Summary:

- Previously left-for-dead blue chip 3M is currently the Dow’s best-performing stock on the year.

- If it weren’t for 3M’s dividend, long-term returns would be much more muted.

- MMM shares are up just 741% in price since 1990, its total return has been 2,165%.

josefkubes

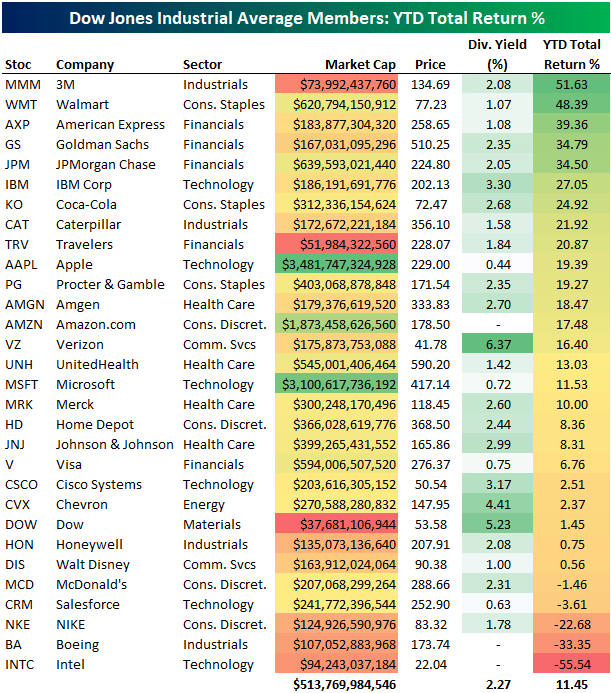

With four months left in 2024, below is a look at the year-to-date performance of the 30 stocks in the Dow Jones Industrial Average. Would you believe that previously left-for-dead blue chip 3M (NYSE:MMM) is currently the Dow’s best-performing stock on the year? With a gain of more than 50% YTD, MMM is just ahead of Walmart’s (WMT) 48.4% gain.

Three stocks in the Financials sector round out the top five: American Express (AXP), Goldman Sachs (GS), and JPMorgan (JPM).

On the flip side, current left-for-dead blue chips have been the year’s worst performers in the Dow: NIKE (NKE), Boeing (BA), and Intel (INTC). All three of these stocks are down more than 20% on the year.

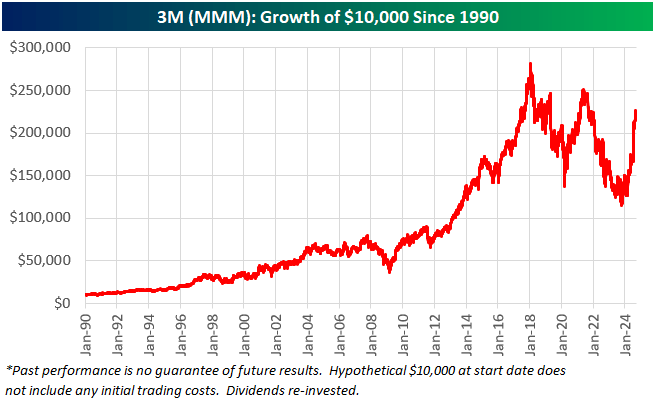

Below is a look at the growth of a hypothetical $10k investment in 3M (MMM) shares at the start of 1990 with dividends re-invested. MMM shares peaked more than six years ago in early 2018, where that $10k had turned into nearly $300k at the highs. From its high point in early 2018 through late 2023, MMM experienced a drawdown of more than 60%, leaving the $10k in 1990 down to just $115k at its recent lows.

With a year-to-date gain of more than 50% in shares, though, the current value of $10k in 1990 is back up to $226k.

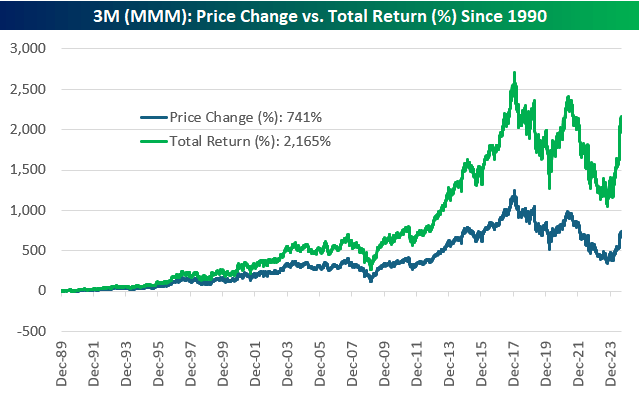

If it weren’t for 3M’s dividend, long-term returns would be much more muted. An easy way to show this is to look at MMM’s share price change versus its total return since 1990. Whereas MMM shares are up just 741% in price since 1990, its total return has been 2,165%. This means that well over 50% of MMM’s returns over this period have been from re-investing the dividends paid out by the company.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.