Summary:

- Interest rates have declined from the 2023 highs, and we are likely to see further reductions in the next couple of years.

- As rates decline, higher yielding stocks can rise in value as the hunt for yield returns.

- It makes sense to buy dividend stocks that are undervalued and pay you to wait for share price appreciation.

- Both of these dividend stocks are currently trading right around very significant support levels on the chart.

JHVEPhoto/iStock Editorial via Getty Images

The start of a new year is always a good time to assess your portfolio and to consider what strategic changes could boost results going forward. While interest rates are now off the peak levels hit in 2023, there still appears to be room for rates to drop further as inflation fades and as potential rate cuts are needed. The Federal Reserve hiked rates very aggressively and the lag time for the full impact of these rate hikes could still be coming and possibly cause a recession. If we do get a hard landing, rates could plunge from current levels and that will spark significant interest from investors in higher yielding dividend stocks. Even if we get a softer landing, rates can drop as the economy slows down. Based on this, I believe the stocks below can provide a very generous level of income and potentially significant gains in terms of capital appreciation:

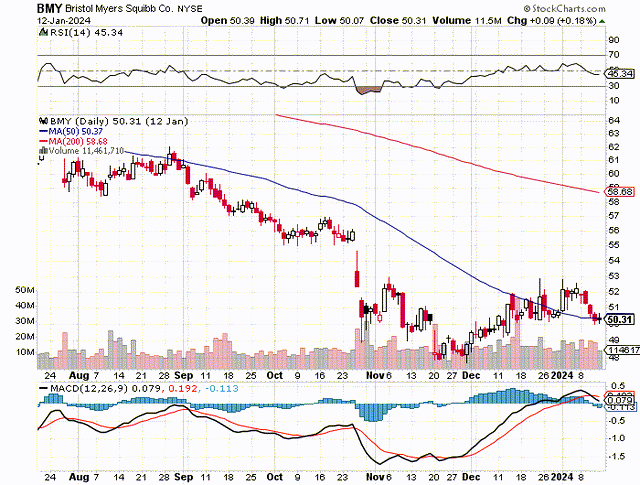

Bristol Myers Squibb (BMY) is a well-known pharma giant but investors have sent the stock lower in recent months over concerns about some upcoming patent expirations. This is a real concern; however, the company recently announced a couple of significant acquisitions which are expected to help growth going forward, in spite of generic drug competition from patents expiring. The company has been on a buying spree and in 2023, it announced it would buy Mirati (MRTX), Karuna (KRTX), and RayzeBio (RYZB). These acquisitions are expected to offset patent expiration issues and increase the growth rate for Bristol Myers Squibb.

The chart below shows that this stock was trading for about $60 per share a few months ago, and dropped to around the $48 level. However, it has been edging higher in what appears to be a new uptrend. It looks like the shares could rebound back towards the 200-day moving average, which is currently $58.90 per share.

I also think the longer term chart below shows something very compelling and that is the fact that Bristol Myers Squibb shares are trading right around the 200-month simple moving average (brown line on chart). That is very important because it should serve as a major support level. If you look at this chart, you can see that every time the share price got close to the 200-month simple moving average, it was a great buying opportunity. That is exactly why it could be a major buying opportunity right now.

The PE ratio and dividend yield make Bristol Myers Squibb stock appear very undervalued. Analysts expect the company to earn $7.29 per share in 2024 and $7.50 per share in 2025. This puts the PE ratio at just around 7x earnings. The dividend is $2.40 per share on an annual basis. This provides a yield of nearly 5%, which pays you while you wait for share price appreciation. Another positive is that pharma companies like Bristol Myers Squibb are fairly recession resistant. The potential downside risks are that the recent acquisitions do not end up holding as much promise for future revenue growth. That could lead to a stagnant share price or worse. However, pharmaceutical companies like Bristol Myers Squibb have been dealing with patent expirations for decades and this company and the share price has seen growth.

Altria Group, Inc. (NYSE:MO) is not a stock that I feel the best about investing in. However, people decide if they want to live their life with unhealthy habits, whether it is smoking or obesity, or alcohol. What I do like about this stock is the fact that it has produced a generous income stream for many years and it still does.

The longer term chart for Altria below shows it is also trading right around the 200-month simple moving average (brown line on chart). Again, this should serve as a major support level and it has historically been a major buying opportunity.

Analysts expect the company to earn $5.09 per share in 2024 and $5.29 per share in 2025. This puts the PE ratio at roughly 8x earnings. The dividend is $3.92 per share on an annual basis, or 98 cents per share quarterly. At current stock price levels, the dividend yield is around 9.4%. That is a very compelling income stream, and it will be even more valued by investors if interest rates decline further in the next couple of years.

It’s worth noting that Altria owns a huge stake in Anheuser-Busch InBev (BUD). According to a Barron’s article the stake is worth about $11 billion and it could sell this asset someday. The proceeds could be used to pay a special dividend and/or buyback many more shares. With a current market cap of about $74 billion for Altria, a sale of an asset this size would be meaningful. The Barron’s article suggests that a sale might not come anytime soon, however, if it does, it could create shareholder value. The article states:

“I really have nothing to report on the Anheuser-Busch asset,” said Sal Mancuso, Altria’s chief financial officer, on the company’s fourth-quarter earnings call in early February. “We continue to do the analysis that we do with all capital allocations. And currently, we believe the best thing for the shareholder over the long term is to hold the asset.”

The potential downside risk that concerns me the most with Altria is that management might make acquisitions that do not work out. It is also concerning that regulations on smoking seem to be getting more restrictive, however, cannabis regulations seem to be loosening and this could be something that Altria gets into, which could offset reduced cigarette usage. Altria has the cash, balance sheet and other assets like its huge stake in Anheuser-Busch InBev to ensure a continuation of the high dividend and to fund growth opportunities in the future, which seemingly could include cannabis.

In Summary: Both of these stocks appear to be out of favor right now and that is when I like to buy. I also like buying when stocks are at levels that have historically rewarded investors, and when the stocks are trading at very major support levels. This appears to be the case with both of these stocks and I see this as a rare and major buying opportunity to get in at a great price. In addition, interest rates should be coming down in 2024 and 2025, and this is likely to boost the share price of dividend paying stocks. With Bristol Myers Squibb trading at about $50, and paying a $2.40 per share dividend, the yield is nearly 5%. Hold this stock for 10 years and you could collect $24 in dividends, (possibly more with dividend increases) and that will take your cost basis down to $26 per share. With Altria trading at about $41, and paying a $3.92 in annual dividends, the yield is nearly 9.5%. Hold this stock for 10 years and you could collect $39.20 in dividends, (possibly more with dividend increases) and that will take your cost basis down to $1.80 per share!

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.