalued relative to the others by 20% a year ago.

The authors on SA would seem to think that one of these is true. There have been more than 40 articles on VICI this year, with all but the six Holds either saying Buy or Strong Buy.

The third possibility is that the market has become over-enthused about VICI relative to other triple nets.

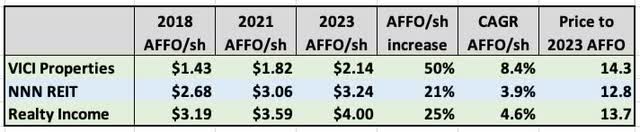

One sees a similar comparison in growth of earnings and in earnings multiples. Here are data on Adjusted Funds From Operations, or AFFO, and on market multiples for these three:

RP Drake

VICI today is valued at a significantly higher multiple than NNN or even cult favorite O. Looking backward, VICI has grown AFFO/sh at a much higher rate.

If this were the forward expectation, then a higher multiple might be justified. But is it?

My task in the research for this article was to do a deeper analysis, in order to see whether VICI is actually the great investment that all those authors thought it to be.

Introduction to VICI

VICI exploded onto the REIT scene with an IPO in 2017. Their announced focus was casinos.

By the end of March 2018 their Enterprise Value was ~$10B. They began with a commitment to good governance and good disclosures, which they have maintained.

That said, their initial properties were spun out of Caesars to help Caesars manage their bankruptcy. As usual that bankruptcy was more about debt than about operating viability.

In 2021 VICI announced their acquisition of the Venetian in Las Vegas and their acquisition of MGM Growth Properties. This gave them more scale and at least a bit of tenant diversification.

Like many REITs, VICI runs with a ratio of Debt to Total Assets near 40%. Unlike most other REITs, GAAP depreciation is very small because their (long-duration) leases are classified as “sales-type” leases under GAAP.

Across the pandemic and since, VICI has collected 100% of rent due. No operator wants to risk losing access to a casino.

The VICI balance sheet is solid, though not a “fortress”. Some specifics:

- In April 2022 VICI got their first investment-grade ratings, with S&P and Fitch both rating them at BBB-.

- However, even today Moody’s still has them at the equivalent of BB+. That is still well short of NNN REIT at BBB+ and of Realty Income at A-.

- The Debt/Adjusted EBITDA ratio is near 5.7x. Moody’s says they would need to see that come down near 5.0x to support an upgrade.

- VICI does have their debt nicely spread out, with annual maturities typically at $1.5B to $2B. In the context of their AFFO near $2B per year and their liquidity of $3.7B, this is not concerning.

- The weighted average debt maturity is 6.1 years, much shorter than their weighted average lease term of 13.2 years. By comparison NNN has debt maturities longer than lease terms.

In recent years, though, VICI has strayed from casinos, investing for example in water parks and bowling alleys. More on that later.

VICI Earnings Growth

Many REITs grow like crazy in the early years after their IPO. They size themselves to be able to add properties at some rate. So in year 2 the portfolio doubles and in year 3 it goes up 33% but by year 10 it is only growing at a 10% rate.

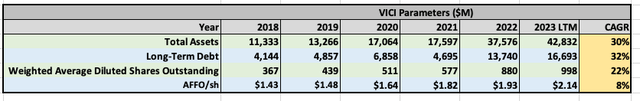

What’s more, if that portfolio growth is being accomplished by issuing stock and taking on new debt, the growth of cash earnings per share is slower. So far here is what VICI has done:

RP Drake

We see a CAGR of 30% for assets and debt. This is supported by 22% of annual dilution, leaving an 8% (8.4%) CAGR of AFFO/sh.

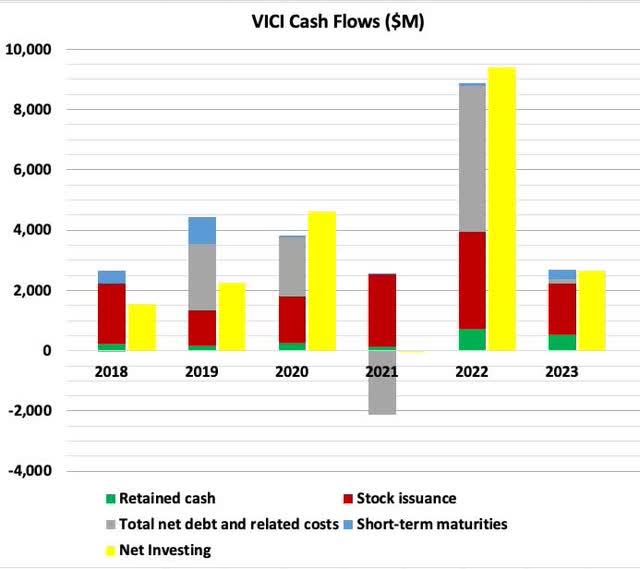

So this is again a classic external growth model driven by stock issuance and new debt. The cash flows tell the same story but don’t capture everything:

RP Drake

You can see the net investing, mainly in those sales-type leases, as yellow bars. They are largely balanced by funds from stock issuance (red) and new debt (gray). Retained earnings (green), the difference between Cash from Operations and Dividends, is a small fraction. [Here 2023 is TTM from Q3.]

But on top of the investing of cash shown in the graphic, VICI has made acquisitions, notably from MGM, that involved the exchange of newly issued stock for other stock along with the assumption of debt. These push the total assets and debt up to the levels shown in the table above.

The VICI business model and their past success now puts VICI in the same bind where Realty Income finds themselves. To keep growing at the same rate, VICI now needs to close more than $10B of new investments per year.

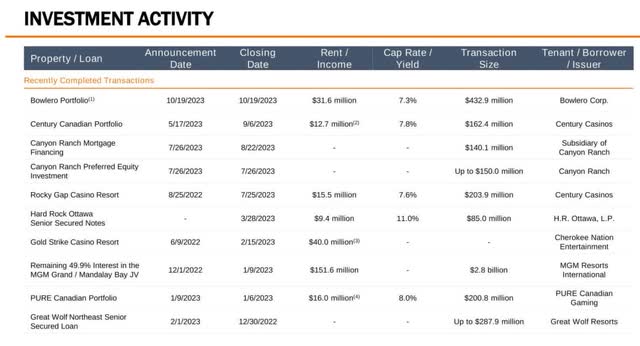

They are certainly not doing that in 2023. Here is their current list, as of early November:

VICI Q3 2023

This totals less than $5B. What is more, it includes a departure from their gaming wheelhouse.

Bowling alleys are a different property type, as are the water parks. And these are too small and inexpensive to drive meaningful growth for VICI. My view is that diversifying their property types for the sake of very little growth adds risk to their ability to grow. [From a credit perspective, though, Moody’s likes it.]

In particular, broadening into other classes of property with high cap rates adds the risk of slower forward growth and occasional headwinds. I like and own EPR Properties (EPR), but also have emphasized in my coverage of them that owning high-cap-rate, experiential properties carries comparatively high risks.

From the above, it would seem likely to me that VICI will grow more slowly going forward, move to lower-quality assets, or both. But as we will see, the full story is actually more challenged.

[We will get to some things to really appreciate, in addition to those mentioned above. This company is a high-quality REIT. The question is one of relative valuation and relative enthusiasm.]

Returns on New Investments

At one point VICI management did have expectations that they would drive very high growth in per share earnings. In an interview Jussi Askola posted for members in 2021, CEO Ed Pitoniak said “what we get compensated for and earn our equity as managers are delivering compounded 12% annual total returns over rolling three-year cycles.”

That threshold surprised me. While 12% did fit their backward-looking results at the time, it would have taken a lot to acquire enough huge properties to keep it going.

And indeed that did not happen.

The VICI Board responded to this, so that in a similar June 2023 interview Pitoniak explained that now the management’s compensation at VICI is largely a function of two things: their ability to grow their FFO per share by at least 6% per year over a 2-year rolling period and reaching at least 10% compounded annual total returns for shareholders over a 3-year period. If they fail to grow their FFO per share by over 6%, they don’t get their bonuses.

That 6% target is hit over time only by a few of the most successful REITs. From that perspective, it is tough but not crazy.

Growth is tougher than it used to be, though. The fundamental driver of growth for any REIT is the Return On (newly invested) Equity or ROE.

ROE is (NOI/New Equity) x (AFFO/NOI).

(NOI/New Equity) is Cap Rate/ Equity Fraction. For a triple net like VICI, (AFFO/NOI) is obtained by subtracting G&A costs and interest expenses, as fractions of NOI, from one. [Here NOI is Net Operating Income.]

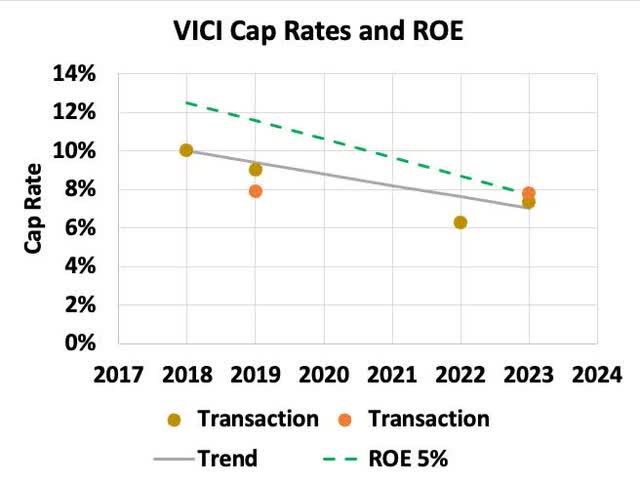

By far the most important driver of ROE is (cash) Cap Rate. The orange dots here show what has happened to that, based on earnings calls.

RP Drake

VICI came onto the scene talking of 10% Cap Rates. But by 2019 their actual deals were at 8% to 9%.

Cap Rates compressed across 2020 and the Venetian deal, in 2022, was at 6.25%. That property was highly valuable. By 2023 we are seeing Cap Rates back up between 7% and 8%.

I dropped the gray line onto this plot as a very rough trend. The dashed green curve shows the corresponding ROE (for 7% G&A), using the 5% interest rate that has been in the ballpark throughout. [This reflects improving credit against a backdrop of increasing interest rates.]

So we see that ROE has dropped 50% from the 12% that seemed imaginable five years ago to the 8% (if not less for the highest-quality properties) that can be done today. This obviously impacts potential earnings growth.

Growth from Rent Bumps, Reinvestment, and Issuing Stock

VICI pays out about 75% of AFFO as dividends. There are always frictional costs, so they likely can reinvest 20% of AFFO. At an 8% to 12% ROE (which includes the impact of the proportional new debt), that generates AFFO/sh growth of 1.6% to 2.4%.

Their rent escalators are very clearly disclosed in their filings. They are in the 2.5% ballpark. Add that to growth from reinvestment, and we should see 4% to 5% growth rates, and nearer 4% today from these sources. That is to say, without issuing any stock.

This is a good result for a REIT. If they do expand the share count by 20% seeking more growth, however, the contribution from these internal sources gets diluted down to just over 3%.

What’s more, the returns from investing the equity raised must yield more than the returns lost by the dilution. If you sell 20% of the company this dilutes the AFFO/sh of existing shareholders by that much.

With a dividend yield near 5% and a payout ratio on AFFO of 75%, the AFFO yield is about 6.7%. The spread that actually matters is the one between the AFFO yield and the ROE.

Today that spread is in the ballpark of 1% on the 6.7%. So if you sell 20% of the company, the increase in total AFFO is (20% x 1% / 6.7%), or 3% on net. This increased AFFO is spread over 20% more shares, however, so one ends up with about 2.5% of AFFO/sh growth by selling that much stock.

A lot of REITs are not issuing stock this year because it does not pencil out to produce a gain in AFFO/sh. VICI can still get such gains by investing funds raised from selling stock, so no wonder they did so in Q1.

TIKR.com

The numbers here give an AFFO/sh growth rate of 5.5%, but this value is not so precise. It would seem that management still has a shot at doing the 6% they need to get their bonuses.

For me the bottom line on growth is that VICI may or may not grow more rapidly than other triple nets. Positives include higher cap rates and better escalators than most. Negatives include higher debt costs and the challenges of their scale.

Risks on the Horizon

This, however, may be too cheery. At current stock prices, the Venetian deal would dilute AFFO/sh.

VICI showed the world how to work the casino space, and there is increasing competition today. Realty Income has shown up to play and no wonder.

But Realty Income bought the Boston Harbor Casino at a 5.9% cap rate and a piece of Bellagio at a 5.2% cap rate. It sure seems to me like they overpaid. More important here, though, is that VICI could not have made either of those purchases without significant shareholder dilution.

So competition seems like a challenge for VICI and they may get priced out of the market they invented. But if the answer is to buy bowling alleys, then managing that 6% growth rate seems a real stretch. (Bye bye bonuses.)

There is another angle, though, that might come around to bite VICI, Realty Income, or any landlord that owns big casinos. What if the operator goes and gets themselves in financial trouble?

For REITs that have their portfolio spread over thousands of properties, the answer is easy. Shed the property, and it almost does not matter how. Do whatever you must to be rid of it. But if one property is around 10% of your portfolio, and is operationally troubled, will there be a buyer and if so, at what price?

The issue here is not that casinos are risky. They have proven to be very stable operationally. The problem is that such stability invites an operator to leverage up to dangerous degrees.

Tenant and property concentration also are highlighted by Moody’s as a source of credit risk.

Putting it Together

In sum VICI is not a perfect REIT.

- There is too much tenant concentration.

- Competition for casinos has markedly reduced their ROE.

- Today the ROE from casinos is not far enough above the AFFO yield to support fast growth.

- Moving into other property types that support higher cap rates delivers slower growth and more risk.

- So their rate of growth may well be lot smaller going forward than it was in the past.

But still there is a lot to like.

- Perfect history of rent collection

- Nicely structured debt maturities

- Clear path to modest AFFO/sh growth in the 4% ballpark

- While an earnings retreat is possible it is very unlikely.

The thing is that these aspects worth liking are not that different from those of NNN and Realty Income. Putting this together with the comparison above, it appears that VICI is now overpriced relative to NNN and even O.

As with other value stocks, the main risk to the market value of VICI is the future valuation of their cash flows. In contrast, the dividend is very solid and likely to grow at least modestly.

Who should buy or own VICI today? Investors wanting a dividend yield near 5% that will grow by several percent per year, at minimum. My REITs held for income all pay larger yields than 5% and their dividends mostly should grow at about the same rate as those of VICI. But if yields normalize I would cheerfully diversify into VICI.

Who should avoid VICI today? Investors looking for economic returns above 10% or the best chances of appreciation coming out of the bear market. For stronger economic returns one needs to look outside the REIT sector. It will never approach the 20% economic returns one can find in strongly growing firms.

For stronger appreciation potential amongst REITs, my view is that investors should look to Alexandria Real Estate (ARE), Camden Property Trust (CPT), and Crown Castle (CCI), even after the recent price action. I own all three, with some recent coverage in these articles.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EPR,NNN,ARE,CCI,CPT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Landlord for a 2-week free trial

We are the largest and best-rated real estate investor community on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.