Summary:

- The Walt Disney Company has shown a promising reversal in profitability in the last quarter.

- Disney’s segments, particularly the “Experience” segment, have performed well, generating significant revenue and operating income.

- The company has a clear plan to save costs, invest in lucrative segments, and capitalize on opportunities such as turning ESPN into a digital sports platform.

Siarhei Khaletski/iStock via Getty Images

Thesis Summary

The Walt Disney Company (NYSE:DIS) has been unfairly beaten down by the stock market, and I believe a big reversal could be due in 2024.

While the company has struggled, the last quarter has shown a very encouraging reversal in profitability, and the company has a clear plan to keep this trend going.

There’s a lot to like about Disney, including its global brand and increasingly diversified revenues.

At this price, I think Disney is a strong buy.

Latest Quarter

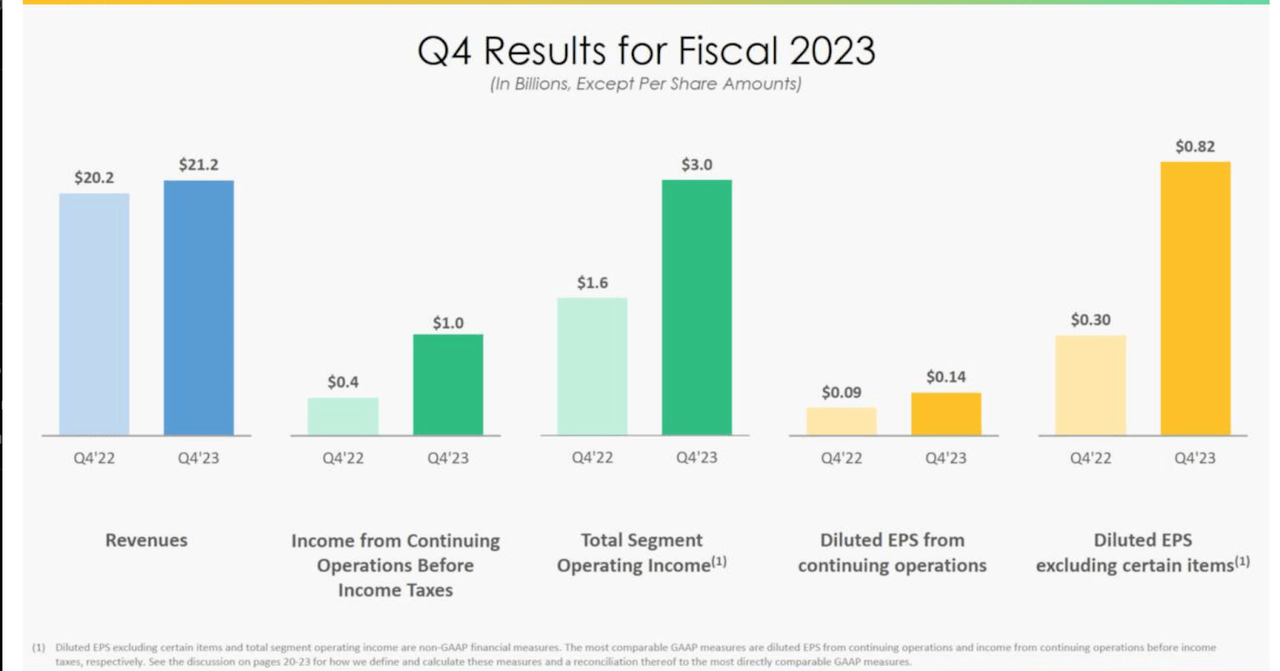

Disney beat expectations in the last quarter, showing great progress towards a return to profitability and exceeding growth expectations.

The company managed to almost double its operating income YoY, while revenues only grew by around $1 billion.

Now, let’s look at each individual segment:

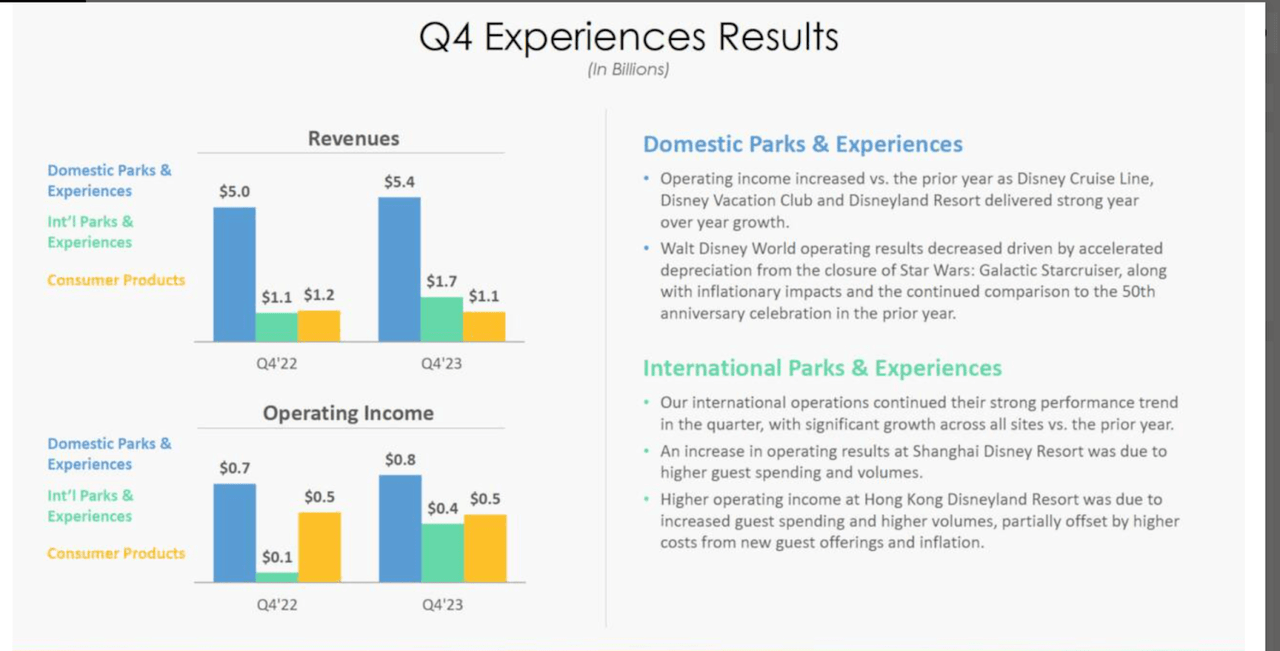

Arguably, the segment that showed the most promise was “Experience”. Disney parks and cruises generated over $8 billion in revenue, generating $1.7 billion in operating income.

The strong performance of the international revenues stands out during this quarter.

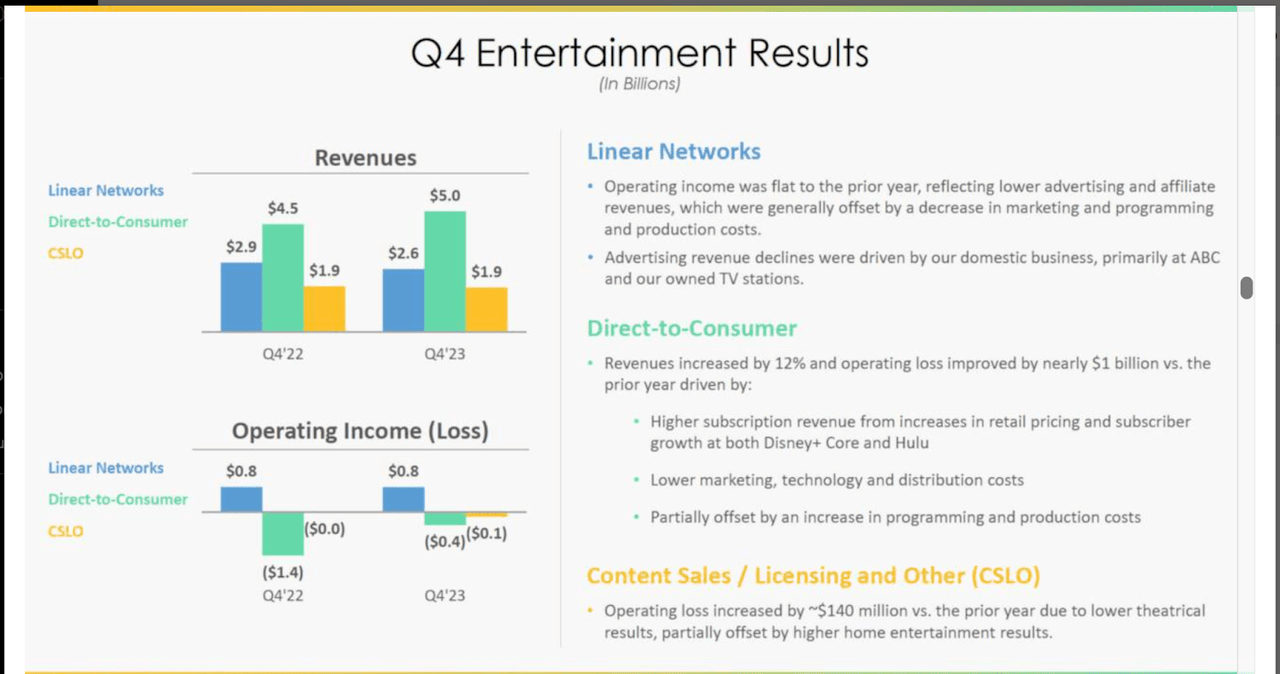

Entertainment (Investor Slides)

Next up, we have Entertainment. Linear Networks, despite falling revenue, maintained positive income, while DTC and CSLO incurred a loss. However, DTC revenue did grow at a healthy 12% while losing $1 billion less than the previous year.

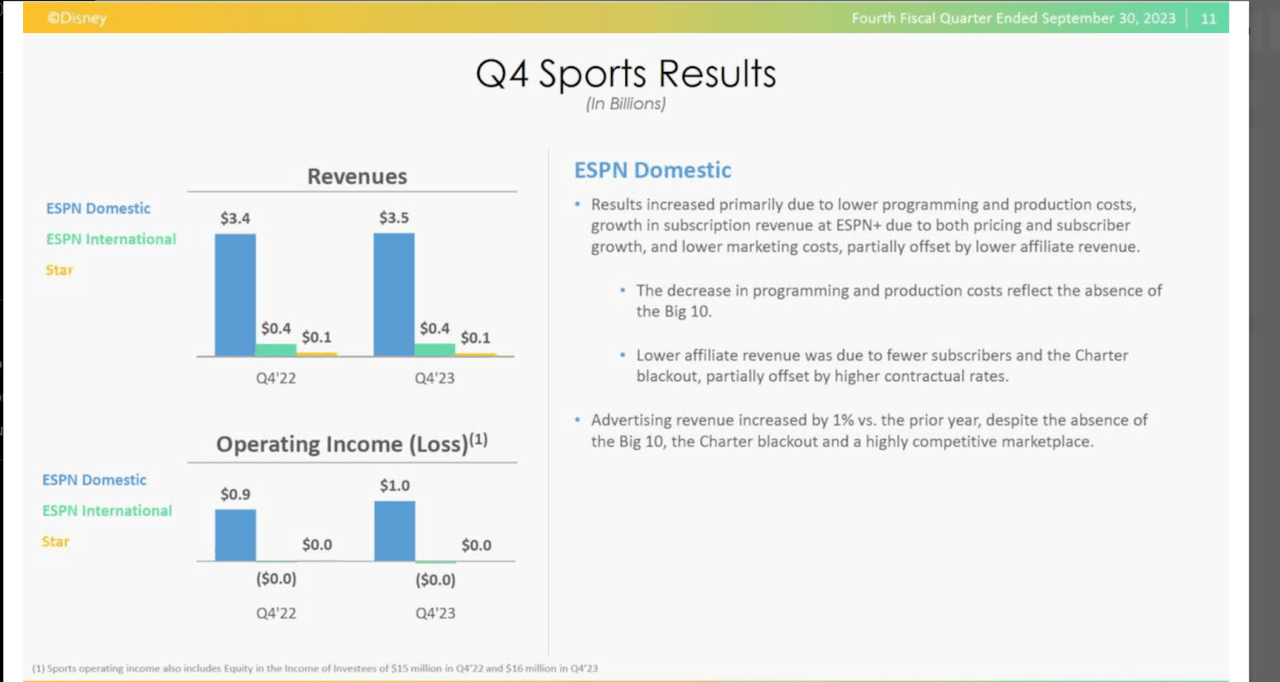

Lastly, ESPN delivered the same results as last year, generating $1 billion in income.

All in all, the last quarter showed an encouraging improvement. The big question now is if Disney can keep the magic going in 2024.

What To Expect in 2024

The way I see it, Disney’s stock has set a great trend, and if it can continue to execute in 2024, then investors could be handsomely rewarded.

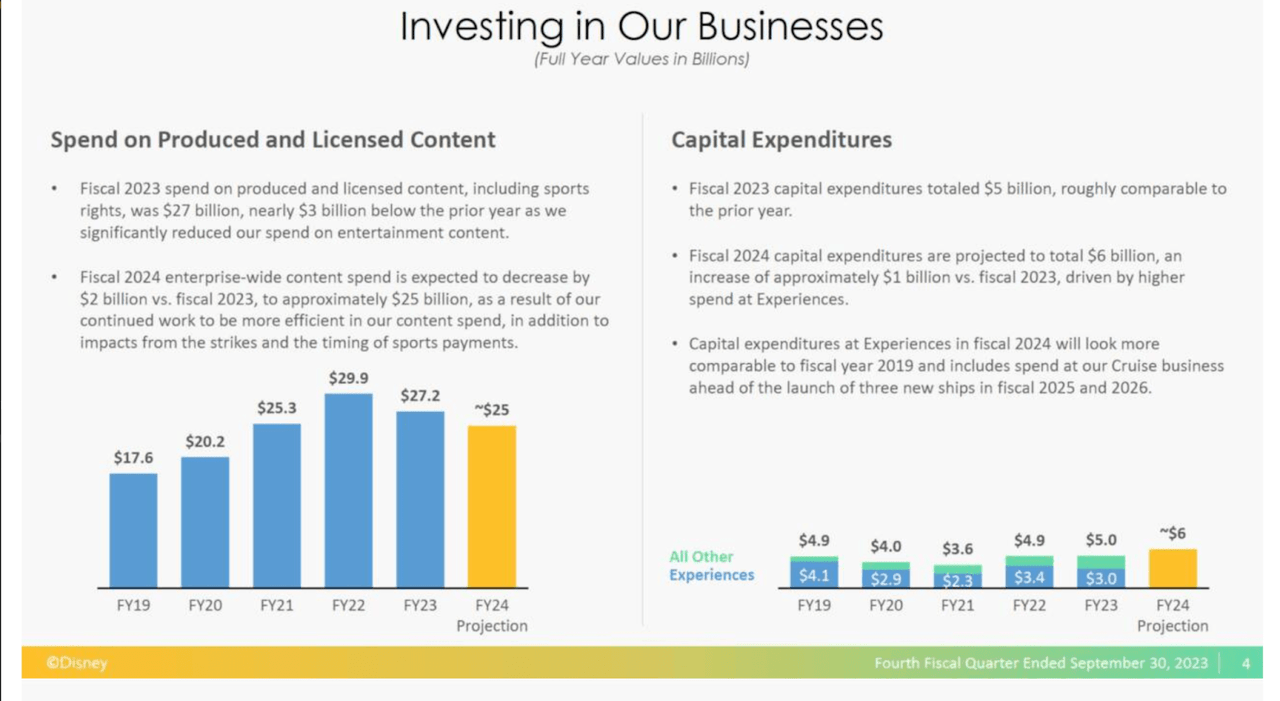

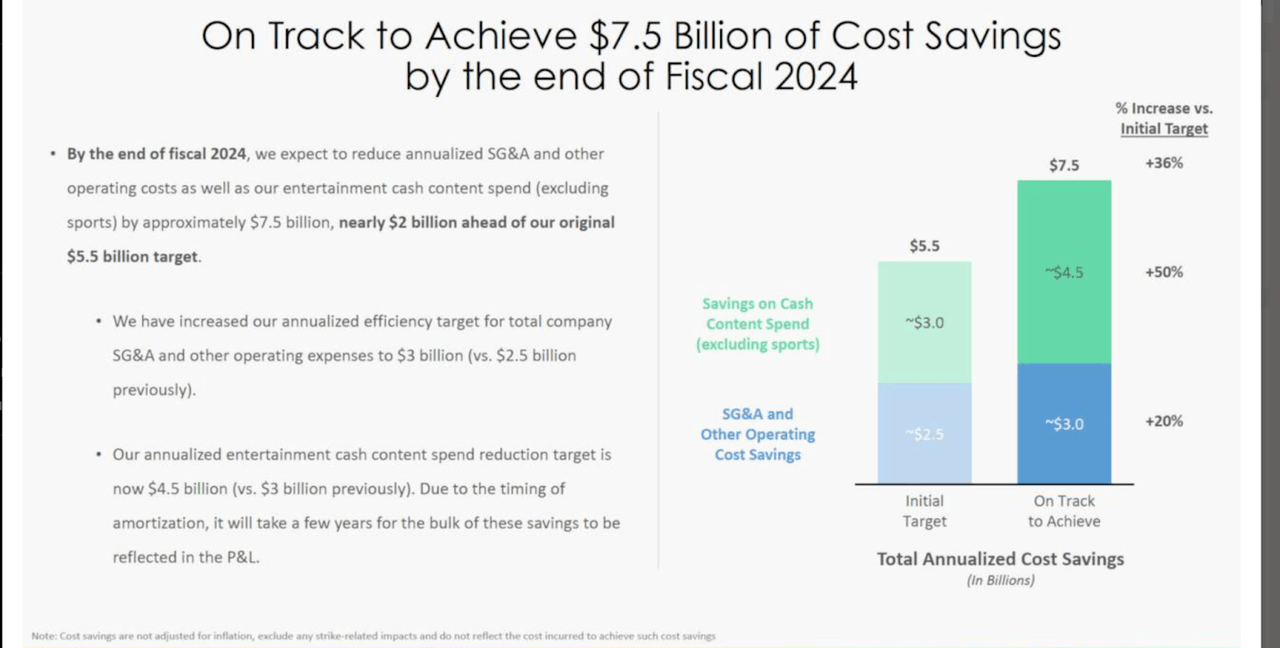

Cost savings plan (Investor slides)

The company has a clear plan to save up to $7.5 billion by the end of the year by cutting down on SG&A and spending less on content. However, as pointed out in the slide, it could take some time for the latter to materialize in the P&L.

And while the company looks to cut down on costs, it still plans to invest aggressively in its most lucrative segments.

By 2025-26, the company will have three more cruise ships. Experiences have been driving the growth, and it makes sense for the company to double down.

Lastly, I think 2024 could also see a big shift take place for ESPN. While many are afraid that the channel will be taken down by the cord-cutting trend, Disney has a great opportunity to pivot.

In the last earnings call, Robert Iger pointed out that ESPN is the most popular brand on TikTok. The value is there, the company just has to find the right way to extract it.

Another core building opportunity is taking ESPN, which is already the world’s leading sports brand and turning it into the pre-eminent digital sports platform, allowing us to reach fans in compelling new ways and fully integrating key features into our primary ESPN offering. We’re already moving quickly down this path, and we are exploring strategic partnerships to help advance our efforts through marketing, technology, distribution and additional content.

Source: Earnings Call

Lastly, it is also worth mentioning that the company has a strong line-up of releases in 2024, including Deadpool 3, Kingdom of the Planet Apes and Inside Out 2. While 2023 was certainly a lacklustre year for Disney movies, the silver lining is that it’s hard for the company to do worse in 2024.

Why I Like Disney

With Disney trading at such a discount, I began to examine the company more closely, and there are certainly a lot of compelling reasons to buy, especially at these prices.

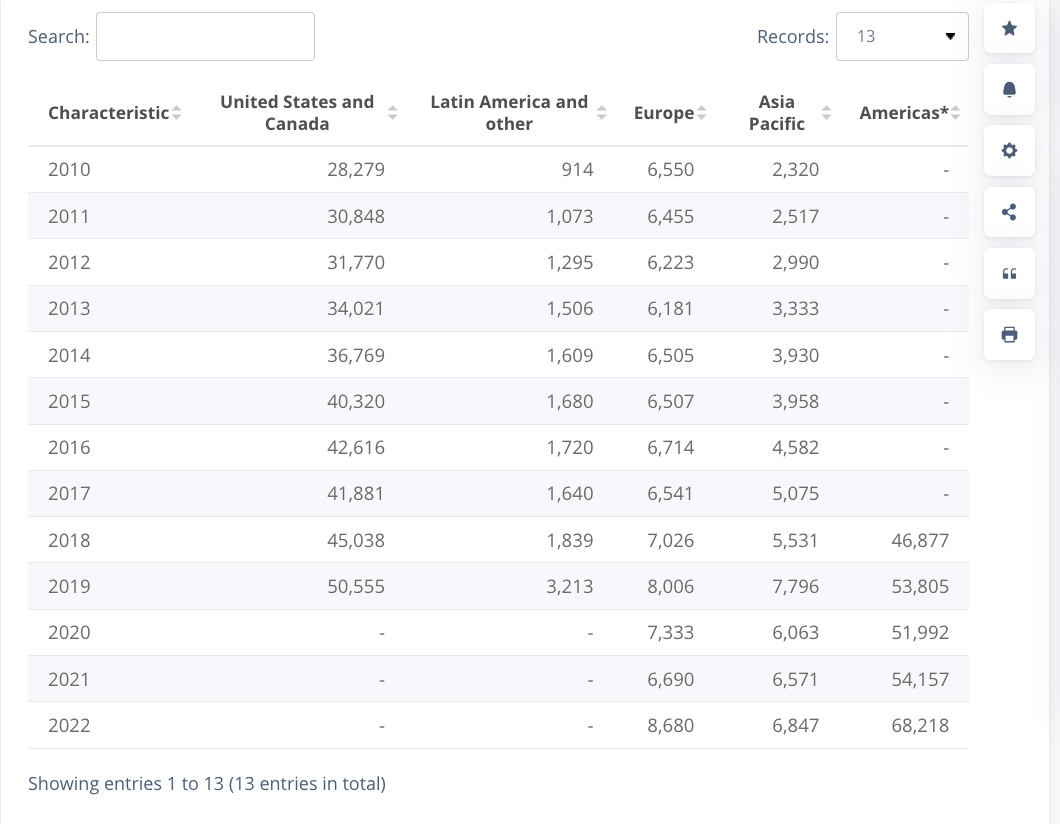

Disney has a very strong global brand, and it is growing its revenues in foreign geographies, especially the Asian market.

Revenues by geography (Statista)

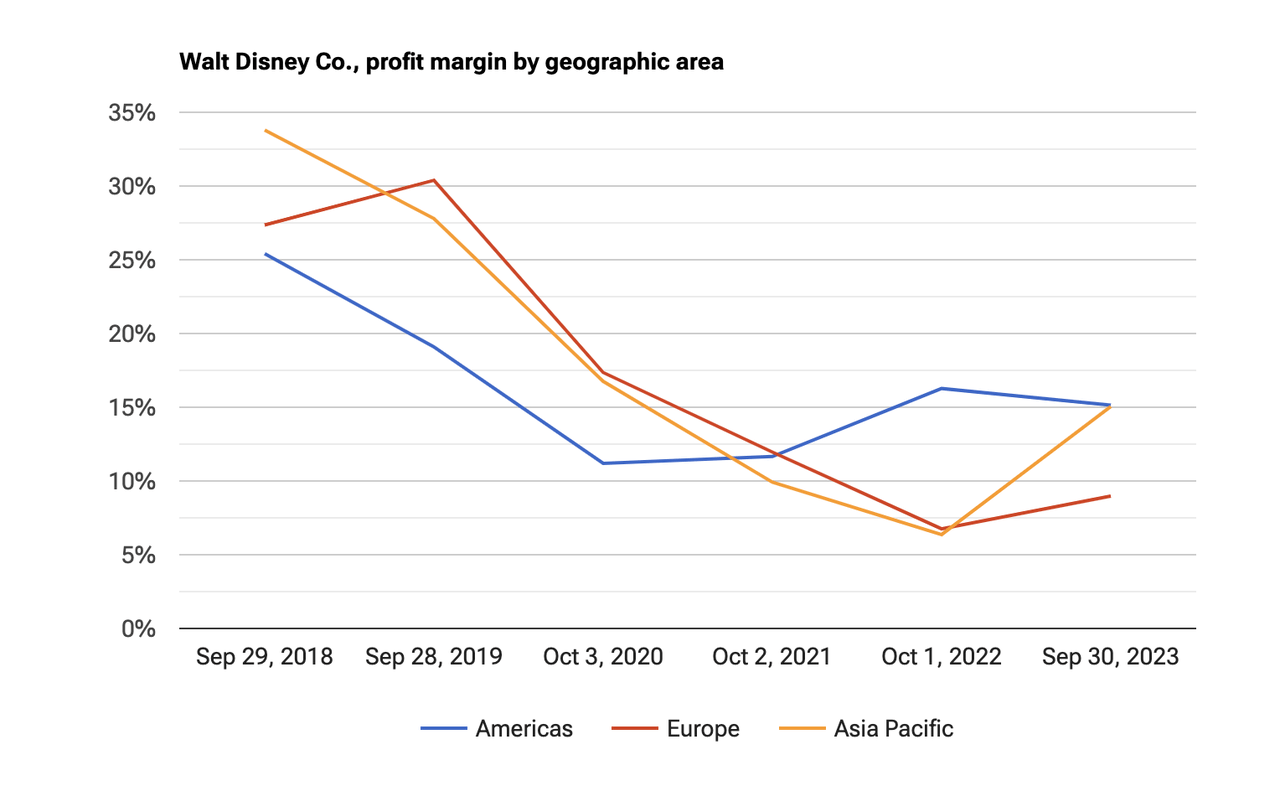

Furthermore, we can also see increases in the margins in these other geographies.

Profit margin by geography (Stock Analysis On Net)

The value of Disney’s global footprint and the moat that this awards the company, is something that can’t be discounted.

On top of that, Disney has recently reinstated a dividend, albeit small. This is only the beginning of what I see as a long period of increased free cash flow, which the company will be able to utilize in order to reward shareholders with buy-backs and more dividend increases.

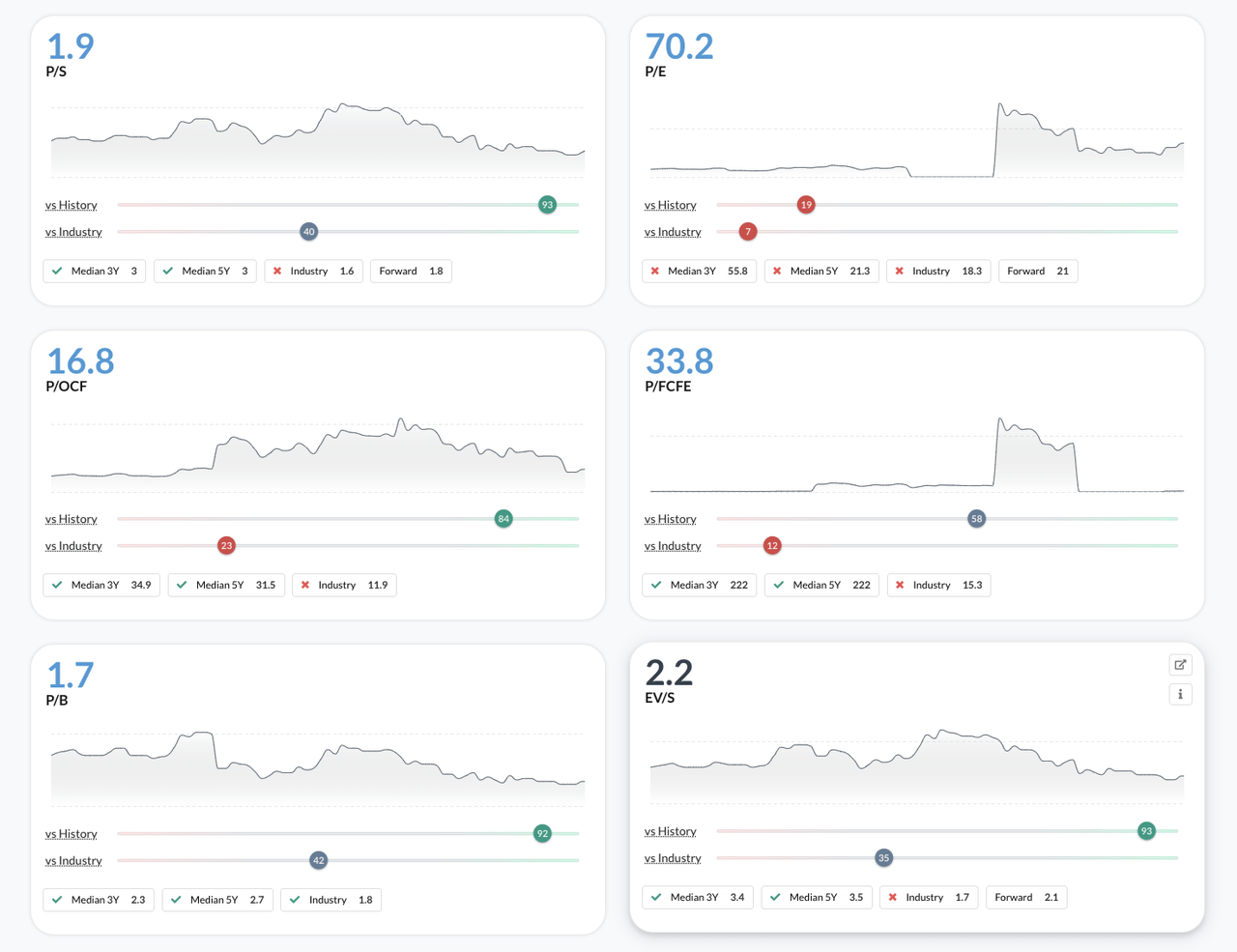

Lastly, the company’s valuation seems very compelling by most metrics.

Relative Valuation (Alphaspread)

Disney is very historically undervalued in terms of P/S, P/OCG and EV/S. The market has punished this stock too much in my opinion.

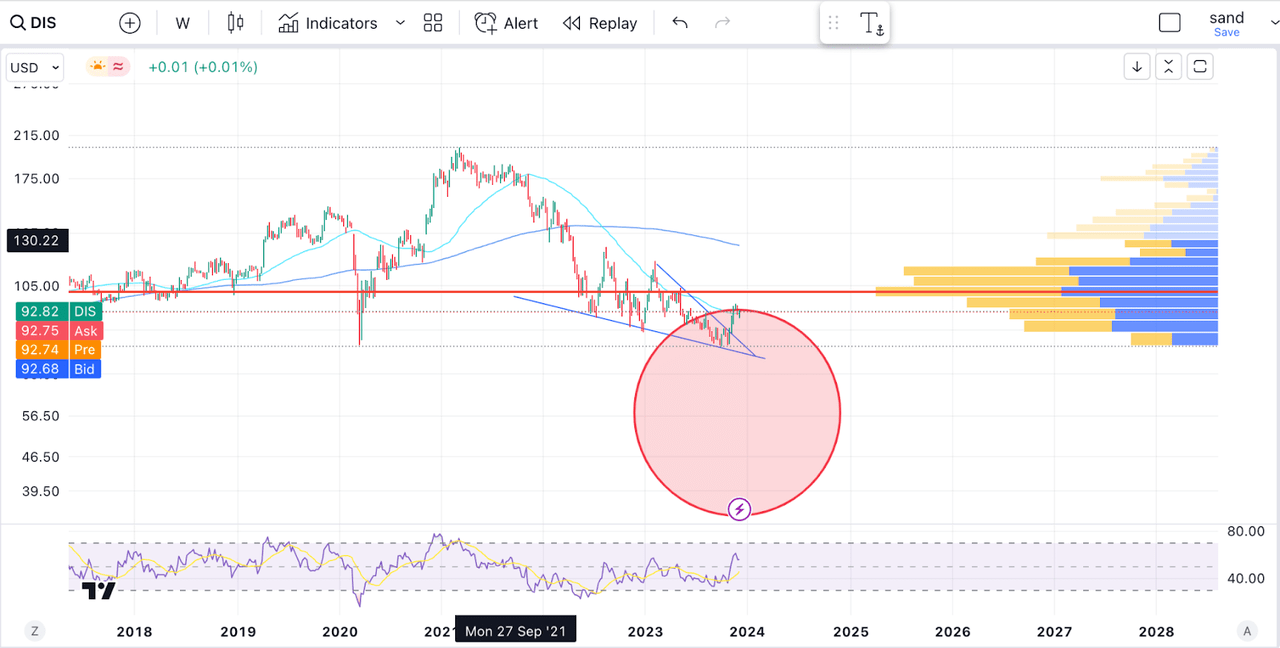

Technical Analysis

If we look at the technical analysis, it looks like a bottom could have been struck.

The stock reversed near the COVID lows, after forming a large bullish divergence on the weekly RSI. We can see that the stock has escaped a downward wedge and even managed to break above the 50-day MA. There’s some strong resistance up ahead at around $105, but once that is clear, the stock could be free to run for a bit.

Risks

Disney still has a lot to prove in 2024, and if it doesn’t execute this year, investors might lose patience.

Despite cost cutting initiatives, this brings about the very real concern that its content platforms could fall behind. Competition in this space is very steep.

Of course, the parks and cruises are vulnerable to events like the covid pandemic. Unlikely to happen again so soon, perhaps, but a precedent has been set, and investors have not forgotten the devastating effects it had.

Lastly, while ESPN does indeed hold value as a brand, the company will have to work hard to turn things around here, and competition in this segment is also ramping up.

Takeaway

All in all, I really like Disney at these prices and after what looks like a compelling reversal on the chart. The company has a clear plan to improve things in 2024, and I have faith that management will be able to at least keep the trend of increasing profitability going.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DIS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This stock is part of my End Of The World Portfolio.

A portfolio of highly diversified, secure and reliable companies that will do well in ANY environment.

Join the Pragmatic Investor today to get full access to the portfolio and more.

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video