Summary:

- Apple stock has underperformed the S&P 500 Index since I downgraded it to ‘Sell’ in April 2023.

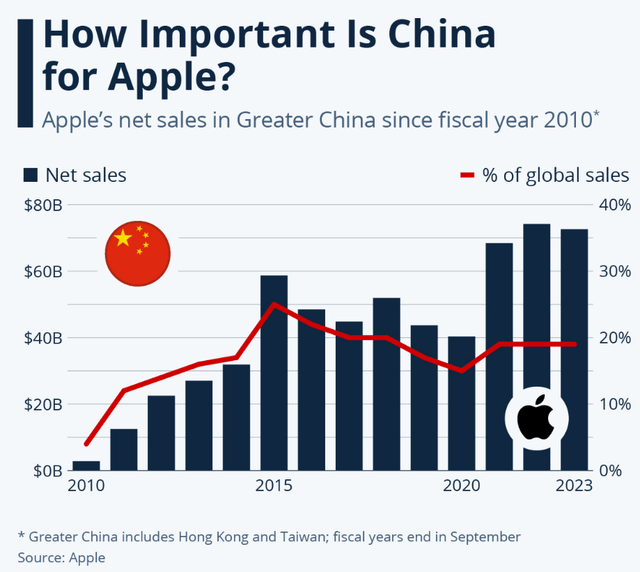

- Apple makes 20% of its sales in China. From what I see, now the Chinese authorities are trying to “artificially” reduce the demand for upgrades.

- AAPL stock still does not look attractive at current price levels if we look at its absolute valuation metrics as well as the valuation metrics associated with growth rates.

- The recent events show that the company may have serious capital allocation issues.

- I expect that the stock would have to fall 15-20% to keep up with a logical rise in FCF yield to at least 5% and therefore I reiterate my ‘Sell’ rating.

ozgurdonmaz

Intro & Thesis

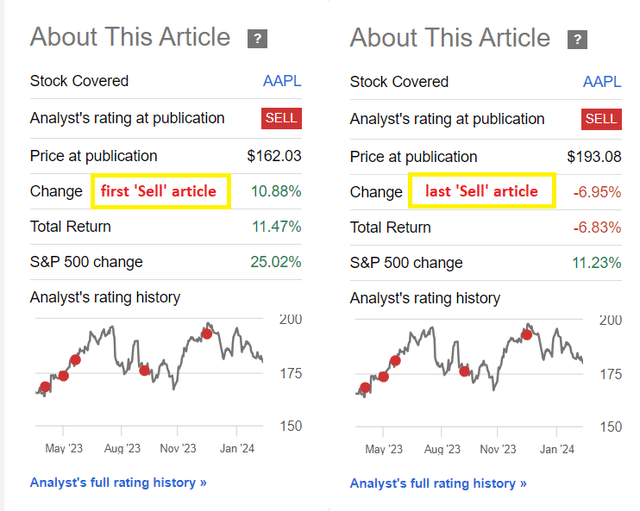

I initiated coverage of Apple Inc (NASDAQ:AAPL) stock in December 2021 and gave the stock a ‘Hold’ rating, indicating the brand’s strength but also a fairly generous valuation at the time. A few articles later, on April 10, 2023, I downgraded the AAPL stock to ‘Sell’. Since then, the stock’s total return has been 11% compared to the S&P 500 Index (SPX) (SP500) return of 25%. Since I last reiterated the rating on December 12, 2023, the stock has lost -6.83% while the SPY has gained 11.23%. Therefore, I believe my calls have aged relatively well since the downgrade.

Seeking Alpha, author’s coverage of AAPL (with notes)

Based on what I see today, Apple stock still seems to me to be one of the underdogs among the big seven tech companies responsible for the rapid growth of the S&P 500 Index in 2023 and year-to-date. My thesis remains unchanged today: Despite the strength of the brand, the rather ‘sticky’ revenue model, and a wide moat, it all seems to be priced in already. In my opinion, what investors are paying for Apple right now is still unreasonably expensive.

Why Do I Think So?

We all understand very well the main thesis for buying AAPL stock at virtually any price: the company is the leader in its niche in terms of units sold, revenue, and FCF, without even a hint of a chance of ceding that palm to someone else. The moat is supported by an elegantly designed software architecture, as well as product quality that gets a little better every year to make consumers want to “upgrade their subscription” again. And I say “subscriptions” intentionally. The company’s entire business model is based on the principle of SaaS companies, whose subscription-based revenue model allows them to better predict revenue and expenses, and generally makes the business more flexible and sustainable. That’s why I think successful SaaS companies with this revenue model have such high-profit margins compared to other types of models. I’m not alone in this assessment: McKinsey’s study has shown that companies with subscription models can achieve a customer lifetime value 2-5 times higher than those without subscriptions.

It’s logical to assume that companies obsessed with consumer loyalty begin to suffer greatly if their customers are reluctant to update their devices (or don’t update them as often as they used to). Judging by the latest data, this is exactly what has gradually begun to happen to the average smartphone buyer globally: According to data from the BofA survey (February 2024 – proprietary source), the number of people intending to buy a new smartphone in 4 years (the longest option in the survey) has risen rapidly since 2019.

![BofA [February 2024, proprietary source]](https://static.seekingalpha.com/uploads/2024/3/4/49513514-17095303395787663.png)

BofA [February 2024, proprietary source]

Apple currently has the highest percentage of loyalty among the other brands: 57% of respondents intend to buy a new model if they already use the brand. However, according to BofA, this figure was 67% in February 2022. I assume that this decline is mainly due to demand problems in China, which accounts for around 20% of the company’s total sales to date.

Statista

The Chinese authorities themselves have a hand in this process, so to speak, by “artificially” reducing the demand for upgrades:

China is reportedly barring government officials and employees at state-owned enterprises from using iPhones. The Wall Street Journal on Thursday reported that Beijing had issued a directive barring central government officials from using the Apple devices.

Source: Al Jazeera [Sep 11, 2023]

Yes, the number of people employed in state-owned enterprises is only 4% of the country’s total population (based on my calculations), but we are still talking about 56.3 million people with permanent jobs and relatively high earnings.

A very important qualitative indicator that accompanies this call should not be underestimated here: The vast majority of the Chinese population supports the government.

The survey team found that compared to public opinion patterns in the U.S., in China there was very high satisfaction with the central government. In 2016, the last year the survey was conducted, 95.5 percent of respondents were either “relatively satisfied” or “highly satisfied” with Beijing. In contrast to these findings, Gallup reported in January of this year that their latest polling on U.S. citizen satisfaction with the American federal government revealed only 38 percent of respondents were satisfied with the federal government.

Source: The Harvard Gazette [July 9, 2020]

This, in turn, could mean that many who do not work for state-owned companies may voluntarily refuse to buy a new iPhone to replace their old one. And here we are talking about a much larger population than 4%.

But let’s go back from China to the global world map and remember that more and more people plan to upgrade their smartphones after 4 years (that is, they plan to use them as long as possible). According to BofA, the vast majority of Apple iPhone users now have iPhones 13:

![BofA [February 2024, proprietary source]](https://static.seekingalpha.com/uploads/2024/3/4/49513514-17095321020512059.png)

BofA [February 2024, proprietary source]

The bank’s analysts conclude that there’s a high probability that these people will soon start upgrading their devices. But I don’t quite agree with that. The survey itself is structured so that it doesn’t include longer answer options like “every 5 years” So if we see rapid growth at “the longest end” of the answer options, then it would be logical to assume that if we extend this “end” for another 1-2 answer options we will get growth there too. If this is true, then people who have an iPhone 13 today will probably wait until 2025 (or even 2026) to upgrade.

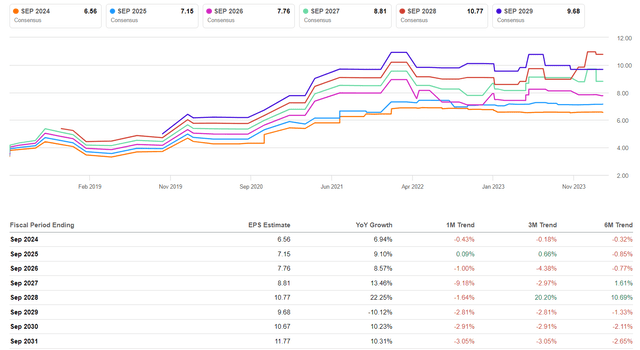

At the same time, even though the market has lowered its EPS forecasts by 1-3%, it’s still raising EPS estimates in the medium term, which in my opinion ignores a whole series of risks surrounding the company.

Seeking Alpha, AAPL’s Earnings Revisions

On February 1, Apple Inc. reported Q1 2024 results, once again beating EPS and revenue estimates:

Seeking Alpha

Revenue rose 2% from the prior year, as double-digit growth in services offset basically flat device sales. The normalized supply chain resulted in lower logistics costs and helped AAPL to improve margins higher than the Street respected. We also saw a better product mix and record-breaking paid subscriptions, surpassing 1 billion. But all that didn’t impress the market participants much, as can be seen from the post-release reaction:

Seeking Alpha

While sorting through research papers from major investment banks, I came across a note from Barclays (February 2024 – proprietary source) who didn’t like AAPL’s guide in Q2 sales ~6% below the consensus estimate. Their pessimistic stance is primarily based on the ongoing macroeconomic uncertainty impacting high-end consumer demand, while regulatory challenges, particularly related to Traffic Acquisition Costs (TAC) and the App Store, also pose potential risks. In addition, they also see a significant decline in sales in China in the December quarter, reflecting the existing challenges in this market.

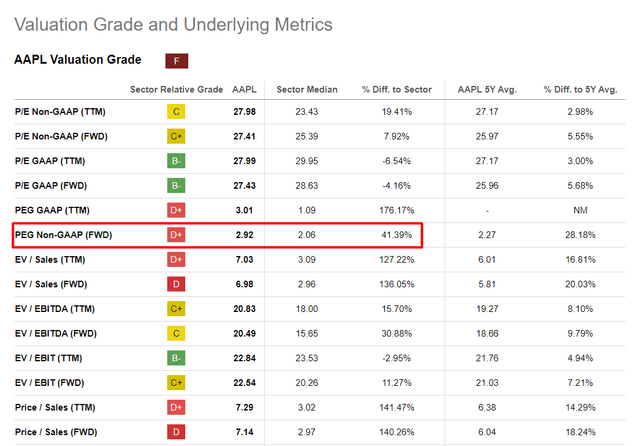

In light of all these problems, AAPL stock still does not look attractive at current price levels if we look at its absolute valuation metrics as well as the valuation metrics associated with growth rates (such as the FWD PEG ratio – more than 41% higher than the sector’s norm):

Seeking Alpha, AAPL’s Valuation, author’s notes

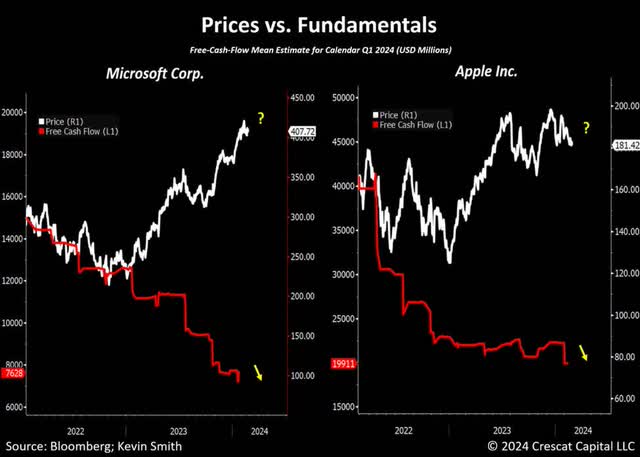

As Kevin C. Smith, CFA of Crescat Capital (the fund whose letters I try to read as soon as they are published), wrote in X, the current valuation extremes in mega tech names like AAPL or Microsoft (MSFT) amid a deteriorating macro environment offer “generational opportunities to position opposite the crowd for potentially large gains.”

@crescatkevin on X

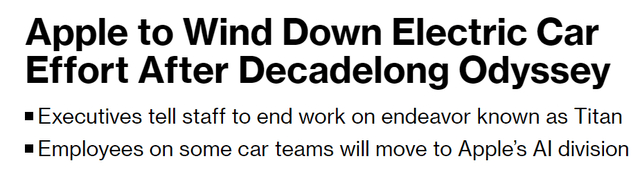

And if I can have a reasonable explanation for MSFT’s declining FCF – the company is forced to spend heavily to maintain shareholders’ hopes of global leadership in AI – then everything is clearer concerning AAPL. I doubt that Vision Pro, in its current form and at its current price, will have a decisive impact on the company’s profits. Furthermore, recent events show that the company may have serious capital allocation issues. The company has decided to abandon the development of its own EV, even though it has taken more than 5 years to develop. Although the Chinese Huawei and Xiaomi have already entered this market.

Bloomberg

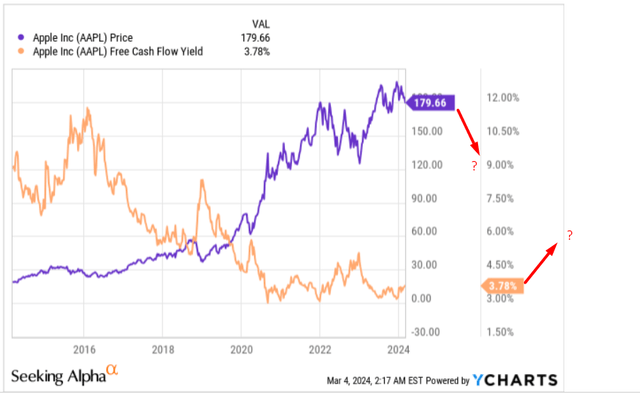

Right now, AAPL stock is trading at an FCF yield of ~3.78%, which is actually much lower than a few years ago. In my opinion, a company’s strong brand is not able to withstand the pressure of its expensive, “heavy” valuation. In the medium term, I expect AAPL’s FCF yield to reach 5% before we can call the stock more or less fairly valued. The downside potential in this case could be 15-20% of current levels.

YCharts, author’s notes

Where Can I Be Wrong?

First of all, my bearish thesis is based on weak demand in China and the risk of a later device update than the market expects. But I could be very wrong about this: as the BofA’s survey data shows, the number of people in China who are thinking about getting an iPhone has increased.

![BofA [February 2024, proprietary source]](https://static.seekingalpha.com/uploads/2024/3/4/49513514-17095318699248555.png)

BofA [February 2024, proprietary source]

However, it is not specified which iPhones customers will switch to. Judging by the growth rate of the Chinese refurbished and used phone market, there is a possibility that Apple will not see any positive financial impact from that.

Custom Market Insights

A further upside risk for my thesis lies in the development of other segments of the company and better supply chains going forward, which can help offset all headwinds with their influence. Here is the opinion of Goldman Sachs analysts (proprietary source):

Although bearish investors could point out the lack of revenue growth this quarter and potential iPhone revenue declines in the upcoming quarter (F2Q24E) on excess channel inventory and tough year-ago comps as F2Q23 benefited from supply chain sales recapture and emerging market strength, we see consolidated revenue growth accelerating in F2H24 on App Store momentum, services price increases, and iPad and Mac refreshes.

Source: GS’s note [January 2024, proprietary source]

The Verdict

While the market is turning to AI and paying ever higher premiums for the dominant players in this market, Apple seems to have nothing to offer here. Its underperformance can be explained by logical fundamental factors that I have been covering regularly in my articles since April last year. The rise in P/E and other valuation multiples against a backdrop of weakness in China, the abandonment of the results of years of investment in EVs, and attempts to sell what I believe is an unfinished AR/VR solution makes AAPL stock look too expensive today. I expect that the stock would have to fall 15-20% to keep up with a logical rise in FCF yield to at least 5% and therefore I reiterate my ‘Sell’ rating.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!