Summary:

- Nu Holdings Ltd. has achieved significant growth in Brazil, characterized by a large customer base, high usage rates, low operational costs, and strengthening existing relationships with additional products.

- The company is strategically expanding into new Latin American markets like Colombia and Mexico, set to replicate success in Brazil.

- Nu Holdings is positioned for continued growth; already becoming a highly profitable business that is still undervalued by most metrics.

- The company is firing on all cylinders with a seasoned management team and strong balance sheet which will allow Nu Holdings to pursue growth new opportunities.

JulPo

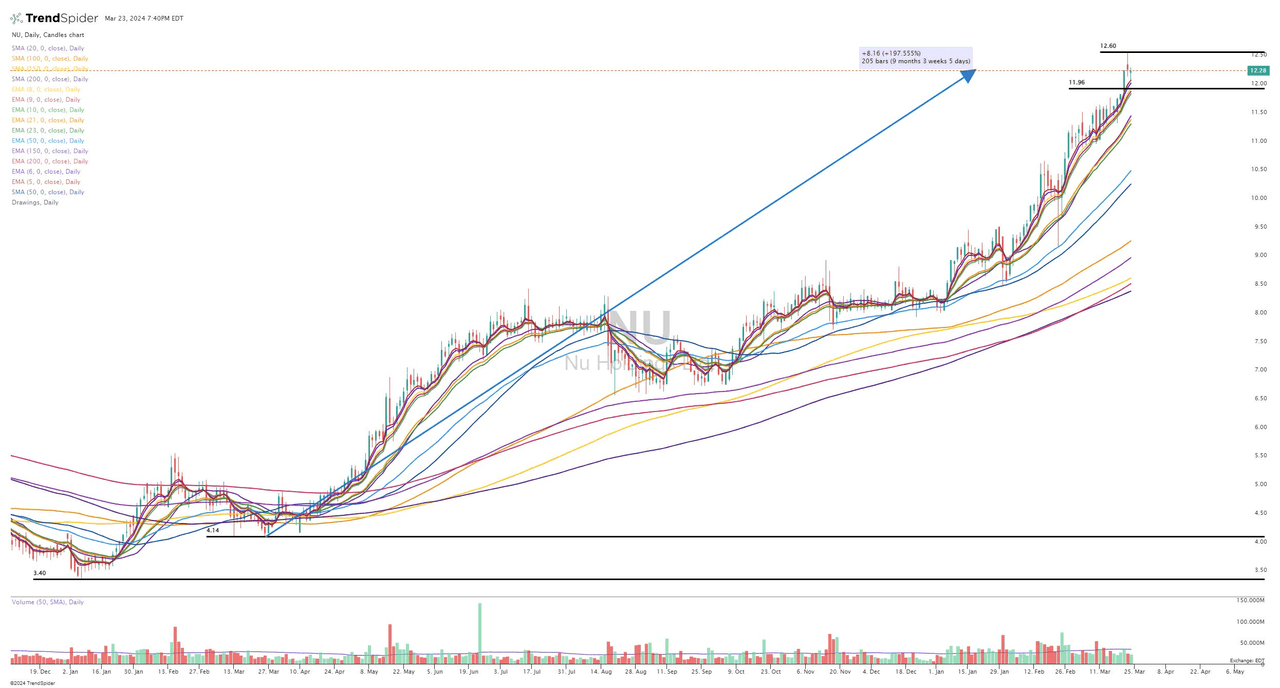

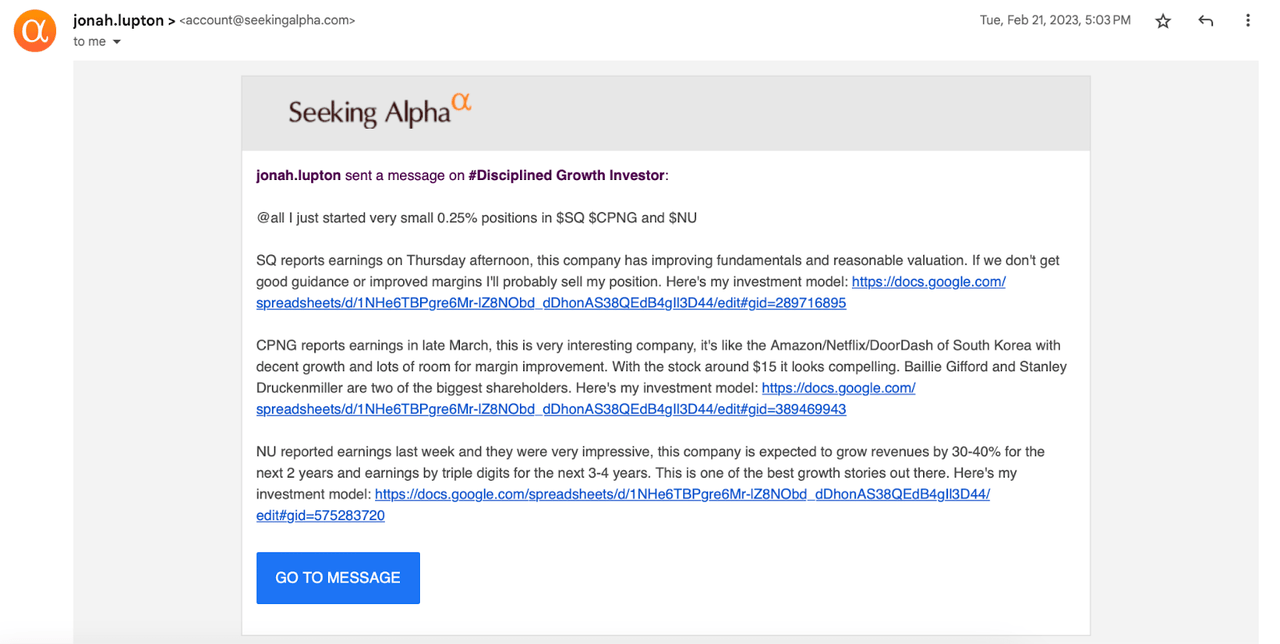

Nu Holdings Ltd. (NYSE:NU) has been on my radar since October 2022, when I published my first mini writeup on the company and started a small position. I did not hold the stock into year-end, but got back in on February 21st, 2023.

At the time, I was actively looking at companies outside the U.S. as a potential hedge against possible U.S. recession while diversifying my investment portfolio and still focusing on stocks that I believed had 100% upside within the next 3 years. Nu Holdings and Coupang (CPNG) were the two most promising/compelling, besides MercadoLibre (MELI), which has been in my portfolio on and off since 2020.

I restarted a position in Nu on February 21, 2023, at $4.75, when the stock bounced off the 20d SMA after a strong earnings report the previous week. Shortly thereafter, I published a comprehensive deep dive (12,000+ words) for my Investing Group on the company. This detailed writeup covered various aspects of Nu’s business, including its history, the banking landscape in Latin America, potential opportunities in Brazil and other countries in the region, as well as its business model, financials, competitive edge, and risks.

Subscribers’ Notification (Seeking Alpha)

After starting with a 0.25% position, I was adding aggressively over the next few weeks as the stock pulled back below $4.15.

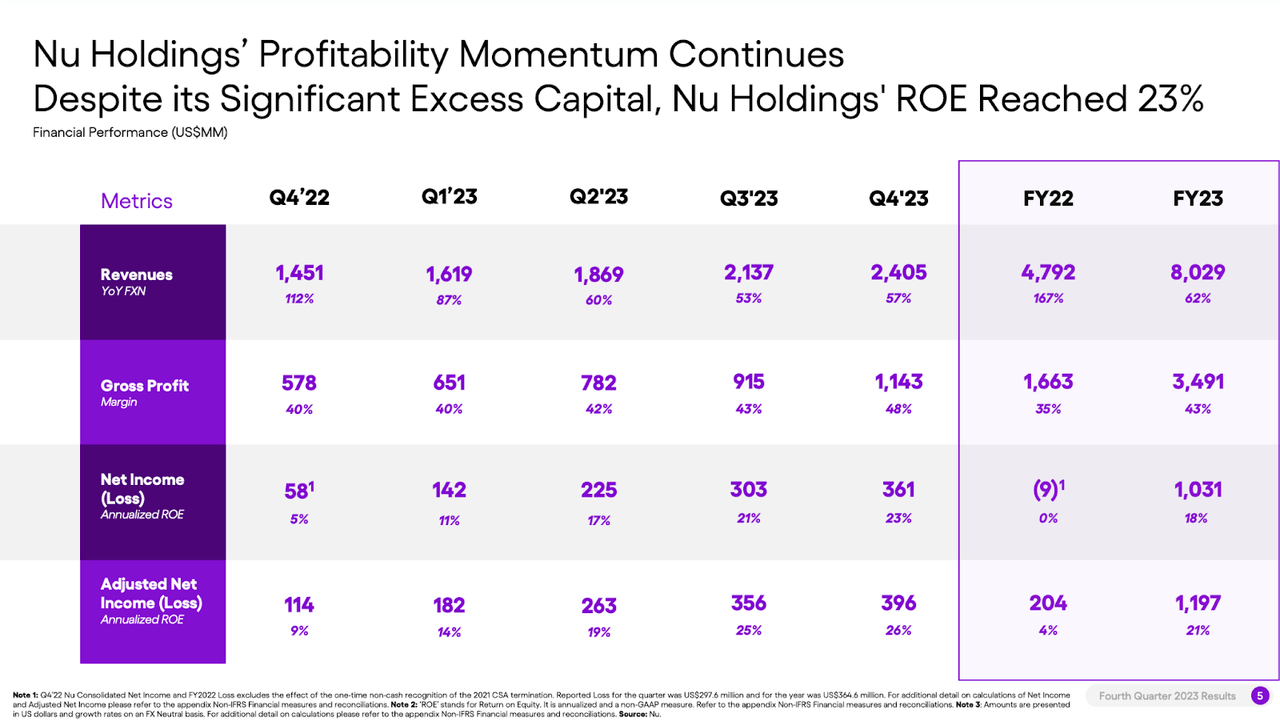

At the time of publishing the deep dive, the company had just reported its Q4 2022 earnings, delivering its first-ever profitable quarter on a net income basis. Management also promised the company would achieve its first full year of positive earnings in 2023.

Looking back, I wish I had bought more NU stock last February because it’s up +197% in the past ~13 months.

I trimmed my position several times over the past few months to lock in some gains. However, I still hold a substantial position at 5.4% – despite NU’s performance since the lows last year, I believe the stock could double again over the next few years.

If Nu was a U.S.-based company, I would have started with a larger position, and it might be closer to 8% today, but given the risks inherent to the Latin American region, such as political risks, extensive regulations, FX risks, rapidly developing competition (Inter & Co is a fast-growing alternative to Nu), and that Nu will always trade at a discount to its counterparts in the U.S., I have to keep it below 6%.

Nu offers me good diversification into the LatAm market, which is one of the fastest growing markets in the world, yet in the early stage of its economic potential. NU is also growing faster than MELI and trades at a lower multiple.

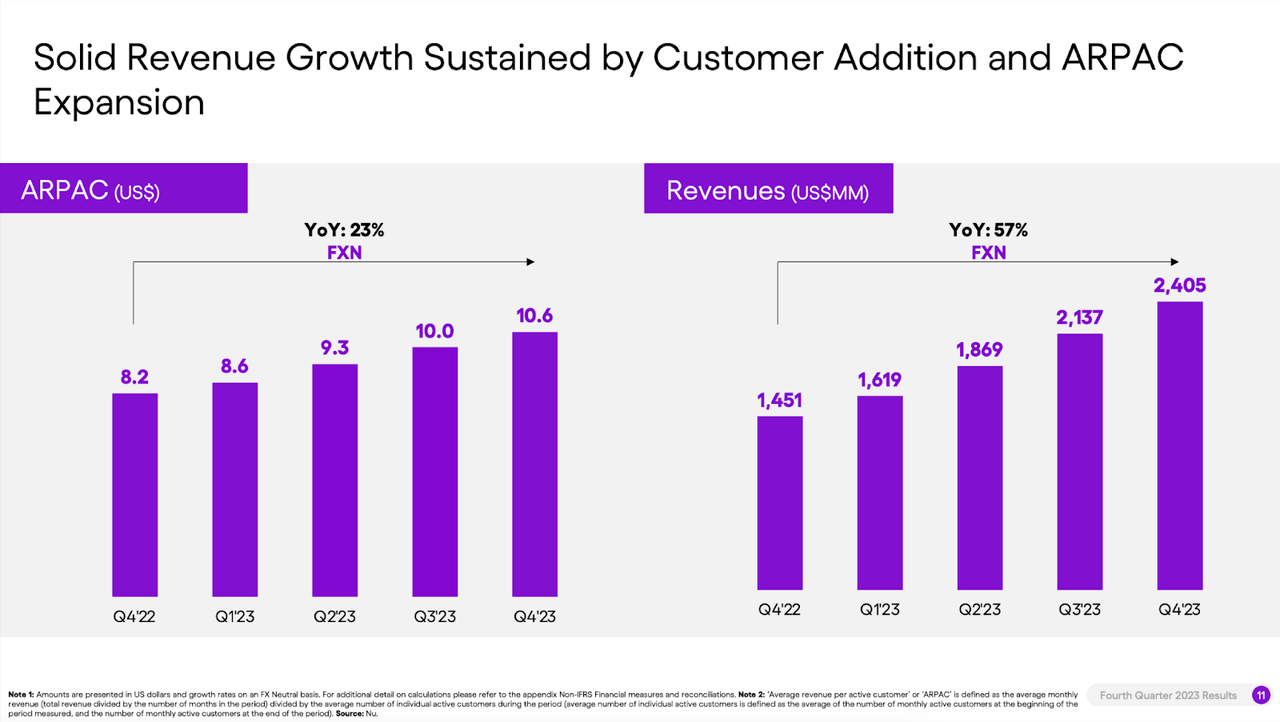

Before I outline my investment thesis for Nu, I’d like to briefly comment on its fantastic 2023 results. Despite a considerable slowdown in revenue growth (62% YoY in 2023 compared to 167% YoY in 2022), the company continued to execute strongly, delivering $8.02 billion in revenues while generating $1 billion in net income. The latter is absolutely remarkable, given that the company posted a $9.1 million net loss a year ago. At the same time, margins have improved, while all key metrics, including customer growth in Brazil, either improved or stayed intact.

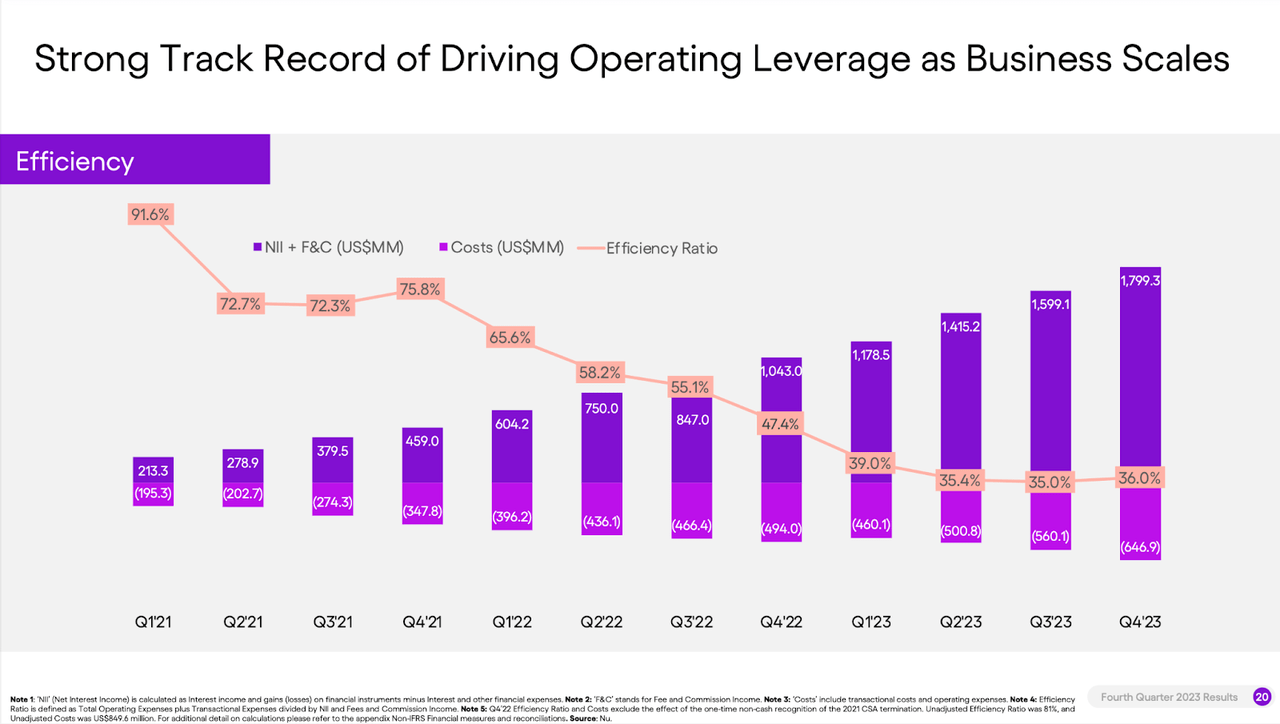

Investor Presentation (Nu Holdings)

This proves Nu’s ability to be a highly profitable business on a scale with plenty of operating leverage. I am more confident than ever that Nu is on the way to becoming a $100+ billion financial powerhouse in Latin America – big investors, including Warren Buffet’s Berkshire Hathaway, Baillie Gifford, Tencent, Sequoia, and the founder of Visa, among others, seem to think alike. This helps to reinforce my investment thesis, especially for companies outside the U.S. where there’s definitely more risks involved.

Investor Presentation (Nu Holdings)

Investment Thesis

My investment thesis for Nu starts with its primary opportunity in Brazil, the seventh-largest economy and one of the fastest-growing in the world. Brazil is home to over 215 million people, almost half of whom are under 30 years old. These young and dynamic individuals are the driving force behind the growth of the middle class and the economy as a whole. This demographic group will spend more in the coming years, and more credit will be taken to support this spending. Furthermore, Brazil is among the top countries globally with the highest mobile adoption rates. According to GSMA, smartphone adoption in Brazil will reach a whopping 88% by 2025 from 78% in 2022.

At the same time, Brazil is significantly underbanked – don’t confuse it with unbanked. Historically, Brazilian banks have been among the most profitable banks in the world, with average ROE in the 20% range. Ridiculous fees and interest rates ripped people off for decades, while customer service was inferior. Nu ultimately changed that, and I tell the entire story of how they did it in my full deep dive. But in short, the landscape of the Latin American financial services industry has changed forever.

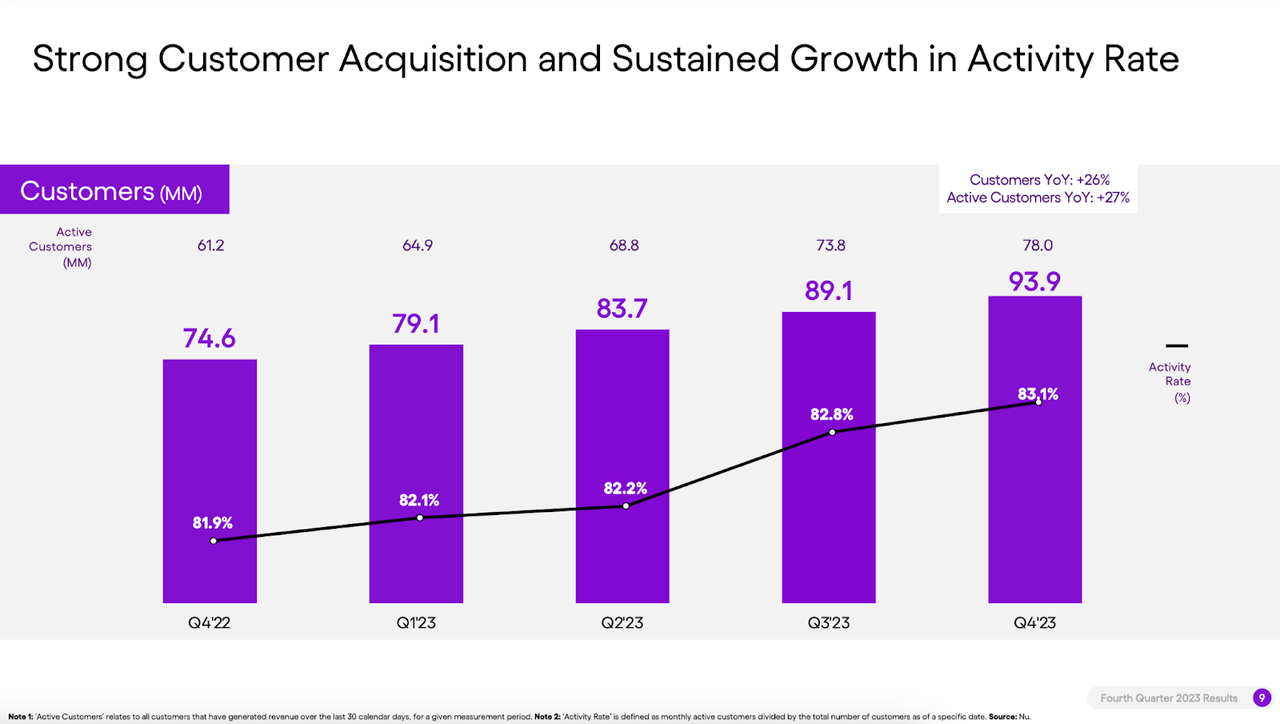

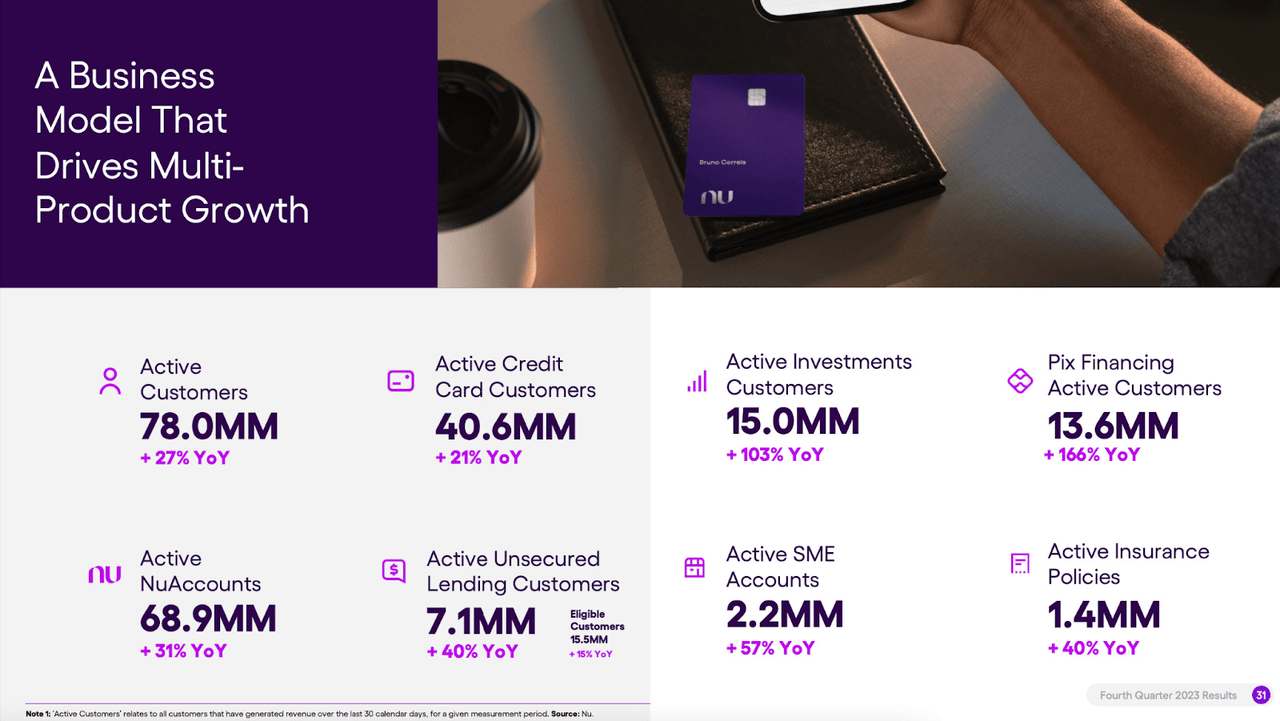

While Nu’s mobile banking is no longer a breakthrough as it was a couple of years ago, as many traditional banks have started adopting a similar approach and new startups have emerged, Nu is still better in every aspect, from technology and customer support to fees and the suite of offerings. This is reflected in the continuous growth of users. The company reached a total of almost 94 million customers (+19 million YoY), of which 87.8 million are in Brazil, representing 53% of the country’s adult population. 83% of these 94 million registered users used Nu at least once a month, a solid rate of usage. Nu is the primary banking solution for 61% of the monthly active customers.

Investor Presentation (Nu Holdings)

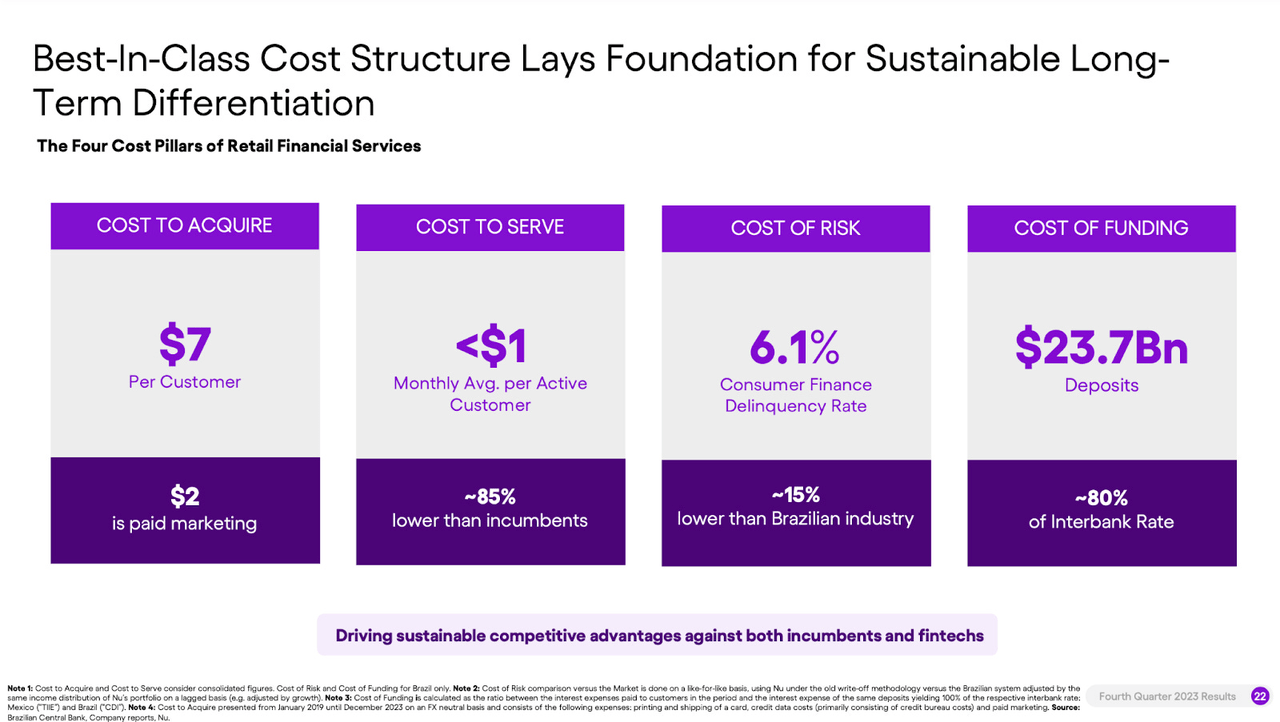

What is even more remarkable is how Nu reached these numbers. It took the company just a little over ten years to hit almost 100 million users (Nu will surpass 100 million customers in 2024), while customer acquisition costs remain incredibly low (~$7 per customer, one of the lowest in the banking industry worldwide) and costs to serve active customers remain below $1 per customer (which is 85% lower than traditional banks in Brazil spend per customer). Even fintechs have a tough time keeping up with this.

Investor Presentation (Nu Holdings)

Customer growth in Brazil will eventually flatten, and we have already seen the progressive shift from customer acquisition to customer monetization, which will further grow revenues and accelerate earnings. Brazil’s operations reached a profitability inflection point in 2022, generating $185 million in net income for the full year for the first time in the company’s history. In 2023, net income skyrocketed to over $1 billion, a mind-blowing increase of almost 500% in just 12 months.

And this seems like just the beginning for Nu. Analysts expect the company to grow its earnings at a minimum of 50% CAGR in the next 3 to 4 years.

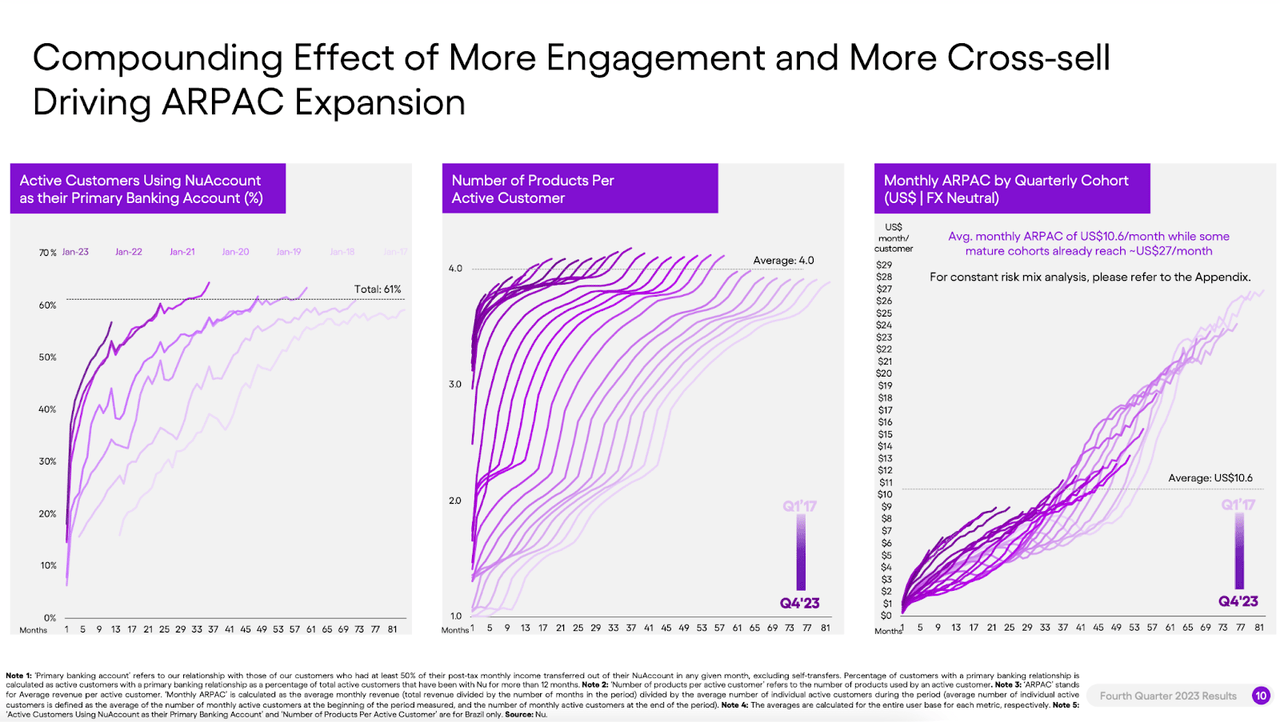

One of the primary growth drivers will be the continuous expansion of revenue per active customer (ARPAC), a critical indicator of the growing business. Nu’s ARPAC reached double-digit ($10) in Q3 2023 for the first time in the company’s history and increased to $10.6 in Q4 2023, a 23% expansion YoY, with more mature cohorts already at $27. Yet, it is still far from what big banks in Brazil earn: their ARPAC, on average, ranges between $33 and $54 per month.

Investor Presentation (Nu Holdings)

I am not sure that Nu will ever reach the same levels (as the legacy banks), but there is certainly more room for ARPAC growth, which will come from cross-selling and upselling opportunities within Nu’s constantly expanding portfolio of products across five categories: banking, investing, lending, insurance, and savings.

Investor Presentation (Nu Holdings)

Those who question Nu’s long-term moat must remember that every new product a customer adopts increases the customer’s stickiness and switching costs. Today, on average, every active customer uses 4 products, with new cohorts adopting new products at a much faster rate.

Investor Presentation (Nu Holdings)

The company’s key products remain in the lending category. At the end of the day, Nu is a bank that generates approximately 80% of its total revenue from lending money to its customers. The growth of the lending portfolio is the key indicator that customers are using Nu’s platform more and more.

I will not go into a deep analysis of its asset portfolio in this writeup, but I would say that it remains healthy. For example, a 15-90 NPL ratio (loans where the borrowers are not fulfilling their financial commitments to repay) decreased another 10 basis points quarter over quarter to 4.1%, while its 90+ NPL ratio stands stable at 6.1%, a pretty high delinquency rate but still lower (about 15% lower) than across the industry.

I really like Nu’s approach to credit underwriting: operating under the assumption that the future will present more challenges than the present, such as increased delinquency rates. Its models constantly price this in.

Furthermore, if you look at the company’s credit exposure (Nu’s total loan portfolio as of the end of 2023 was at $18.2 billion (up 49% YoY and 18.18% QoQ), of which $14.5 billion are credit card loans (80% of total) and $3.7 billion are personal loans (20% of total)), you will notice that it is predominantly short-term, with the average duration of 6 weeks for its credit card portfolio and 6 months for personal loans. In uncertain times, Nu can pretty quickly reduce the overall risk exposure, even at scale.

Going forward, I am specifically looking for the growth of secured (collateralized) loans in Brazil, which have much higher margins than unsecured loans and provide the company with much more stability and less risk. Nu is progressing on this front, recently introducing payroll loans (currently for federal public servants, retired and pensioners who are beneficiaries of the National Institute of Social Security) and FGTS-backed (a mandatory savings fund for employees in Brazil, in which employers are required to deposit a percentage of an employee’s monthly salary) loans.

Further growth in Brazil will also come from gaining a share in the upmarket segment. The company has already shown substantial progress in growing the wallet share of the upmarket segment and increasing purchase volume, which jumped to $32.6 billion in total in Q4 2023, up 29% YoY and 12.4% QoQ. Nu is actively working towards bringing mid to high-income individuals who already have relationships with major banks to its platform by offering attractive loans, which is a win-win situation for both sides: this segment of customers has higher chances to pay off the debt, which allows Nu to offer loans at much better rates without sacrificing on profitability.

The opportunity in Brazil remains significant, and I am pretty sure that Nu will continue to flourish in its home market. The question now is: can Nu replicate the same success in other markets?

The second part of my investment thesis for Nu is its international growth, specifically in Colombia and Mexico. These are the two other countries in South America with relatively stable economies and the same attributes like high mobile adoption, internet penetration, young demographics, and a high percentage of the underbanked population.

Nu established its operations in these countries in 2020 but has been taking baby steps since then, having launched its flagship credit card offering first. Both countries have pretty low (in mid-teens) credit card penetration rates, providing plenty of growth opportunities.

The strategy here is to roll out the products gradually, keeping the costs low and learning along the way. The other reason is that Nu is in the process of acquiring the necessary financial and banking licenses in both countries, which takes time and close attention from regulators. These limit its operations currently.

Nu is in the early stage of its growth in both countries, having just 5.5 million (up from 4.3 million in Q3 2023) customers in Mexico (128 million population) and 800,000 in Columbia (51.9 million population). The growth trajectory is expected to accelerate with the launch of new products, like the recent introduction of savings accounts featuring high-interest rates. Deposits in Mexico have already soared to surpass $1 billion at the end of Q4 2023 (just in 7 months since the launch), and Colombia will only see the effects of launching the savings account product, which went live in January 2024.

I personally think Mexico is an even bigger opportunity than Brazil ten years ago. Not only is Mexico already surpassing Brazil’s early growth rate, but it also has some attributes that Brazil does not have, such as the massive U.S./Mexico remittance market, valued at $61.49 billion in 2023. Stepping into the remittance market will accelerate the growth of new customers who will have more incentive to open an account with Nu. The recent launch of the option of being able to receive money from the United States, in partnership with Felix Pago, is the first step towards it.

Ultimately, I see Nu as a one-stop shop for anything related to finance in all markets of operations. Management strives to create a Money Platform with multi-products, covering literally every aspect of its customers’ financial lives while making it affordable, convenient, and secure. The biggest opportunity is actually in getting more and more people to move their entire financial lives to Nubank.

This is the recipe for becoming a $100+ billion financial powerhouse in Latin America, which I believe Nu will achieve in the next 3-4 years by capturing a significant market share from legacy banks, expanding its overall opportunity, and operating with superior economics. Not to mention that it will be a highly profitable business on the scale, opening new opportunities for the company not visible on the surface right now, which could include wealth management, investment banking, and much more.

Valuation

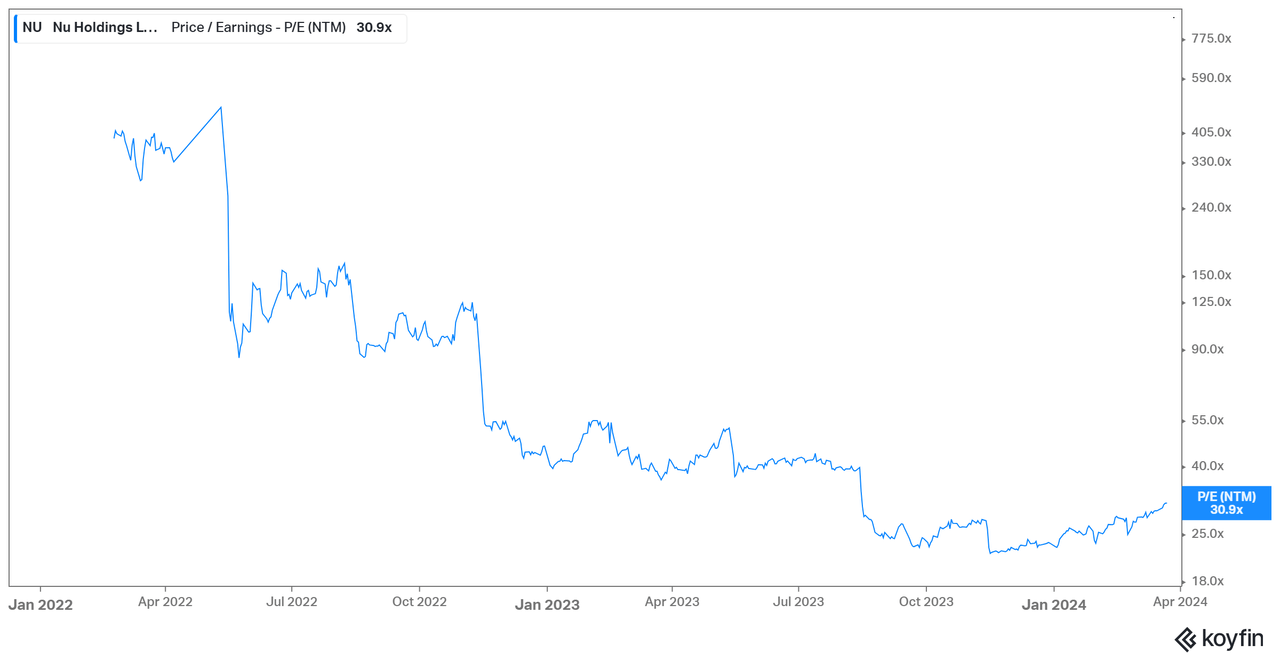

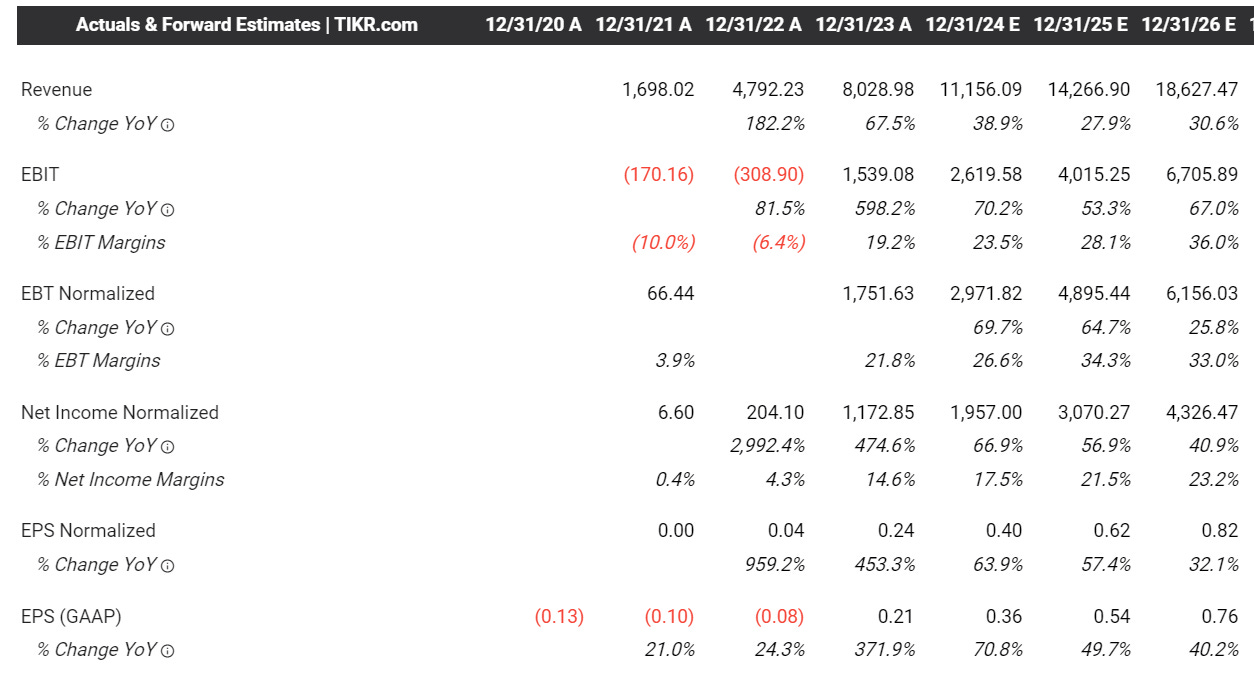

NU doesn’t provide guidance (same as MELI), so we’re partly relying on the analysts. Below are the current consensus numbers. As you can see, revenues are still growing nicely, but margins have gotten much better over the past couple of years, and analysts are expecting continued improvement in that area – going from -10% EBIT margins in CY2020 to +19.2% EBIT margins in CY2023 is incredible, but growing revenues by +372% over the past 2 years is even more incredible.

In terms of multiples, we don’t have EBITDA or FCF, but we can still look at EBIT and P/E. With the current enterprise value at approximately $53.8 billion, it means…

NU is trading at:

-20.5x CY2024 EV/EBIT- 27.5x CY2024 EV/NET INCOME- 13.4x CY2025 EV/EBIT- 17.5x CY2025 EV/NET INCOME

To be honest, if you look at the expected growth rates below (70% EBIT growth in CY2024 and 53% EBIT growth in CY2025), I’d argue that NU is at least 50% undervalued at current prices.

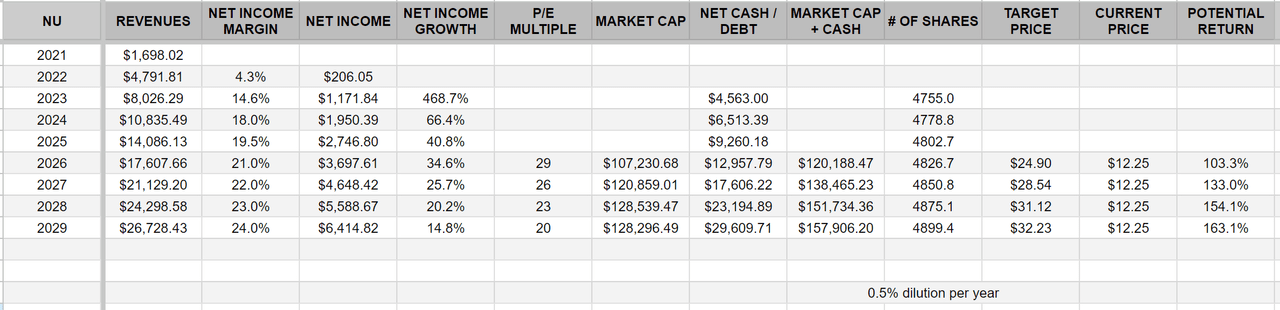

Just look at the net income estimates for CY2026 at $4.3 billion. If net income is growing 40% in CY2026 and 30% in CY2027, throw a 32x multiple on $4.3 billion, add back the cash, divide by 4.8 billion shares, and you have a $30+ stock – however, I don’t think NU will ever trade at a fair multiple because of the risks associated with being a LATAM company I covered earlier.

NU Estimates (TIKR)

Using the consensus estimates above plus my own estimates through CY2029, here’s my updated investment model (which gets updated quarterly). Based on my model, I do think NU could double again over the next 2-3 years with 150-200% upside over the next 4-6 years.

NU’s Investment Model (Jonah Lupton)

Conclusion

NU’s fundamentals (revenue growth, earnings growth, margin expansion, etc.) are incredible, and the current valuation is very reasonable (if not very undervalued). However, it’s hard to predict what risks or headwinds NU might face in the coming years from new competition or different geopolitical events in the countries it operates in or hopes to expand into.

Just like UBER, CELH, and SMCI, I think NU has made easy money; However, that doesn’t mean it’s not worth owning at these prices if you’re a long-term investor.

If NU was based in the U.S. with these numbers at this valuation, it would definitely be my largest fintech position, but for now, I think ~5.4% is big enough, and of course, I’d add to NU on any pullbacks. NU has never been stronger in terms of operating results, yet the valuation and multiples still look very compelling. There are U.S.-based fintechs growing half as fast as NU with worse margins yet trading at P/E multiples at least 50% higher than NU.

It’s honestly hard to find anything wrong with Nu Holdings Ltd. – it’s mostly just the risks of operating in countries like Brazil, Mexico, etc., where governments can perhaps be influenced in an effort to help the legacy banks fight back against NU. But outside of unpredictable geopolitical events, I think NU will keep crushing it. By CY2030, this company should have 150-200 million customers with an ARPAC of $20-30 per customer, especially if they continue to grow their product portfolio and push into wealth/asset management.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NU, MELI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Jonah Lupton is a former Wall Street wealth advisor and portfolio manager turned entrepreneur and full-time investor/trader. Jonah is looking for companies with 100%+ upside over the next 2-3 years.

Jonah leads an investing group, Fundamental Growth Investor, where he and his team publish the most comprehensive deep dives on public companies (7,000+ words). Jonah also shares his investing and trading portfolios (3.5-year CAGR of 86%) alongside investment models, daily webcasts, quarterly earnings analysis, trading alerts, and a live chat community group.