Summary:

- Netflix’s 2Q results show good execution on its paid-sharing initiative, reigniting subscriber growth and building momentum for the future.

- The focus is shifting towards increasing average revenue per membership with new sales initiatives like ad-supported plans and paid sharing.

- NFLX’s subscriber growth may continue in the near term but may moderate in 2024 due to potential price increases and tapering of paid-sharing rollout growth.

demaerre

Netflix, Inc.’s (NASDAQ:NFLX) 2Q results were positive, demonstrating good execution on its paid-sharing initiative that reignited subscriber growth and is building momentum into 2H. NFLX has recently shifted its focus away from subscriber growth, more toward revenue. As price increases for the current offerings are difficult to implement under the current economic conditions and competitive landscape, management is trying to increase the average revenue per membership (ARM) with new sales initiatives such as an ad-supported plan and paid sharing. The contribution of these plans to sales has been visible in the first half of 2023 and will likely strengthen going forward.

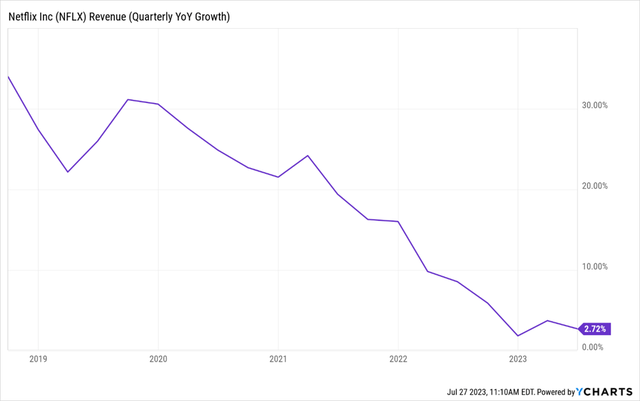

Revenue Growth Will Take Time

On the revenue front, it’s a tale of two different drivers. In 2023, revenue growth will be fueled by volume or new members vs. 2024, where the driver will switch to ARPU as Netflix implements price increases. Its goal has been to accelerate revenue gains by double digits, but the 3Q guidance for 7.5% suggests that may only happen in 4Q. The softer 2Q results and forecast are a function of weakness in ARPU, which Netflix attributed to no price hikes, a change in the mix shift that skews more to lower-ARPU countries and a smaller “extra member” fee benefit that would goose ARPU. The company’s move to nix its cheapest, ad-free tier in the US, UK and Canada will also push members to pricier tiers and boost ARPU.

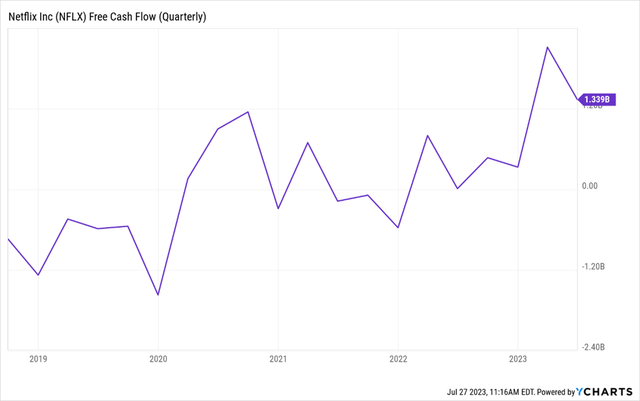

FCF Boost Remains the Highlight

The writers’ strike played a part in the improvement in the company’s free cash flow. The strikes have brought Hollywood to a standstill, but the near-term impacts will be positive for big media’s free-cash-flow profile. Netflix boosted its FCF guidance by over 40% to $5 billion for this year, while Disney suggested that the walkouts will reduce its $30 billion content budget. Though most companies have said they can manage with unscripted and sports, as well as robust libraries, the reality is that the industry would be hurt in the event of an extended strike. The last WGA strike in 2007 lasted about three months. The longer the strikes go on, the higher the uncertainty for 2024, especially for companies with heavy exposure to scripted content.

Surprisingly, the P&L and cash content spending in 2Q were much lower than anticipated, resulting in an operating income beat, albeit not as substantial as the beat on content expenses. This was partly due to a significant increase in marketing expenses, showing a 9% YoY growth compared to being flat in the previous quarter. The company maintained its margin guidance for the year, despite some favorable factors in the quarter and potentially future quarters related to programming costs. However, this guidance seems to consider the possibility of headwinds, such as content write-offs or other ancillary impacts of the writers’ strike.

Overall, 2023 seems to be a transitional year for the company, as it is implementing various growth strategies, including paid sharing, eliminating the basic tier, introducing ad-supported streaming, and making price cuts in many markets. It’s possible that some of these initiatives are pulling growth from future years into 2023, making it essential to observe revenue growth acceleration to evaluate the success of these measures.

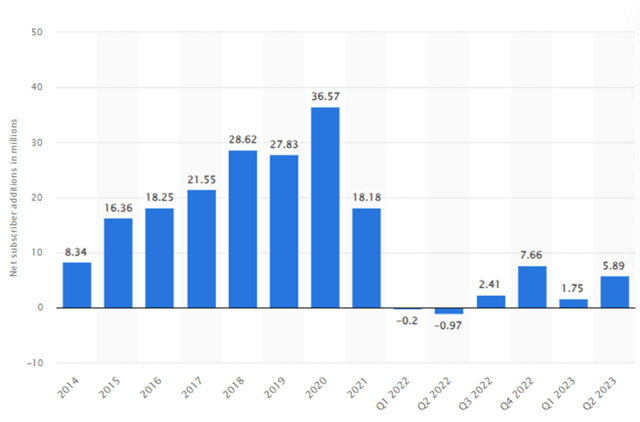

Password Crackdown Initiative Resulting in Sub Growth

The streaming industry is in the midst of a shift in which streamers are no longer chasing subscribers, focusing instead on profitability. One of the key takeaways from Netflix’s 2Q earnings was that the password-crackdown initiative (paid sharing) has gotten off to a strong start. Though there was a risk that it would spark elevated churn, those concerns seem to have dissipated. The streamer posted a solid 5.9 million gain in 2Q and gave guidance for roughly similar additions in 3Q, suggesting that the crackdown is bringing in more new members vs. extra ones. This implies that 2023 subscriber gains could potentially exceed 20 million, vs. 9 million in 2022. Those adds will remain strong but may moderate in 2024, given potential price increases as well as a tapering off of the initial paid-sharing rollout growth. I think there’s a significant subscriber opportunity given a substantial amount of global freeloaders that can be gradually monetized through this crackdown.

A look At The Valuation

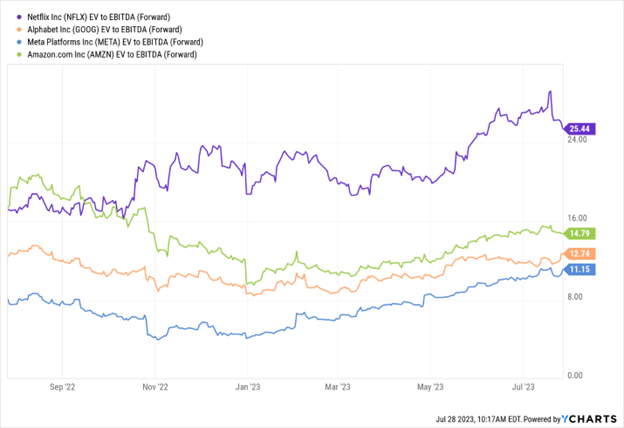

While I acknowledge Netflix’s strong position in the streaming industry, its current valuation seems to already factor in potential gains from short-term growth strategies like paid sharing and advertising. Over the past year, Netflix’s stock has risen by approximately 42%, outperforming the broader market (SPX is up ~19%). The rise in stock has been fueled by fading concerns about subscriber numbers, as the crackdown on paid sharing and password sharing resulted in lower churn rates. As a result, expectations for subscriber growth have increased not only for the current year but also for the future.

Despite the optimistic subscriber growth outlook, there hasn’t been a significant change in revenue and EBITDA estimates for 2023. Thus, much of the stock’s surge can be attributed to an expansion in its valuation multiple. While I remain optimistic about Netflix’s earnings and free cash flow growth, it’s worth noting that the company’s EV/EBITDA multiple of around 26x is substantially higher than that of other tech giants like Alphabet Inc. (GOOG), Meta Platforms, Inc. (META), and Amazon.com, Inc. (AMZN).

To sum up, Netflix has undoubtedly emerged as a winner in the streaming competition, mainly because of the challenges faced by new entrants in the market. However, the current growth expectations rely more on optimization tactics than on broader market trends, suggesting a maturing business model. The opportunities presented by paid sharing and advertising are likely to be most beneficial in Netflix’s mature markets, raising questions about their scalability in the long term. Additionally, the use of paid sharing may accelerate the exhaustion of pricing power, which could have its drawbacks. Consequently, while I am positive about Netflix’s position in the streaming industry and the continued execution by the management, I believe that the current valuation has significantly raised performance expectations for the company.

Ycharts

Conclusion

Netflix’s 2Q results were positive, demonstrating good execution on its paid-sharing initiative that reignited subscriber growth and is building momentum into 2H. Netflix raised its 2023 free cash flow to at least $5 billion on declining cash costs of under $15 billion. The recent launch of NFLX’s adsupported tier, as well as the broader Paid Sharing launch, should further help re-accelerate subscriber & revenue growth while driving high-margin incremental revenue. While I am quite positive on the earnings and FCF growth trajectory, it is important to note that Netflix stock is trading at an EV/EBITDA multiple of 26x. This may suggest that the current multiple already reflects revenue and sub growth and reflects much of the expected improvement from new growth drivers.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.