Summary:

- Various estimates put the grid scale battery market at over one trillion dollars.

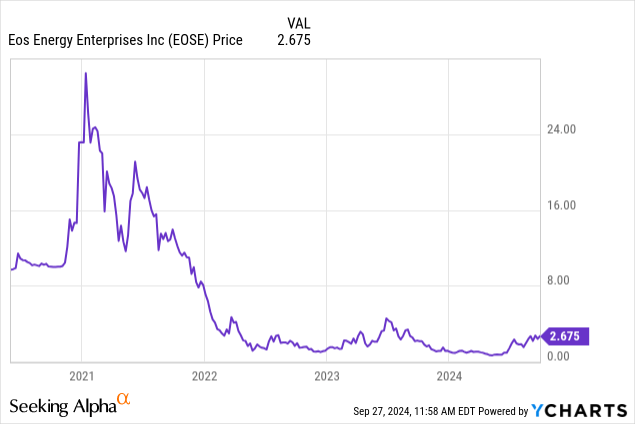

- EOS went public via a SPAC, suffered, and has come back to life with a large financing package and another large potential government loan.

- The chemistry used by EOS is more benign than others, non-flammable, and offers an economic longer duration discharge than other solutions.

Investment Thesis. As discussed below, the gridscale battery market is more than a trillion dollar opportunity over the next 15-25 years. A market of this size will support multiple players. And some of those players are already beginning to emerge, with their different battery chemistries and different capabilities.

Today, the largest installed base of grid scale batteries are lithium ion, that can discharge their energy over 2-4 hours, handling short blackouts, and frequency and voltage dips on the power grid. Other battery chemistries can discharge their energy over 4-12 hours, helping to bridge from afternoon solar production through the night to morning production. Further technologies can discharge over multiple days. These last two duration categories are referred in industry parlance as LDES- Long Duration Energy Storage.

This article will focus on LDES capable batteries and on one entrant, Eos Energy Enterprises, Inc. (NASDAQ:EOSE). EOS went public via a SPAC merger in November 2020. Like so many SPACS their stock went into a death spiral and they burnt through their available cash quickly.

Then, in August 2023, the company got a provisional loan commitment from the DOE for $398.6 million. And they are still waiting for that commitment to close. In June 2024 the company obtained a loan for $315.5 million from the alternative investing giant partnership Cerberus. While the terms of this facility are very rigorous, with multiple hoops through which the company must fly, it took speculation about their imminent demise off the table.

What are the headline numbers? As discussed below, projections are all over the map including endpoints, definition, and units used. But here are the headlines:

- Bain, quoted in the economist on September 1, 2024, feels the grid scale battery market will be $1-3 trillion in 2040. Author converts their forecast to 50 TWh in 2050.

- Stifel feels the installed capacity of batteries will be 3,000 TWh in 2050. Have emailed the analyst to see if this outlier number is an error (should it be GWh?).

- The US DOE has done a series of “liftoff reports including “Pathways to Commercial Liftoff: Long Duration Energy Storage” Their report has a very narrow definition of LDES ranging from 10 hours duration to 160 hours, missing the very very large portion of the battery market below 10 hours. They show the installed base for this segment as 469 GW. Author converts their forecast to 4.69 TWh in 2050.

- McKinsey, in conjunction with the LDES council, has a long report on the LDES market. In it they posit, “…[LDES will have deployed] 85 to 140 terawatt-hours (TWh) of energy capacity by 2040 and store up to 10 percent of all electricity consumed. This corresponds to a cumulative investment of $1.5 trillion to $3 trillion”

- Dr. Meng, of Argonne Labs, gave an excellent Ted talk. In it she mentions the need for 100’s of TWh of grid scale battery, alas with no time mentioned. This would mount to trillions of dollars at today’s battery prices.

My summary of these headlines is that this at least a trillion dollar market looking out 15 to 25 years.

And what about EOS? EOS commissioned their State of the Art robotic manufacturing line at the end of the second quarter. In one of their first batch of tests for the Cerberus loan they demonstrated that they can assemble the major components of their zinc halide battery every 10 seconds. The stated capacity of this line is 1.25 GWh per year. At the company’s stated selling price of $250/kwh, derived from its regular backlog reports, this is $312 million per year. But in an excellent bit of math on x.com @Ugur Seker shows the capacity may already be more than twice this amount.

Eos’s Z3 battery is well priced and well positioned in a market that is beginning to stratify into discharge duration:

| Company | Chemistry | Duration Hours | $/kwh | Notes |

| Tesla | LiOn | 2-4 | $264 | 1 |

| EOS | Zinc Halide | 3-12 | $250 | 2 |

| ESS | Iron/Salt Water | 3-12++ | $378 | 3 |

Notes:

- Order Megapack | Tesla

- price derived from backlog charts, see e.g.

- ESS disclosed the sale of one “Energy Warehouse” in 3Q 2022, with this implicit price. The price per kwh for its newer and larger “Energy Center” just being released should be substantially less, and perhaps in line with the two other chemistries.

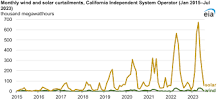

Why is duration of discharge important and why will it stratify the market? The preponderance of grid scale batteries installed today are Lithium Ion technology. While paralleling batteries allows longer discharges than those shown, the economics of doubling the cost every time you parallel the battery doesn’t allow it. Hence the need for other chemistries with an economical way to deliver longer discharge duration. Here’s a government chart of solar curtailments in California:

California PV Curtailments (EIA)

The way to profit from those curtailment spikes is with an LDES battery such as that made by EOS.

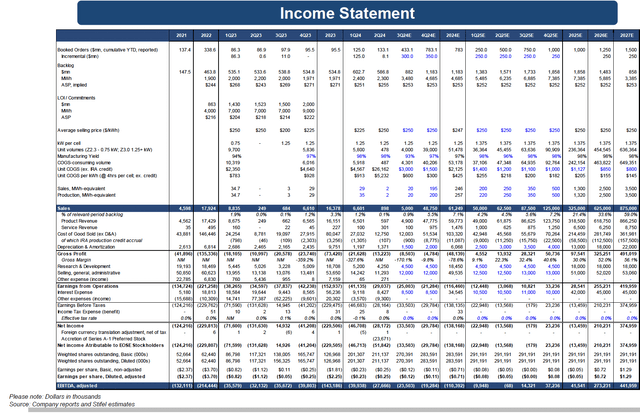

And what about forecasts for EOS? Stifel has put out a good research report with projections. Their stock price forecast is $6 in 2026. Here is their Income Statement projection:

Stifel research report August 21, 2024 (Stifel)

Note that they show positive EBITDA beginning in 3Q 2025. If @Ugur Seker’s math (cited previously) is correct they may already be above the line reading “Production, MWh equivalent” based on a 10-second cycle time on their automated line, and reasonable estimates on yield and uptime. And that would put the $6 price target well within reach before the 2026 estimate.

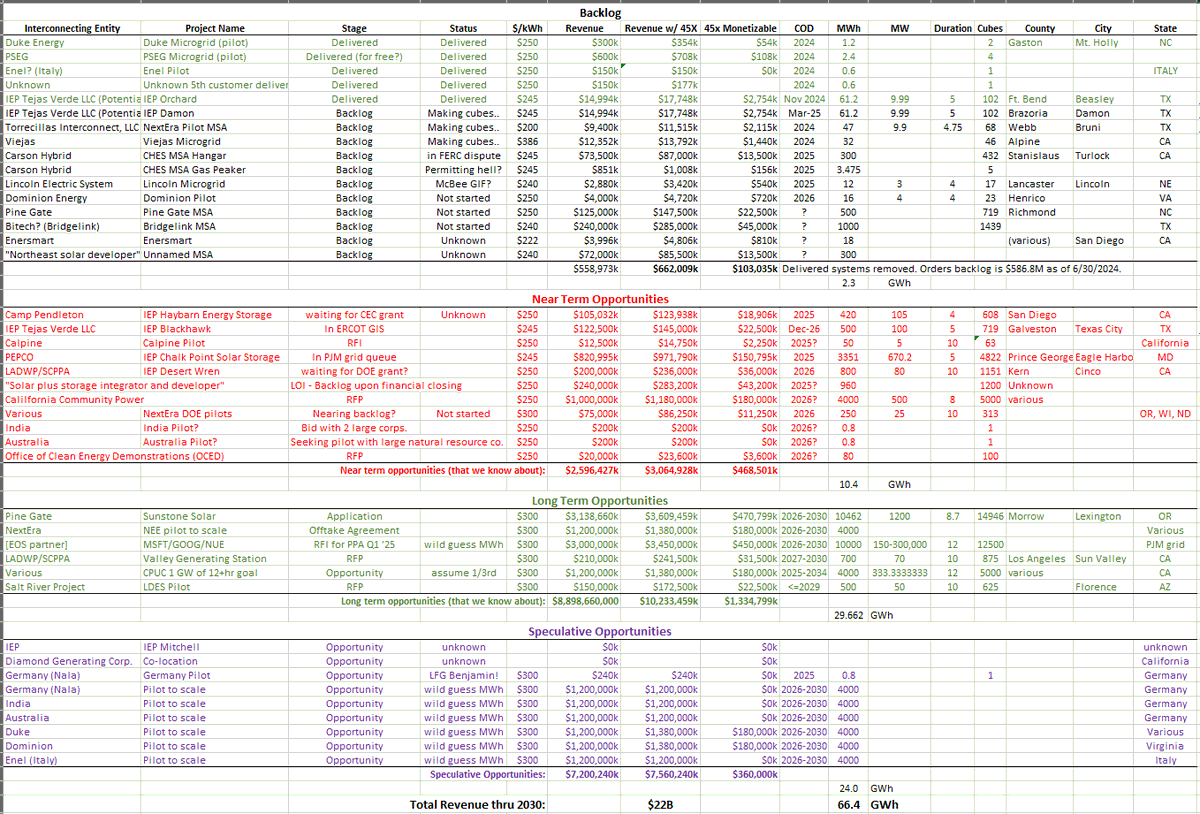

A much more granular look at where this revenue will be coming from is available pinned to the account of @Bert Gilfoyle on x.com:

EOS estimated backlog and pipeline (Bert Gilfoyle x.com)

Kudos to Bert for this painful sleuth work, which he regularly updates, and a finger wag to management for not being more transparent on their backlog and pipeline.

Pros and Cons of EOS and their zinc halide chemistry.

Pros:

- Product is 90% sourced in the USA. This makes the product eligible for greater credits under the Inflation Reduction Act.

- Mining of the main component zinc is much more environmentally benign than lithium.

- Having just started up their automated line, EOS has immediate availability. The Tesla Megapack, for instance, has deliveries dating into 2025 and beyond.

- The zinc based Z3 Cube is non-flammable. Lithium batteries seem to be reporting about a fire a week recently.

- Price is better.

Cons:

- While there is a need for confidentiality, there is zero visibility into what is holding up the issuance of the DOE loan.

- There is limited visibility on the covenants for the Cerberus loan. Heavily redacted documents are available and we know the test dates. But it’s impossible to make an educated guess on whether the tests will be met.

- I believe management has done a poor job on press releasing their pipeline and backlog. Vendors, customers and competitors and municipalities have more information than do the shareholders.

- Related to the point on visibility on backlog and pipeline, we don’t know the probability or timing of this turning into revenue.

Conclusions. I have established a large position in EOS common stock and options after the Cerberus loan was made. With the current pace it “feels like” the redacted performance goals for additional tranches of Cerberus funding will be met. The performance of the first automated line is truly impressive and beyond that which was initially telegraphed. Cerberus seems to be delivering customers to the table, and may be financing their projects. I believe the 2026 $6 price target that Stifel has set out may be exceeded, perhaps as soon as this year.

Good luck to EOS longs!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EOSE GWH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.