Summary:

- An over 26% loss in 2022 with one day to go.

- AAPL has underperformed the S&P 500 but has outperformed the Nasdaq.

- Technical and fundamental issues facing the $2 trillion company.

- AAPL has experienced severe corrections in the past.

- The three reasons I will continue to buy for my grandchildren.

Shahid Jamil

Steve Jobs, Ronald Wayne, and Steve Wozniak founded Apple (NASDAQ:AAPL) in 1976 in Steve Jobs’ garage. Over the next 46 years, the company grew to be the world’s leading technology company with the top market cap. AAPL’s innovation made it the first to eclipse a $1 and $2 trillion value. On January 3, 2022, the company experienced another first, as the value rose to over $3 trillion when the intraday share price rose above $182.86. On January 4, the shares reached a record high of $182.94. Since then, AAPL has made lower highs and lower lows, falling to $125.87 on December 28, 2022, the lowest level since June 2021.

Apple reached the $1 trillion level on August 2, 2018. Sadly, Steve Jobs passed on October 5, 2011. The company’s innovative CEO and founder, who also was an entrepreneur, industrial designer, media proprietor, and investor, never witnessed many of the company’s financial successes. Steve Jobs handed the reins of his company to Tim Cook, who has done an admirable job filling what many thought was unfillable shoes. However, many investors believe that if Steve Jobs had lived, AAPL would have done even better.

Over the past half-century, Steve Jobs, and Elon Musk rose to be the modern-day Thomas Edison or Leonardo da Vinci.

Apple has had a rough ride in 2022, and the since the trend is always your best friend, the shares could continue to fall. Markets reflect the economic and geopolitical landscapes, and rising interest rates and problematic relations between the U.S. and China are weighing on AAPL shares.

In 2021, I became a grandfather to two beautiful girls.

Saving for their college educations and future is one of our primary concerns, and I consider no other stock better for a two-decade horizon than AAPL.

An ugly 2022 for AAPL shareholders

AAPL is a core holding for many portfolios, mutual funds, and indices, and 2022 has not been a good year for shareholders.

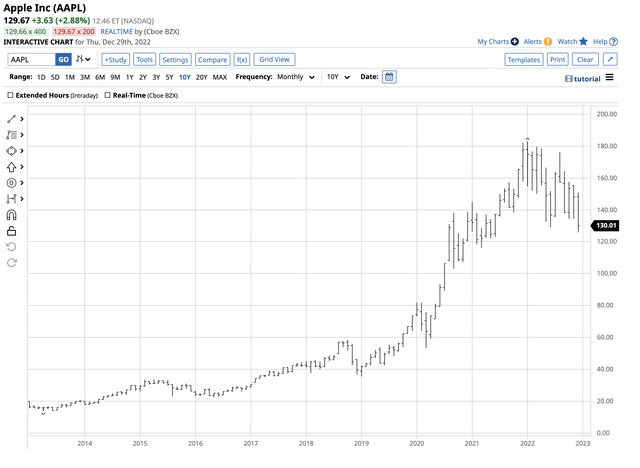

Ten-Year Chart of AAPL Shares (Barchart)

The chart highlights AAPL’s decline from $177.57 on December 31, 2021, to $125.87 on December 28, 2022, a 29.1% drop. At below the $130 level on December 29, the shares remain close to the low and have caused indigestion for many investors, with a 27% decline in 2022 with only one day until the end of the year. At the current level, AAPL remains the company with the highest market cap at just over the $2 trillion level. Microsoft (MSFT) is the second most valuable U.S. company, with a nearly $1.8 trillion value at the $240.50 per share level. MSFT shares were 28.5% lower in 2022 as of December 29.

AAPL compared to the diversified S&P 500 and the tech-heavy NASDAQ

AAPL is not alone when it comes to value destruction in 2022. With its shares 27% lower on December 29, AAPL has lots of company.

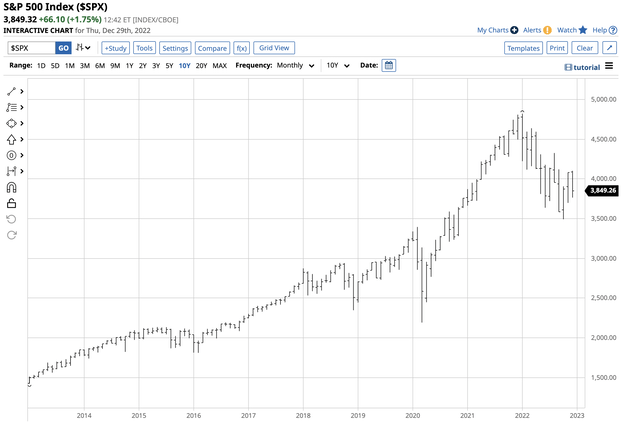

Chart of the S&P 500 Index (Barchart)

The chart of the most diversified U.S. stock market index shows the S&P 500 dropped from 4,766.18 on December 31, 2021, to 3,849.32 on December 29, 2022, a 19.2% drop as the index outperformed AAPL and MSFT this year. However, the tech-heavy Nasdaq is another story in 2022.

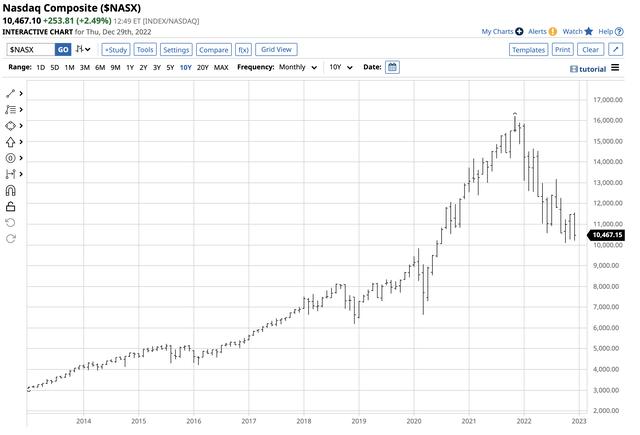

Chart of the NASDAQ Index (Barchart)

The Nasdaq chart shows the ugly performance that took the index from 15,644.97 at the end of 2021 to 10,467.10 on December 29, an ugly 33% plunge.

Technical and fundamental factors remain bearish

AAPL is a technical and fundamental mess in late 2022. Matt Maley, the Chief Market Strategist at Miller Tabak, has pointed out that the $130 level is “so important because it’s where the lows from June come in (which was the low for 2022). Therefore, any meaningful break would give the stock a key ‘lower-low’…and that would be quite bearish because Apple has already broken below its trend-line from the March 2020 pandemic lows (and below its 200-day moving average).“ AAPL was just below the $130 level on December 29 after falling below $126. Trend-following traders are likely short the shares, and technical investors could be stopping out of long positions given the bearish price action.

Fundamentals remain problematic as the company depends on Chinese factors, experiencing labor shortages because of COVID-19 infections. Delays in Chinese production have impacted production, leading to product shortages.

Meanwhile, macroeconomic and geopolitical factors also have weighed on AAPL shares. Rising interest rates are bearish for stocks, and the rise in the U.S. dollar to a two-decade high has weighed on multinational companies’ earnings, and AAPL is not immune from the impact of higher rates and a strong dollar. Moreover, deteriorating relations between Washington, D.C., and Beijing and the potential for legislative actions to ban Chinese companies like TikTok have only exacerbated the challenging landscape for companies like AAPL, with a significant manufacturing presence in China.

Moreover, the threat of a severe U.S. recession in 2023 has caused many consumers to cut back on expensive purchases, impacting the demand for new iPhones, computers, notepads, and other Apple products.

The technical and fundamental landscape for AAPL and other leading technology companies has created an almost perfect bearish storm for the company’s shares.

Not AAPL’s first ugly correction

At the most recent low, AAPL shares had dropped 31.2%.

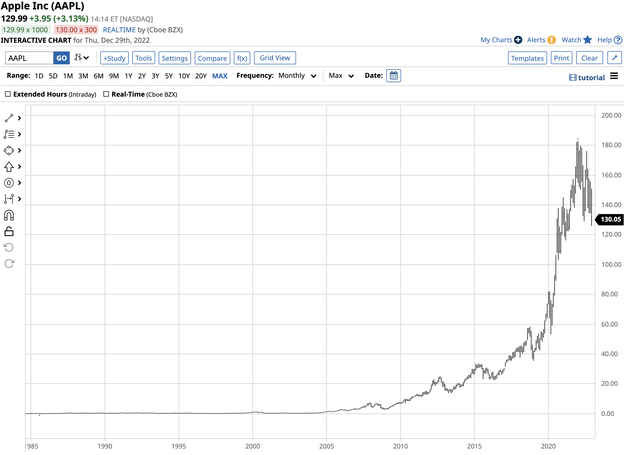

Twenty-Year Chart of AAPL Shares (Barchart)

The chart shows a series of corrections over the past two decades:

- After reaching a high of $7.25 in December 2007, AAPL shares dropped 61.5% to $2.79 in January 2009.

- AAPL shares rose to $25.18 in September 2012 and fell 45.4% to $13.75 in April 2013.

- After trading at $33.63 in April 2015, the shares corrected 33.5% to $22.37 in May 2016.

- AAPL appreciated to a $58.37 record high in October 2018 before falling 39.2% to a $35.50 low in January 2019.

- The 2020 pandemic took AAPL shares from $81.96 in January 2020 to $53.15 in March 2020, a 35.2% drop.

While many market participants are panicking over the 31.2% drop in 2022, the stock’s history highlights that the correction is nothing new for AAPL shares.

The three reasons why AAPL is my stock of choice for my granddaughters

Saving for my beautiful granddaughters involves picking stocks and investments that will survive and thrive in the long term. With college 17 years away and their adult years two decades in the future, only the cream of the crop fits the bill. Despite its $2 trillion valuation, AAPL continues to offer long-term capital growth. Three factors put AAPL on the top of my list:

- AAPL is cash rich, with over $48 billion in total cash and short-term investments. The company also has over $352.7 billion in long-term assets vs. $302 billion in long-term liabilities. Seeking Alpha’s factor grades award AAPL an A+ in profitability. In a bear market. The companies that will emerge with the strongest rallies from the bear market are moneymakers. With lots of cash, AAPL is well-positioned to make accretive acquisitions or buy back shares if they continue to decline.

- Rising wealth in India, the world’s second most populous country, will increase the demand for iPhones and other Apple products as the worldwide brand is iconic. While AAPL’s app store is under a regulatory microscope in Europe, the risk may be far higher than the likely outcome.

- AAPL has been one of the most innovative companies in history. Inbred innovation is the company’s culture. AAPL’s long-term chart shows the rewards for shareholders that have stuck with the company through thick and thin.

Long-Term Chart of AAPL Shares (Barchart)

Steve Jobs took the shares from a low of 7.0 cents in 1985 to $15.25 in October 2011 when he passed. Under Tim Cook, the shares reached $182.94 in early 2022.

It’s impossible to pick bottoms in any market that is in a bearish trend, and they often fall to levels that defy logic, reason, and rational analysis. However, AAPL has been the cream of the crop in technology for decades, which is likely to remain the same in the coming years. I will buy AAPL shares for my granddaughters, and if the shares continue to decline, I will add to their long positions. When the girls are ready to attend college and begin their adult lives, the shares will likely be much higher as the company will remain the gold standard in the technology sector.

Happy New Year to all, and all the best for a healthy, happy, and profitable 2023!

Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, forex, and precious metals. My weekly report covers the market movements of over 20 different commodities and provides bullish, bearish, and neutral calls; directional trading recommendations, and actionable ideas for traders. I am offering a free trial and discount to new subscribers.