Summary:

- Like it or not, Google is losing its share in the search engine market, and this is why I remain unfazed.

- I’m a fan of the company’s diversification strategy, which includes significant growth in its cloud computing business, with Google Cloud gaining market share against Amazon AWS and Microsoft Azure.

- Alphabet’s valuation metrics are promising, with a lower PE ratio compared to Amazon and Microsoft, and strong market sentiment backing the stock.

- Moving forward, I’m watching Google’s first-mover advantage in quantum computing through its new Willow chip.

- Google is a stock you buy and forget about for a long time; hence, I hereon share my positive sentiment and why this investment will pay off.

dimitris_k/iStock via Getty Images

Monkey Number 1

When did you last want to look up something and didn’t use Alphabet’s (NASDAQ:GOOG) (NASDAQ:GOOGL) (NEOE:GOOG:CA) Google? Call me a boomer, but I’m not a fan of the whole AI chatbot, and, more often than not, I still ‘Google it.’ With that being the case, I also think we’re all aware by now: Google is losing market share, with AI chatbots increasing in popularity. Perplexity, according to data, has grown from 55 million visits back in August of this year to over 90 million in October, but that traffic is mainly bound to desktop searches.

According to a recent report, Perplexity AI is now in its final stages of raising $500 million in funding with a $9 billion valuation, up from $3 billion in June, amid the AI boom. In more recent news, OpenAI also released its SearchGPT at the end of October, which is only available for paying customers for now. Long story short, these AI bots are marking a new era, and according to Statista projections, the number of AI tool users is expected to go from 115.91 million in 2020, almost tripling in 2024 at 314.3 million, and reaching as high as 729.1 million in 2030 (a whopping 132% increase from 2024-2030). According to a survey by Evercore, out of 1,300 Americans, 8% said ChatGPT is now their go-to search engine, up from only 1% a few months ago.

The risk is there, and it’s staring us right in the face. The question remains: Will Google be able to compete with what I like to call its first real competition, the AI chatbots? Is its Gemini 2.0 Flash experimental AI model, launched Wednesday, good enough to compete with Open AI or its likes? The short answer is that it’s too soon to tell.

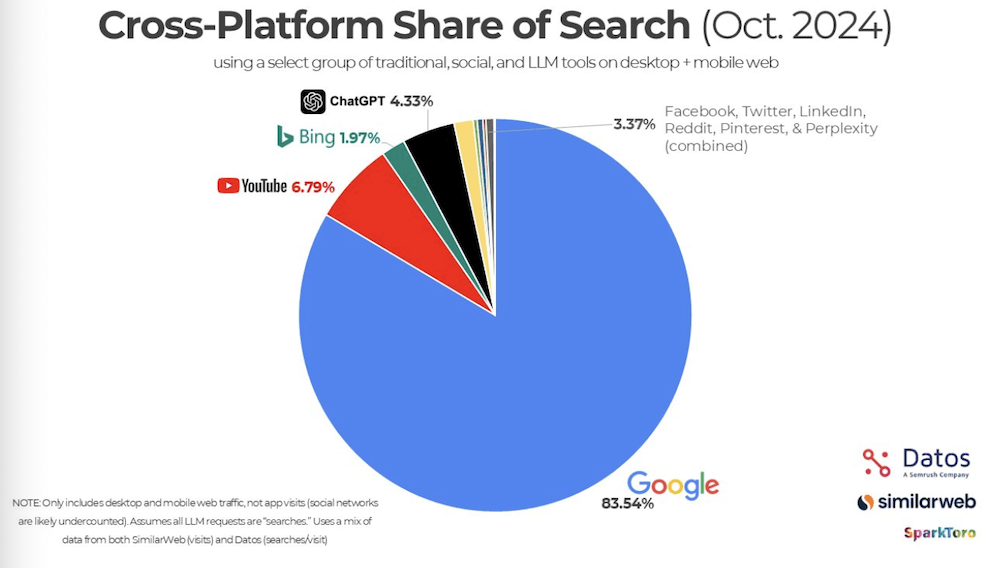

Alphabet’s Google remains the king of search engines, with over 89.9% of the search engine market share, although it was down from 92.3% in October of 2022. For now, I think the panic around Google neglects the entirety of Alphabet, which is way more than just a search engine – obviously, while keeping in mind the company makes over 57% of its revenue from its search business and ads, with search revenue up 12% year-over-year to $49.38 billion as of 3Q24, indicating the “market share loss” isn’t showing up on the numbers yet (if ever).

But this is not a “Google is a staple name in the search engine market, and it’s not going away” kind of article. Because you already know that. And though Google continues to lose market share to the, more or less, new AI ChatGPT, Perplexity, and other search engines like Bing, Yandex, and DuckDuckGo, as seen below based on Rand Fishkin of SparkToro assumptions, I think the blow softens once we realize that the world we live in is increasing in 1. internet users and 2. revenue per user. This means that the entire market itself is growing, and so I’m not too worried about new players jumping in because the cake is big enough.

Rand Fishkin of SparkToro

The other monkeys

I’m following the company’s strategy of depending less on its search engine business and diversifying its revenue streams for mid-to-long term. I am watching Alphabet’s cloud computing business, certainly now with Trillium 6th generation TPU, announced in mid-May and used to train Gemini 2.0, which, according to GEO Sundar Pichai, is the company’s “most capable model yet.” The latest improvements in Trillium give it a boost to its latest predecessor; I don’t want to bore you with the details, but it happens to be 4x more performant than its predecessor with 67% more energy efficiency, 4.7x in peak compute performance per chip, and is, starting December 12, generally available for Google Cloud customers.

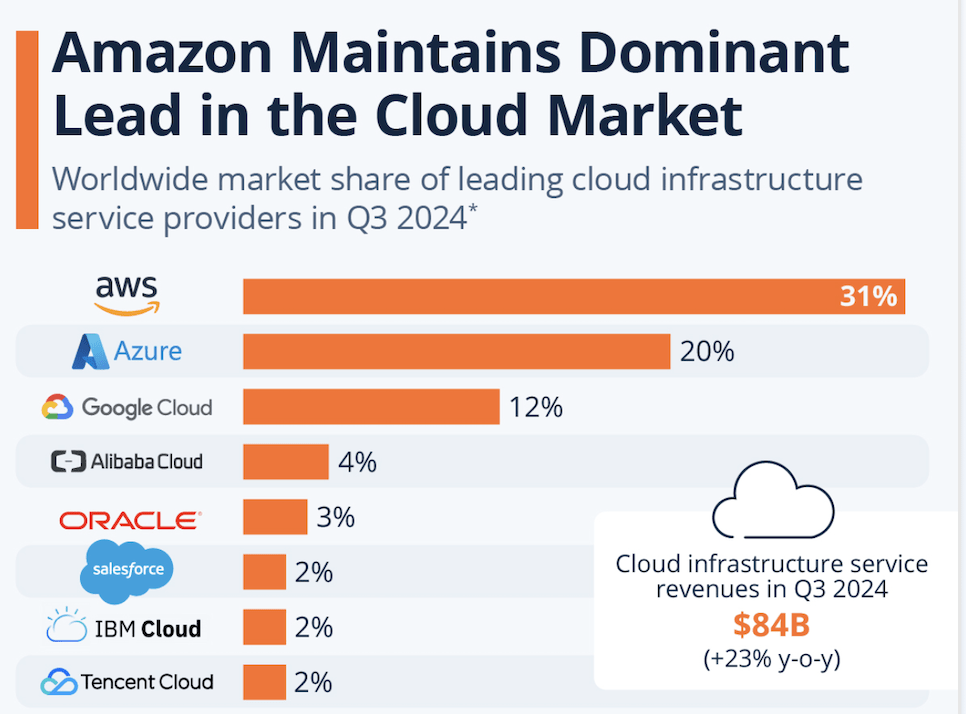

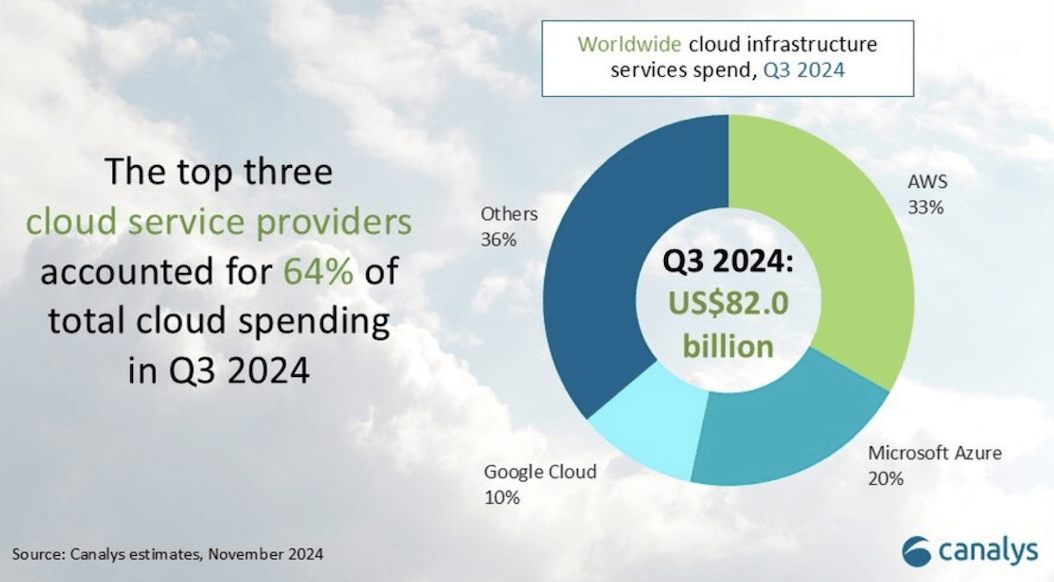

According to Synergy Research Group, Google Cloud is third in terms of market share, at 12%, edging closer to Microsoft’s (MSFT) Azure at 20% and Amazon’s (AMZN) at 31%, as seen below.

Statista

I think Alphabet is slowly gaining share, so I checked its growth against Amazon’s AWS and Microsoft’s Azure to see a trend. And what do you know? Google Cloud is consistently increasing its pace of growth each quarter since 3QCY23, with growth at 22.4% in a year-ago quarter, up over the past 4 quarters at 25.6% in 4Q23, 24% in 1Q24, 28.8% in 2Q24 and is now at 35% growth. As for Amazon and Microsoft, growth seems to be stale in the case of AWS over the past 2 quarters and more or less maintaining the 29%-31% range for Azure, with the expectation of this quarter at 33%.

|

Cloud Computing/ Quarter |

3QCY24 |

2QCY24 |

1QCY24 |

4QCY23 |

3QFY23 |

|

AWS |

19% |

19% |

17% |

13% |

12% |

|

Azure |

33% |

29% |

31% |

30% |

29% |

|

Google Cloud |

35% |

28.8% |

24% |

25.6% |

22.4% |

Back to the beloved TPUs, Google is to achieve over 70% market share in the in-house developed cloud ASIC accelerator market this year, according to DIGITIMES Research. The global shipment of self-developed cloud AI ASIC accelerators is projected to reach $3.5 million units in 2024, and Google’s market share is projected to grow to a staggering 74%, up from 71% in 2023. As a result of its latest TPU v6, Google is now also ahead of other cloud service providers in network architecture through a technology it developed in-house. I say ahead because Google introduced its first-gen TPU in 2016, bypassing the traditional Nvidia and allowing whoever followed suit to optimize AI workloads-related performance, save costs, and reduce time to market. Google’s early investment in the space makes it the third-largest semiconductor house in the data center space, and since then, it has made many enhancements in bandwidth and speed; for instance, the rate is up from duplex 200G in 2017 to duplex 800G by 2024, with single channel rate also up from 50G PAM4 in 2017 to 200G PAM4 in 2024. Below are the top cloud service providers that account for 64% of total cloud spending in 3Q24.

Canalys estimates

At the risk of boring you with the technicalities, this is only the beginning, with investment in cloud computing on the rise as well. As of 3Q24, global spending on cloud infrastructure services was up by 21% year over year to $82 billion. During the same period, Google announced over $7 billion in planned data center investments with around $6 billion to projects within the U.S. Microsoft also announced new cloud and AI infrastructure investments in Brazil, Italy, Sweden, and Mexico to expand capacity for the long-term demand forecasts. As for Amazon, AWS announced plans to also increase investments, with spending projected to be around $75 billion in 2024, allocated to expanding technology infrastructure.

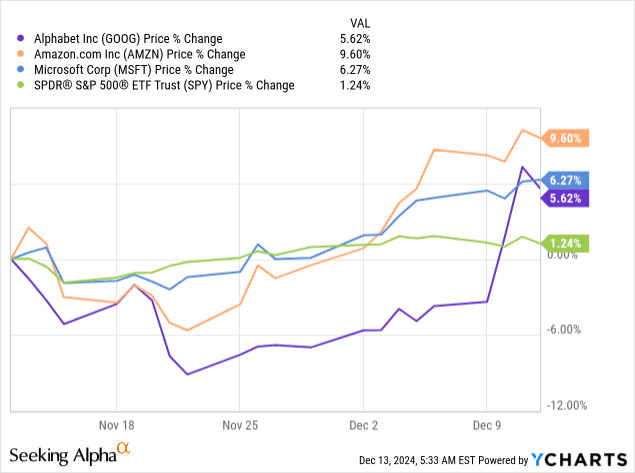

As for the stock movement over the past month, Alphabet has underperformed its biggest competitors, Amazon and Microsoft, but it outperforms the S&P 500. The stock is up 5.6%, against Amazon’s up 9.6%, Microsoft’s up 6.2%, and the S&P 500’s up 1.2%.

YCharts

Risks:

Every investment is with risk, and Google’s case is no different. I think the biggest risk comes from the fact that the company remains more or less dependent on its ads business. Alphabet’s primary source of ad revenue is its position in the search engine market, and so anything that jeopardizes that position, jeopardizes +50% of Alphabet’s revenue. And, there are a couple of things on the horizon that are pressuring Alphabet, although I’m a fan of how management is navigating that pressure.

The first risk is over the race for ad firm dollars spent with Amazon, Meta, and TikTok, who have tapped into the ad spend through avenues aside from search. Alphabet is fending off these big guys for ad spend, and simultaneously it’s having to defend its core position within search. The competition has traditionally been with Bing, who has gotten little to no attention, but over the past two years things have changed. I discussed in more detail earlier, but there is an expanding threat from AI-related chat searches (OpenAI, and others I discussed earlier) and Microsoft now with its partnership with OpenAI. Pair this with the antitrust lawsuits from the U.S. department of Justice, aka the DOJ, regarding search dominance, Google has its hands full.

Valuation:

Alphabet has a market cap of $2.40 trillion and an enterprise value of $2.34 trillion. The stock price was up over 45.48 in the past 52 weeks, and its beta is 1.03, making the price volatility similar to the market average. The market sentiment backs my optimism, with around 26% of Street Analysts giving the stock a strong buy, over 55% giving it a buy, and 19% a hold. The PT median and mean have been on an upward trajectory since mid-September. The PT mean and median were both $202 in September, slightly down to $200 in October, until growing to $210 and $207, respectively, through November until now. The valuation metrics look promising, too, with Alphabet’s trialing PE ratio at 26.06 and forward PE ratio at 22.8, both lower than Amazon’s and Microsoft’s; the latter’s trialing PE is 37.5, and Forward PE is 34.3, and the former’s trialing PE is 49.1 and forward PE is 39.4. As for the EV/Sales, Alphabet’s is at 6.87, higher than Amazon’s at 4.02 but lower than Microsoft’s at 13.2.

What’s one more circus? The monkey I’m currently eying.

I think we all know about the new Willow quantum computing chip by now. So why should you care about this? I think the simple answer is that Alphabet has a first-mover advantage in the long term in the quantum chip. AKA, it’s now a trendsetter. And even if others follow, the company will have that first-mover advantage to some extent. Following Google’s announcement on Monday, quantum computing stocks surged Tuesday as a result. With Rigetti Computing (RGTI) up a whole 45%, Quantum Computing (QUBT) up 1.8%, and D-Wave (QBTS) up 0.4%. Alphabet was up 5% and closed the day at $186.

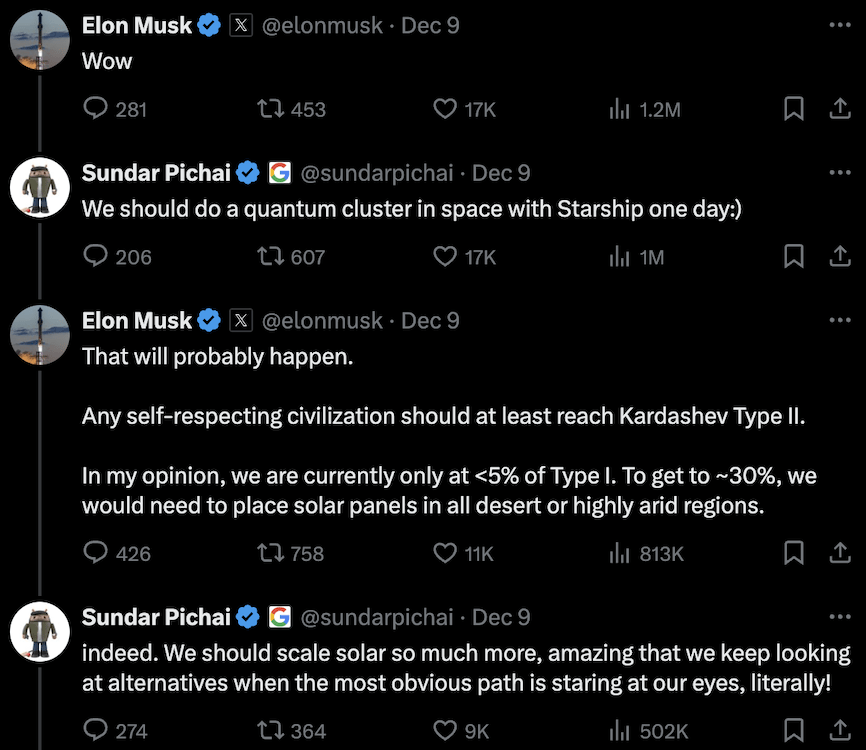

While Willow is still at the “prototype stage,” Google’s CEO Sundar Pichai said the company sees “Willow as an important step in our journey to build a useful quantum computer with practical applications in areas like drug discovery, fusion energy, battery design + more.” Elon Musk is a fan of Willow and has expressed interest in a back-and-forth interaction on X, as seen below.

X

Everything considered, I think the stock is attractive at current levels, and I would advise investors to jump in as I think the positives haven’t been fully priced in yet, and the stock could see more upside in the near term. As for the long term, I believe the company’s diversification into different circuses works to its benefit well by making it less and less dependent on the search market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.