Summary:

- At its core, Exxon Mobil is focused on the fossil fuel space, with its operations largely dedicated to oil and gas extraction and refining.

- To prepare for the future, management is making some big moves that have the potential to pay off significantly.

- This transformation will prove good for both shareholders and the environment if management can make good on its promises.

Brandon Bell

Anybody who knows much of anything about Exxon Mobil (NYSE:XOM) knows that the company is a giant in the energy market. In particular, its emphasis is on oil and natural gas exploration and production, as well as on the production of fuels, aromatics, various chemical products, and more. Given that the world will eventually move away from oil and other fossil fuels as much as possible, it may seem foolhardy to be drawn to the company. However, management has a plan for the future. And if the company can deliver on this plan, it could serve not only as a catalyst for growth, but also as a means for the company to further diversify from activities that are deemed undesirable from an environmental perspective.

Exxon Mobil is changing

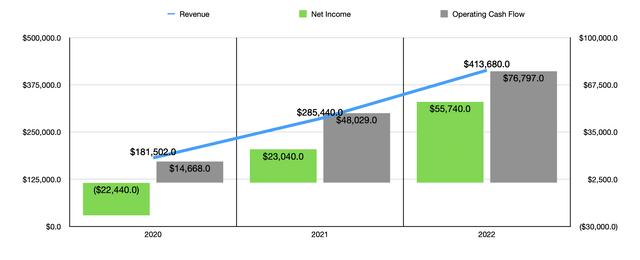

By pretty much any measure, Exxon Mobil should be considered a behemoth in its market. In 2022 alone, the company generated revenue of $413.7 billion. From that, it saw operating cash flow of nearly $76.8 billion and net profits of $55.7 billion. Not surprisingly, the greatest exposure for the company is to the U.S. market. But only about 37.4% of its sales and other operating revenues come from here at home. The rest comes from overseas. The most significant nation to which it has exposure is the UK, which accounted for 8.5% of its revenue activities last year.

Much of the company’s fortunes change based on what happens in the global energy market. In its annual report, for instance, the company said that for every $1 per barrel change that it experiences in the oil market, its after-tax profits under the Upstream segment will change by $500 million compared to what the company saw last year. A change in natural gas prices of only $0.10 per Mcf will impact earnings under that segment to the tune of $140 million. Of the revenue that it generates, only about $45.2 billion comes from these particular operations. But the company does have a sizable footprint in other activities. The most significant of its segments from a revenue perspective is the Energy Products segment, which comprised 76.7% of the firm’s revenue last year. But it also generates sales from selling various chemical products and specialty products.

*$ in Millions

When I say that the energy markets can have a significant impact on how the company performs, I mean it. Just look at operating cash flow and earnings, shown in the chart above, over the three years ending in 2022. At the end of the day, the company truly is dedicated to the energy markets. And in truth, it’s highly unlikely that demand for all of its various activities will ever completely vanish. However, it is also the case that the world is looking to wean itself off of fossil fuels as much as possible in order to combat climate change.

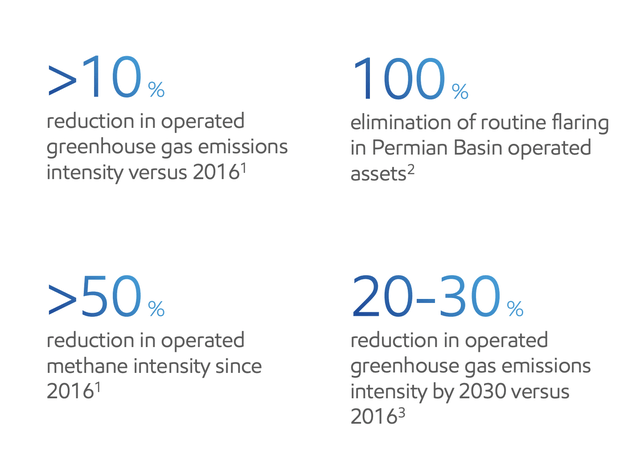

The good news for shareholders is that management is well aware of what the future holds. They also have a plan. By making significant investments in itself, as well as in activities that it wants to engage in, the company has already saw a reduction in its own environmental footprint. For instance, since 2016, the company has reported a 10% reduction in operated greenhouse gas emissions intensity. This included a more than 50% reduction in operated methane intensity over the same window of time. And with additional investments planned for the future, the company hopes to see a 20% to 30% reduction in operated greenhouse gas emissions intensity by 2030 compared to 2016.

The path to that future does not come cheap. According to management, they plan to spend around $17 billion on investments geared toward lower emissions activities between 2022 and 2027. $10.2 billion, or 60%, of this investment will be focused on the company reducing its own emissions. But that leaves another 40%, totaling $6.8 billion, that will be focused on reducing the emissions of others. There are some great steps that the company has taken in this regard already.

One initiative that the company is focused on is the production of what it calls a ‘blue’ hydrogen plant located down in Texas. Blue hydrogen involves carbon dioxide that is generated from natural gas. During the process of transforming natural gas to hydrogen, the carbon dioxide is essentially split off, captured, and then transported trace suitable location where it is injected into deep underground rock formations for permanent storage. The hydrogen, meanwhile, is isolated from this process and can be used for heating, transportation, industrial uses, and more. In all, the company is planning to invest $7 billion to develop the world’s biggest low-carbon hydrogen plant at this location, with total daily capacity of low-carbon hydrogen totaling 1 billion cubic feet. Some amount of ammonia, which is incredibly valuable for the fertilizer market, will also be produced from this location. But of course, the company could decide as late as next year whether or not it wants to truly construct the project in question. On April 4th, news broke that the company had been selected to transport and store up to 2.2 million metric tons per year of carbon dioxide for a $1.8 billion facility recently unveiled by Linde (LIN).

Separate from this, the company also announced, earlier this year, that it was moving forward with a $560 million investment that will be made by one of its majority-owned affiliates in order to construct the largest renewable diesel facility in Canada. This refinery should produce around 20,000 barrels of renewable diesel per day. At full capacity, this facility is expected to reduce greenhouse gas emissions in the Canadian transportation market by around 3 million metric tons per annum. Naturally, anything that is recycled means that the customers paying for the recycled product in question will not require additional product taken out of the ground.

In October of last year, management announced that they were working with a few other firms, including CF Industries (CF) and EnLink Midstream (ENLC), for carbon capture activities aimed at permanently storing up to two million metric tons of carbon dioxide emissions each year from its manufacturing complex in Louisiana. This project is not slated to begin development until 2025. But it does involve the company developing a 125,000-acre carbon dioxide storage location, with CF Industries committing to building a carbon dioxide dehydration and compression unit nearby.

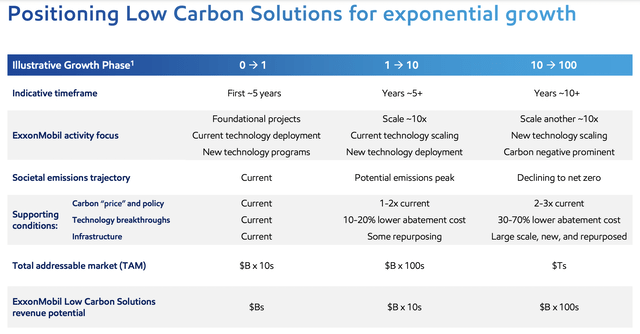

At this moment, we don’t know exactly how small these particular operations are. This is because they don’t fall under any of the core operating segments of the company. Instead, they fall under the Corporate and Financing portion of the enterprise. Total sales and operating revenues under this segment were only $36 million in 2022. Given the enormity of Exxon Mobil today, you may wonder why I’m fixated on such a small piece of the pie. This is because management has incredibly high expectations moving forward. Starting around five years or so out from now, management is forecasting that they can generate annual revenue associated with its low carbon operations that could be in the 10s of billions of dollars. 10 years or so out from now, they think it’s possible that it could even grow into the hundreds of billions of dollars for them.

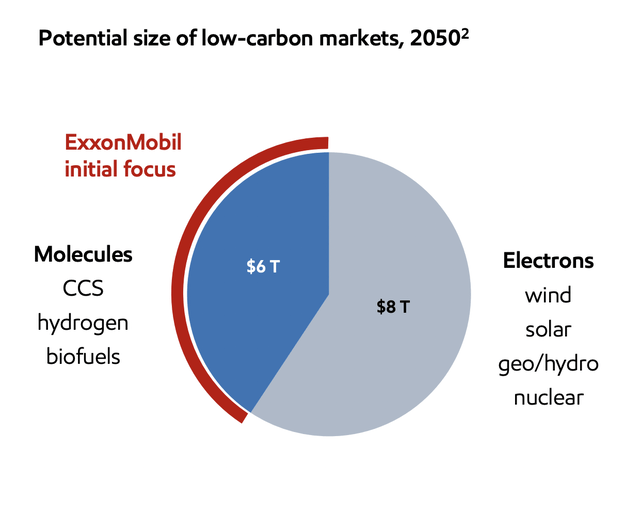

If this seems improbable, consider that, by the year 2050, Exxon Mobil believes that the global low-carbon market will grow to roughly $14 trillion in size. Their particular focus is on the $6 trillion that includes carbon capture and storage, hydrogen, and biofuels. But this is not to say that they can’t or won’t eventually emphasize the other $8 trillion opportunity that includes wind, solar, geothermal, hydro, and nuclear. Given the massive capital expenditures that the company can make, the opportunities are virtually limitless. This year alone, for instance, total capital expenditures for the company should be between $23 billion and $25 billion. That won’t stop the company from rewarding shareholders directly though. Last year, for instance, the firm allocated $14.9 billion to dividends and another $15.2 billion to stock buybacks. Along the way, the company also allocated $7.2 billion toward debt reduction.

There are other estimates independent of Exxon Mobil that indicate how large various aspects of the low carbon market should grow over the next few years. The green hydrogen market, for instance, was worth around $1 billion in 2021. By 2030, one source estimates that it will grow to $72 billion, translating to an annualized growth rate of 55%. A different source altogether pegged the market globally at $3.2 billion in 2021. With a 39.5% annual growth rate expected of it in the future, it should climb to roughly $64 billion by the end of this decade. Other markets are smaller. We don’t exactly have a dollar figure on this one, but we do know that in 2021 the global renewable diesel market involved about 2.61 billion gallons worth of diesel. That number should shoot up to 7.45 billion gallons by 2027. In North America, we do have a decent estimate to go on. The market here should be worth about $12.9 billion this year, with a 7.1% annualized growth rate between now and 2044 taking the market up to $49.1 billion.

Takeaway

Right now, Exxon Mobil is still very much a company that’s dedicated to its core operations. But this doesn’t mean that this picture will remain unchanged forever. In fact, the company is already laying the groundwork for what could be a major transformation in the years to come. Without this change, the company could eventually find itself in trouble. At the moment, these specific operations are still immaterial to the company. But as we get closer to the middle and eventually the end of this decade, investors should expect a lot more from the business on the low-carbon front. So long as this is done well, I could see this as a great catalyst for the company moving forward, especially because the current spaces in which it operates won’t dwindle away overnight.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!