Summary:

- A. O. Smith’s net sales have shown strong growth over the past three years, with modest expansion in profit margins in 2023.

- The company’s core North America water heater business is expected to remain robust, and the acquisition of Impact Water Products is expected to bolster its water treatment business.

- When compared to peers, AOS outperformed them in terms of growth outlook and profitability margins. However, its current share price does not provide a sufficient margin of safety.

JulNichols

Synopsis

A. O. Smith (NYSE:AOS) specialises in the manufacturing and sales of residential and commercial water heaters, boilers, and water treatment products. AOS’s past three years of financials have shown strong net sales growth. In addition, its profit margins showed modest expansion in 2023. For 1Q24, net sales continued to grow, but they were modest in the low single digits. Its 1Q24 margins were relatively robust as well when compared to 1Q23. Looking ahead, its core North America water heater business is expected to remain robust. Additionally, its acquisition of Impact Water Products is expected to bolster its water treatment business. However, with insufficient margin of safety in its current share price, I am recommending a hold rating.

Historical Financial Analysis

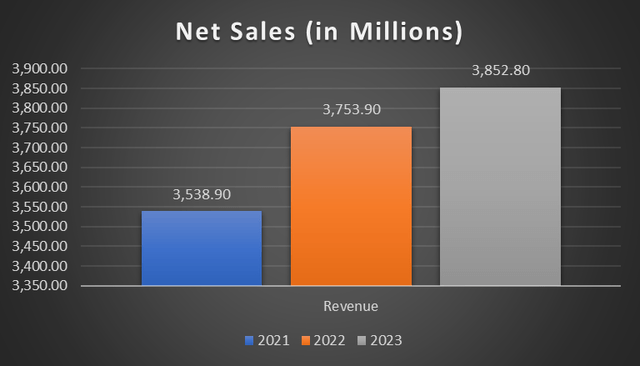

Over the last three years, AOS’s top line has been growing strongly. For 2021. It reported net sales of $3.538 billion. For 2022, net sales grew 6.1% to $3.753 billion. The growth was driven by pricing actions to offset the impact of inflation on costs and also by the contribution from AOS’s acquisition of Giant. For 2023, AOS’s top line continued growing as it reported net sales of $3.852 billion. This growth was attributed to higher sales volume of water heaters but was partially offset by unfavourable foreign currency impacts and lower boiler sales.

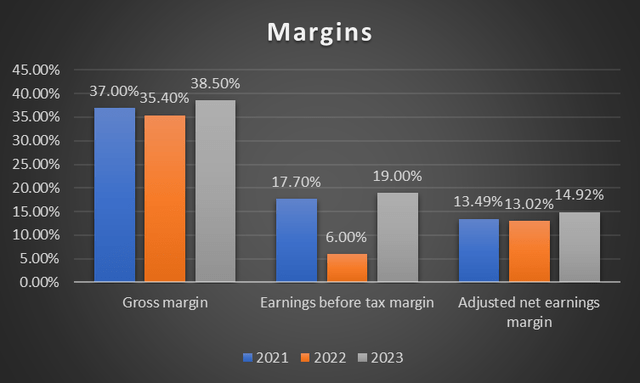

In terms of profitability margins, all three of them were volatile over the last three years. For 2022, gross margin fell to 35.40% due to higher steel and other raw material costs, offsetting AOS’s pricing action. Additionally, AOS’s 2022 earnings before tax margin fell to 6% due to a pension settlement expense that was related to the termination of its pension plan. However, on an adjusted basis, AOS’s 2022 adjusted net earnings margin contracted only slightly to 13.02%.

For 2023, gross margin started to recover and expanded to 38.50%, mainly driven by lower material costs. Additionally, 2023’s earnings before tax margin was 19%, which is higher than 2021’s level of 17.70%. Lastly, AOS’s 2023 adjusted net earnings margin expanded from 13.02% to 14.92%.

Business Overview

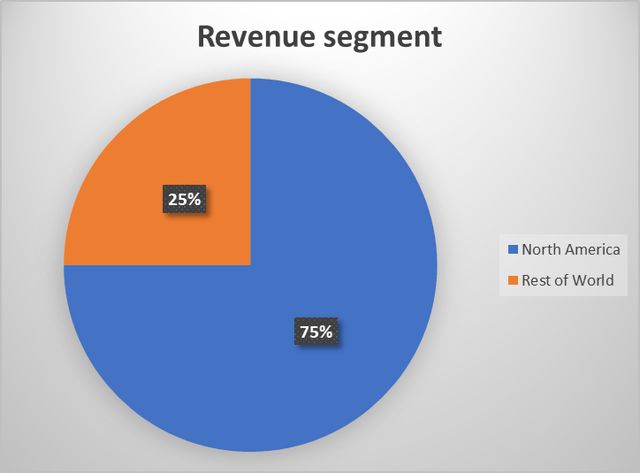

Based on its FY2023 result, AOS’s revenue is segmented into two areas: North America (NA) and Rest of World. Looking at the revenue segment chart, NA forms the largest share of AOS’s total revenue, as it accounts for 75% of its total revenue. Rest of World makes up the remaining 25%. For context, AOS’s 2023 reported revenue was approximately $3.9 billion.

First Quarter 2024 Earnings Analysis

For 1Q24, AOS’s sales increased 1.3% year-over-year to $978.8 million. The growth was driven by a shift in product mix towards high-efficiency commercial water heaters, including heat pumps. On the segment level, NA segment sales grew 2% year-over-year to $766.3 million. This growth was attributed to higher commercial water heater volume and a positive shift towards high-efficiency water heaters. For Rest of World segment, sales were up 4% year-over-year. Sales growth was due to higher volumes of kitchen products sold in China and inter-segment sales from newly introduced tankless water heaters manufactured in China and shipped to the US.

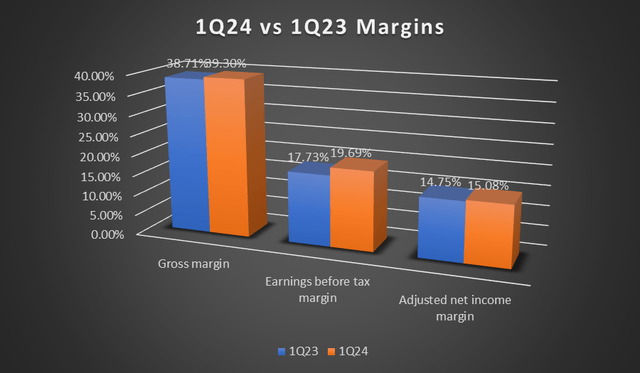

Apart from top-line growth, AOS’s 1Q24 profitability margins also expanded slightly when compared with 1Q23. AOS’s gross profit margin expanded to 39.3% from the previous period’s 38.7%. This gross margin expansion was driven by lower steel costs. Due to its gross margin expansion and zero impairment expense for the quarter, AOS’s earnings before tax margin expanded from 17.73% to 19.69%. Therefore, on an adjusted level, AOS’s adjusted net income margin expanded modestly to 15.08% from 1Q23’s 14.75%.

Robust Core North America Water Heater Business

Investors Relation

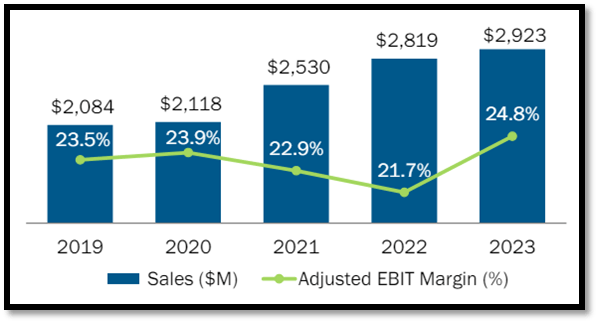

Over the last five years, AOS’s NA segment has shown strong top-line growth. In 2019, this segment reported sales of $2.084 billion. By 2023, it had grown to $2.923 billion, and this represents a compound annual growth rate (CAGR) of 8.8%. Apart from the strong sales growth, the segment’s adjusted EBIT margin in 2023 of 24.8% has surpassed 2020’s 23.9%.

Author’s Chart

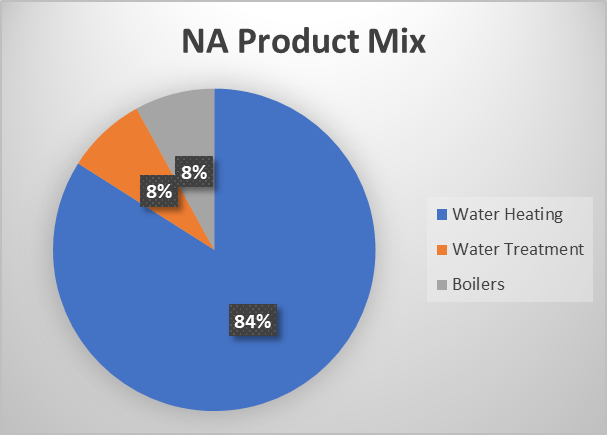

Looking at the product mix chart, it is clear that water heating forms the largest share of NA sales, accounting for 84%. Following closely behind and with equal weights are water treatment and boilers. In terms of end markets, residential forms 74%, while commercial forms the remaining 26%. From these data points, it is clear that NA water heater is AOS’s core business.

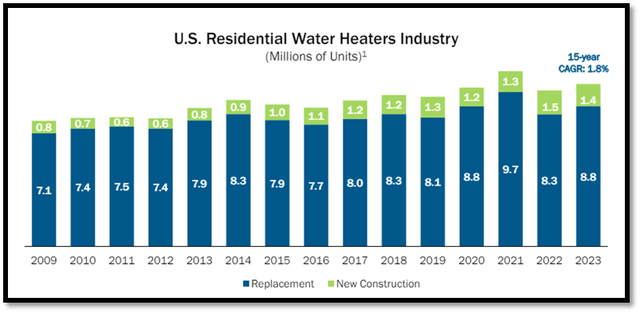

Since 2009, the US residential water heater industry has been consistently growing. For 2009, it reported a total of 7.9 million units. For 2023, this figure has grown to 10.2 million units, representing a CAGR of 1.8%. According to management, AOS owns 37% of the NA market share. Rheem owns 34%, while Bradford White owns 20%. The remaining 9% are owned by others. Therefore, making AOS the market leader in the NA residential market, which is dominated by three main players.

Additionally, it is also clear that replacement accounts for approximately 80% to 85% of total volume, with the remainder belonging to new construction. This indicates a stable business, as most of the sales are driven by the necessity to replace rather than relying on new constructions. Looking ahead, management guided 2024 US residential water heater industry unit volumes to be flat. However, looking at the chart, for the last 4 years, the US residential water heater volume was above historical levels. Therefore, although volume is expected to be flat, this also implies that 2024 volume will still be above historical levels, which is expected to bolster AOS’s future revenue.

Acquisition of Impact Water Products

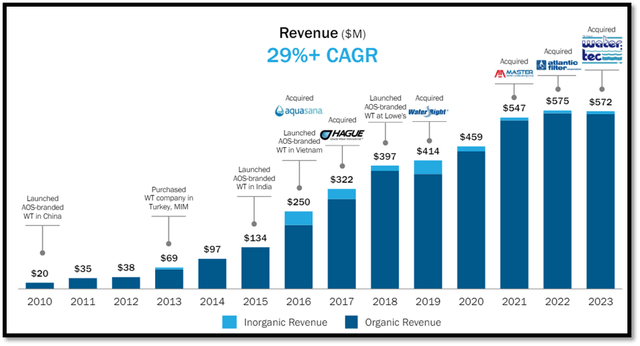

On March 6, 2024, AOS announced its acquisition of Impact Water Products. Impact Water Products specialises in the manufacturing and distribution of residential and commercial water treatment equipment. The aim of the acquisition is to support further growth in AOS’s water treatment business by expanding its presence on the West Coast. Looking at the strong sales growth trend and acquisition of Impact Water Products, these factors are expected to bolster AOS’s sales outlook. For FY2024, management guided NA water treatment to grow in the range of 8% to 10%.

In North America, the water treatment addressable market is estimated to be approximately $2.6 billion, and this size represents a significant growth opportunity for AOS to expand its market share in the water treatment market. In 2010, AOS water treatment sales were $20 million. By 2023, it had grown significantly to $572 million, representing a CAGR of ~29%. This strong growth was achieved through a combination of both organic growth and acquisition.

Relative Valuation Model

Author’s Relative Valuation Model

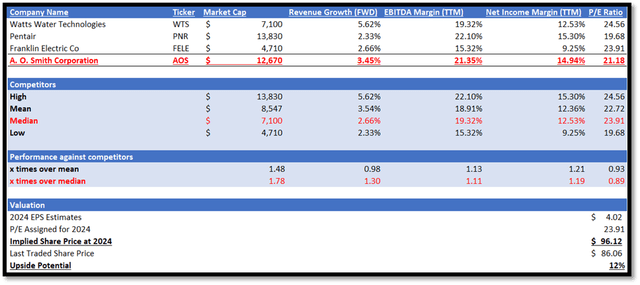

AOS operates in the building products industry and specialises in water heating, boilers, and water treatment. According to its annual report, AOS provided a list of competitors, and I utilised them in my relative valuation model. I will be comparing AOS with its peers in terms of growth outlook and profitability margins.

In terms of growth outlook, AOS outperforms its peers as it has a forward revenue growth rate of 3.45% vs. peers’ median of 2.66%, which represents 1.30x over its peers’ median. Regarding profitability margins, I will be comparing in terms of EBITDA margin trailing twelve months (TTM) and net income margin TTM.

In terms of EBITDA margin TTM, AOS also outperformed its peers, as it reported 21.35% while its peers’ median is 19.32%. AOS’s net income margin TTM of 14.94% is also higher than its peers’ median of 12.53%. Overall, AOS outperformed its peers in all financial metrics used in my model. Currently, AOS’s forward P/E ratio is trading at 21.18x, which is lower than its peers’ median of 23.91x. Given AOS’s outperformance, I argue that it should be trading at peers’ median forward P/E ratio.

For 2024, the market revenue estimate for AOS is ~$3.99 billion, while 2024 EPS is $4.08 per share. According to management, they guided 2024 net sales to be in the range of $3.97 billion and $4.05 billion, while the EPS estimate is between $3.90 and $4.15. The midpoint of the EPS guidance is $4.02. With management’s 2024 guidance and my forward-looking analysis as discussed, the market’s estimates are justified and reasonable. By applying my target P/E of 23.91x to AOS’s 2024 EPS estimate midpoint, my 2024 target price is ~$96.12.

Risk

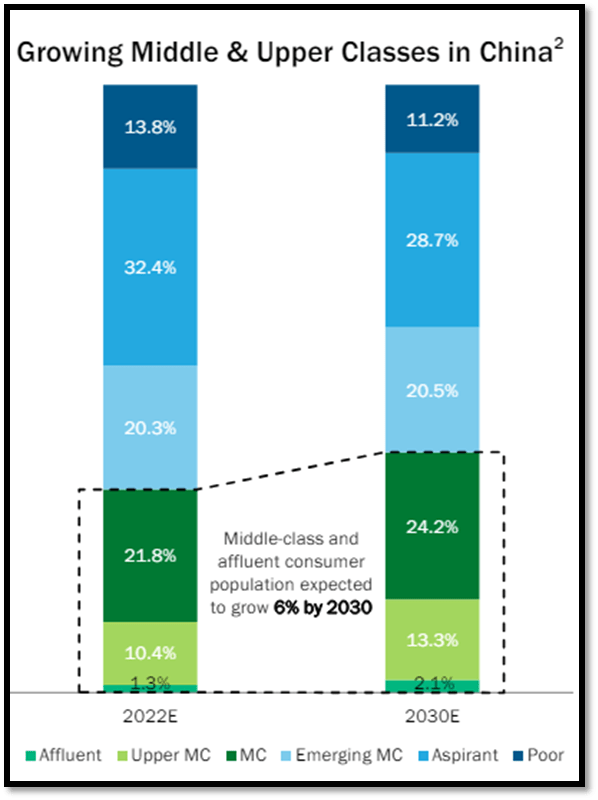

One upside risk to my hold recommendation is in regard to AOS’s China market growth potential. According to management, approximately 22% of 2023 sales originated from China. Therefore, it is a region that offers AOS significant growth opportunities. Sales in China increased by 4% in FY2023, despite previous COVID-19 pandemic disruptions.

AOS derives most of its sales from premium-tier products, it is well-positioned to benefit from rising consumer spending on high-quality, connected products. As consumer preferences shift towards e-commerce and premium brands, AOS’s market share in China might have the potential to grow. In addition, looking at the following chart, China’s middle class, upper middle class, and affluent population are expected to grow until 2030, further supporting this growth opportunity.

Investors Relations

Conclusion

Over the last three years, AOS has demonstrated strong top-line growth. To top it off, its profit margins showed a slight margin expansion in 2023. For 1Q24, net sales growth continued, but it was modest. On a brighter note, its 1Q24 margins remained robust year-over-year.

Looking ahead, its core NA water heater business is expected to remain robust. Therefore, this is expected to support its growth outlook. In addition, AOS acquired Impact Water Products with the aim of expanding its presence in the West Coast. When compared to peers, AOS outperformed its peers in terms of growth outlook and profit margins. Although I adjusted my target P/E upwards, AOS’s current share price does not provide sufficient margin of safety. Therefore, I am recommending a hold rating for AOS.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.