Summary:

- Canoo’s stock has plummeted since December 2020 due to a myriad of issues.

- The company has never generated positive net income.

- Canoo’s low P/B ratio of 0.16 and negative investor sentiment highlight skepticism about its future prospects.

- Many discounted cash flow models indicate 100% overvaluation.

- I am assigning a sell rating to Canoo.

Nikolay Tsuguliev/iStock via Getty Images

While canoes typically float, the stock price for Canoo Inc. (NASDAQ:GOEV) has been sinking since December 2020. In this article, I discuss Canoo’s declining fundamentals, lackluster valuation, and negative sentiment. These factors tell a story of consistent underperformance and mounting red flags, making a bleak outlook for investors. I have given the company a sell rating until it demonstrates tangible progress in stabilizing its leadership and securing better production. Without these changes, the risks far outweigh any speculative potential.

Canoo’s Declining Fundamentals

Let us review Canoo’s balance sheet from 2020 to 2023. Total assets have declined by 28%. Total liabilities increased by 39%, while shareholder equity decreased by 55%. The number of shares outstanding more than tripled, rising from 10 million to 38 million. After examining the income statement, things are not much better. Canoo has had no positive net income. 2023 operating expenses were approximately 50% higher vs. 2020, while revenue has not seen any meaningful growth. I do not intend to provide a comprehensive review of the financial statements in this article. If you choose to look further, you will find more of the same as I have described above.

The fact that Canoo has faced ongoing financial struggles for years is nothing new to investors. For some, that may be part of the appeal of owning a part of this company. After all, high risk comes with high reward. In this case, however, I think the writing on the wall tells us that the company will face further decline. Canoo has been marred with challenges in scaling operations and securing stable funding. For instance, in 2021, the company shifted its focus to manufacturing electric delivery vans and trucks. The idea sounded great, but the company posted a significant net loss of $346.8 million, while revenue was only $2 million. The bulls may say, “It takes time to make money!” or “They’re just getting started.” Sometimes that’s true; Amazon, for example, was not profitable for at least a decade. The problem Canoo has is that big ideas like a strategic shift require stable leadership. TechCrunch and The Verge have consistently reported on Canoo’s executive departures over the years, such as the resignations of co-founders Ulrich Kranz and Stefan Krause. More recently, Canoo’s CFO and their top attorney have also resigned.

These challenges set the stage for evaluating how Canoo’s market value compares to its financial fundamentals.

Low P/B Ratio Indicates Skepticism

The book value per share is calculated by dividing the company’s equity by the number of shares outstanding. The book value per share is objective and calculable. The market price per share, on the other hand, is only equal to what someone is willing to pay. Rarely does the stock price equal the book value per share due to speculation. When looking at a strong company that has a solid competitive edge, market value is typically higher than book value. Tesla, for example, has a book value of $21.80 per share, but the market value is $345.16. Dividing the market value by the book value equals a price/book (p/b) ratio of 15.83. A p/b ratio greater than 1 can indicate that investors feel the company will have an improved financial position in the future, while a p/b ratio less than 1 may indicate that investors feel the financial performance will degrade.

Canoo has a p/b ratio of .16. The market rate per share is about $0.38, while the book rate is $2.38 per share. Canoo has a p/b ratio that is significantly lower than its competitors, as shown in the table below.

|

P/B Ratio Comparison |

||||

|

Ticker |

GOEV |

|||

|---|---|---|---|---|

|

P/B Ratio |

0.16 |

0.83 |

0.66 |

1.06 |

Investors should consider the driving forces behind the p/b ratio of each company. Niu Technologies is the only company in this comparison to have had a positive net income in the past 5 years, which likely explains why it has the highest p/b ratio. None of these companies have a high p/b ratio like Tesla because they are struggling to secure a spot in a highly competitive environment. They all face similar issues of scalability, but because of Canoo’s negative sentiment among investors, I think that Blink Charging, Gogoro, and Niu Technologies potentially serve as better prospects.

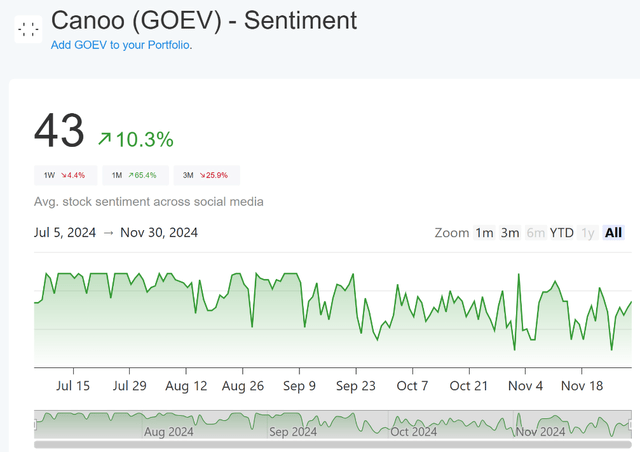

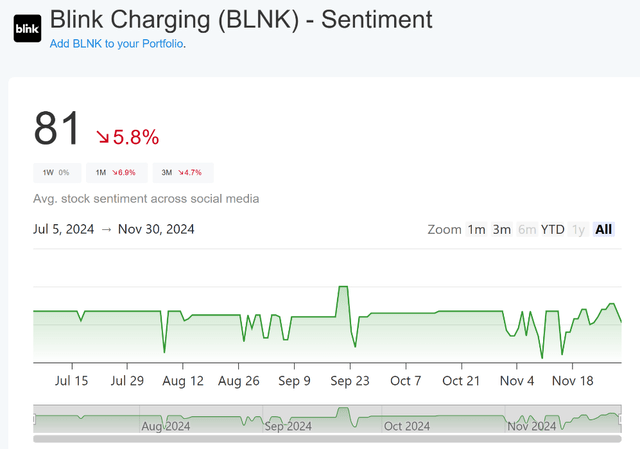

Altindex is a website that utilizes alternative data when analyzing stocks. Their sentiment metric analyzes posts on various internet stock forums for things such as tone, keywords, and the overall context of mentions. Each post is determined to be positive, neutral, or negative, and then all the posts are aggregated into a score ranging from 0 to 100. Although they did not have data available for GGR and NIU, I was able to compare Canoo (one-time registration required) and Blink (one-time registration required).

Canoo has seen more fluctuation in sentiment than Blink, but Blink has consistently had twice the amount of positive sentiment than Canoo. I believe that Canoo has garnered a negative sentiment for the reasons outlined in the next section, which informs my opinion that Canoo should receive a sell rating.

Negative Sentiment Takes Flight

In Canoo’s Q3 2024 conference call, Tony Aquila, the company’s CEO, was asked, “Is there substantial progress on obtaining governmental program loans for non-dilutive capital?” Tony responded with, “We have received our first letter of encouragement for accessing non-dilutive capital from government programs. We are optimistic about receiving appropriate funding as the current administration wraps up its programs. We have applied for multiple programs but have received one letter so far.” A letter of encouragement is just that, a document encouraging the company to try again in hopes that they might get something on the next attempt. It does not sound promising.

Investors have likely been monitoring the state incentives that Canoo could gain as a result of shifting its workforce from California to Oklahoma. However, Canoo did not point to these incentives as their primary motivation for relocating, instead suggesting operational efficiencies. This could be deliberate. It is possible that Canoo does not want to draw attention to the fact that at least three prior deals with the State of Oklahoma have fallen through. To quote an article published by The Frontier, “The EV-startup Canoo Inc. says it can reap more than $100 million in incentives and tax breaks to manufacture its vehicles in Oklahoma, but three previous economic development deals with the state have fallen through in as many years.” In another article by The Frontier, it was stated that it was unclear if the furloughs at Canoo’s Oklahoma City factory could cause any of the $1 million to be clawed back.

In a publication by local news outlet KFOR, one of the furloughed employees reportedly stated, “They don’t have the paint body area up. General Assembly doesn’t even have the full protocols on how to assemble that. It was still training for that. There’s robotics which they don’t have, a lot of them aren’t even configured to run and operate. There has not been one single vehicle that has been wholeheartedly produced here in Oklahoma.” To me, it sounds like Canoo is going to need a lot more encouragement than just a letter from the government.

Investors may also harbor negative feelings over payments that were made by Canoo to rent the CEO’s private jet. As reported by TechCrunch, the rent payments cost more than double Canoo’s annual revenue for 2023. With declining fundamentals, were rental payments for a private jet really the best way to bring value to shareholders? I don’t think this sits right with investors.

Negative Discounted Cash Flow Estimates

Aside from looking at the p/b ratio and market sentiment, discounted cash flow “(DCF)” is another method by which to value a company. With this method, the future cash flows of a company are calculated, and then discounted to the present value, to arrive at a stock price. If the discounted cash flow is worth more than the cost of the investment, this could suggest that the investment is worthwhile. Though, this does not paint a better picture for Canoo. Under Alpha Spread’s DCF model, they have calculated that the stock price is worth -$24, which means the stock is 100% overvalued since the price of a share cannot go below $0. Another company, Value Investing, calculated that the stock price is worth -$214.00, also a 100% overvaluation. Guru Focus’s DCF model also suggested the stock is 100% overvalued. Financial Modeling Prep arrived at a figure of -$5 per share.

Risk Factors to Consider

While I am confident that a sell rating is the right decision here based on Canoo’s remaining financial struggles, leadership instability, and operational missteps, several risks could affect the thesis and its sell rating. One major risk is the potential for positive sentiment shifts due to new government incentives or partnerships (although, it does not appear that the incoming Trump Administration is likely to be friendly toward the EV sector). Canoo has applied for various governmental programs aimed at supporting electric vehicle production, and if it successfully secures funding or operational advantages, investor outlook could improve dramatically. Historically, even struggling companies in high-growth sectors like EVs can see stock prices rally on the back of favorable policy changes or new contracts.

Another risk is the possibility of a leadership turnaround. While the company has suffered from executive departures and the negative consequences of prior management decisions, it is possible that new leadership or a restructuring could help stabilize operations. If Canoo were to appoint a team capable of executing its plans and gaining investor confidence, it could reduce skepticism surrounding the company’s future prospects, even if its financials remain bleak for the time being.

Finally, Canoo could potentially overcome its current financial difficulties through an unexpected technological breakthrough, or if its shift toward electric delivery vans gains traction faster than expected. Many early-stage EV companies face scalability issues, but some, like Tesla, have overcome them with the right combination of funding, timing, and consumer demand. If Canoo secures the necessary resources and partnerships, it could experience a rebound despite the current pessimism surrounding its stock.

Ultimately, while the risks to this thesis exist, they require significant positive developments for Canoo to reverse its fortunes. In my opinion, these are unlikely to materialize, and the current downward trajectory remains the most likely outcome.

Summary

Canoo has seen its stock price plummet since December 2020, primarily due to its worsening financial situation, poor valuation, and negative sentiment. The company’s fundamentals and bad press have led me to assign a sell rating to this stock. Canoo has failed to generate positive net income amidst growing operating expenses and unsatisfactory revenue.

Canoo’s market value has been undermined by its poor financial performance, as evidenced by its low price-to-book (P/B) ratio of 0.16, which is significantly lower than that of similar competitors. This suggests that investors lack confidence in the company’s future prospects, a sentiment supported by alternative data on investor sentiment, which has been overwhelmingly negative. Furthermore, Canoo’s executive turnover, including the resignation of co-founders, top executives, and even an attorney, has raised doubts about the company’s leadership and long-term vision.

While risks to this thesis exist, such as the potential for positive shifts due to new government incentives, leadership changes, or technological breakthroughs, these would require significant improvements that seem unlikely to me, given the company’s track record. Until Canoo demonstrates tangible progress in stabilizing its leadership, meeting operational targets, and addressing its financial challenges, the outlook remains negative. Canoo looks destined to stay adrift in the investment seas, so accordingly, I have assigned the company a sell rating.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.