Summary:

- AADI is a commercial stage company with a potential label expansion ahead.

- It is adequately funded, run by expert management, and has a major catalyst next year.

- All told, AADI looks good.

Iryna Drozd

Aadi Bioscience (NASDAQ:AADI) is a commercial stage oncology drug developer working with the mTOR pathway. Lead asset FYARRO (nab-sirolimus) is an albumin-bound sirolimus approved for advanced malignant PEComa (perivascular epithelioid cell tumors), a type of rare cancer occurring in the soft tissues of internal organs. The company’s exclusive focus is on cancers that are highly mTOR dependent, and it uses a nanoparticle albumin-based (nab) platform validated by paclitaxel. Fyarro is licensed from Celgene, and in the initial years, Celgene also funded the company. The company was founded and is led by Neil Desai, PhD, a co-creator of abraxane, along with Patrick Soon-Shiong, at Abraxis.

According to Endpts, the mechanism of action here is:

Abraxane was a decades-old chemotherapy, encased in an albumin coat that tricks tumor cells into absorbing the tumor-killing agent…With Fyarro, Desai took a decades-old immune-modulating drug, rapamycin, and coated it in a similar albumin coat. Once taken up by the tumor, it knocks down mTOR, a protein that has long been linked to tumor proliferation, among other things.

Fyarro is approved for an ultra-rare sarcoma with no more than 100-300 new cases in the US every year. The disease has a high mortality rate, and estimated survival is only 12-16 months. Everolimas and sirolimas are the two approved mTOR drugs, with some of their variations also being approved. No drugs are approved for advanced malignant PEComa besides Fyarro. The company makes the following differentiation between Fyarro and other mTOR drugs:

-

High drug levels in tumor result in more complete mTOR target inhibition and greater tumor suppression not achieved with other mTORi’s

-

Improved PK, half-life and exposure without compromising safety – wide therapeutic index

-

Flexibility in combination strategies

-

Overcomes limitations of other mTORi’s such as highly variable oral absorption, poor PK, narrow therapeutic index

-

Unlocks full potential of mTOR inhibition

The following efficacy data was seen in the trial that enabled approval:

- Overall Response Rate (95% CI) 39% (22%, 58%)

- Complete Response 7% (2/31)

- Partial Response 32% (10/31)

- Stable Disease 52%

- Progressive Disease 10%

- Disease Control Rate‡ 71%

- Median Duration of Response 39.7 months

- Median Progression Free Survival 10.6 months (5.5-NR)

- Median Overall Survival 53.1 months

The OS data is especially impressive considering that historical survival is merely 12-16 months after chemo.

Fyarro was launched in February 2022 and by December the molecule had made $10mn in sales, which is good considering the small patient population. However, the drug is priced at nearly $500,000, which the company says is proper given the high unmet disease burden and the small patient population. About update, the company stated in the November conference call:

In the community setting, the uptick continues to increase, now accounting for about 60% of sales overall. Further, we are promoting our science at key medical meetings like ENA and CTOS which we believe further expands both our brand and company awareness.

As of September 30, there were more than 90 unique accounts ordering FYARRO, up approximately 50% from last quarter, with a reorder rate still exceeding 80% across all ordering accounts. Adoption in the academic treatment centers remain strong and we continue to be impressed by the fact that almost half of ordering accounts since launch are now represented by those in the community treatment setting.

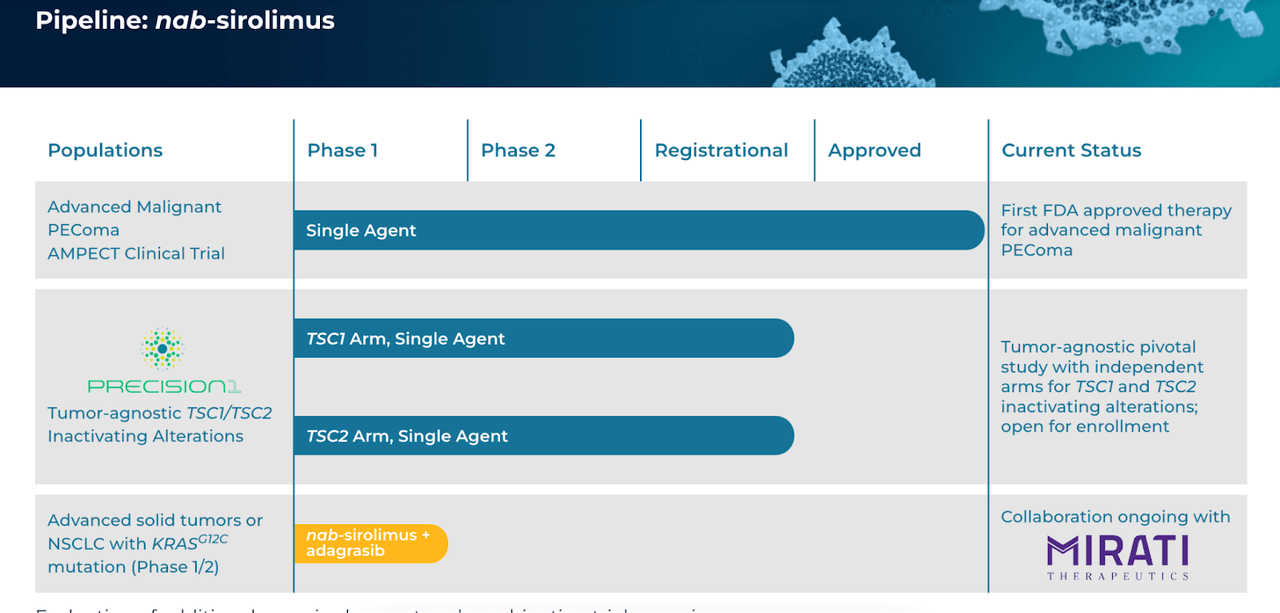

The company’s pipeline now looks like this:

AADI PIPELINE (AADI WEBSITE)

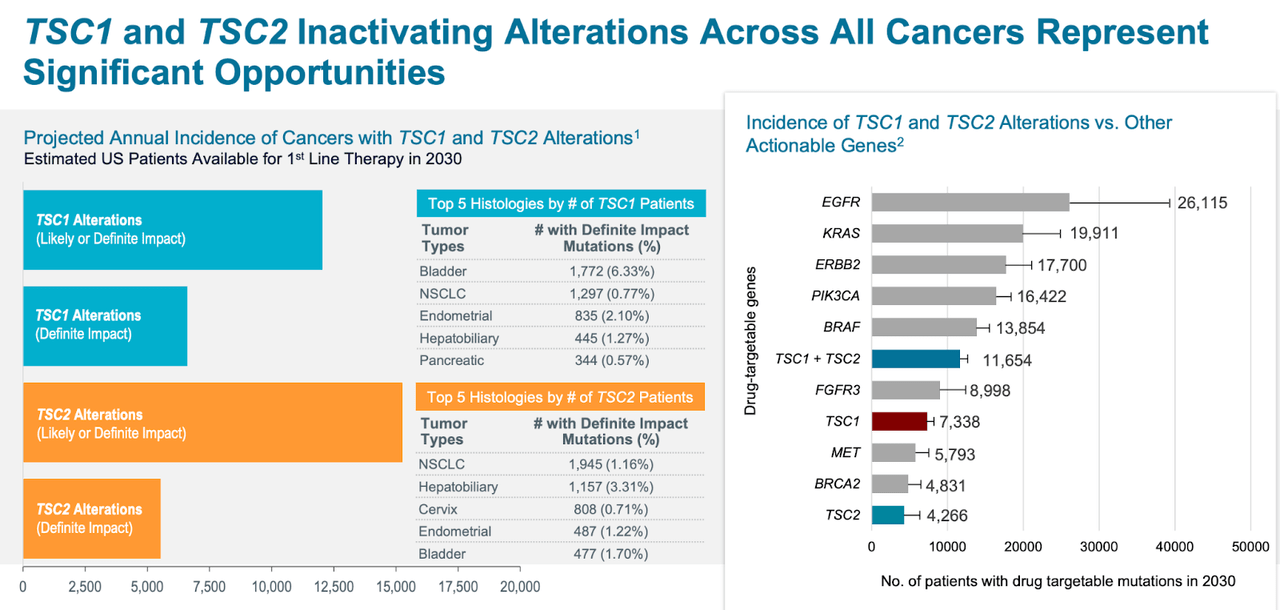

Thus, this is a one-molecule company and the way for it to expand is through label expansions right now. The Precision 1 trial, now ongoing, is testing the molecule in tumor-agnostic TSC1/TSC2 inactivating alterations. This is a pivotal (registrational) study. TSC1 and TSC2 are upstream regulators of mTOR activity within the PI3K/Akt/mTOR pathway. A simple genetic sequencing captures patients with TSC1/TSC2 mutation, which occurs in 1-2% patients per cancer type. The total patient population is large:

Patient Population (AADI website)

The AMPECT trial for PEComa saw indications validating the TSC1/TSC2 pathway. In a number of metrics, patients with TSC1/TSC2 genes had much higher response than those without; for example complete or partial responses were 9/14 (64%) for the former group and only 1/11 (9%) for the latter. However, on stable disease and progressive disease metrics, the latter group did better.

Financials

AADI has a market cap of $266mn and a cash balance of $183mn as of November. Total revenue for the quarter ended September 30, 2022 was $4.2 million resulting from sales of FYARRO. Research and development expenses for the quarter were $8.8 million while selling, general and administrative expenses were $9.9 million. At that rate, the company has a cash runway through 2025.

In September, despite the approval, the company was forced to raise $72mn to keep itself going. These funds were raised through a PIPE financing from new and existing investors, through an equity sale at fair market price, as well as pre-funded warrants. The funds are to be used to progress the Precision 1 trial, whose preliminary data is expected in the first half of 2024.

Valuation and risks

FYARRO resulted in $10mn in sales in the launch quarter. The approved indication is a very small market with no other approved drugs. Thus, we should expect between $40mn and $50mn in sales in the very first year, which, given the low valuation of the company, makes it very attractive. More than the current indication, the specific way the molecule is produced – using the same technology used by nab-paclitaxel, but only replacing paclitaxel with rapamycin, provides scope for a much larger market with label expansions. The company also has a very strong cash balance. Given all of that, I would say, qualitatively, that the company is undervalued.

As to risks, apart from the usual ones, I wonder about the use of generic rapamycin and the consequences thereof. I looked at their patent estate – which is vast – but these things will need time to get more clarity.

Bottomline

AADI is a commercial stage co led by a very impressive management. The mechanism of action and especially the technology behind Fyarro sounds very logical given how the same technology worked for abraxane. The company has backing from investors, as seen by the late stage PIPE. The approved drug is selling okay in a small indication, but the pipeline potential is really large. They are well-financed, and there’s a major catalyst next year. I think those are some of the reasons that will interest investors.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

About the TPT service

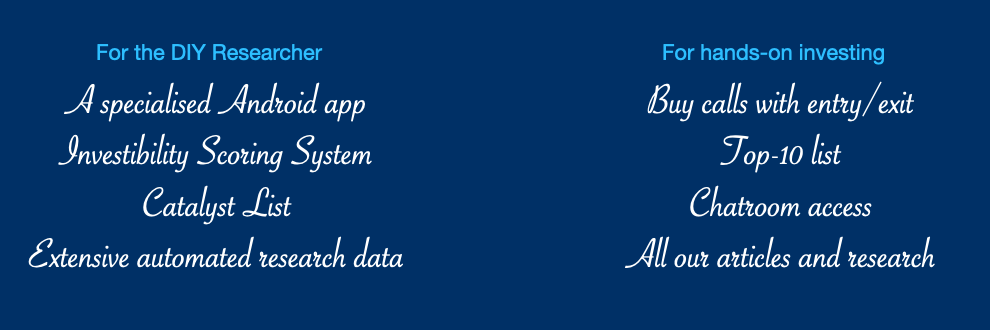

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.