Summary:

- Apple Inc. is a high-quality stock with strong profitability, but its extreme valuation and technical patterns suggest caution for buy-and-hold investors.

- Despite past stellar performance, AAPL’s future returns are uncertain, with significant risk attached due to high valuations and market maturity.

- I am more likely to participate in AAPL indirectly through ETFs or trading, focusing on quality, long-term valuation, and price analysis.

- My YARP portfolio strategy includes hedging and using covered call ETFs to balance risk and potential returns in tech stocks like AAPL.

Lighthouse Films/DigitalVision via Getty Images

Apple Inc. (NASDAQ:AAPL) is one of those stocks that “everyone” has an opinion on. Here’s mine. Not because I’m feeling left out, but because my focus is primarily on dividend investing. And at the end of this article, I will briefly describe my interest in it. I don’t own it yet, and as luck would have it, it went ex-dividend the day I’m writing this. So that means I have a month until the next opportunity to swap some price return (gain or loss) for dividend income. More on that at the end.

My main focus here is the underlying stock, AAPL. Because I’m not the first to observe that it has made plenty of people wealthier. Yet today, this technician/quant/portfolio constructor – me – who believes traditional deep-dive fundamental analysis is gradually fading in importance, can’t ignore the elephant in the market’s room. The Magnificent 7, including AAPL, tell us a lot about what the broader market will do.

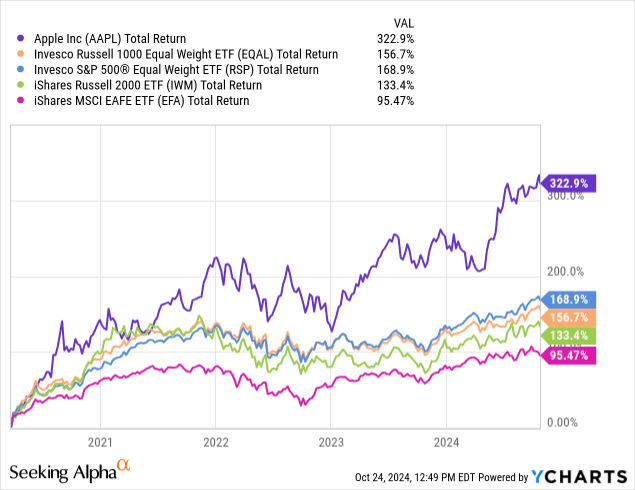

That does not mean that as goes AAPL, so goes the stock market. Ask any disappointed small-cap or international investor about that. Or ask an equal-weighted investor in the S&P 500 or the Russell 1000. They have all underperformed this $3 trillion market cap stock by gigantic margins since the pandemic bottom on 3/23/2020. Here’s a picture of AAPL’s dominance over that time.

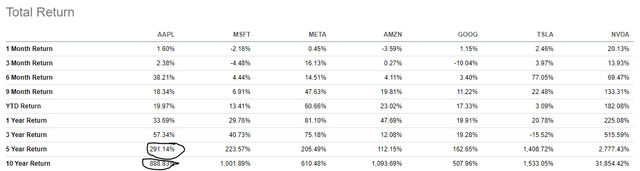

But that’s the past, and congratulations to any investor who has invested in AAPL for five years or more. Returns of 888% over 10 years don’t come on trees. AAPL is the third best Mag-7 performer the past five years. So it is a leader among leaders.

Seeking Alpha

OK, now what?

As I’ve explained before, past performance is good for analyzing the risk that went into earning that return. That is, while AAPL has worked out very well long-term, that doesn’t tell us a darn thing about the future. AAPL investors have seen four declines of at least 25% and as much as nearly 50% in a 12-month period since 2009. But the stock recovered each time, due to its strength, product innovation and perhaps most of all, its sticky customer base that allows for upgrade cycle after upgrade cycle.

It is easy to look back after all of this and say “had it all along,” but investing is not like that. Just when we think we have it figured out, the market teaches us a hard lesson. That’s what I have realized, 38 years into doing this professionally, including three stints as a mutual fund manager and 27 years as an investment manager for private clients (we sold our firm in 2020, into “semi-retirement”).

Fortunately, while I did not own AAPL shares directly, I have participated in its long-term success in other ways. Whether it was through the stock’s position within ETFs I’ve owned or trading the stock or options a bit on the side, there are nearly infinite ways to, shall we say, take a bite of this apple.

Not if, but how, how much, and when?

And I think that is a truly important thing to keep in front of mind in modern markets. Because for iconic stocks like this, I see three key factors in its future path. And while two of those are negative on the surface, investing to me is not an all or nothing decision. Thus, my analysis of AAPL is about one thing. Not IF to own it, but HOW to own it, and how much, and when. That’s the same ongoing decision I make with every stock and ETF. And I find that approach is a lot better to keep me sane in this business, rather than getting emotional and becoming a “fan” of this stock or that ETF.

That’s why I tend to call out fandom when it comes to securities that, I think, have become too popular and dare I say fashionable. That’s for clothes and rock bands, not stocks and ETFs!

So here are my three keys to investing in AAPL going forward, in whatever form that may be:

1. Quality

2. Long-term valuation

3. Price analysis, including volatility/risk aspects

Quality

AAPL is written about nearly every day, and certainly several times a week, by so many different analysts here. Since my main goal at this stage of my career is to be “useful,” with all of that fundamental analysis from elsewhere, the platform is not made better by my thorough fundamental take on this well-known stock and household name brand business.

I’ll simply say this: AAPL could really screw up in the coming years – a lot – and still be a fortress business with cash flow galore, and a product line that can always slow and disappoint investors, but that is likely survivable. There’s no “moat” issue here. And even if there was, I am fine “renting” stocks instead of owning them, as more often than not in modern markets, that provides a much smoother ride. That’s not a popular concept, I suspect. But it’s what I’ve landed on after managing “other people’s money” for a living and now my own, post sale of our advisory business.

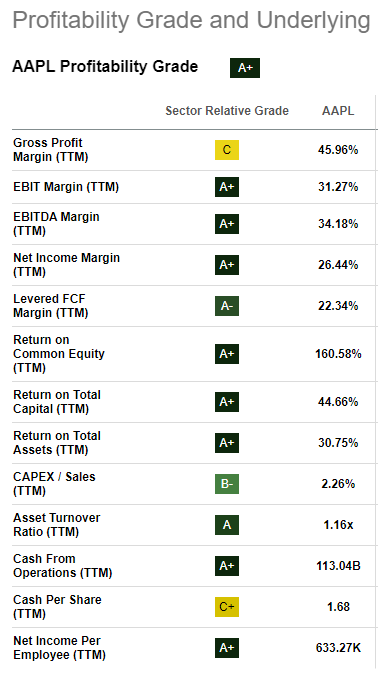

Seeking Alpha

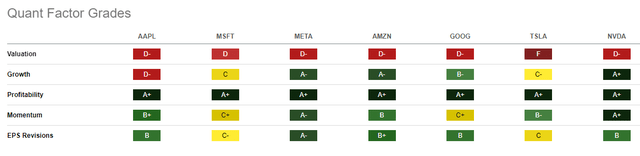

AAPL is an A+ for profitability in Seeking Alpha’s quant factor grading system, which I rely on a great deal. Because I’m not a fundamental analyst. So I use other inputs that I’ve come to trust. That’s one of them. And as shown here, AAPL grades out like most of the Mag-7 do. Top profitability and extreme valuation. Those two polar opposite grades are supplemented by a mixed growth picture, though AAPL’s maturity as a business has something to do with its growth dropping to a D, the lowest in the group. And keep in mind, these are relative to sector. AAPL used to be the rabbit, now it is being chased by the newer, younger rabbits in that sector.

Seeking Alpha

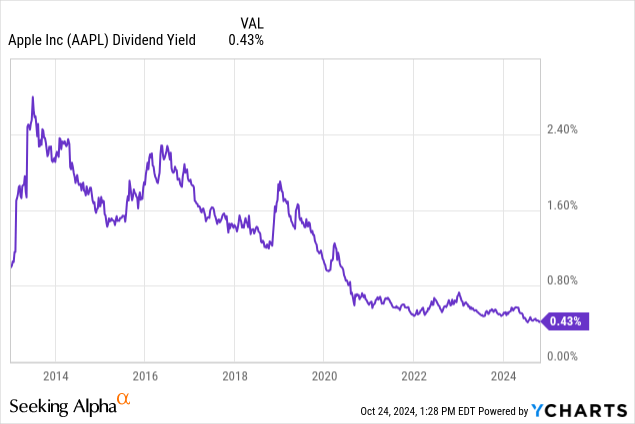

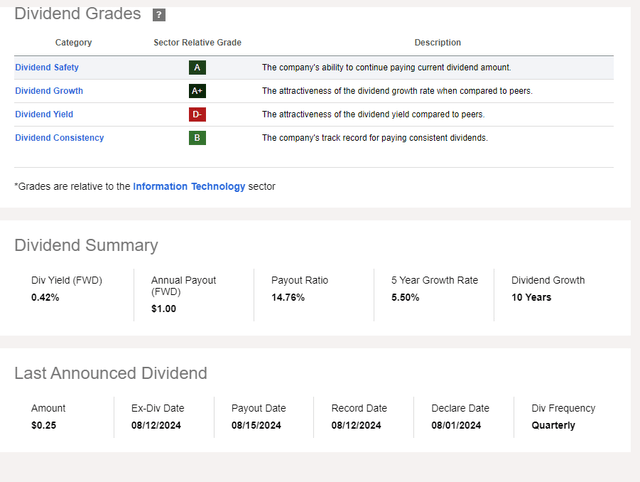

The last time I owned AAPL directly for a portfolio holding (not via ETFs or in a trading account) was way back in 2013, shortly after it instituted a regular dividend. I doubled my money with a nearly 3% yield at cost to boot, and thought I was a hot shot. But I sold that “2-bagger,” escaped the subsequent 25% decline in 2015-2016, and never returned to it directly. It was outside the boundaries of my stock selection approach, with that yield never getting anywhere close to where it had been. Owning it indirectly through ETFs with symbols like DIA, XLK (it is more than 20% of that ETF), SPHQ, TDIV and several others at different points in time worked out well. But to see that $30 stock I sold now at $30 with a “2” in front of it, as in $230, is not a great feeling.

It would be great to see AAPL use some of that cash hoard to up the dividend, but stock buybacks are their preferred “yield” method, as is the case with many other companies. This is why I approach dividend investing differently than most. It is a challenge, but well worth it, to find the stocks that still do what dividend investors want them to do.

Seeking Alpha

So, quality and moat are AAPL’s quality advantage. But valuation and technical pattern to me are enough to convince me that this is a good stock to approach indirectly. Here’s what I mean.

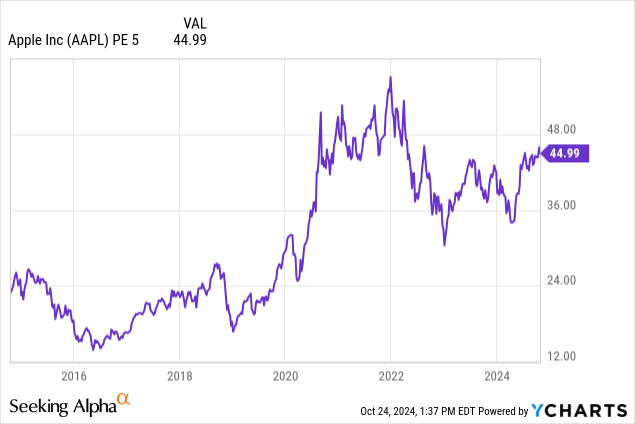

I just cannot “un-see” that 45x smoothed PE ratio pictured above. The stock is not falling for reasons other than “fair value.” Because paying that value is unfair! Especially for a business that is increasingly looking like IBM did in the 1990s: a tenured, highly respected former tech high-flyer, which is now essentially a value stock that is not cheap.

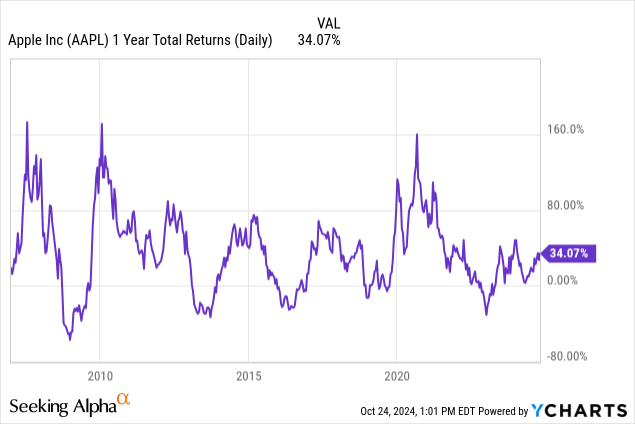

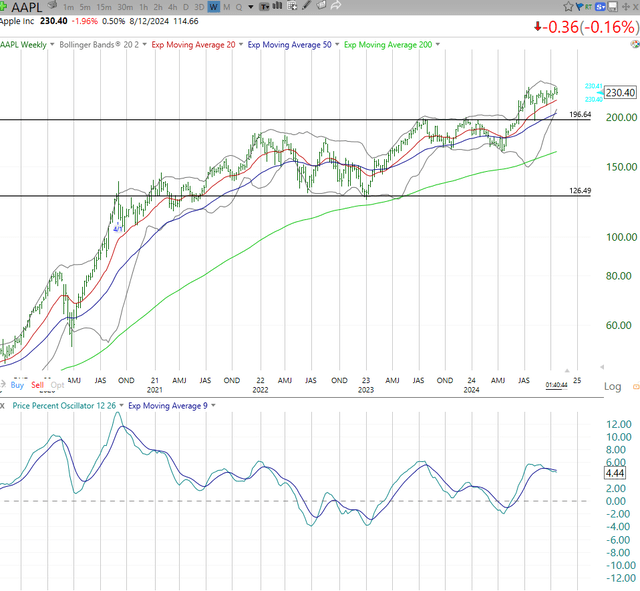

So we have quality – a positive and the valuation – a negative, and now it is time for my bread and butter: price analysis. And here I find that AAPL is like that cat with nine lives. It struggles within a trading range, sometimes for a while, but investors do not sour on it, “because it is AAPL, after all.” That keeps leading me to the “I want to participate, but not as a buy and hold investor” conclusion. Not simply due to AAPL itself, but because there are so many other places to look, where the aforementioned hurdles are not present. That is, while AAPL can double in 2–4 years from here, so can any stock, potentially. It really depends on how much risk is attached to pursuing that return. I think that the risk is high.

One reason is the chart picture itself. It broke out from a wide but clear trading range that existed from early 2021 through this past summer. And what I see here is a great chart if the stock yielded 6%. I’d collect that dividend, and now I have a decent shot at a bit of upside on top of that. But AAPL yields 0.4%. So that’s a no-go for me. This is not the worst chart I see, but it is far from the best in terms of what I call “reward/risk tradeoff” which is everything to me. I simply care too much about risk at this stage of my career and life to get excited about buy and hold with AAPL here.

Seeking Alpha

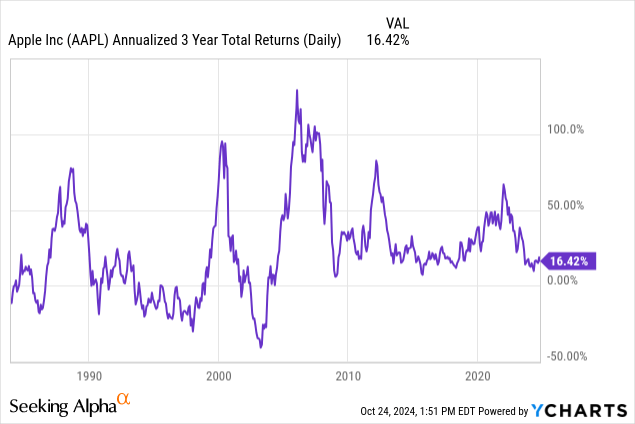

Finally, this chart of rolling 3-year returns, which I use a lot in my work, says a couple of things to me. First, it is down-trending pretty meaningfully. The euphoria of the past decade is fading. Trees don’t grow to the sky, especially from elevated valuations and when the business has matured.

But what this also tells me is that should AAPL come back to where it bottomed many times, albeit a good 40% south of its current price, it might again be that superstar in the making it was when I bought it back in 2013.

My takeaway on AAPL

I land in the same spot with AAPL as I did with Nvidia (NVDA) and Microsoft (MSFT) before it, in recent articles. I will trade them in small size in my trading accounts because modern investing treats these stocks like playthings. So I’ll play along.

But my serious money for AAPL is not in the stock itself. I have not bought the ETF that has nearly $90 million in assets, the YieldMax AAPL Option Income Strategy ETF (APLY), at this point. But I have added it to my list of potential adds to my YARP portfolio, as a way to turn AAPL’s popularity and my concerns about broad market valuation of tech stocks into cash flow. And since my YARP portfolio is always hedged in some manner, including puts on major market indexes, the structure of APLY and its peer funds for other Mag-7 names make a nice, clean hedge.

Seeking Alpha

As shown above, AAPL plus NVDA and MSFT make up 25% of the Nasdaq 100 ETF (QQQ). I own covered call ETFs on the latter two, so if I did eventually add AAPL to the mix, that would be a highly correlated mix to the downside if QQQ broke down. THAT is where either QQQ puts, an inverse QQQ ETF or even both could allow me to potentially have my dividend cake and eat it too. At the same time, the covered call ETFs do have some upside each month, and if the stocks fly higher once again... that’s what I use QQQ call options for.

There’s always a way when you are a flexible investor. I found ways to participate and get my “fair share” of the tech wave of the past decade. And I’m looking forward to finding innovative ways to keep doing that, at a time when that part of the market might just be priced for perfection.

MY YARP PORTFOLIO IS COMING TO SEEKING ALPHA. Thanks for reading my research. My investment process and my personal YARP active, risk-managed, dividend and total return portfolio will soon be available as a Seeking Alpha Investing Group subscription service. We are launching within the next few weeks, and the first wave of subscribers will get a lifetime discount. Details coming soon, so keep reading my articles and be on the lookout for the launch announcement.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As noted in the article, I do not own AAPL outright, am considering APLY, a small ETF that writes covered calls on it, and I own DIA and FNGS, ETFs that have some AAPL in them.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.